Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 28, 2018

Global sovereign risk snapshot Q4 2017

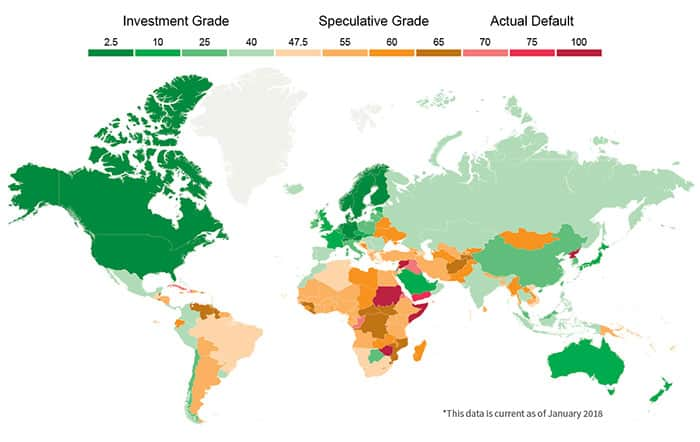

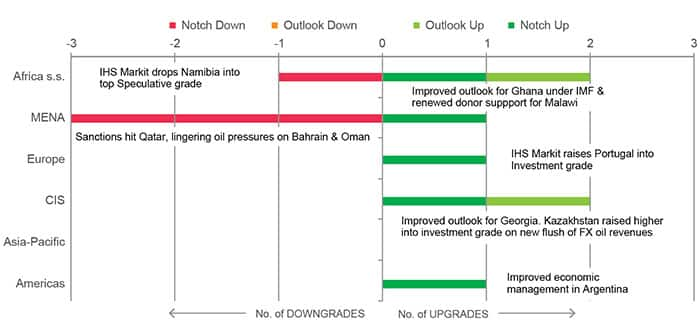

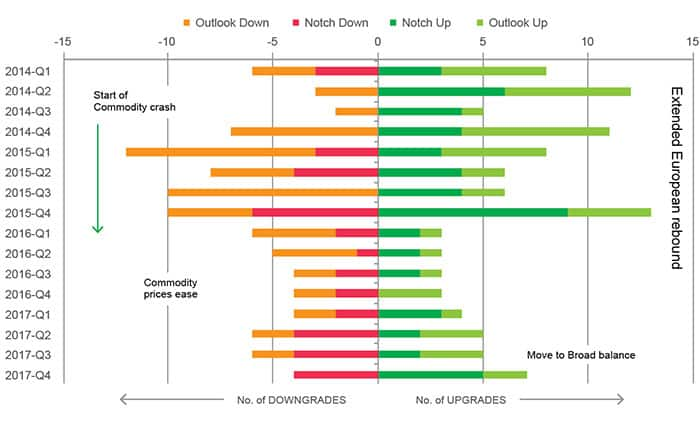

Ratings upgrades more than double downgrades in the final quarter of 2017 with 35 upgrades to 17 downgrades. Commodities continued to place negative pressures on the balance of payments of countries that were late in adopting remedial policy measures. There were no downgrades in Asia-Pacific, the Commonwealth of Independent States or Europe during this time frame.

Key sovereign rating highlights in Q4 2017

- The extended European ratings rebound continues

- Portugal rebounded into lowest investment grade after exit from financial crisis, bailout, and resumption of GDP growth

- Outlooks have begun to improve in CIS for Belarus, Georgia, Kazakhstan, and Ukraine

- Bahrain and Oman fell again on lingering oil pressures, rising debt: We dropped Bahrain from lowest investment grade in Q4

- Egyptian rating receives upgrade on improved external accounts and stronger GDP growth

- Score improves to 50 points (equivalent to BB- in the generic scale), from 60 points; outlook moves from Positive to Stable

- The upgrade is supported by the improvement in the country’s policymaking and reduction of market distortions

- The Macri government will have to show sustained improvements in the country’s inflation rate and in the and in the fiscal deficit in order to continue obtaining financing at reasonable costs

The Sovereign Risk Service covers both short- and medium-term risks for 206 countries worldwide. It utilizes transparent sovereign risk ratings when assessing credit worthiness and trade credit risk and enables the comparison of IHS Markit ratings to the ratings of other agencies.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-sovereign-risk-snapshot-q4-2017.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-sovereign-risk-snapshot-q4-2017.html&text=Global+sovereign+risk+snapshot+Q4+2017","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-sovereign-risk-snapshot-q4-2017.html","enabled":true},{"name":"email","url":"?subject=Global sovereign risk snapshot Q4 2017&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-sovereign-risk-snapshot-q4-2017.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+sovereign+risk+snapshot+Q4+2017 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-sovereign-risk-snapshot-q4-2017.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}