Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — Nov 18, 2024

By Matt Chessum

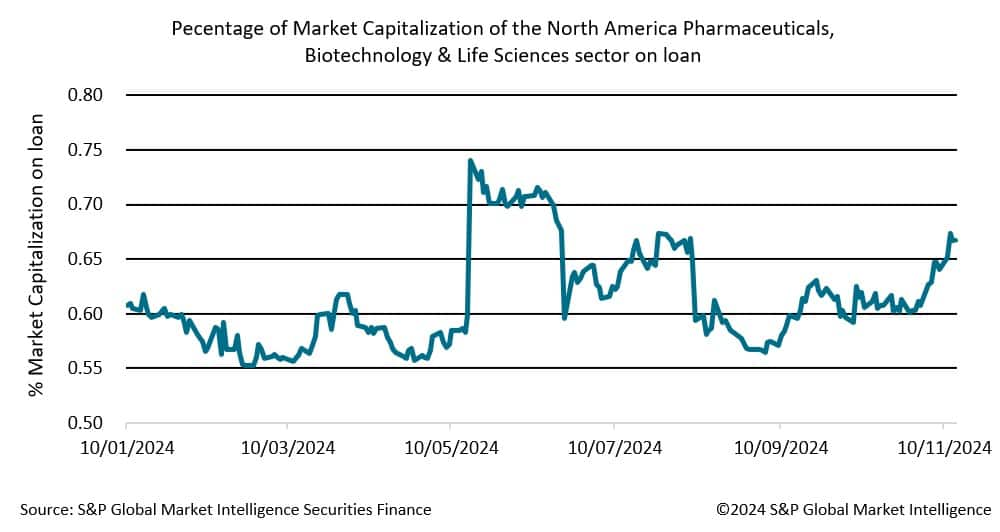

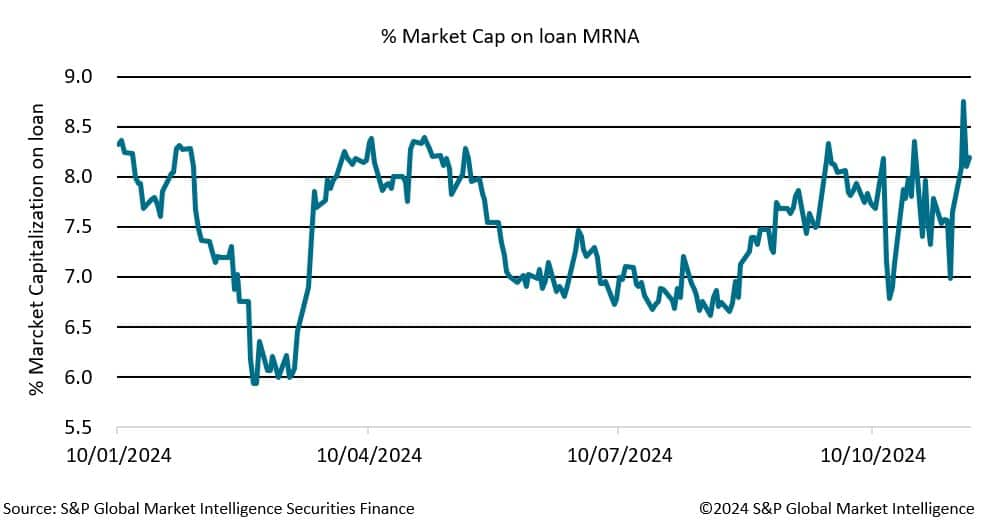

As political climates shift, the pharmaceutical, biotechnology, and life sciences sectors often face significant volatility in investor sentiment, particularly during presidential elections. Recently, this volatility has been underscored by a notable increase in short interest across the sector, with Moderna (MRNA) experiencing its highest level of short interest seen in 2024. Investors are clearly cautious, and this reflects a broader apprehension about how political changes may impact regulatory frameworks, drug pricing, and overall market stability.

