Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 05, 2020

Daily Global Market Summary - 5 May 2020

Most global equity markets closed higher, as a growing number of countries, cities, and companies continue to reopen, albeit with significant safety precautions. Oil prices continued their march higher today in anticipation of an uptick in demand, with the backdrop of reduced production, that will coincide with the reopening of the global economies. All eyes will be focused on this Thursday's US jobless claims and Friday's US non-farm payroll reports for any indication of a bottoming out in the rate of US job losses.

Americas

- US equity markets closed modestly higher today, with all closing near the day's lows after a synchronized sell-off that began at approximately 3:10pm ET and coincided with comments by Fed Vice Chairman Richard Clarida on CNBC. Nasdaq closed +1.1%, S&P 500 +0.9%, Russell 2000 +0.8%, and DJIA +0.6%. The below is the S&P 500 and shows the 1.1% decline between 3:10pm ET and the low point of the day of 2,863 at 3:44pm ET.

- On a CNBC interview today, Fed Vice Chairman Richard Clarida pledged that the Fed will continue to provide whatever support is necessary to support markets and the economy, and said more help may indeed be needed. In addition, Clarida said "Our policies we think will be very important in making sure that the rebound will be as robust as possible. We're in a period of some very, very, very hard and difficult data that we've just not seen for the economy in our lifetimes, that's for sure." (CNBC)

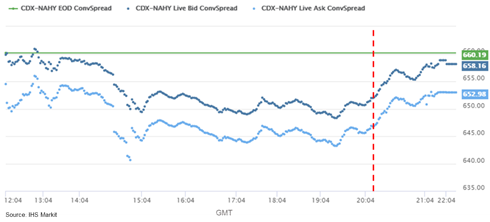

- IHS Markit CDX North America High Yield index began to sell-off at 2:30pm ET, which is shortly before the US equity markets switched course at 3:10pm ET (as indicated by the red dashed line), but still closed better on the day at -5bps/656bps:

- 10yr US govt bonds closed +2bps/0.66% yield.

- Crude oil closed +20.4%/$24.56 per barrel.

- Walt Disney Co reported today that the pandemic cost it $1.4 billion in operating income for the three months ended March 28. Overall operating income for the company fell 37% to $2.4 billion and revenue for the quarter rose 21% to $18 billion. The division that includes the Disney+ streaming service, direct-to-consumer and international division operations posted revenue of $4.1 billion in a quarter that registered a significant boost in subscribers. (WSJ)

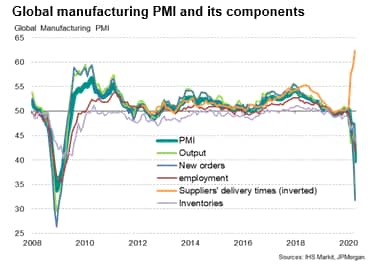

- The JPMorgan Global Manufacturing PMI, compiled by IHS Markit from its business surveys in over 30 countries, slumped from 47.3 in March to 39.7 in April, its lowest since the height of the global financial crisis in March 2009. The PMI has signaled three successive months of deteriorating health of worldwide manufacturing, with April seeing a marked intensification of the decline amid the escalating COVID-19 pandemic. (IHS Markit Economist Chris Williamson)

- The headline PMI understated the deterioration in the health of the manufacturing sector in terms of production and demand, as the headline calculation includes suppliers' delivery times as one of its five constituents.

- The below chart shows suppliers' delivery times index was the only one of the five components to boost the PMI, indicating the most substantial lengthening of delivery times ever recorded in the survey's 22-year history.

- In times of strong economic growth, more inputs are demanded by manufacturers to support higher production, putting pressure on suppliers whose lead-times then lengthen. However, the current situation is unusual, because demand has slumped but enforced factory closures due to the COVID-19 outbreak mean supplies of inputs are in short supply.

