Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 08, 2020

Daily Global Market Summary - 7 May 2020

APAC equity markets closed modestly lower and Europe/US markets ended the day higher, despite the additional 3+ million new unemployment insurance claims filed in the US and the Turkish lira breaking through new record lows (again) today. Most benchmark government bonds ended the day higher, with 2yr US government bonds reaching a new record low yield. The main focus tomorrow will be the US non-farm payroll report scheduled to be released at 8:30am ET.

Americas

- US initial claims for unemployment insurance, at 3,169,000 in the week ended 2 May, remained at historically high levels, although below the all-time high of 6,867,000 in the week ended 28 March. This was the seventh straight week with claims in seven figures; these figures suggest that over 30 million workers have lost their jobs (non-seasonally adjusted) since mid-March because of COVID-19, which is a staggering 18.7% of the labor force. Continuing claims, which lag initial claims by a week, rose by 4,636,000 to an all-time high of 22,647,000 in the week ended 25 April. (IHS Markit Economist Akshat Goel)

- US productivity (output per hour in the nonfarm business sector) declined at a 2.5% annual rate in the first quarter, less of a decline than we had expected, following an unrevised increase of 1.2% in the fourth quarter. Hours, on the other hand, declined 3.8% in the first quarter, more of a decline than we had anticipated. Compensation per hour rose at a 2.2% rate in the first quarter, beating our expectation for a 1.3% decline. This largely reflected the decline in hours that was well below IHS Markit's assumptions, as unit labor costs were close to our expectation, increasing 4.8% in the first quarter. (IHS Markit Economists Ken Matheny and Lawrence Nelson)

- US employers announced 671,129 planned layoffs in April, according to Challenger, Gray & Christmas—up a whopping 201.9% from March. April's number was up an astronomical 1,576.9% over the same period a year earlier. April's total of over 600,000 planned layoffs marked the highest single-month total on record (Challenger began tracking job-cut announcements in January 1993). According to Challenger tracking, COVID-19 caused companies to announce 821,210 job openings in March, primarily grocers, those involved in food delivery, and certain consumer product delivery services. As the pandemic dragged on through April, however, total hiring plans announced dropped by 65.9% to 280,200. (IHS Markit Economist Rebecca Mitchell)

- 10yr US govt bonds closed sharply higher today at -7bps/0.64% yield. 2yr notes closed at -4bps/0.13% yield, but reached a record low yield of 0.10% towards the end of the trading session (prior low was 0.16% in September 2011)

- US equity markets closed higher; Russell 2000 +1.6%, Nasdaq +1.4%, S&P 500 +1.2%.

- The Nasdaq is now back into positive territory at +0.08% YTD, but still 8.7% below its record high set on 19 February.

- IHS Markit's Research Signals published their April 2020 Model

Performance Report yesterday, which indicated:

- Within the US Large Cap universe the Price Momentum model had the strongest one month decile return spread performance, returning 5.41%, while the Earnings Momentum model lagged.

- For the US Small Cap universe IHS Markit's Value Momentum 2 model had the strongest one month decile return spread performance, returning 1.66%, while the Deep Value model lagged. The performance of the Value Momentum 2 model was driven by the performance of the long portfolio.

- Within the specialty model library the Bank and Thrift 2 and the Insurance models had the strongest one month decile return spread performance returning 12.43% and 8.61%, respectively, while the Semiconductor and the Retail models struggled. The Insurance model's one year cumulative performance is the highest at 20.51% while the Retail model's performance is the lowest at -6.28%.

- Crude oil closed -1.8%/$23.55 per barrel.

