Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 24, 2018

Flash Eurozone PMI signals steady expansion but optimism hits two-year low

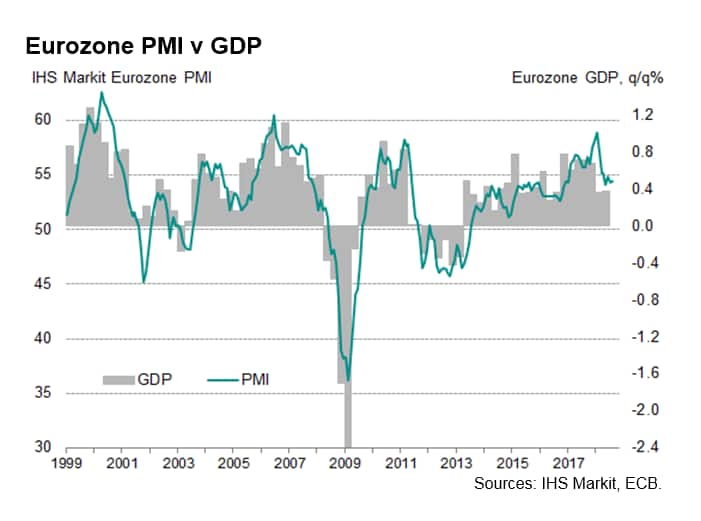

- Eurozone PMI upturn signals 0.4% GDP rise in Q3

- Future expectations slide to lowest since September 2016

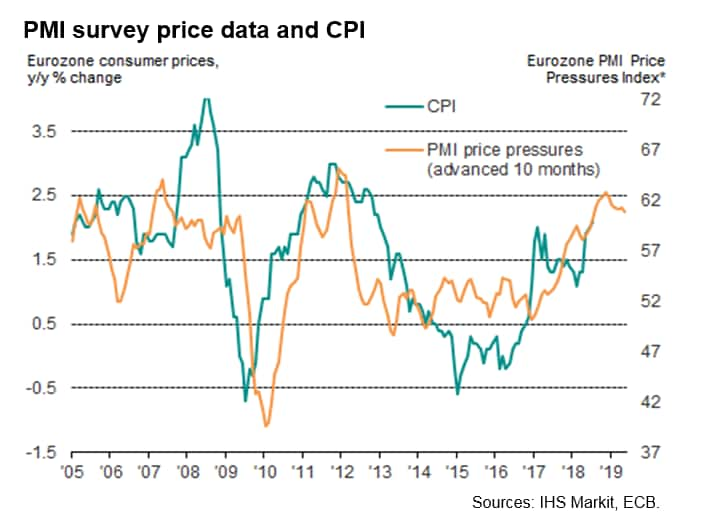

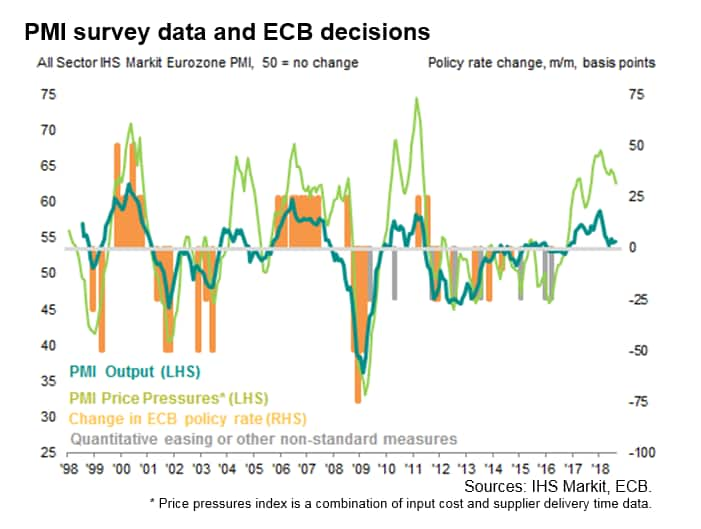

- Price pressures remain elevated but cool further

Flash PMI survey data indicated that the eurozone economy continued to grow in August, albeit with the rate of expansion remaining one of the weakest seen over the past year-and-a-half. Companies' expectations of future growth meanwhile slipped to the lowest for nearly two years.