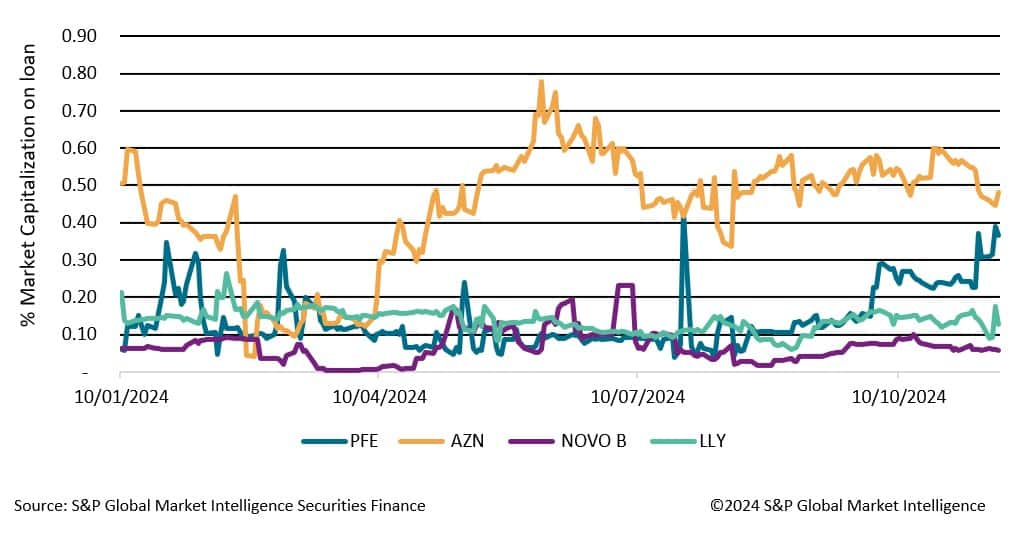

The recent announcement of President-elect Donald Trump's intention to nominate Robert F. Kennedy Jr. as the Secretary of Health and Human Services has sent shockwaves through healthcare stocks, further fuelling investor uncertainty. Last week, this apprehension manifested in dramatic moves in share prices across the sector. Moderna, for instance, was among the worst performers on the S&P 500, plummeting 7.3%. Meanwhile, Pfizer's stock fell by 4.7%, and European vaccine manufacturers faced similar pressures, with Bavarian Nordic and AstraZeneca experiencing declines of 14% and 2.8%, respectively.

The ripple effects were not confined to vaccine producers alone. Companies involved in obesity and diabetes treatments also felt the heat, as Novo Nordisk, the maker of Ozempic, saw its shares drop by 3.4%, while Eli Lilly, known for Zepbound, suffered a 4.9% decline. This broad-based sell-off highlights how investor sentiment can be influenced by the political landscape, particularly when it involves figures who have publicly expressed scepticism about vaccines and public health initiatives.

The volatility seen reflects deeper concerns about the direction of healthcare policy. Investors are often wary of potential changes in regulation that could affect pricing structures or reimbursement rates. The nomination of Kennedy Jr., who has been vocal against vaccines, raises uncertainty about future health policies and the administration's stance on a number of public health issues. Such uncertainty can lead to a cautious approach from investors, prompting them to reevaluate their positions in the sector.

While Moderna is currently facing heightened short interest, the trend is not isolated. Short interest in the sector as a whole has been on the rise, as investors hedge against potential downturns. Although Pfizer (PFE), AstraZeneca (AZN), and Novo Nordisk (NOVO B) still maintain relatively low levels of short interest, there was a noticeable uptick last week, reflecting a growing concern among investors about the potential impacts of political changes on their operations.

In the world of pharma and biotech, where the stakes are high and the competition is fierce, the intersection of politics and investor sentiment can lead to a rollercoaster of investor sentiment. Companies that are heavily reliant on government contracts, regulatory approvals, or public health initiatives are particularly vulnerable to shifts in political and investor sentiment. As a result, investors often find themselves in a game of "buy low, sell high," but in this case, the "low" can be driven by factors beyond the companies' control.

The volatility experienced by pharmaceutical, biotechnology, and life sciences companies during presidential elections and political changes is a multifaceted issue. It underscores the importance of political awareness in investment strategies. As the industry braces for any potential changes of the new administration, investors will need to keep their finger on the pulse, ensuring they are ready to navigate the highs and lows of this dynamic market. After all, in the world of healthcare stocks, it's not just about staying healthy; it's about staying ahead.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.