- IHS Markit's CDX North America high yield index closed sharply

higher at -32bps/646bps:

- The upscale department store Neiman Marcus founded in 1907 has filed for bankruptcy protection, becoming the latest retailer to file as a result of the COVID-19 shutdown. Chief executive Geoffroy van Raemdonck said the retailer would emerge in a stronger position from the bankruptcy, which it plans to use to eliminate $4 billion from its $5.5 billion debt burden. (FT)

- New COVID-19 mutant strain could hamper vaccine development. Delineating whether certain mutations have altered the virus enough to impact its transmissibility will need far more research in the coming months. However, if a new strain is confirmed - as highlighted by the Los Alamos National Laboratory - it would be of concern to vaccine developers, which have relied on spike protein targets obtained from the original sequence that was first isolated in Wuhan, China. (IHS Markit Life Science's Margaret Labban and Eóin Ryan)

- US beef production plants have been closing owing to the spread of COVID-19 among employees that are working in close proximity. On April 23, beef prices reached $273 per hundredweight (cwt) - an 11.3% increase from a month ago and 34.9% higher from two months ago - bringing prices to record heights from previously weak levels. Overall demand is projected to weaken as the year progresses owing to the new recession underway. Production remains uncertain, as it was anticipated to still rise overall this year but is now expected to be reduced due to quarantine protocols and related slowdowns in plant activity. (IHS Markit Agribusiness' Bryce Bock)

- Fitch Ratings has downgraded Brazil's outlook from Stable to Negative and has reaffirmed the sovereign risk rating at 50 (BB- on the generic rating scale). This carries more risk than IHS Markit's rating of 45 (BB+ on the generic rating scale). The downgrade to Brazil's outlook was warranted by worsening fiscal and economic prospects caused by the spread of the COVID-19 virus as well as by political uncertainty; a rift between President Jair Bolsonaro and Congress has deepened and two key ministers have left the cabinet. (IHS Markit Economist Rafael Amiel)

- Chile's central bank cut rates from 1.75% in February to 0.5% in March as the negative impact from the spread of the COVID-19 virus became clearer. The bank kept rates unchanged at its 6 May meeting and suggested that the accommodative stance will remain over the short term to cushion the anticipated recession in 2020. We do not anticipate changes in the policy rate until 2022. Until then, inflation will be contained and domestic demand will be weak, hence the BCC will maintain an expansionary monetary policy stance. (IHS Markit Economist Ellie Vorhaben)

Europe/Middle East/ Africa

- March's 11.2% month-on-month (m/m) plunge in the volume of retail sales in the eurozone is the biggest in the history of the series by a huge margin. On a year-on-year (y/y) basis, the same applies, with the 9.2% decline also well below the rate of contraction signaled by consumer sentiment data, which usually track actual spending trends relatively well. Textiles and clothing and footwear were particularly hard hit (-40.8% y/y), electrical goods and furniture also (-15.4% y/y). As expected, sales of medical products (+4.0% y/y) and mail-order and internet sales (+10.7% y/y) outperformed. To put March's m/m drop into perspective, the largest m/m fall during the global financial crisis was around 1%. It should also be noted that eurozone retail sales data provide only a partial picture of consumer spending trends as key areas such as vehicle sales (which had collapsed) are not included, suggesting that private consumption overall will have been even weaker. (IHS Markit Economist Ken Wattret)

- German orders in March plunged by almost 16%, a harbinger of

additional major output declines to come in April due to the

lockdown measures to contain the COVID-19 virus pandemic. (IHS

Markit Economist Timo Klein)

- Seasonally and calendar-adjusted German industrial production excluding construction declined by 11.2% month on month (m/m) in March, having still expanded by a combined 2.2% in January-February.

- The manufacturing breakdown reveals that investment goods output was the main drag, down 16.5% m/m, whereas intermediate and consumer goods output declined by less than half that pace.

- Orders dropped 15.6% m/m overall, which was spread quite evenly across domestic and foreign orders.

- Orders split by industrial branch underlines that the chemicals/pharmaceuticals sector remained resilient for obvious reasons (-0.7% m/m), whereas demand for vehicles was curtailed by almost one-third (-29.4%), followed by machinery (-16.4%) and metal processing (-10.3%).

- IHS Markit's current forecast for German GDP growth in 2020 is -6.5%, this already assuming that economic restrictions will be lifted step by step from May onwards and that there is no second or third wave of infections in Germany as a whole.

