Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 23, 2019

Ethiopia's privatization drive

Ethiopia's Council of Ministers on 30 November approved an amendment to the Investment Proclamation 2012, which is likely to be finalized by the House of People's Representatives (parliament) in December. The law provides a framework for foreign investors to participate in the aviation, energy, logistics, and telecommunication sectors, but the banking sector is excluded.

Parliament is very likely to finalize the new investment law before 2020, enabling foreign investors to operate in competition against, or in joint venture arrangements with, Ethiopian companies in aviation, energy, logistics, and telecommunications. Prompt passage of the law is almost certain because the ruling Ethiopian People's Revolutionary Democratic Front (EPRDF) controls nearly all the seats in parliament. Once the law is passed, foreign companies will be allowed to enter joint ventures with Ethiopian companies, up to a maximum 49% share of ownership. A minimum USD200,000 in capital is required for a single project and any investor may operate a foreign-currency account in Ethiopian banks. The amendment bill was drafted within the Prime Minister's Office by former World Bank and International Monetary Fund officials of the Ethiopian Investment Commission (EIC) responsible for coordinating Ethiopia's 'Doing Business Road Map'. This was established to improve the country's business environment to support the flagship 'Home-Grown Economic Reform Program'.

The banking sector is excluded from privatization, although IHS Markit sources note that the current draft bill states that 'financial services', such as developing credit information sharing systems, are open to foreign investors. A further draft regulation seen by IHS Markit on 29 November, which has not yet been submitted to the Council of Ministers, specifically excludes foreign investors from banking and insurance. A first step in opening the banking sector was the inclusion of the Ethiopian diaspora in August 2019. A key barrier to foreigners obtaining operating licenses or stakes in state-owned banks is that Ethiopia's banking sector is highly concentrated, with the state-owned Commercial Bank of Ethiopia (CBE) accounting for 60% of sector assets and currently experiencing severe foreign-currency shortages. Opening the sector to foreign investment would help to alleviate the sector's liquidity shortages, particularly in the provision of capital for large transactions. In addition, it would facilitate trade transactions due to improved access to foreign currency and should assist in developing Ethiopia's virtually non-existent capital markets.

A key indicator of banking-sector liberalization would be government measures to reform and strengthen the financial performance of state-owned Development Bank of Ethiopia (DBE), which also would improve the banking sector's overall stability. In September, the National Bank of Ethiopia (NBE), the central bank, relaxed exchange control regulations on foreign-currency accounts held by the diaspora and, in November, lifted its mandatory requirement for private banks to purchase bills valued at the equivalent of 27% of their loan book from the NBE. According to the International Monetary Fund (IMF), 75% of funds from the mandatory NBE bill purchases were channeled to the DBE, which is responsible for longer-term financing of mega-projects and is struggling with poor asset quality. Although the sector's level of non-performing loans (NPLs) was just 3% as at June 2018 (when last reported by the NBE), the NPL ratio for the DBE stood at 39% as of June 2018. This is putting pressure on the sector's already weak liquidity position.

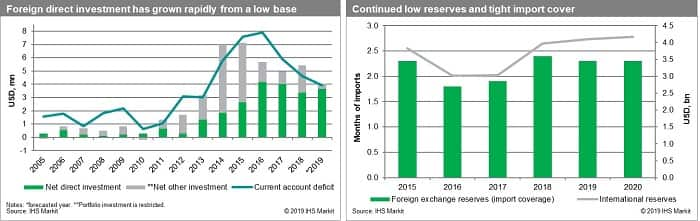

IHS Markit assesses that a key barrier to foreign investment will be the persistent shortage of foreign exchange (FX), although the shortage is less likely to affect larger corporations in export-focused sectors compared to small and medium-sized enterprises (SMEs). Our outlook is that this shortage is likely to persist as a constraint to investment. The government is struggling to break the cycle of weak exports and depleted foreign reserves, with the latter likely in our assessment to remain below three months of import cover for the one- to five-year outlook. SMEs typically face payment delays of over 90 days, while importers are suffering growing backlogs with letters of credit because of severe liquidity shortages in the domestic banking sector. Overall, SMEs are particularly badly affected by FX shortages, making them less attractive for foreign investors, whereas larger corporations are likely to be less-severely impacted by these shortages. We assess that FX shortages are least likely to affect the non-bank financial and telecommunications sectors as investment destinations, as they are less capital-intensive and not dependent on high-value imports.

Ethiopia's privatization drive

- If Ethiopia's GDP growth falls significantly below our current forecast levels of 7.5% in 2019 and 7.4% in 2020, driven by declines either in foreign direct investment (FDI) inflows or in support from development partners, then the government will become more likely to seek to break the cycle of weak exports and FX shortages by liberalizing the managed exchange rate.

- If the central bank devalues the Ethiopian birr, it will reduce downside FX risks for potential investors. It could thus boost future FDI once the currency was viewed as better underpinned.

- If the investment amendment bill is modified before approval by parliament to increase the minimum capital requirement to above USD200,000, this will indicate a potential increase in the aggregate amounts invested: the capital requirement is low versus those of regional peers and an increase is unlikely to deter investors.

- If Defense Minister Lemma Megersa, the deputy chairperson of the prime minister's Oromo Democratic Party, defects this month given his opposition to the ruling EPRDF's merger into a single party, this will indicate reduced support in parliament for the Investment Amendment Bill or the need to include greater fiscal and local-content concessions to the regional states, especially Oromia.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fethiopias-privatization-drive.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fethiopias-privatization-drive.html&text=Ethiopia%27s+privatization+drive+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fethiopias-privatization-drive.html","enabled":true},{"name":"email","url":"?subject=Ethiopia's privatization drive | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fethiopias-privatization-drive.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Ethiopia%27s+privatization+drive+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fethiopias-privatization-drive.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}