Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 06, 2020

Daily Global Market Summary - 6 May 2020

Global equity markets closed mixed today on increasing tensions between the US and China, while benchmark government bonds sold off and the US dollar strengthened for the fourth consecutive day. Crude oil also broke its five-day streak of price increases, albeit remaining more than double its $11.57 closing price on 21 April.

Americas

- US equity markets closed modestly lower today, except for the Nasdaq +0.5%; DJIA -0.9%, Russell 2000 -0.8%, and S&P 500 -0.5%.

- 10yr US govt bonds closed +4bps/0.71% yield.

- DXY US dollar index closed +0.5% today, which is the fourth consecutive day of strengthening and it is +1.2% since the start of May.

- The Treasury Department is launching a 20-year bond later this month in a $20 billion auction, as part of the upcoming record quarterly issuance. The Treasury officials estimated Monday they would borrow a record $2.99 trillion in the second quarter, more than five times as much as quarterly borrowing during the height of the 2008-09 financial crisis (WSJ)

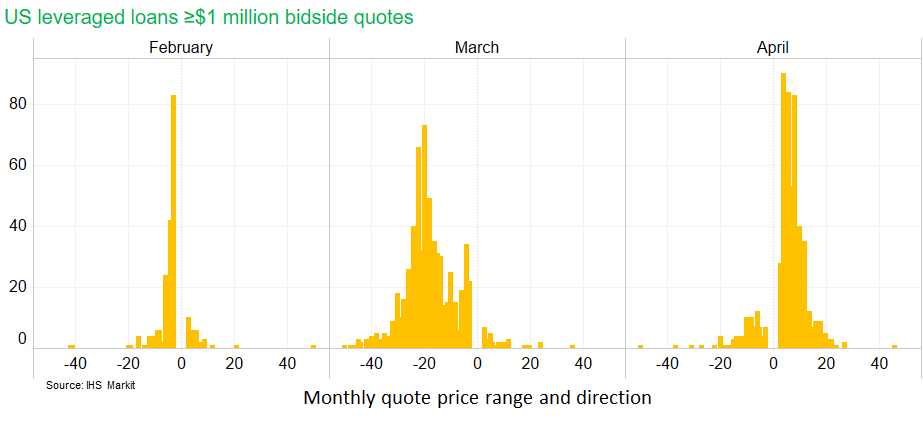

- The below chart shows the count of US leveraged loans that were quoted with size (bidside) within intramonth price ranges between -50 to +50 points (excluding -2 to +2 point ranges given the very high frequency) for the months of February, March, and April. The analysis includes over 1,360 unique loans with $1 million or higher quoted bid sizes in February and approximately 1,100 in March and over 1,000 in April. The data highlights that prices dropped on average 20 points in March, while the majority of quoted loans recovered less than 12 points in April.

- IHS Markit's CDX North America investment grade index closed +3bps/93bps and high yield +24bps/679bps.

- MGM Resorts International said some of its 63,000 furloughed workers could be laid off starting Aug. 31 amid a murky outlook for the closed U.S. casino industry. In a letter to furloughed employees Tuesday, MGM Resorts Acting Chief Executive Bill Hornbuckle said demand for travel would be significantly decreased through the end of this year and possibly into the next because of the coronavirus pandemic. (WSJ)

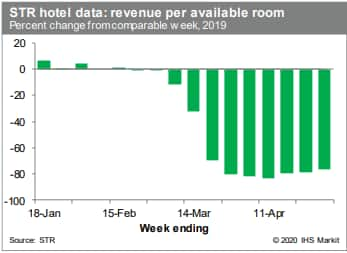

- Revenue per available room at US hotels during the week ending 2 May was down 76.8% from the comparable week one year ago. This is up from a low point in mid-April, when revenues were down 83.6%. While the 2 May reading is still miserable, there are signs that travel-related spending is beginning to turn up. (IHS Markit's US Regional Economics team)

- General Motors's quarterly profits declined 87% to $294 million vs $2.1 billion Q1 2019, but US truck sales strengthened, and the automaker is resuming production when US and Canadian plants reopen this month. Sales at GM declined 6% overall to $32.7 billion in the first quarter, the company said today, while sales in the US declined 7%. Yet US sales for full-size pick-up trucks 27% from the same period a year earlier. (FT)