- The German passenger car market has recorded a 61.1% year-on-year (y/y) decline in registrations in April to just 120,840 units as a result of the country's response to the coronavirus disease 2019 (COVID-19) virus outbreak, according to the latest data from the KBA. This dragged the year to date (YTD) down by 31% y/y to 822,202 units. Private registrations actually performed better during the month than commercial registrations, falling by 57.8% to record a 41.9% share of the market. The German market fared slightly better than some other Western European markets, as the UK was down 97% for the month. (IHS Markit AutoIntelligence's Tim Urquhart)

- Turkey blocked BNP Paribas, Citibank and UBS from making lira transactions after the currency hit a record low of ₺7.27/USD against the dollar today, as investors fretted about a lack of reserves to protect the economy from the coronavirus impact. (Reuters)

- The Turkish new light-vehicle market decreased by 14.6% year on year (y/y) in April to 26,457 units, according to data released by the Automotive Distributors' Association (Otomotiv Distribütörleri Derneği: ODD). Of this total, passenger vehicle sales were down by 10.6% y/y to 21,825 units during the month, while light commercial vehicle (LCV) sales stood at 4,632 units, down 29.3% y/y. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- The Monetary Policy Committee (MPC) of the Bank of England voted unanimously to keep interest rates at a record low of 0.1% at its latest meeting. The Bank has refrained from adding to its new quantitative easing (QE) program, under which it plans to increase its holdings of UK government and corporate bonds by GBP200 billion (USD247 billion) to GBP635 billion, to be financed by printing money. The Bank intends to increase its stock of corporate bonds by GBP10 billion to GBP20 billion. The total stock of asset purchases had risen by GBP83.5 billion to GBP528 billion on 6 May and the MPC noted that the stock of asset purchases would reach GBP645 billion by the beginning of July, at the current pace of purchases. IHS Markit's view is that the new QE program will be expanded in the coming months to provide further support to the Treasury's aggressive borrowing plans in the next few months. (IHS Markit Economist)

- The French trade deficit stood at EUR3.3 billion (USD3.6

billion) in March, down from EUR5.0 billion in February. The

deficit totaled EUR14.3 billion during the first quarter, slightly

below EUR14.8 billion during the same period in 2019.

- Exports of transport equipment (which account for around one-fifth of total merchandise exports) fell by almost one-third compared with February. Although some car manufacturers partially restarted operations in late April, production will only resume very gradually, and a lack of demand will keep car exports depressed for the rest of the year.

- Exports of industrial machines, down 20% month on month (m/m), and textiles (down 30% m/m) also declined markedly in March. The only bright spot was sales of pharmaceutical products (which account for 7% of the total), which rose by one-quarter. Meanwhile, exports of agricultural products declined by a modest 2% m/m.

- Brent crude closed -0.9%/$29.46 per barrel, which was well below the day's high of $31.87 per barrel. In fact, Brent declined 8.9% between 9:00am and 3:40pm ET.

- Equinor reported first quarter 2020 net loss of $705 million, compared with a net income of $1,712 million a year-ago period. Adjusted earnings were $2,047 million, down 51% from $4,187 million a year ago, primarily due to lower liquids and gas prices, the company said. Net operating income was $58 million, down 99% from $4,732 million a year ago. Equinor reaffirmed its revised 2020 capital budget of $8.5 billion announced in March 2020. The company reduced its capex by around 20% in response to the lower commodity prices and impact of COVID-19 crisis. (IHS Markit Upstream Companies and Transaction's Karan Bhagani)

- Gazprom's construction contractor Stroytransneftegaz said yesterday (6 May) that it had evacuated 1,100 fly-in-fly-out construction workers from the Chayanda gas field in Sakha-Yakutia Republic because of a coronavirus disease 2019 (COVID-19) virus outbreak at the site and following protests. Stroytransneftegaz announced the temporary suspension of work at the field, which supplies natural gas to China. (IHS Markit Country Risk's Alex Kokcharov)

- Nissan has halted production at its Zona Franca facility in Barcelona (Spain) as strike action has hit component supplies to the site. ABC.es reports that vehicle manufacturing stopped at the site yesterday (6 May) afternoon on a walk out on 4 May at the nearby Montcada i Reixac stamping facility, which is also run by the automaker. (IHS Markit AutoIntelligence's Ian Fletcher)