- Rather than surging demand causing supply delays, we are seeing a supply shock that has artificially boosted the PMI through the lengthening of lead-times

- The seasonally adjusted final IHS Markit US Services PMI Business Activity Index registered 26.7 in April, down notably from 39.8 in March and fractionally lower than the previously published 'flash' figure of 27.0. The escalation of emergency public health procedures resulted in the cancellation and postponement of customer orders, with new business contracting at the most severe rate since the series began in October 2009. At the same time, service providers registered the fastest fall in cost burdens on record. The decline in input prices partially stemmed from lower wage costs. In an effort to retain clients and kick-start sales, companies sought to pass on reduced input costs to customers through the sharpest fall in average prices charged in the series history. (IHS Markit Economist Chris Williamson)

- The nominal US trade deficit widened in March by $4.6 billion to $44.4 billion, more of a widening than the Bloomberg consensus had expected but close to IHS Markit's assumption. The overall widening in March reflected a 9.6% decrease in nominal exports and a 6.2% decrease in nominal imports, both larger than IHS Markit had assumed. Services accounted for roughly one-half of the decline in exports and roughly two-thirds of the decline in imports. (IHS Markit Economist Kathleen Navin)

- US households increased their debt balances in the first quarter by $155 billion (1.1%, not annualized), hitting a total of $14.30 trillion. Year-on-year (y/y) growth of total household debt quickened by 0.2 percentage point to 4.6%. Total household debts surpassed their recession-era peak in the first quarter of 2017 and have expanded for 23 consecutive quarters. Though the data for this release are taken from consumer credit reports on 31 March, such reports are updated throughout the month and delinquencies are unlikely to appear immediately; as such, the effects of the COVID-19 pandemic are not yet clearly visible in this release. (IHS Markit Economist David Deull)

- Mortgages, the largest category of debt, accounted for essentially all of the increase with a $156-billion advance to $9.71 trillion.

- Student loans added $27 billion (1.8%) for a 3.3% y/y growth rate, their lowest in the 16-year record.

- The overall delinquency rate (the share of balances delinquent by 30 days or more) improved by 0.1 percentage point to 4.6%.

- Bankruptcy notations were added to about 189,000 consumers' credit reports in the first quarter, among the fewest on record since 2000.

- Canada's merchandise trade deficit widened by $517 million to $1.41 billion in March. Exports declined 4.7% month on month (m/m) and imports decreased 3.5% m/m. Canada's trade surplus with the United States decreased by $116 million to $3.9 billion. The trade deficit with the rest of the world increased by $400 million to $5.3 billion, led by the increases in the United Kingdom, Saudi Arabia, and South Korea. (IHS Markit Economist Chul-Woo Hong)

- SK Innovation has announced plans to set up a second electric vehicle (EV) battery plant in Georgia, United States. According to a company press release, SK Innovation will invest around USD727 million in the new plant, which will have an annual production capacity of 11.7 GWh. In total, SK Innovation is planning to invest a total of USD2.5 billion in its two battery plants in the US, which will have a combined annual capacity of 21.5 GWh, with the first currently under construction. It has been reported that that plant will supply batteries to the Volkswagen (VW) plant in Tennessee. (IHS Markit AutoIntelligence's Jamal Amir)

- US-based chipmaker Intel has confirmed its acquisition of Israel's public transit app Moovit for USD900 million, reports Reuters. This acquisition will help Intel to develop robotaxis with plans to launch it in early 2022 in countries such as Israel, France, and South Korea. According to the report, Moovit will remain independent, while its technology will be integrated into Intel's Israeli automotive hub, led by autonomous vehicle company Mobileye, which Intel acquired in 2017 for USD15.3 billion. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Fiat Chrysler Automobiles (FCA) Canada has put up large posters on COVID-19 at the gates of its plants and erected medical tents in their parking lots, according to media reports. Automotive News Canada reports that at FCA Canada's plant in Windsor, Ontario, four medical tents have been erected covering about 12 parking places in the employees' parking lot over the weekend of 2-3 May. The report cites an FCA Canada spokesperson as saying that similar actions have been taken at the automaker's plant in Brampton, Ontario. (IHS Markit AutoIntelligence's Stephanie Brinley)

