Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 22, 2018

IHS Markit PMI surveys signal further 190k non-farm payroll gain in June

- IHS Markit flash PMI survey data indicate further strong job gains in June

- Forward-looking indicators suggest downside risk to future hiring trend

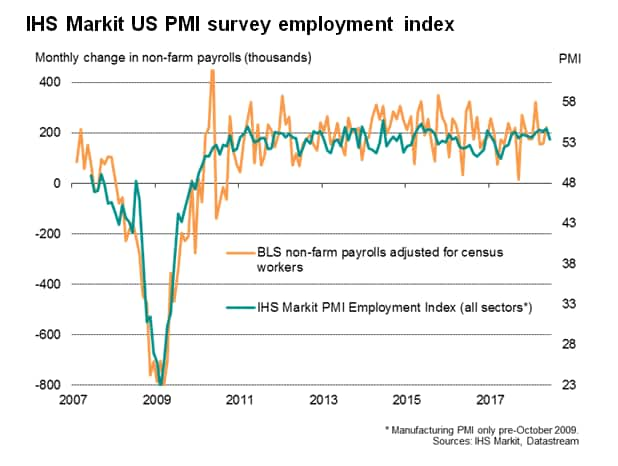

IHS Markit's PMI surveys signal another bumper month of employment growth in June. The flash survey results, which are based on approximately 85% of usual replies received in any given month, showed employment rising robustly at the end of the second quarter. The weighted index of manufacturing and service sector job creation registered 53.4, remaining well above the 50.0 level which is the neutral cut-off point between expansion and contraction. At this level, the survey employment gauge is historically consistent with non-farm payrolls rising by 190k at the end of the second quarter.

Official non-farm payroll data are released on 6th July, and are typically one of the most market-moving numbers in the trading calendar. While a high standard error [*] in the official data means forecasting the precise numbers is far from straightforward, the PMI series exhibits a strong correlation with the official data which can add significantly to estimations of upcoming umbers.

Since the IHS Markit PMI data were first available in 2009, covering business trends in both manufacturing and services, the survey indicator of total employment has exhibited an adjusted r-square of 0.894 in an OLS regression with non-farm payrolls. The correlation between the PMI employment index and non-farm payrolls is 95% [*].

Over the course of 2017, a PMI-based regression predicted an average non-farm payroll gain of 182k, which is exactly in line with the current estimates from the Bureau of Labor Statistics. For the first five months of 2018, the PMI has pointed to an average 219k gain, which is slightly above the current BLS estimate of 199k, suggesting the latter may get revised higher.

Slowdown ahead?

However, while the payroll gain indicated by PMI data remained strong in June, it was nevertheless the weakest recorded for a year, suggesting some pull back in recruitment compared to prior months. Furthermore, other indices from the PMI survey hint at a possible further slowdown in hiring in coming months.

First, new orders growth weakened to the slowest seen so far this year, and in the factory sector have even dropped behind output growth for the first time this year. With output growing faster than order books, production capacity may be reined-in in coming months unless demand revives.

Second, firms' expectations of future output growth slipped to the lowest since January. If output expectations have fallen, it's likely that hiring intentions have likewise cooled.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

© 2018, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-pmi-surveys-signal-190k-nonfarm-payroll-gain-june.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-pmi-surveys-signal-190k-nonfarm-payroll-gain-june.html&text=S%26P+Global+PMI+surveys+signal+further+190k+non-farm+payroll+gain+in+June+%7c+S%26P+Global","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-pmi-surveys-signal-190k-nonfarm-payroll-gain-june.html","enabled":true},{"name":"email","url":"?subject=S&P Global PMI surveys signal further 190k non-farm payroll gain in June | S&P Global&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-pmi-surveys-signal-190k-nonfarm-payroll-gain-june.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=S%26P+Global+PMI+surveys+signal+further+190k+non-farm+payroll+gain+in+June+%7c+S%26P+Global http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fihs-markit-pmi-surveys-signal-190k-nonfarm-payroll-gain-june.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}