Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 22, 2018

Flash Eurozone PMI signals 0.5% GDP rise in Q2, but also hints at weakening trend

- Flash Eurozone PMI shows modest rebound in June

- Faster service sector growth contrasts with manufacturing slowdown

- Forward-looking indicators point to downside risks to future output

Flash PMI survey data for June showed business activity regaining some momentum, but failing to fully recover the rate of expansion seen earlier in the year. Forward-looking indicators also hint at growth weakening again as we head into the second half of 2018.

Solid second quarter

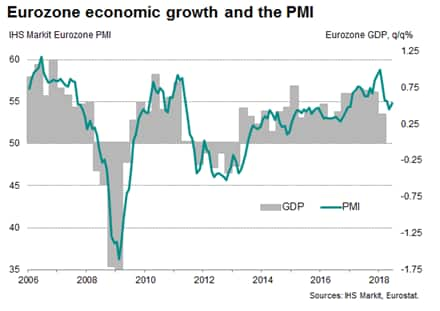

The IHS Markit Eurozone Composite PMI rose from 54.1 in May to 54.8 in June, according to the flash reading. With growth kicking higher in June, the surveys are commensurate with GDP rising 0.5% in the second quarter.

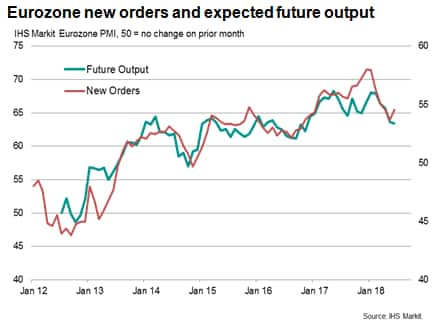

Encouragingly, inflows of new orders also picked up, after having fallen to a one-and-a-half year low in May, registering the largest gain since April. Hiring likewise perked up, with June seeing the largest payroll gain since January and one of the steepest rises seen over the past 18 years.

However, while an improvement on the 18-month low seen in May, the June reading represented the second-weakest expansion seen over the past 17 months, highlighting how the pace of business activity growth has eased since the turn of the year. At 54.7, the second quarter average PMI reading is the weakest since the end of 2016.

Downside risks to outlook

The details of the survey also warn against any complacency. While the June upturn provides some hope that the softening of official data earlier in the year may have overstated the region's weakness, the risks remain tilted towards a further slowdown in the second half of the year.

Note that the June uptick could be at least in part explained by business returning to normal after an unusually high number of public holidays in May.

These holiday effects had been more prominent in causing the weak May readings for France and Germany, and it's likely no coincidence that it's in these two countries where the June rebound was most pronounced. The rest of the region saw the output index rise only marginally by 0.2 index points in June, compared to 1.3 and 0.9 points (rounded to 1 decimal place) increases in France and Germany respectively.

Business expectations about output in the year ahead are also running at one-and-a-half year lows, and output continues to increase at a faster rate than incoming new orders, all of which suggests that output and employment growth could weaken again in July unless demand picks up again.

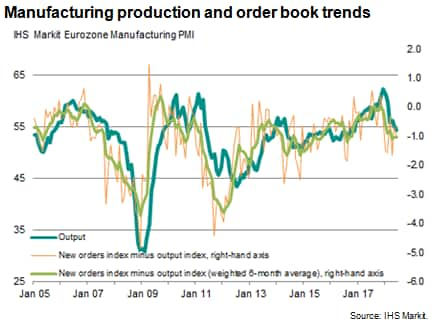

Manufacturing is looking especially prone to a further slowdown in coming months, with companies citing trade worries and political uncertainty as their biggest concerns. Sentiment about the year ahead in the factory sector has sunk to its lowest since 2015 and export growth has weakened markedly so far this year. Recent factory output and order book ratios, which act as a reliable forward-gauge of production, remain subdued (though have at least shown some signs of bottoming out).

Slowdown overstated

While we suspect the underlying trend in the economy has weakened and see downside risks at the start of the third quarter, we also note that the survey data continue to suggest that the recent official data up to April have overstated the extent of the weakening of the economy. We will know more with the official data for May.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

© 2018, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-signals-0.5-gdp-rise-in-q2-but-also-hints-at-weakening-trend.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-signals-0.5-gdp-rise-in-q2-but-also-hints-at-weakening-trend.html&text=+Flash+Eurozone+PMI+signals+0.5%25+GDP+rise+in+Q2%2c+but+also+hints+at+weakening+trend+%7c+S%26P+Global","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-signals-0.5-gdp-rise-in-q2-but-also-hints-at-weakening-trend.html","enabled":true},{"name":"email","url":"?subject= Flash Eurozone PMI signals 0.5% GDP rise in Q2, but also hints at weakening trend | S&P Global&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-signals-0.5-gdp-rise-in-q2-but-also-hints-at-weakening-trend.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=+Flash+Eurozone+PMI+signals+0.5%25+GDP+rise+in+Q2%2c+but+also+hints+at+weakening+trend+%7c+S%26P+Global http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-signals-0.5-gdp-rise-in-q2-but-also-hints-at-weakening-trend.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}