Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 24, 2017

Global Sovereign Risk Snapshot Q2 2017

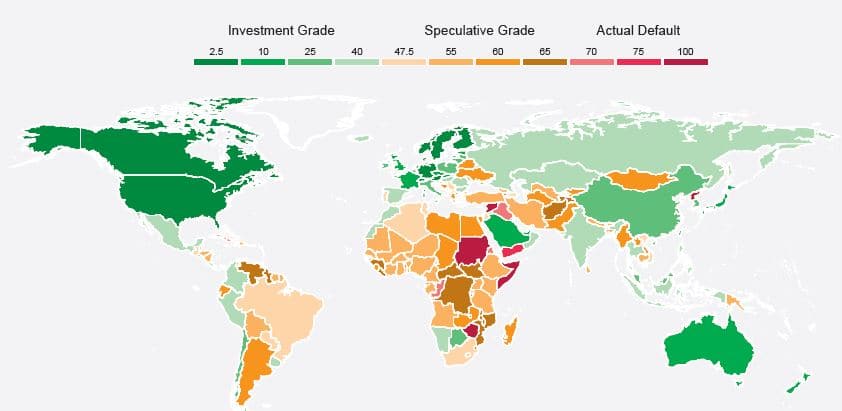

Global Sovereign Risk Ratings

- Three hotspots for downgrades in the second quarter: El Salvador, Qatar, and South Africa

- Long-extended European ratings rebound continues, picking up Bulgaria, Portugal, Slovenia, and Spain in the second quarter.

- Greece moves slowly away from Possible Default scenarios rating.

- Indonesia and Vietnam remain two rating bright spots in Asia.

- Commodity-related downgrades continue to ease, but many countries not out of woods yet.

Risks Mount in South Africa and Business Conditions Deteriorate

- Political tensions in the Zuma government have led to widespread concern over the independence of institutions and the integrity of the macroeconomic framework.

- IHS Markit’s June composite PMI’s fell in negative or contractionary territory, with the fastest falls since April 2016.

- A surprise GDP contraction in Q1 leaves the country technically in recession, with a growth forecast of 0.5% for 2017.

- IHS Markit had downgraded South Africa’s rating from 40/100 (or BBB-) to 45/100 (or BB +); a highly significant fall from lowest investment grade to speculative.

- Political tensions in the Zuma government have led to widespread concern over the independence of institutions and the integrity of the macroeconomic framework.

- IHS Markit’s June composite PMI’s fell in negative or contractionary territory, with the fastest falls since April 2016.

- A surprise GDP contraction in Q1 leaves the country technically in recession, with a growth forecast of 0.5% for 2017.

- IHS Markit had downgraded South Africa’s rating from 40/100 (or BBB-) to 45/100 (or BB +); a highly significant fall from lowest investment grade to speculative.

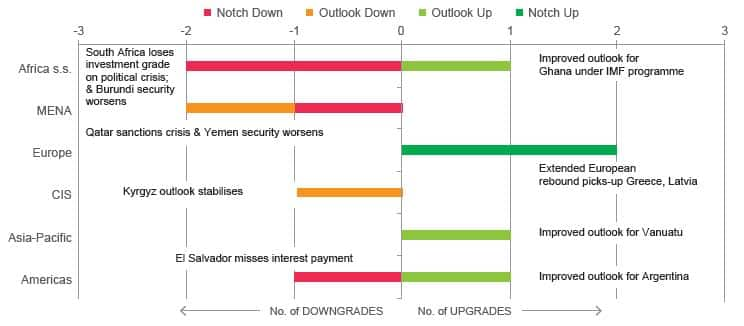

Regional Rating Changes in Q2 2017

Global sovereign rating actions were evenly balanced in the second quarter of 2017 at 26 upgrades and 26 downgrades, after the balance had turned slightly net positive in the previous two quarters.

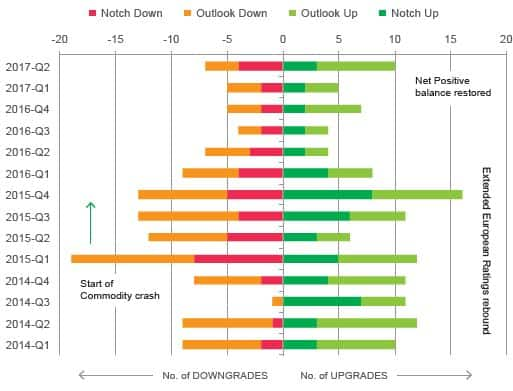

Rating Changes for 2014 Q1 to 2017 Q2

Commodity-related sovereign risk rating downgrades eased off considerably between the third quarter of 2016 and the first quarter of 2017, after reaching record levels in the second quarter of 2016. The long extended European rating rebound continued into Q2, with IHS Markit picking up Lativa and finally, Greece. Ratings outlook turnarounds were marked in first quarter 2017 for Brazil, Argentina, and Colombia, where some resumption of modest growth is expected in 2017; In Asia, Indonesia and Sri Lanka also saw ratings outlook turnarounds.

The Sovereign Risk Service covers both short- and medium-term risks for 206 countries worldwide. It utilizes transparent sovereign risk ratings when assessing credit worthiness and trade credit risk and enables the comparison of IHS Markit ratings to the ratings of other agencies.

Jan Randolph is an Economist and expert for IHS Markit’s Risk Centre and heads the Sovereign Risk services.

Posted on 24 August 2017

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-sovereign-risk-snapshot-q2-2017.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-sovereign-risk-snapshot-q2-2017.html&text=Global+Sovereign+Risk+Snapshot+Q2+2017","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-sovereign-risk-snapshot-q2-2017.html","enabled":true},{"name":"email","url":"?subject=Global Sovereign Risk Snapshot Q2 2017&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-sovereign-risk-snapshot-q2-2017.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+Sovereign+Risk+Snapshot+Q2+2017 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-sovereign-risk-snapshot-q2-2017.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}