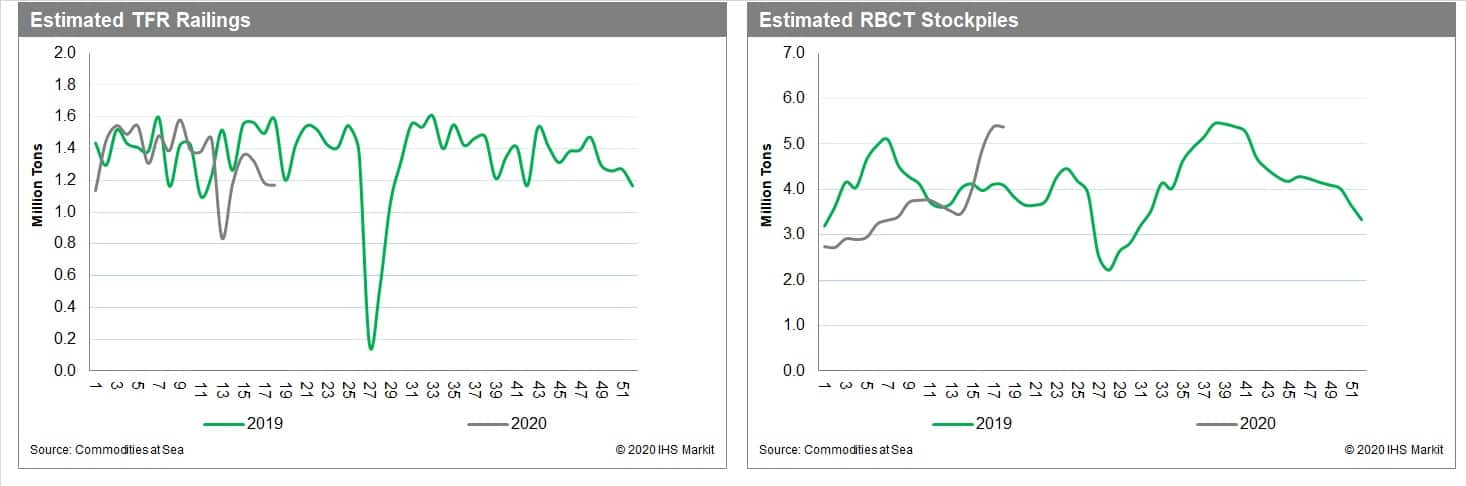

- At the end of week-18, coal stocks at South Africa's Richards

Bay Coal Terminal (RBCT) terminal are calculated at around

5.4-5.5mt at around previous week levels. TFR railings during the

reported period remained below normal average levels at around

1.1-1.2mt (see charts below). As per IHS Markit's Commodities at

Sea, during the week 18, RBCT coal shipments are calculated at

985kt (4.2mt on 30-day basis) vs 614kt (2.6mt on 30-day basis). The

shipments over the week started firming on back of resumption of RB

coal shipments to India. During 14 April to 30 April there was no

vessel loaded to destination India, and only from 01 May 2020,

three capes and one supra has been shipped to India. Another

interesting shipment noticed over the week was of MV MARINER

(56,784dwt). The supra was loaded at RBCT (05 May 2020) and is

going towards Malta. It may most probably discharge in around

Italy. Last RB shipment to Europe was shipped way back in Dec 2019.

(IHS Markit Commodities at Sea's Rahul Kapoor and Pranay

Shukla)

- IHS Markit's iTraxx Europe investment grade index closed unchanged/86bps and the iTraxx Xover high yield index closed -6bps/515bps.

- Most 10yr European govt bonds closed higher today except for UK +1bp; Italy -7bps, France -4bps, and Spain -3bps.

- European equity markets closed higher across the region; France +1.5%, Germany/UK +1.4%, Spain +0.9%, and Italy +0.5%.

Asia-Pacific

- Volkswagen (VW) witnessed a rebound in demand during the last week of April as new buyers switched from public transport to keep themselves safe amid the ongoing COVID-19 virus outbreak, according to Reuters. Jürgen Stackmann, member of the VW board and responsible for sales and marketing of passenger cars at VW, said, "It is clear to see that China will go through a V shape [recovery] … We are not counting on a V shape recovery for Europe." (IHS Markit AutoIntelligence's Nitin Budhiraja)

- At least 11 people have died and more than 300 taken ill following a gas leak that has been traced to the LG Polymers India (LGPI; Mumbai) polystyrene (PS) production plant at RR Venkatapuram, near Visakhapatnam, India. The incident occurred on Thursday at about 2:30am local time. LGPI is a subsidiary of LG Chem. The plant was in the process of reopening post-lockdown when the accident happened. The leak, which CW understands to be of styrene gas, was reportedly from two 5,000-metric ton storage tanks. It is not yet known if or how many employees may have been affected.