- US firm PetMed Express has posted a robust set of recent financial results, despite social restrictions put in place to temper COVID-19. The pet pharmacy's fourth quarter and fiscal year ended on March 31, 2020. The company benefited from strong online sales, posting fourth-quarter revenues of $74.3 million - a year-on-year improvement of 15%. PetMed sells prescription and non-prescription pet medications, as well as nutritional supplements. The Delray Beach, Florida-based company said re-order sales for the quarter were $65.2m (+17%), while new order sales came to $9.1m (+5%). PetMed gained around 107,000 new customers over the three months. Over the same period in 2019, it added about 101,000 new customers. (IHS Markit Animal Pharm's Joseph Harvey)

- Crude oil closed -2.3%/$23.99 per barrel.

- Brazil's industrial production fell by 9.1% in March compared with February as lockdowns and plant closures reduced output. The outlook is bleak as more plants closed in April and still remain closed. Seasonally adjusted data show that Brazil's industrial production (IP) was down by 9.1% month on month (m/m) in March; all four broad categories shrank in April, with durable goods and capital goods showing the deepest contractions. (IHS Markit Economist Rafael Amiel)

- The IP index shows a 28% m/m drop for the all-important automotive sector.

- Production of electronic items had already suffered a relatively sizeable contraction in February because of the lack of inputs that regularly come from China.

- March's drop in industrial output takes volume produced to levels seen in May 2018 when a strike by lorry drivers paralyzed the country for a few days. However, unlike 2018, when IP rebounded following the strike, we now forecast a further deterioration. Current levels of output are similar to those recorded in August 2003.

- IHS Markit has downgraded Chile's short-term rating from AAA (equal to 0 on IHS Markit's rating scale) to AA (5). The medium-term rating remains unchanged at A+ (15). Both outlooks have been downgraded from Stable to Negative. (IHS Markit Economist Ellie Vorhaben)

- Chile's short-term rating was downgraded because of rising interest-service burden and IHS Markit anticipate increasing debt levels in 2020 in order to fund fiscal stimulus measures.

- Lower global demand and weaker copper prices will lead to a deterioration in Chile's export revenue.

- However, Chile has built up ample foreign-exchange reserves, which reached 18% of GDP at the beginning of 2020. It also has a stabilization fund that collects excess copper revenue, amounting to USD12 billion.

Europe/Middle East/ Africa

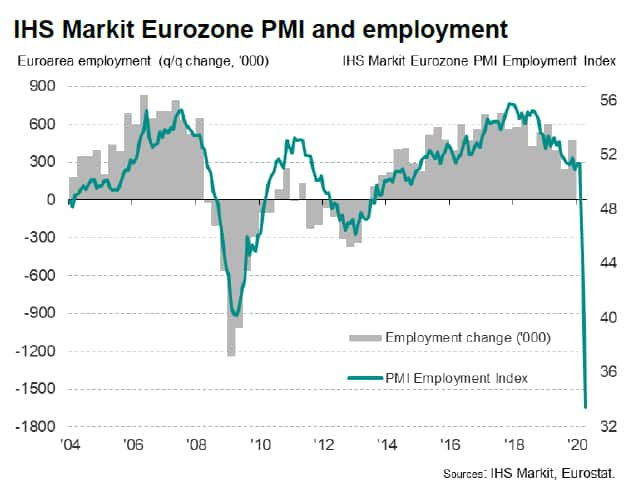

- The headline IHS Markit Eurozone Composite PMI™ - the survey's main gauge of output across the combined manufacturing and service sectors - plunged from a prior all-time low of 29.7 in March to 13.6 in April. With the previous low having been 36.2, hit in February 2009, the current downturn is clearly of far greater ferocity than seen even at the height of the global financial crisis (GFC). Jobs are also being lost at a rate never previously seen as companies cut operating capacity in line with a record fall in new order inflows across the region. The survey's composite employment index sank in April to almost seven points lower than the GFC nadir. (IHS Markit Economist Chris Williamson)

