Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 11, 2020

APAC electronics sector closes 2020 with strong rebound

- The Asia-Pacific electronics industry, which is a significant part of the manufacturing sector for many East Asian economies, has shown a strong rebound during the second half of 2020, after being significantly impacted by disruptions caused by the Covid-19 pandemic lockdowns in the first half of 2020.

- The latest IHS Markit Purchasing Managers' Index (PMI) survey data shows a strengthening recovery in global electronics output, as the world economy and major consumer markets have gradually emerged from the severe economic slump in the first half of 2020. This recovery has been reflected in China's electronics exports data, which rose strongly in November, rising 24.8% year-on-year due to strong Christmas demand for consumer electronics in key global markets, notably the US and EU.

APAC electronics sector output rebounds after Covid-19 related disruptions

The electronics manufacturing industry is an important part of the manufacturing export sector for many East Asian economies, including China, South Korea, Taiwan, Malaysia, Singapore, Philippines, Thailand and Vietnam. Furthermore, the electronics supply chain is highly integrated across different economies, with China being an important supplier of intermediate electronics parts for a number of Southeast Asian electronics sectors. The complete shutdown of Chinese industrial production for a protracted period consequently created significant supply chain disruptions to the electronics manufacturing sector in many Southeast Asian economies during February and March.

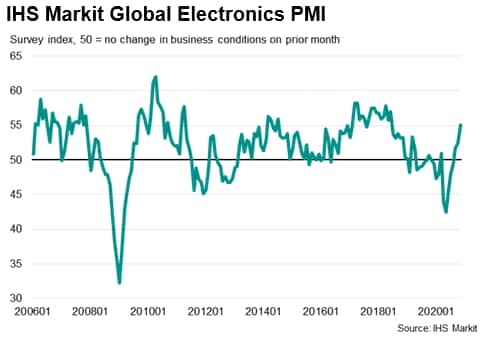

As the impact of the pandemic widened in the Asian region during April, the headline IHS Markit Global Electronics PMI fell to 43.6 in April, down from 49.2 in March, to signal a sharp deterioration in business conditions faced by electronics manufacturers. The April reading pointed to the fastest decline since April 2009, with many businesses temporarily closed amid the global Covid-19 outbreak. In addition to supply side disruptions to electronics output, widespread lockdowns of retail businesses in many major markets worldwide also disrupted consumer demand for electronics goods as well as products that have significant electronics components, such as autos. Extended periods of lockdown in major electronics manufacturing hubs, including China and Malaysia, as authorities tried to control the spread of the pandemic, resulted in disruption of industrial production and consumption, impacting on global supply chains.

However, since April, the IHS Markit Global Electronics PMI has showed significant improvement. The headline seasonally adjusted PMI rose to 53.4 in November, up from 51.8 in October. The latest reading pointed to the quickest improvement in the overall health of the global electronics sector for over two years, amid stronger increases in both output and new orders.

The global electronics PMI's new orders index rose from a near-12-year low of 35.0 in May to a level of 52.8 by November, reflecting a significant recovery in new orders.

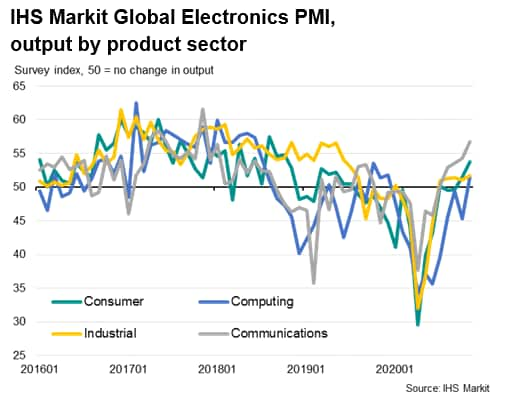

Each of the four monitored sub-sectors recorded an improvement in business conditions during November, led by communications firms, with all four sub-sectors recording expansionary conditions. The strongest recovery has been in output for communications electronics, the index for which reached 56.7 in November, helped by improving demand for mobile phones.

A number of Asian economies have reported strong growth in electronics exports in the second half of 2020, as the global shift towards working from home and ecommerce retailing resulted in surging demand for laptops and smartphones from companies, governments, and households.

In Malaysia, production of electrical and electronic products fell by 34.2% y/y in April, as the government's strict lockdown measures resulted in a sharp contraction in industrial production. However, as the lockdown restrictions were eased from May onwards, production rebounded. In October, production of electrical and electronic products rose by 9.8% y/y, with electronics exports up 3% y/y.

In South Korea, semiconductor exports increased 16.4% y/y in November, boosted by newly launched mobile phone products as well as increasing sales of mobile phone parts.

Taiwan's exports of electronic components rose by 19.5% y/y in November, driven by strong demand for integrated circuits.

In Vietnam, exports of personal computers and related products rose strongly in the third quarter of 2020, up by an estimated 20% y/y, as the global shift to remote working boosted demand for personal computers. For the first ten months of 2020, exports of personal computers, electrical products and spare parts rose by 25% y/y.