- Mainland China's merchandise exports rose 3.5% year on year

(y/y) in April in terms of US dollar, a second consecutive month of

recovery following March's 6.6% y/y contraction and a 17.2% y/y

decline in February and January, according to the General

Administration of Customs (GAC) on 7 May. Meanwhile, merchandise

imports plunged 14.2% y/y, compared with a 0.9% y/y decline in

March. The rebound in exports was beyond expectation given the

April and March Purchasing Managers' Index (PMI), which reflected

continuous deterioration of overseas purchase. (IHS Markit

Economist Yating Xu)

- The growth of exports in April were largely driven by a backlog of delayed export orders as domestic industrial production has largely recovered to normal in April. For example, exports of mechanical products increased 5.5% y/y compared with previous 9% y/y contraction, and high-tech product exports rose 10.9% y/y from a 7.5% y/y decline in March.

- By country, developed countries led the improvement in exports, as the US purchase rose 2.2% y/y, Japanese purchase rose 33.0%, the and contraction of European Union (excluding the United Kingdom) narrowed from 11.7% y/y to 4.5% y/y.

- Geely Auto (Geely) has announced its sales results for April. Combined sales volume of Geely and Lynk&Co branded vehicles in April totalled 105,468 units, up 2% year on year (y/y). Sales in April also marked a strong rebound of 44% from March during which only 73,021 vehicles were sold by the automaker. Chinese light-vehicle sales are forecast to drop by 15.5% from 2019 in part due to slower economic growth caused by the pandemic. To reach its target, Geely has to cope with demand contractions in both China and overseas market. (IHS Markit AutoIntelligence's Abby Chun Tu)

- The South Korean government is to issue fines and file criminal complaints against the local units of Mercedes-Benz, Nissan, and Porsche for manipulating the emissions data of diesel vehicles sold in the country between 2012 and 2018, reports Korea JoongAng Daily. South Korea's Ministry of Environment says that it will impose fines of KRW77.6 billion (USD63.3 million) on Mercedes-Benz, KRW1 billion on Porsche, and KRW900 million on Nissan. The three automakers were found to have installed illicit software on diesel-fueled cars to manipulate levels of emissions of exhaust gas recirculation and selective catalytic reduction when driving under test conditions, according to the ministry. (IHS Markit AutoIntelligence's Jamal Amir)

- The Reserve Bank of Australia (RBA) maintained its targets for the cash rate target and yield for three-year Australian Government Securities (AGS) at 0.25%, as it outlined a baseline scenario where output falls by 6% during 2020. The May statement includes the baseline assumption that the unemployment rate (last reported at 5.2% for March) will shoot up to 10% in coming months and still be above 7% come late 2021. Implying a long period of low interest rates in Australia. (IHS Markit Economist Bree Neff)

- The Australian Bureau of Statistics also reported on 6 May that seasonally adjusted retail sales (turnover) surged a record high 8.5% month on month (m/m) in March, led by what boils down to panic buying at grocery stores and household goods retailers and pharmacies (see "other"). That panic buying helped to push retail sales volumes up a seasonally adjusted 0.7% quarter on quarter (q/q), the strongest result in seven quarters, providing lift to the March quarter GDP reading. The huge surge in March will come with sharp and painful payback in April when containment measures to battle the COVID-19 virus were significantly ramped up across Australia. (IHS Markit Economist Bree Neff)

- APAC equity markets closed mixed; India -0.8%, Hong Kong -0.7%, China -0.2%, South Korea flat, and Japan +0.3%.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-7-may-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-7-may-2020.html&text=Daily+Global+Market+Summary+-+7+May+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-7-may-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 7 May 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-7-may-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+7+May+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-7-may-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}