- The final UK PMI data for April indicated that the economy collapsed in April at a rate vastly exceeding anything seen previously in the 22-year history of the survey. The headline all sector output index from the IHS Markit / CIPS surveys fell to an all-time low of 13.4 in April, down from 36.3 in March. Prior to March, the previous low in the 22-year survey history was 37.5, reached in November 2008. The latest survey data were collected between 7th-29th April and, although temporary business closures were widely reported, the overall response rate to the surveys was in line with the historical average. (IHS Markit Economist Chris Williamson)

- Mercedes-Benz will launch a new technological innovation in the field of the steering wheel on the 2020-model-year E-Class that will be launched in the next few weeks, according to a company press statement. The new steering wheel design will be digitized and will be known as the "capacitive steering wheel". The new wheel's design contains a two-zone sensor mat that detects whether the driver's hands are gripping the steering wheel, something that will prove highly relevant as Mercedes-Benz introduces various levels of automation to its cars over the coming years. (IHS Markit AutoIntelligence's Tim Urquhart)

- Abbott (US) is on the verge of launching about 4.5 million diagnostic tests onto the French market with the reported capability to detect antibody immunoglobulins G (IgG) against COVID-19. Target testing measures using an accurate antibody diagnostic are a core part of the French government's strategy for reducing COVID-19 infections and safely easing social and economic restrictions. Roche (Switzerland) is also gearing up to launch its antibody test capable of screening for immunoglobulin M (IgM), immunoglobulins G (IgG), and immunoglobulin A (IgA) antibodies. The Roche diagnostic is expected to be market-ready around two weeks after Abbott's kit launches in France. Other companies are expected to follow suit, including Bio-Rad (US), Yhlo (China), and Snibe (China). (IHS Markit Life Science's Eóin Ryan)

- Statistics Norway has for the first time released a "flash" GDP estimate to gauge the economic impact of emergency quarantine and social-distancing measures to tackle the COVID-19 virus outbreak. The first-quarter 2020 GDP estimate is based on the information available as of 21 April and could be subject to future large revisions. Total real GDP (mainland economy plus petroleum activities, pipeline transport, and ocean transport) shrank by 1.5% quarter on quarter (q/q) in the first quarter; this included a 5.5% month-on-month (m/m) drop in March. (IHS Markit Economist Raj Badiani)

- According to the latest external trade data from the Georgian National Statistical Office (GeoStat), the goods trade deficit widened by 1.7% in the first quarter, with exports contracting by 5.9% year on year (y/y) and imports falling more moderately by 1.4% y/y. Revised data show that the trade gap had started to widen marginally (by 0.6% y/y) in the fourth quarter of 2019, although it still narrowed by 7.7% in 2019 as a whole. Exports to both European Union countries and countries of the Commonwealth of Independent States (CIS) fell by nearly 16% y/y in the first quarter, while exports to other countries increased by 22% y/y. The latter is mainly explained by a surge of 186% in exports to China, which resulted in that country's share of Georgian exports soaring to 12.8% from 4.2% in the same quarter in 2019. (IHS Markit Economist Venla Sipilä)

- Qatar National Bank (QNB) raised USD1 billion in a five-year bond carrying an interest rate equivalent to 225 basis points over mid-swaps. The deal, which Reuters noted was the first sub-sovereign issuance out of the Gulf region since February, garnered over USD3.75 billion in orders, with the price tightening 35 basis points over initial guidance. (IHS Markit Banking Risk's Alyssa Grzelak)

- IHS Markit has downgraded Algeria's medium-term sovereign risk rating to BB- (equivalent to 50 points on the IHS Markit scale) from BB+ (45), and short-term sovereign risk rating to A+ (15) from AA- (10), mainly driven by the steep drop in hydrocarbon prices. The short- and medium-term outlooks in the sovereign ratings will remain negative, suggesting that we could take further rating action by cutting Algeria's rating again in the next 12 months if Algeria's government does not make the necessary expenditure cuts and is unable to attract foreign investment to soften the blow in the economy caused by lower foreign currency revenues through the hydrocarbon sector. The government has repeatedly said that it is not approaching a multilateral, such as the International Monetary Fund (IMF) or World Bank, to finance its deep deficit. Instead the government plans to make expenditures cuts and import cuts to balance both its fiscal and current account deficit. However, the necessary cuts to balance these accounts are quite ambitious (e.g. reduce the import bill of agricultural products by 50%), and the government has failed to do so over the past five years, which makes it unlikely that the government will be able to do it this time. (IHS Markit Sovereign Risk's Francisco Tang Bustillos)

