Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

CREDIT COMMENTARY — Nov 22, 2024

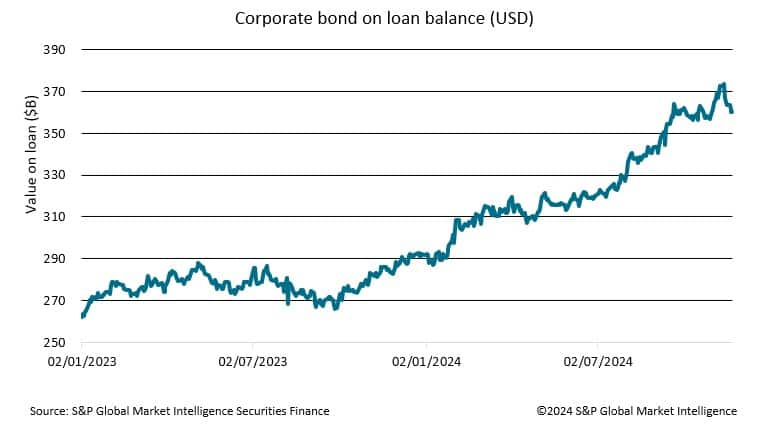

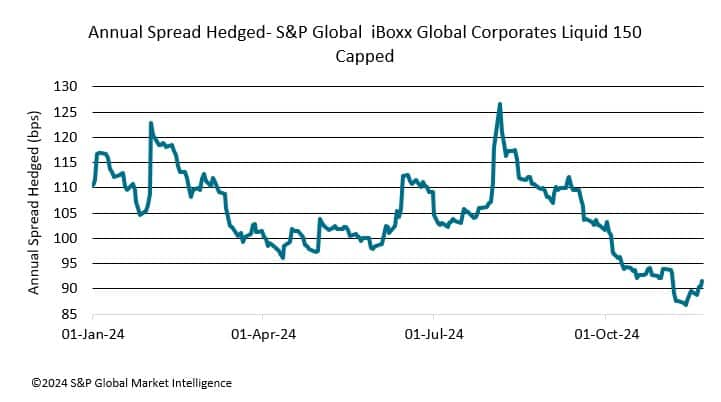

The securities lending market has seen a notable rise in the on-loan balances of corporate bonds. This trend is particularly pronounced in the investment-grade (IG) segment, where spreads remain historically tight. The increase in on-loan balances may be intricately linked to the prevailing market conditions, where investors are increasingly questioning whether they are being adequately compensated for the additional risk associated with these tight spreads.

Investment-grade corporate bonds have traditionally been viewed as a relatively safe investment, offering modest returns in exchange for lower risk. However, the current environment, characterized by tight spreads, has led to a re-evaluation of this risk-return dynamic. Investors are beginning to question whether the yields offered by these bonds are sufficient to justify the risks, especially in a market where economic uncertainties and potential interest rate fluctuations loom large.

Compounding this situation is the broader macroeconomic backdrop of relatively high interest rates. As central banks around the world have moved to tighten monetary policy in response to inflationary pressures, investors have been on the hunt for higher-yielding, quality assets. This search for yield has driven up the prices of investment-grade corporate bonds, as investors flock to these securities in an attempt to lock in returns before rates start to fall. However, this surge in demand has also led to concerns about potential overvaluation. As bond prices rise, the yields they offer decrease, prompting some investors to worry that they may be overpaying for these assets.

Hedge funds remain adept at navigating the intricacies of the corporate bond market and capitalizing on emerging opportunities. Hedge funds are known for their ability to exploit market inefficiencies, and the current conditions present a fertile ground for their strategies. One way hedge funds might take advantage of the situation is through relative value trades. By identifying discrepancies in bond valuations, hedge funds can go long on undervalued bonds while shorting those they perceive as overvalued. This strategy allows them to profit from the relative price movements while managing their overall risk exposure.

Additionally, hedge funds may engage in arbitrage strategies, particularly between the cash and derivatives markets. For example, they might exploit pricing differences between corporate bonds and credit default swaps (CDS). By simultaneously buying and selling related securities, hedge funds can lock in profits while hedging against credit risk. This approach requires a sophisticated understanding of market dynamics and the ability to execute complex trades efficiently.

The increase in securities lending demand across the corporate bond asset class may be driven by hedge funds' pursuit of these strategies. As they borrow bonds to implement their trades, the on-loan balances naturally rise. This activity not only reflects the strategic manoeuvres of hedge funds but also underscores the broader market sentiment regarding the valuation and risk associated with investment-grade corporate bonds.

The rising on-loan balances of corporate bonds in the securities lending market highlight a confluence of factors shaping the current financial landscape. Tight investment-grade spreads, high interest rates, and the search for yield have all contributed to a complex environment where investors are reassessing risk and value. The interplay between these forces will undoubtedly continue to shape the dynamics of the corporate bond market, influencing both the direction and the valuation of this asset class.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.