Electronics industry suppliers' delivery times hit by supply chain disruptions

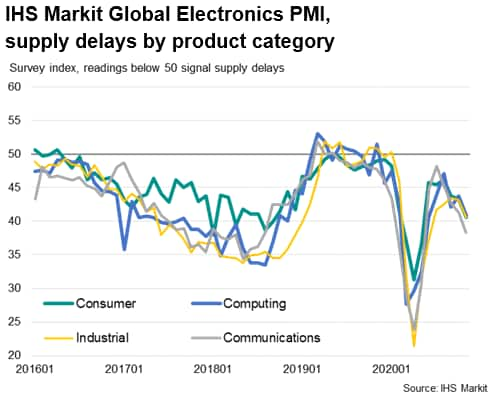

Due to the extensive disruption of manufacturing output in many leading electronics manufacturing hubs due to the Covid-19 pandemic, the situation in April reflected severe supply-side problems in electronics supply chains. April survey data pointed to input delivery times lengthening drastically. In fact, the rate at which vendor performance deteriorated in April to set a new survey record. During April, companies widely cited difficulties in obtaining inputs, particularly from the US, Europe and China.

Despite supply chain disruptions, there has been a considerable rebound in global electronics suppliers' delivery times in recent months, from a low of 24.9 in April to 46.0 by August. However, supplier delivery times have worsened again during the fourth quarter of 2020, with the November reading having declined again to 39.4, with companies reporting raw materials shortages amidst rising global electronics demand.

Reshaping of electronics supply chains in APAC

The process of diversification of manufacturing production and supply chains away from China has already been underway over the past decade, initially driven by rapidly rising manufacturing wage costs in coastal provinces of China. The escalating US-China trade war since 2018 has further intensified this process of supply chain diversification, as firms shifted some production of manufacturing exports for the US market away from mainland China in order to mitigate the impact of US tariff measures. The Covid-19 pandemic has become a further driver for this supply chain diversification process. All of these factors are continuing to reshape APAC supply chains for the electronics industry.

One of the biggest winners of the shift in electronics supply chains away from China over the past decade has been Vietnam. Vietnam has attracted large inflows of foreign direct investment into its electronics manufacturing sector, notably from South Korean electronics firms. The importance of Vietnam's electronics industry has risen dramatically, with the electronic industry's share of total GDP rising from around 5% in 2010 to around one- quarter of GDP by 2019, a key factor helping to drive rapid growth of both exports and GDP.

Total electronic and electrical manufacturing exports accounted for 33% of total Vietnamese merchandise exports in 2019. Vietnam has become the biggest foreign production hub for Samsung Electronics, which booked USD 66 billion of sales in 2018 out of its Vietnamese operations, which was equivalent to around 28% of Vietnam's GDP.

Vietnam's new EU-Vietnam Free Trade Agreement (EVFTA) which was implemented on 1st August 2020 will also help to boost Vietnam's electronics sector.

The Indian economy is also benefiting from new investment inflows into its electronics industry, linked to the rapid development of telecoms infrastructure. The rollout of 4G networks is helping to support the medium-term outlook for new smartphone sales, and will be further boosted by the development of 5G networks. The strong growth of India's mobile phone market is attracting a large number of foreign electronics firms to increase their manufacturing capacity in India.

The decision by Apple to increase its manufacturing of iPhones in India has resulted in a significant number of its component manufacturers also shifting production and diversifying supply chains to India. Apple component maker Wistron is hiring an additional 10,000 staff in India as it increases its local manufacturing capacity. This reflects the strong growth potential of India's domestic market as well as supply chain diversification away from China as US-China technology tensions have escalated in recent months. Apple suppliers Foxconn and Pegatron have also planned to significantly increase production capacity in India.

The estimated value of domestic Indian manufacturing of mobile phones reached USD 24.3 billion in the 2018-19 financial year, compared with just USD 3.1 billion in 2014-15. The overall exports of mobile handsets from India were valued at USD 2.6 billion in the 2018-19 financial year, according to the Indian Department of Commerce.

APAC electronics sector outlook

The gradual easing of lockdown restrictions in many of the world's largest economies has resulted in a rebound of world consumer demand since June 2020. This is helping to boost demand for electronics products, as well as for a wide range of other consumer goods and industrial goods that utilize electronics components. New orders from the US and Europe for the Christmas season have also helped to support recovery in new orders for the electronics sector during the second half of 2020.

In 2021, world growth is expected to gradually strengthen through the year, with the global economy forecast to grow at a pace of 4.2% y/y. Most major economies are expected to show a significant rebound in economic activity as vaccine rollouts result in improving economic momentum. Consequently, global electronics demand for both consumer and industrial electronics is expected to strengthen in 2021.

Over the medium-term outlook, a number of factors should continue to support further recovery in the global electronics cycle.

Firstly, a return to positive economic growth in the world economy is forecast for 2021, which should help to boost consumer demand for electronics products. Continued positive economic expansion for the global economy is also forecast for 2022-2023.

Secondly, the rollout of 5G networks will support increasing demand for new model 5G smartphones over the next three years, helping to boost demand for communications electronics.

Thirdly, the continued development of industrial automation and increasing use of robotics and smart devices for industrial applications and new technologies such as autonomous vehicles will also help to boost demand for electronics components such as semiconductors.

These trends will help to boost output and exports in the electronics sectors for many Asian economies, with the East Asian region continuing to play a key role in global electronics supply chains.

© 2020, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fapac-electronics-sector-closes-2020-with-strong-rebound.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fapac-electronics-sector-closes-2020-with-strong-rebound.html&text=APAC+electronics+sector+closes+2020+with+strong+rebound+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fapac-electronics-sector-closes-2020-with-strong-rebound.html","enabled":true},{"name":"email","url":"?subject=APAC electronics sector closes 2020 with strong rebound | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fapac-electronics-sector-closes-2020-with-strong-rebound.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=APAC+electronics+sector+closes+2020+with+strong+rebound+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fapac-electronics-sector-closes-2020-with-strong-rebound.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}