Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 22, 2019

Brexit-exposed sectors in Ireland suffer as Brexit day approaches

- 'Most exposed' sectors see output expansion weaken at end of 2018

- Divergent trends noted between the most- and least-exposed sectors

Irish firms operating in sectors deemed to be most at risk1 from Brexit showed signs of stress throughout 2018, according to PMI data from IHS Markit.

With ten weeks to go until the UK is due to leave the EU and Theresa May's Brexit deal rejected by the UK parliament, uncertainty among Ireland's most vulnerable firms is likely to be heightened in the near-future.

Divergence with 'least exposed' sectors grows sharply

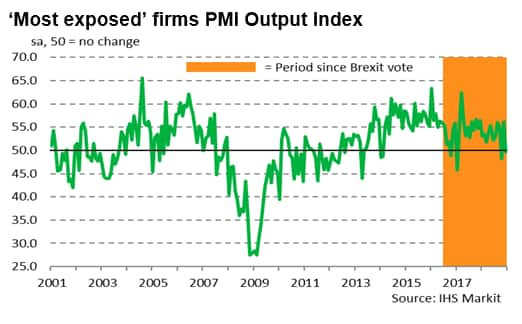

A recovery in output enjoyed by firms most exposed to Brexit in 2017 largely failed to continue last year, with the gap in performance between the 'most exposed' and 'least exposed' sectors becoming much larger, especially in late-2018. December saw the PMI survey's Output Index for the 'most exposed' sectors run some 7.7 points below that for the 'least exposed' sectors, the fourth greatest divergence seen since the EU referendum. The final quarter of the year consequently saw the average rate of output expansion ease notably. Indeed, contractions in output were recorded in October and December 2018.

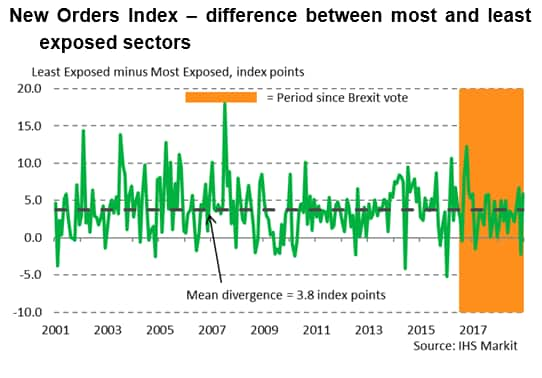

The outperformance of the 'least exposed' sectors compared to their peers in 'more exposed' industries was also evident with regards to inflows of new business. December saw the PMI New Orders Index for the 'most exposed' sectors drop 5.9 index points below that for the 'least exposed', a much greater divergence than the average of 3.8 index points seen since the start of 2001. A similar divergence was seen with the rates of job creation and business sentiment.

Preparation paying off

Although greater than normal, the recent underperformance of the 'most exposed' sectors has not been as great as the period immediately following the UK's 2016 referendum. This could be due to efforts by companies to prepare for Brexit, such as by reducing any reliance on UK business.

The Irish government has released guidelines and undergone detailed preparations for Brexit. The state economic development agency focused on generating export sales (Enterprise Ireland) has a designated webpage2 for Irish firms seeking information on Brexit.

Also available are extensive Brexit help articles, a 'Be Prepared Grant', which offers 5,000 euros for companies to develop a Brexit support plan, and detailed market access guides for Irish companies looking to export goods and services.

Outlook after Brexit

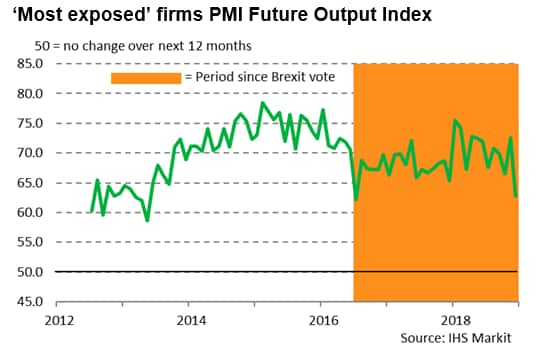

Looking forward, companies in the 'most exposed' sectors have seen sentiment regarding output in the coming year dip markedly in recent months.

December saw the PMI Future Outlook Index sink to the lowest since the aftermath of the UK's referendum in July 2016. That said, Irish firms in general still expect that output will rise over the coming 12 months.

The increasing uncertainty over EU negotiations and the unwinding of often complex supply chains with the UK provide headwinds for Irish companies over the coming year.

Despite this, the wider Irish economy is expected to grow at a solid pace in 2019. Indeed, some may say that the Irish economy is thriving relative to other European countries. IHS Markit forecasts GDP growth of 4.0% in 2019, keeping Ireland as one of the quickest-growing eurozone economies. An open economy, strong inflows of foreign direct investment and a highly educated and productive workforce are just some of the reasons why Ireland will see sustained growth of its economy in 2019.

With just 66 days before Brexit day arrives, all eyes are on Westminster as many Irish firms wait with baited breath for a deal to emerge.

1These sectors include manufacturing of food and metal products as well as transport industries.

2https://www.prepareforbrexit.com/

Amritpal Virdee, Economist, IHS Markit

Tel: +44 207 064 6460

amritpal.virdee@ihsmarkit.com

© 2019, IHS Markit Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbrexit-exposed-sectors-in-ireland-suffer-as-brexit-approaches.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbrexit-exposed-sectors-in-ireland-suffer-as-brexit-approaches.html&text=Brexit-exposed+sectors+in+Ireland+suffer+as+Brexit+day+approaches+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbrexit-exposed-sectors-in-ireland-suffer-as-brexit-approaches.html","enabled":true},{"name":"email","url":"?subject=Brexit-exposed sectors in Ireland suffer as Brexit day approaches | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbrexit-exposed-sectors-in-ireland-suffer-as-brexit-approaches.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Brexit-exposed+sectors+in+Ireland+suffer+as+Brexit+day+approaches+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbrexit-exposed-sectors-in-ireland-suffer-as-brexit-approaches.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}