Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — May 11, 2023

We've seen a flurry of announcements about investments in US electric vehicle (EV) and battery facilities, due in part to the passage of the Inflation Reduction Act (IRA) in 2022. These high-profile announcements will create around $80 billion in new investment and 75,000 jobs at face value.

States have been aggressively lobbying for their share of investment in the burgeoning US EV industry. To date, the traditional US automotive belt that spans from the Midwest to the Southeast has taken a huge slice of the investment pie: The top automobile-producing states in the Midwest and Southeast are slated to receive about 90% of the incoming investment and jobs.

The IRA's revival of the $7,500 EV tax credit — which comes with US production, parts, and sourcing requirements to qualify — has been a key driver of the flow of investment. As automakers gear up for the US EV transition, they have looked at familiar places with proximity to existing facilities, supply clusters, and experienced labor. While there are some significant differences in the components and systems used in EVs and the skills needed within the labor pool, there is enough overlap to encourage automakers to focus their EV investment dollars in established industry clusters. This was not necessarily the case for companies that started out untethered to gasoline-powered vehicles, most notably Tesla Inc., which opened its Gigafactories in Reno, Nevada, and Austin, Texas — areas that had little to no linkages to the automotive industry.

These recent EV-related expansion plans to date have skewed heavily to the South. Georgia attracted three of the top six projects by planned investment and the top two by planned jobs. Tennessee, Kentucky, and the Carolinas have also attracted their share of notable investments. Combined, this gives the South a resounding 66% of planned jobs. The Midwest has seen a strong push in EV investment in its own right, of course, and projects across Michigan, Indiana, Kansas, and Ohio combine for 26% of planned jobs. The West is slated to house two battery plants in Arizona and Statevolt's Gigafactory in California, totaling 8% of planned jobs among these investments. Costs likely swayed the project decisions to the South, which has lower wages and unionization rates along with generally cheaper electricity and real estate prices. Future labor needs are a key consideration, too: The South has an enormous leg up on the Midwest in terms of population growth trends and its ability to draw residents from around the country.

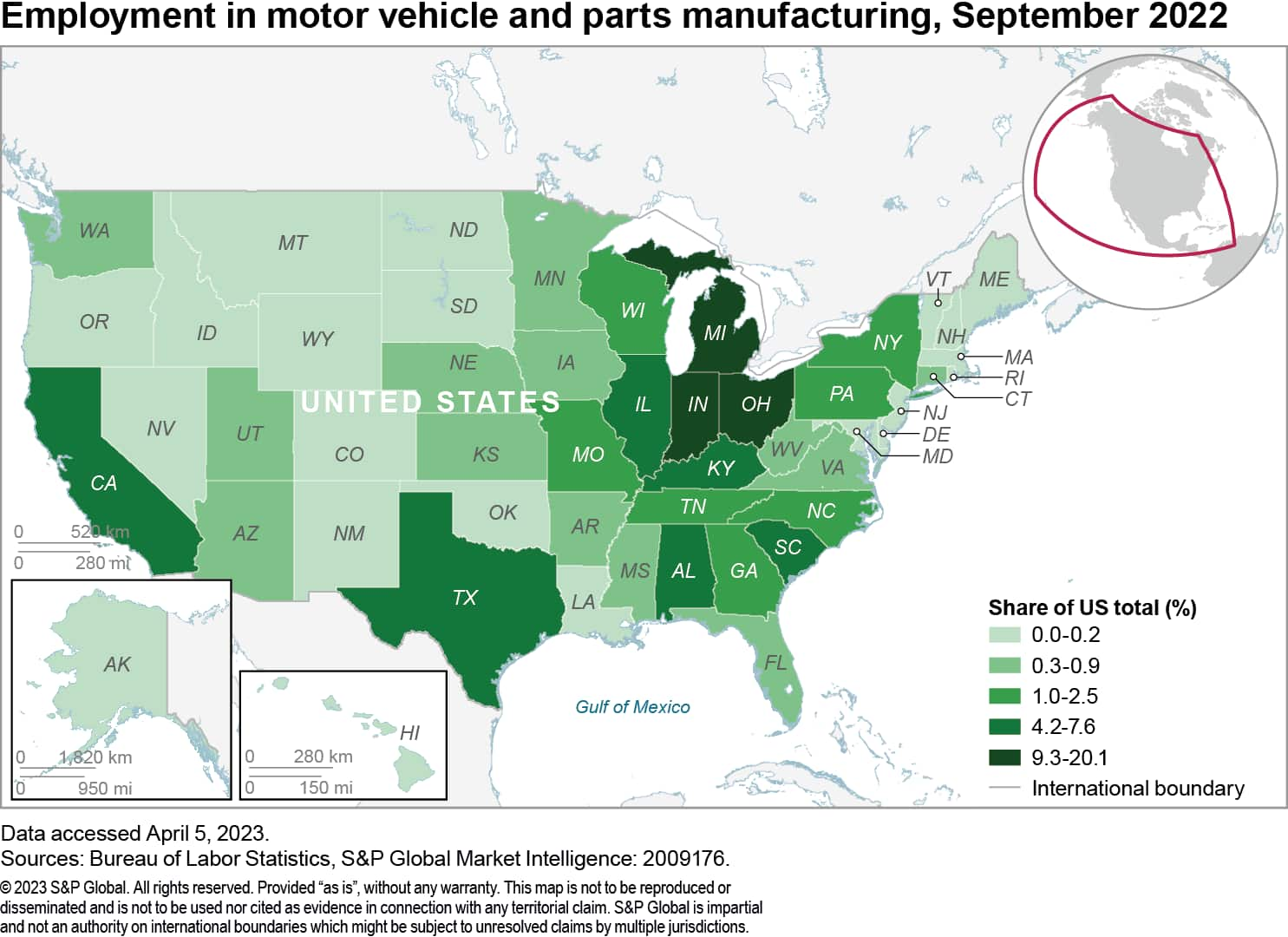

The current share of automotive production (North American Industry Classification System 3361 & 3363 in the map) is heavily concentrated within a few states in the Midwest, especially Michigan (20%), Ohio (10%), and Indiana (9%). Several states in the Southeast also have a significant share, including Kentucky (7.0%), Alabama (5.5%), and South Carolina (4.0%), with Georgia (2.5%) and North Carolina (2.0%) a step lower. Jobs created for EV cars, light trucks, and parts will fall under these two NAICS categories except for standalone battery plants (NAICS 33591). Current employment in NAICS 3361/3362 (over 835,000) far outweighs battery manufacturing (around 46,000), but NAICS 33591 is poised for rapid expansion as the announced battery plants come online. Over time, jobs related to EV production in NAICS 3361/3362 will come at the expense of jobs producing traditional combustion vehicles. With less labor required per EV vehicle, this transition can be at odds with overall employment levels in the industry. From a regional perspective, however, shifting production trends related to where companies open new facilities can be a net positive for jobs in certain areas within the United States.

While the US EV transition is still in a nascent phase, these projects provide an early signpost to where automakers are looking to build out their EV production and battery facilities. The automotive belt has been the top choice, but the balance is shifting in favor of the Southeast over the Midwest. Georgia and North Carolina are receiving a disproportionately large share compared with their current market concentration in the industry. If the recent announcements are a precursor for things to come, the South is poised to take a greater portion of US vehicle production in the years ahead.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.