Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 15, 2021

Easing COVID-19 restrictions to trigger stronger Italian growth from Q2

- Italy just avoided a technical recession in Q1 2021 when the economy grew by 0.1% q/q.

- Looser regional COVID-19 restrictions will trigger stronger economic growth in the second and third quarters.

- Many consumer-facing services are enjoying improved trading conditions since early May.

- Real GDP is to expand by 4.7% in 2021 and 4.1% in 2022. However, the upward revision to first quarter GDP developments points to higher 2021 growth projection.

Italy avoided a technical recession in early 2021, which is defined as two consecutive quarters of GDP contraction. The national statistical office reports that the economy grew by 0.1% quarter on quarter (q/q) in the first three months of the year, compared to its first estimate of a 0.4% q/q drop.

The economy shrank by 1.8% q/q in the fourth quarter of 2020. In annual terms, GDP fell by 0.8% year on year (y/y) in the first quarter, after an 8.9% drop in the full year 2020. Consumer spending shrank notably in the first quarter, with spending on hospitality and leisure services impacted by households' fears of infection risks and by the impact of the tight regional restrictions.

Many regions have relaxed restrictions as new infections continue to fall. The color categories are:

White zones: Bars and pubs can stay open until 21:00, while restaurants can serve until 23:00. The curfew begins at 23.30 as opposed to elsewhere at 22:00.

Yellow zones: Restaurants, bars, and ice-cream shops can serve customers at both lunch and dinner - but only at outdoor tables, and businesses must close in time for the 22.00 curfew.

All schools and universities resume in-person teaching in yellow and orange zones.

Cinemas and theatre shows will be allowed outdoors. Indoor showings can also go ahead at 50% capacity.

All shops are open in yellow zones.

Orange zones: All shops are open, but malls are closed on weekends and public holidays except for shops selling essential goods. Restaurants and bars are closed except for takeaway. People are not allowed to leave their towns except for emergencies, work, and health reasons.

Red zones: Restaurants and bars are closed, except for takeaways and deliveries, and all non-essential shops are shut.

The main regions in the following color categories from 1 June:

Yellow zone: Abruzzo, Aosta Valley, Basilicata, Calabria, Campania, Emilia Romagna, Lazio, Liguria, Lombardy, Marche, Piedmont, Puglia, Sicily, Trentino-South Tyrol, Tuscany, Umbria, and Veneto (57.2 million of Italy's total population of 60.4 million).

White zone: Friuli Venezia Giulia, Sardinia and Molise (3.2 million).

Several factors point to stronger economic growth from Q2

Italy is to enjoy stronger pick-up in activity in the second and third quarters of 2021, with GDP growth expected to accelerate to 1.9% q/q and 2.3% q/q in the second and third quarters, respectively. All regions moved from the red and orange zones to the less restrictive yellow and white zones because of falling new infections. Importantly, many consumer-facing services are enjoying improved trading conditions since early May.

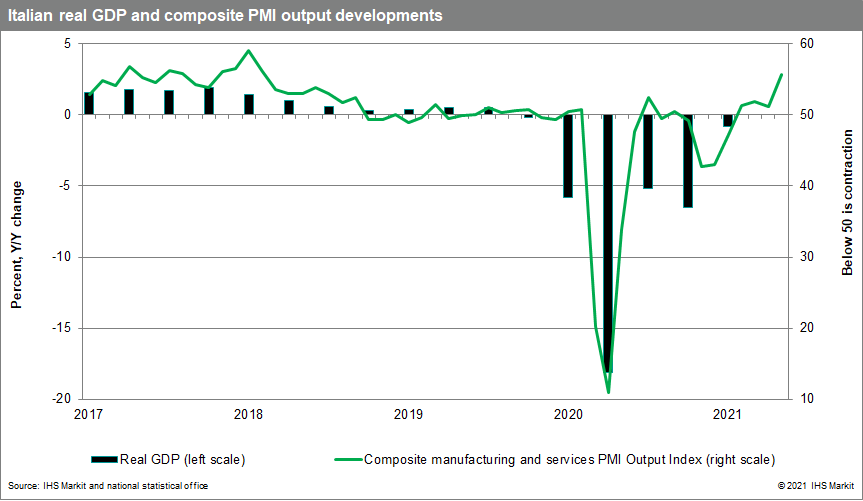

The IHS Markit PMI composite output index (manufacturing and services) is in positive territory for a third successive month to signal the continued recovery in Italy's private sector output during May. Moreover, the latest reading signaled the quickest expansion in private-sector output for over three years.

Indeed, May's PMI survey flagged that Italian manufacturing activity continued its strong recovery path, with new orders and output growth among the strongest in survey history. The same survey signaled services' business activity rising for the first time since July 2020 in May and at the quickest pace since March 2019. Reopening companies reported a surge in new business as demand began to recover in line with easing COVID-19 restrictions.

Increased optimism from mid-2021 also reflects the COVID-19 vaccine rollout in Italy and elsewhere in Europe helping a partial revival of tourism activity in Italy. This would provide a welcome lift to the struggling hospitality, accommodation, and retail sectors in the tourist hot spots.

The balance of risks is better balanced. Falling infection rates have allowed looser containment measures, but this easing, alongside the emergence of highly infectious variants, presents a lingering risk.

The immediate growth outlook is partly dependent on the continued logistical challenge of the unparalleled vaccination program, which began on 27 December 2020.

Like elsewhere in Europe, Italy's vaccination campaign was initially delayed due to vaccine shortages. However, the rollout has gathered significant momentum, with Italy now hitting its target of administering 500,000 COVID-19 vaccinations in a single day.

As of 1 June, 23.9 million people in Italy had received at least one dose of a COVID-19 vaccine, or around 40% of the population. In addition, nearly 12.3 million people have been administered both doses. Italy hopes 60% of the adult population will be vaccinated by mid-July, with herd immunity of 80% cover forecast for the end of September. According to our May forecast, we expect real GDP to expand by 4.7% in 2021 and 4.1% in 2022. However, the upward adjustment to first quarter GDP developments points to a further upward revision to our 2021 growth projection in the June update, probably to just above 5%.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feasing-covid19-restrictions-to-trigger-stronger-italian-growth.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feasing-covid19-restrictions-to-trigger-stronger-italian-growth.html&text=Easing+COVID-19+restrictions+to+trigger+stronger+Italian+growth+from+Q2+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feasing-covid19-restrictions-to-trigger-stronger-italian-growth.html","enabled":true},{"name":"email","url":"?subject=Easing COVID-19 restrictions to trigger stronger Italian growth from Q2 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feasing-covid19-restrictions-to-trigger-stronger-italian-growth.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Easing+COVID-19+restrictions+to+trigger+stronger+Italian+growth+from+Q2+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feasing-covid19-restrictions-to-trigger-stronger-italian-growth.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}