- The BMW Group has revealed that its first-quarter net profit declined by only 2.4% year on year to EUR574 million (USD619.8 million) despite the emergence of the global COVID-19 virus pandemic, which most severely affected the firm's Chinese operations during the period in question. However, the y/y comparison was skewed by the fact that the company's first-quarter 2019 results were badly hit by the recognition of a provision for approximately EUR1.4 billion in connection with the Statement of Objections received from the European Commission regarding ongoing anti-trust proceedings. If that had not been included, then the first-quarter 2020 net profit would have been around 30% down on the figure posted in the same period last year, which would have been a truer indication of the impact of a near 20% decline in global deliveries during the latest reporting period. (IHS Markit AutoIntelligence's Tim Urquhart)

- Fiat Chrysler Automobiles (FCA) has released its financial results for the first quarter, reporting a net loss of EUR1.69 billion (USD1.84 billion), a decline of 373.7% from a net profit of EUR619 million in first quarter 2019. FCA's results in the first quarter show only the initial impact of the economic disruption caused by the COVID-19 pandemic, and the automaker indicated that its second-quarter results will show a greater impact. However, the company expects to see its production resume in North America and Latin America in the coming weeks, suggesting that by the end of May, its global production network will have resumed operations. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Brent crude closed -4.0%/$29.72 per barrel.

- IHS Markit iTraxx Europe investment grade index +2bps/86bps and iTraxx-Xover high yield +14bps/522bps.

- 10yr European government bonds closed lower across the region; Italy +11bps, Germany +8bps, France +7bps, Spain +6bps, and UK +3bps.

- Most European equity markets closed lower except for UK +0.1% and Switzerland +0.6%; Italy -1.3%, Germany -1.2%, and France/Spain -1.1%.

Asia-Pacific

- Unnamed sources in India have reportedly said that Gilead Sciences is in discussions with Jubilant Lifesciences (India), Dr Reddy's Laboratories (India), Cipla (India), and Strides Pharmaceuticals (India) for granting voluntary licenses to manufacture remdesivir. This has not been confirmed by Gilead, but the company says that it is working to build a global consortium of companies to expand global capacity and production of remdesivir. Meanwhile, Bangladesh's Beximco has said that it will begin production of remdesivir this month, but it is unclear whether the company has a licensing deal to manufacture the product. (IHS Markit Life Science's Sacha Baggili)

- Indonesia's economic growth slumped to just 2.97% year on year (y/y) in the first quarter of 2020, down from 4.97% y/y growth in the previous quarter, as rising COVID-19 infections triggered social distancing measures and increased wariness by consumers and businesses. With consumer price inflation coming in at an exceptionally low 2.7% y/y in April ahead of Ramadan, there are strong indications that domestic demand is weakening further in the current quarter. (IHS Markit Economist Bree Neff)

- Hyundai and its affiliate Kia have partially resumed operations at their plants in South Korea, reports Yonhap News Agency. The South Korean duo suspended operations at their domestic plants from 30 April until 5 May to keep inventories at manageable levels amid the ongoing COVID-19 virus pandemic, which is taking its toll on global vehicle demand. (IHS Markit AutoIntelligence's Jamal Amir)

- Toyota Kirloskar Motor has announced that it has begun preparations to resume production operations at its Bidadi plant in Karnataka, reports The Financial Express. The company started some preparatory operations at the plant yesterday (05 May) based on the latest directive issued by the Indian government. (IHS Markit AutoIntelligence's Isha Sharma)

- Most APAC equity market closed higher across the region, except for Australia -0.4%; South Korea +1.8%, Hong Kong +1.1%, India +0.7%, and China +0.6%.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-6-may-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-6-may-2020.html&text=Daily+Global+Market+Summary+-+6+May+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-6-may-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 6 May 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-6-may-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+6+May+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-6-may-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}