Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 08, 2018

Gun related stocks under fire

Gun related stocks under fire

- Short sellers target gun manufacturers and retailers

- Declining share prices under Trump

- Short demand for Vista Outdoor equal to 52-wk high

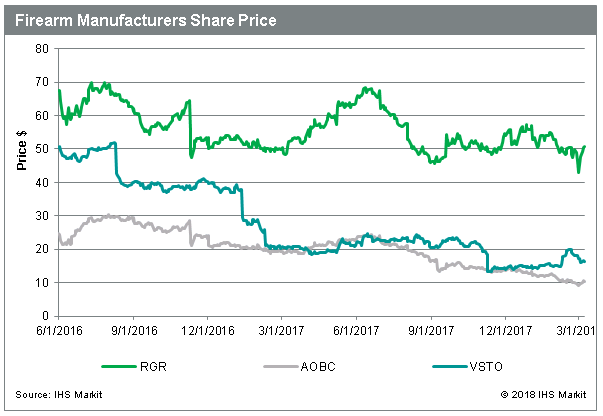

Firearm related stocks have come under increasing public pressure following the Parkland shooting, extending a challenging period which started with the Pulse nightclub shooting in June 2016. Vista Outdoor and American Outdoor Brands have lost more than 50% of their value since then. Sturm Ruger, the only manufacturer to post a new high following Trump’s election, was down 11% overall during that time.

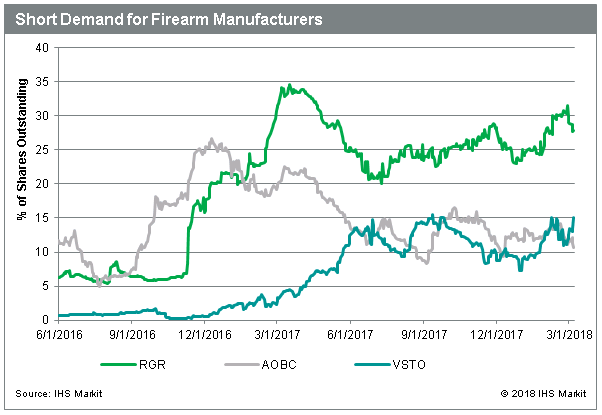

Short sellers targeted gun manufacturers prior to the current administration, and they have reacted to recent challenges by increasing bets against Ruger and Vista Outdoor. American Outdoor was the most shorted in the group following the election, though that title was handed off to RGR in Q1 2017.

Since the start of 2018, short bets against RGR and VSTO have continued to increase, and the short demand for VSTO is back over 15% of shares outstanding, equal to the highest level observed since its IPO in 2015.

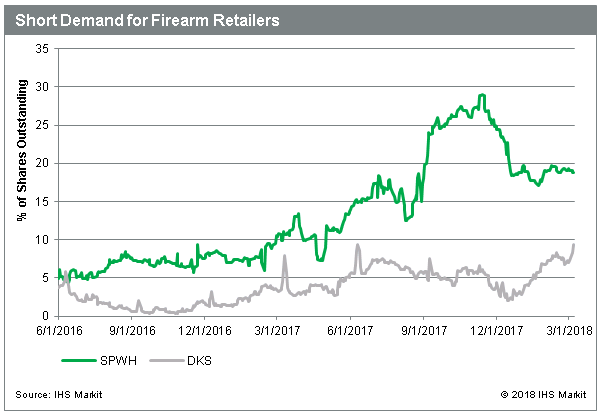

It is difficult to separate the impact of the debate around firearms from the general challenges facing all retailers, however, short interest in Sportsman’s Warehouse remains elevated and short sellers have ramped up bets against Dick’s Sporting Goods.

In recent years, there has often been a sharp move lower for gun stocks following a mass shooting, but within a few weeks, the narrative of fearful consumers panic-buying guns in anticipation of greater regulation would emerge and the stocks would make new highs. It remains to be seen how public pressure will affect manufacturers going forward, although developments in Florida suggest further regulatory changes may lie ahead. With that said, RGR shares have bounced back to where they were at the start of February, and short sellers have covered the initial spike in demand which followed the Parkland incident.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fgun-related-stocks-under-fire.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fgun-related-stocks-under-fire.html&text=Gun+related+stocks+under+fire","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fgun-related-stocks-under-fire.html","enabled":true},{"name":"email","url":"?subject=Gun related stocks under fire&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fgun-related-stocks-under-fire.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Gun+related+stocks+under+fire http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fgun-related-stocks-under-fire.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}