Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Apr 24, 2023

By Sara Johnson

Despite persistent inflation and tightening financial conditions, the global economic expansion will continue at a moderate pace. Near-term growth is dominated by service sectors that are enjoying renewed post-pandemic demand. Economic performance will vary widely across regions, with growth in Europe and the Americas experiencing subpar growth and emerging markets of Asia-Pacific and parts of Africa achieving robust growth.

The global economy is performing better than anticipated when 2023 began. Global real GDP growth picked up from an annual rate of 1.5% quarter over quarter at the end of 2022 to an estimated 2.5% pace in the first quarter of 2023. Mainland China, India and other emerging markets led the acceleration. Meanwhile, the United States and the eurozone appear to have dodged recessions. S&P Global's Purchasing Managers' Index™ (PMI™) surveys through March signal strong post-pandemic resilience in service sectors alongside subdued growth in manufacturing. This dichotomy is apparent across regions of the world.

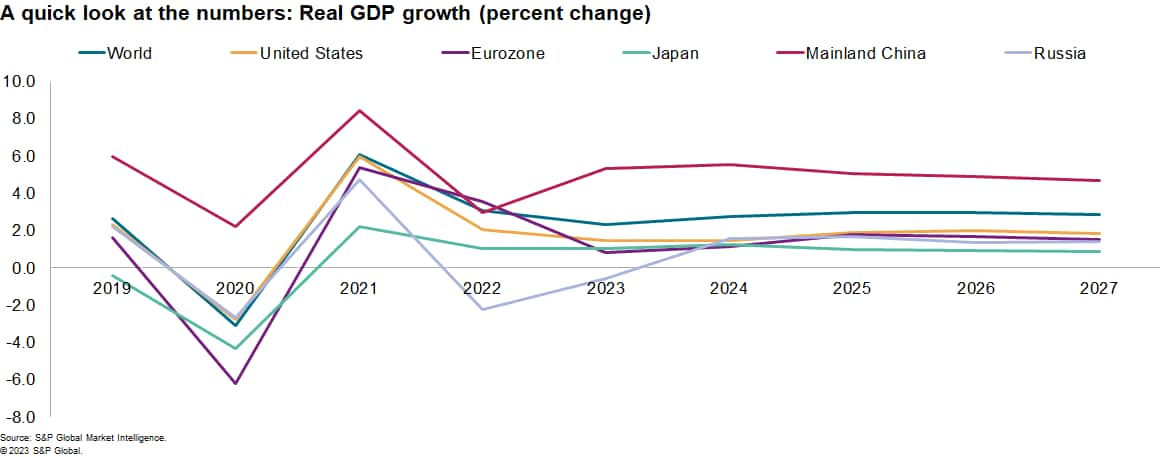

The S&P Global Market Intelligence forecast calls for world real GDP growth to slow from 3.0% in 2022 to 2.3% in 2023.

The slowdown is centered in Europe and the Americas — regions where high inflation and monetary policy tightening are restraining consumer and business spending. The reopening of mainland China's economy following the end of COVID containment policies is providing an offsetting lift to the world economy. As inflation subsides and monetary policies ease, global growth should pick up to 2.7% in 2024 and 3.0% in 2025. We revised this month's forecast up by 0.1 percentage point in 2023 and down by 0.1 percentage point in 2024.

Inflation is on a downward path but underlying pressures persist.

Global consumer price inflation peaked at 8.3% year over year in September 2022 before edging down to 7.0% in March 2023. Nonenergy commodity prices are expected to drift downward through mid-2024 in response to improving supply and logistics conditions, high interest rates and weak demand for goods. Services price inflation will be more persistent, owing to labor shortages, pent-up demand and capacity reductions during the pandemic. Food price inflation will ease as crop production rebounds, but the forecast is subject to risks related to weather, animal diseases and the Russia-Ukraine war. Global consumer price inflation will likely slow from 7.6% in 2022 to 5.7% this year and 3.5% in 2024.

With inflation rates still well above targets, we expect the US Federal Reserve and European Central Bank will tighten monetary policies in May and June.

Policy rates will reach highs of 5.25% in the United States, 4.50% in the United Kingdom and 4.25% in the eurozone (refinance rate) and hold at these levels throughout 2023. As inflation subsides, monetary easing in 2024-25 will bring these policy rates down to their long-run neutral levels in the range of 2.00% to 2.75%.

A banking crisis was averted, but financial stresses remain a concern.

A flight to safety after the mid-March collapse of Credit Suisse and Silicon Valley Bank (SVB) resulted in lower reference bond yields and widened spreads for high-yield bonds and weaker emerging market credits. Rapid regulatory intervention prevented wider financial instability and calmed markets. Yet, this episode has exposed some structural problems in banking that will not be quickly resolved. Although bank capital positions are generally strong, the rapid rise in interest rates since early 2022 has reduced the market value of banks' security holdings. Commercial real estate loans are subject to rising default risk in a period of high vacancy rates and rising interest rates. Meanwhile, bank deposits are increasingly mobile as customers seek higher yields or increased insurance coverage. In response, banks may hold more liquid assets, reduce lending and tighten credit standards. Thus, Europe and North America are likely to experience subpar growth in business investment and household discretionary spending in 2023-24.

US economic growth is slowing as credit conditions tighten.

After 2.6% annualized growth in the fourth quarter of 2022, we estimate that real GDP increased at a 1.9% rate quarter over quarter in the first quarter of 2023. Mild weather and strong gains in employment, income and household wealth fueled robust growth in consumer spending at the start of 2023, but momentum is fading. Our latest tracking estimate shows no growth in real GDP in the second quarter, and we expect sluggish growth at best in the second half of 2023. High interest rates and more restrictive lending conditions will lead to declines in construction of commercial and industrial buildings, while homebuilding will remain depressed. The US unemployment rate is projected to rise from 3.5% in March to a high of 4.6% in 2025. After slowing from 2.1% in 2022 to 1.4% this year, real GDP growth gradually picks up to 1.5% in 2024 and 1.9% in 2025.

Despite resilience in services, European economies face multiple headwinds.

After a slight contraction in the final quarter of 2022, the eurozone will experience tepid growth throughout 2023 and into 2024. High inflation continues to undermine household purchasing power while tighter financial conditions restrain investment. Eurozone real GDP growth will slow from 3.6% in 2022 to 0.8% this year. As inflation and interest rates retreat, growth will gradually improve to 1.1% in 2024 and 1.8% in 2025. However, several risks could tip the European economies into recession, including an escalation of banking stresses, persistent core inflation, escalation of the conflict in Ukraine, and more severe and widespread downturns in house markets.

Mainland China's economy is accelerating after the end of COVID containment policies.

Real GDP rose 4.5% year over year in the first quarter of 2023, up from 2.9% in the previous quarter. Hospitality and transportation — sectors hit hardest by pandemic controls — bounced back most sharply. Constrained by weak export markets, manufacturing growth is reviving more slowly. Policies to ease credit conditions for property developers have sparked recoveries in housing prices, sales and construction completions, but new housing starts have continued to decline. After 3.0% growth in 2022, real GDP will increase 5.3% in 2023 and 5.5% in 2024 before resuming a long-term deceleration. Led by solid growth in mainland China and India, Asia-Pacific's real GDP is forecast to pick up from 3.2% last year to 4.1% in 2023 and 4.6% in 2024, accounting for about 60% of global growth.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.