Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 11, 2020

Global recovery slows in November, but optimism for the year ahead surges higher

The following is an extract from IHS Markit's monthly PMI overview presentation. For the full report please click on the link at the bottom of the article.

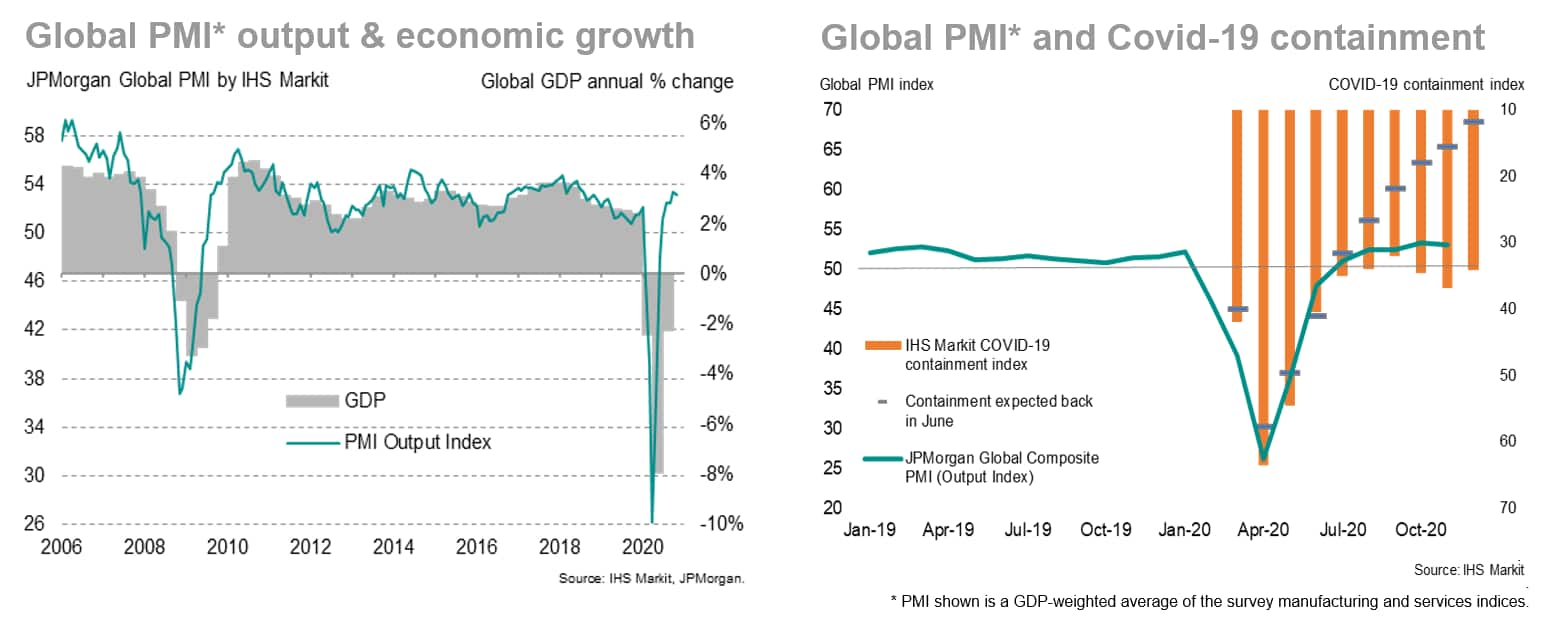

The global economic recovery hit a speed bump in November, as rising COVID-19 infections led to a renewed slowing of business activity. The JPMorgan Global PMI™ (compiled by IHS Markit) edged down from 53.3 in October, its highest since August 2018, to 53.1. While the PMI has now indicated expanding business activity for five successive months, reflecting a rebound after the pandemic caused an unprecedented collapse in the second quarter, the November data reveal a slight waning in the pace of that recovery.

The slowing in the global expansion in part reflects some cooling of initial lockdown rebounds, but also came at a time of renewed waves of virus infections in many countries, which have in turn led to increased lockdowns. IHS Markit's COVID-19 Containment Index has risen from 32 in September to 37 in November, though notably remains well below levels seen earlier in the year (during tighter lockdowns). The hit to global GDP from the pandemic in Q4 consequently looks considerably less severe than seen earlier in the year.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2020, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-recovery-slows-in-november-but-optimism-for-the-year-ahead-surges-Dec20.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-recovery-slows-in-november-but-optimism-for-the-year-ahead-surges-Dec20.html&text=Global+recovery+slows+in+November%2c+but+optimism+for+the+year+ahead+surges+higher+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-recovery-slows-in-november-but-optimism-for-the-year-ahead-surges-Dec20.html","enabled":true},{"name":"email","url":"?subject=Global recovery slows in November, but optimism for the year ahead surges higher | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-recovery-slows-in-november-but-optimism-for-the-year-ahead-surges-Dec20.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+recovery+slows+in+November%2c+but+optimism+for+the+year+ahead+surges+higher+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-recovery-slows-in-november-but-optimism-for-the-year-ahead-surges-Dec20.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}