Steady third quarter expansion

The IHS Markit Eurozone Composite PMI® edged higher from 54.3 in July to 54.4 in August, according to the flash reading (which is based on approximately 85% of usual replies). The rise signalled a marginal acceleration of output growth during the month and, as such, raises hopes that the third quarter could see GDP growth match the 0.4% expansion seen in the second quarter. In fact, the survey evidence suggests that the official data so far this year could yet be revised slightly higher.

Jobs growth also remains encouragingly robust, which should help further stimulate consumer spending. Employment growth hit a six-month high, once again running close to survey record rates. Service sector jobs growth struck the highest since October 2007, though factory payroll growth slipped to a 17-month low.

However, it's also clear that growth has moderated since earlier in the year. The latest increase in output was the third-weakest since January 2017. Although growth rates improved slightly in manufacturing and services, both remained among the weakest seen for at least one-and-a-half years.

Similarly, new order growth picked up marginally in both sectors but, measured overall, was the third-weakest since December 2016. A particularly sluggish performance was seen in manufacturing, where new export orders registered the smallest monthly rise for two years.

Future growth warning lights

Warning lights are also flashing for the outlook. Analysis of past data indicates that demand needs to pick up to sustain current output and employment growth in coming months, especially in manufacturing, where output growth continued to exceed order book growth (see charts). Yet the risks seem tilted to the downside.

The overall volume of orders received but not yet completed continued to rise, albeit at the weakest rate for 19 months. While backlogs grew at a fractionally increased rate in services, the rise in manufacturing was only marginal and the smallest for just over three years.

The smaller accumulation of uncompleted work was the result of the reduced inflow of new orders compared to earlier in the year combined with sustained robust hiring.

Future expectations of business activity meanwhile deteriorated to a 23-month low, slumping to a 34-month low in manufacturing and a 21-month low in the service sector. Escalating political worries, rising prices and a recent slowdown in order book growth have all contributed to the gloomiest outlook for almost two years.

Elevated, but cooling, price pressures

The flash surveys also found price pressures to have remained elevated as higher wages were seen in some countries, alongside increased fuel, transport and commodity prices. However, although input cost and selling price inflation rates remained among the highest seen over the past seven years, both cooled to three-month lows. Output price inflation eased in both manufacturing and services.

Upturn led by 'core'

Within the eurozone, growth accelerated in France and Germany but slowed across the rest of the single-currency area.

The rate of growth of Germany's private sector economy accelerated to the fastest since February, indicative of GDP growth rising to 0.5% in the third quarter. The improvement was driven by a stronger increase in service sector activity. Manufacturing output rose at an identical rate to July, but new orders growth for goods slipped amid the smallest rise in exports for over two years.

Employment growth held close to record highs in Germany, but slower backlog accumulation hints at the pace of job creation cooling in coming months.

France also saw growth perk up, hitting a four-month high as the pace of expansion lifted higher in both manufacturing and services. However, although both sectors reported faster inflows of new business, growth rates remained well below peaks earlier in the year, notably for goods exports, and the third quarter is so far looking the weakest in terms of output growth since 2016. Future expectations also dropped sharply in both sectors, with the combined measure slumping to a 21-month low. Job creation remained buoyant, albeit on course for the weakest quarterly rise for a year.

Elsewhere in the eurozone, output and new order growth rates weakened to 22-month lows, with future expectations hitting a five-year low.

© 2018, IHS Markit Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-signals-steady-expansion-240818.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-signals-steady-expansion-240818.html&text=Flash+Eurozone+PMI+signals+steady+expansion+but+optimism+hits+two-year+low+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-signals-steady-expansion-240818.html","enabled":true},{"name":"email","url":"?subject=Flash Eurozone PMI signals steady expansion but optimism hits two-year low | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-signals-steady-expansion-240818.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+Eurozone+PMI+signals+steady+expansion+but+optimism+hits+two-year+low+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-signals-steady-expansion-240818.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}