Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 24, 2018

Global Economic Preview: Week of 27 August 2018

- US GDP and price data updates

- Italy, France, India and Brazil GDP releases

- Eurozone inflation and unemployment

- Japan's production, retail and jobless data

- Bank of Korea policy meeting

The coming week sees US second quarter GDP and consumer expenditure numbers, including closely-watched price indices, with France, Italy, India, Brazil and Canada likewise publishing second quarter GDP. Japan also updates a host of official indicators, including manufacturing output and retail sales.

Eurozone business and consumer sentiment surveys are meanwhile accompanied by unemployment and inflation numbers, the latter being especially important to gauge the ECB's appetite to rein-in its stimulus.

In the UK, mortgage lending data will meanwhile provide an updated insight into property demand in the environment of higher interest rates.

Monetary policy action comes from South Korea.

Robust US growth, and higher inflation, to be confirmed

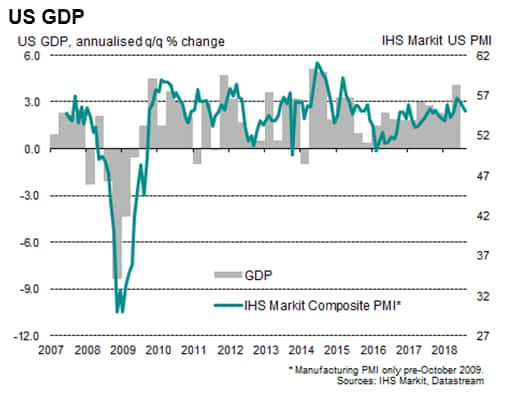

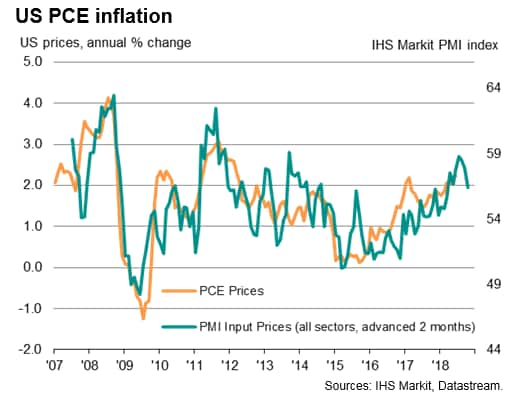

Second quarter US GDP growth is likely to be confirmed at a similar rate to the first 4.1% estimate, with price pressures also likely to have picked up. However, recent survey data suggest both growth and price pressures have since shown signs of cooling as we move through the third quarter, albeit remaining elevated in both cases. The flash IHS Markit PMI surveys showed growth slipping to a four-month low in August but remaining consistent with 2.5% annualised GDP growth. The survey's price gauge meanwhile indicated core PCE price pressures will have lifted higher in July, but could soon start to moderate.

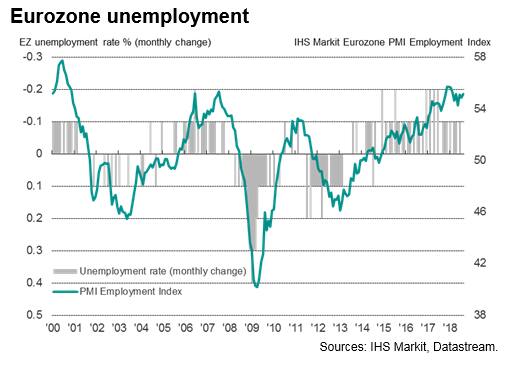

Eurozone jobless rate to fall to new post-crisis low

ECB watchers will be eying unemployment and inflation numbers, with the jobless rate widely expected to dip down to 8.2% from 8.3%, its lowest since December 2008. Inflation is meanwhile expected to hold steady at 2.1%, though some acceleration is likely in Germany, where latest survey data showed businesses raising prices at a faster rate in August.

Recent Eurozone PMI survey data indicated a steady pace of economic expansion and near-record jobs growth so far in the third quarter, as well as elevated price pressures.

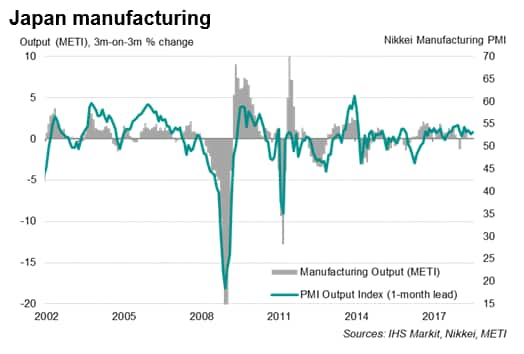

Japan data updates

A busy week of data releases for Japan includes industrial production, manufacturing output, unemployment and retail sales. The official data come on the heels of August Nikkei flash PMI data, which acts as a reliable advance indicator of official production and shipment data. The survey indicated that manufacturing output and order books continued to expand, boosting hopes of a further GDP rise in the third quarter. However, the survey also brought further signs of falling exports and sharply higher input prices.

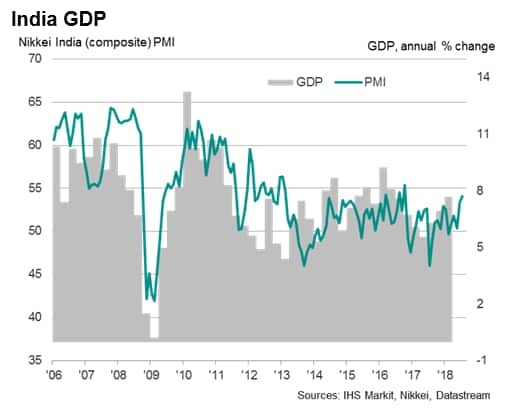

India's economy expected to slow

Second quarter GDP numbers are expected to show India's economy slowing to a 7.3% annual growth rate, down from 7.7% in the opening months of 2018. Better prospects could be in store for the third quarter. The Nikkei PMI surveys indicated that India enjoyed its strongest expansion for over one-and-a-half years during July, particularly supported by the service sector.

Bank of Korea faces close policy call

The Bank of Korea meets to decide on monetary policy, with analysts expecting a close call. The central bank has frequently leaned towards a hawkish stance, but signs of manufacturing weakness and a softening job market could delay a rate hike. According to Nikkei PMI data, South Korea's manufacturing sector business conditions deteriorated to the greatest extent for over one-and-a-half years in July.

Download the article for a full diary of key economic releases.

© 2019, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-preview-week-of-27-august-2018.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-preview-week-of-27-august-2018.html&text=Global+Economic+Preview%3a+Week+of+27+August+2018+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-preview-week-of-27-august-2018.html","enabled":true},{"name":"email","url":"?subject=Global Economic Preview: Week of 27 August 2018 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-preview-week-of-27-august-2018.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+Economic+Preview%3a+Week+of+27+August+2018+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-preview-week-of-27-august-2018.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}