Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 23, 2018

Indian banking-sector developments likely to strengthen troubled state banks

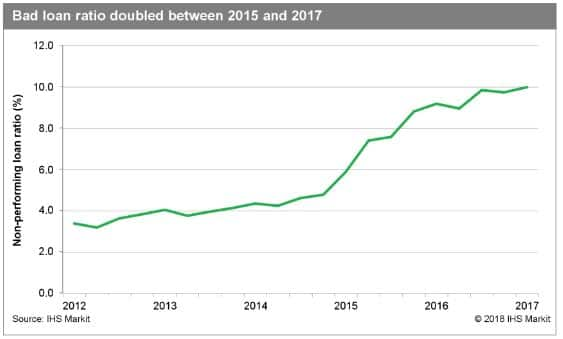

On 16 July, Life Insurance Corporation of India agreed to buy a stake of up to 51% in troubled state-owned Industrial Development Bank of India, which has a non-performing loan ratio of approximately 28%.

Following the Life Insurance Corporation of India (LIC)'s board approval, the Industrial Development Bank of India (IDBI) share sale should be concluded within six months. The measure flags the government's efforts to recapitalise state banks - which hold some INR8 trillion (USD116.2 billion) of non-performing loans (NPLs) - without further direct recourse to the state budget. On 3 July, the Indian cabinet approved Project Sashakt - a five-point strategy to assist banks to recover or sell stressed assets. These policies are unlikely to overhaul India's banking sector or resolve its NPL problems, but provide public-sector banks (PSBs) with incremental measures to address impairment instead of pursuing bankruptcy proceedings under the Insolvency and Bankruptcy Code (IBC) as mandated by the central bank, Reserve Bank of India (RBI).

LIC's purchase of IDBI stake reflects government intent

to reduce PSB holdings

The request to LIC to invest in IDBI reflects the

government's goal of reducing its holdings in PSBs, although LIC is

state-owned, leaving IDBI indirectly state-controlled rather than

truly in private ownership. IDBI is the first bank to be formally

privatised, and IHS Markit assesses that more state sales are

likely in the one-year outlook. Although LIC support is unlikely to

prove sufficient to resolve the heavy impairment of the state-bank

sector, it does buy time for IDBI, restoring its capital position

and reducing the risk of it failing.

Project Sashakt encouraging foreign investors to

purchase PSBs' NPLs

Project Sashakt provides for the setting-up of part

bank-owned asset management companies (AMCs) and alternative

investment funds (AIFs), to purchase and manage NPLs. However,

under the proposed framework affected banks would own 60-70% of the

AMCs, and would thus remain highly exposed to the NPLs (by way of

their equity exposures). Additionally, removing NPLs from PSBs'

balance sheets to the AMCs is likely to weaken regulatory

monitoring. Although banks may accept haircuts on transfer, they

remain at risk of further losses, with additional downside risk to

their already delicate capital positions.

However, establishing AMCs is likely to increase foreign investors' ability to acquire NPLs from PSBs. On 13 July, Bank of America Merrill Lynch and Deutsche Bank expressed interest to purchase NPLs both undergoing IBC and outside bankruptcy procedures. Such foreign involvement is risk-positive, deepening the market and potentially improving price levels for risk transfer of impaired assets. IHS Markit further assesses that following the removal of NPLs from the portfolio of PSBs, credit risk standards should be improved and state-directed lending curb to help manage the risk of further asset-quality deterioration.

Outlook and implications

IHS Markit expects that in addition to the above measures, which offer only partial solutions to the state-owned banking sector's deep-rooted problems, the government will aim to consolidate the 21 PSBs into approximately 10-12 larger entities. According to media reports, the first merger is likely to involve Syndicate Bank, Canara Bank, Vijaya Bank, and Dena Bank. Consolidation will be driven by the government's goal of meeting its divestment target for financial year 2018-19 of approximately USD11 billion. Divestments have been progressing slowly, recently indicated by the government's unsuccessful attempt to place a 76% stake in the national air carrier, Air India, in June 2018.

To improve banking-sector credibility and facilitate divestments, the Indian government is likely to encourage more foreign ownership in Indian banks - both public and private. The foreign direct investment (FDI) limit for PBSs is likely to be increased to 49% from 20%, and for private banks, is likely to be increased to 100% from 74%. This is most likely to benefit larger public banks, including State Bank of India and Punjab National Bank. In the private sector, HDFC, which currently has the highest foreign shareholding, of 73%, and ICICI Bank (with 59%) are the likely main beneficiaries.

Project Sashakt will create divergence in the process of NPL resolution. According to RBI requirements, PSBs initially were expected to commence NPL resolution of large accounts under the IBC by end-August, if unable to resolve them internally within a stipulated 180-day period between March and August 2018. Project Sashakt appears to increase regulatory uncertainty for PSBs, with the RBI and the Indian government now suggesting different mechanisms for resolution. Reduced uncertainty would be indicated if the government and RBI define a clear demarcation prior to the end-August deadline. As a more positive-risk indicator, Project Sashakt is likely to assist resolutions under the IBC, given the reported mismatch between the number of cases already referred for insolvency proceedings and current capacity to address these: as of March 2018, the backlog to process applications for IBC cases was over five months.

In the one-year outlook, if the RBI delays the adoption of tighter new Indian Accounting Standards and relaxes the deadline for Basel III implementation, this would be a risk-negative indicator for potential foreign investment into the banking sector. Such delay would put India further behind international norms, and is likely to reduce investor protection (in terms of provisioning buffers and risk accounting) within the sector. A second risk indicator of the scope for privatisation will be labour market disruption. Although Indian banking-sector labour unions are less effective than those in sectors like transport or textiles, large-scale protests by banking unions, leading to interruption of banking services for over a week, are likely to deter the government's intent to increase FDI, particularly in PSBs. In the event of repeated strikes, this policy is likely to be delayed until after India's general election (scheduled for April 2019, or potentially earlier).

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2findian-bankingsector-developments-trouble-72318.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2findian-bankingsector-developments-trouble-72318.html&text=Indian+banking-sector+developments+likely+to+strengthen+troubled+state+banks+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2findian-bankingsector-developments-trouble-72318.html","enabled":true},{"name":"email","url":"?subject=Indian banking-sector developments likely to strengthen troubled state banks | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2findian-bankingsector-developments-trouble-72318.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Indian+banking-sector+developments+likely+to+strengthen+troubled+state+banks+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2findian-bankingsector-developments-trouble-72318.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}