- DAF Trucks Brazil has announced the resumption of production at its plant in Ponta Grossa, Parana state, from 4 May. Operations had been suspended at the plant since the end of March to avoid the spread of the COVID-19 virus. DAF has scheduled the return of employees in phases, between administrative employees, who returned to work on 27 April, and assembly line employees, who returned to work on 4 May. DAF is following strict hygiene measures such as installation of sanitizers in various parts of the plant, frequent disinfection of common areas, use of reusable fabric masks, temperature monitoring of all employees, and maintenance of minimum distancing of 1.5 meters between employees between desks as well as on the production line. (IHS Markit AutoIntelligence's Tarun Thakur)

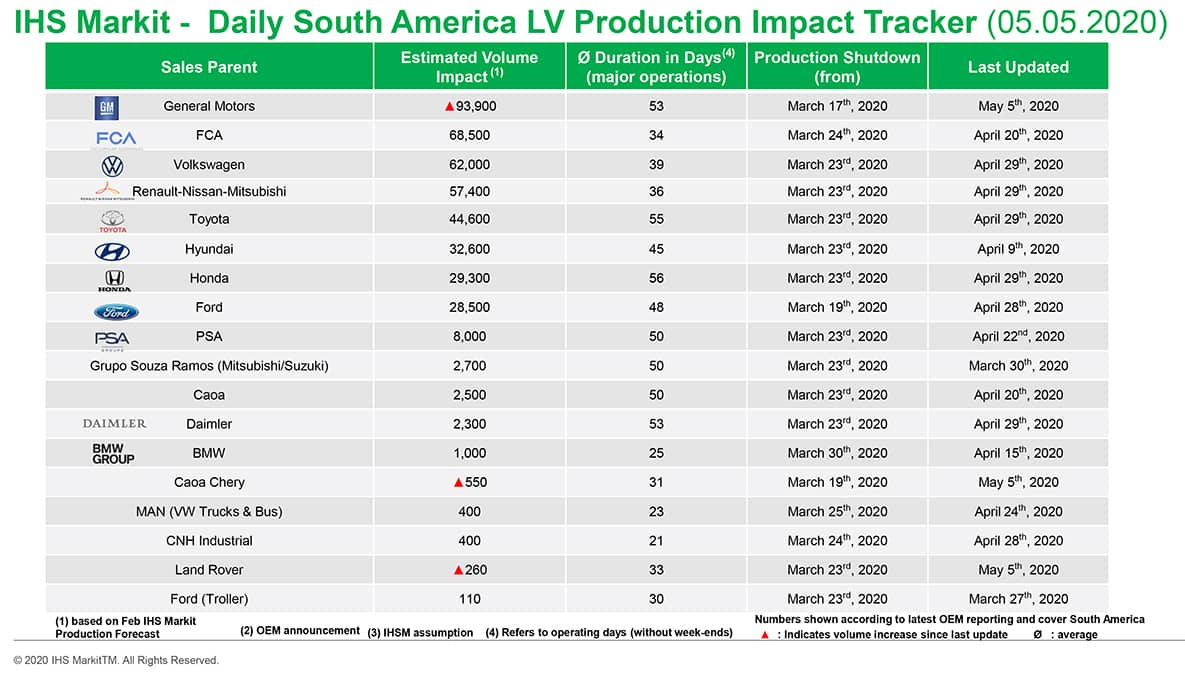

- In South America, automakers have now aggressively suspended production, with minor changes to extend shutdowns at GM and Renault-Nissan-Mitsubishi Alliance plants in Brazil. In South America, by the evening of 22 March, more than 95% of the light-vehicle assembly plants in Brazil and Argentina had reported suspended production. We had reduced the expected total lost light-vehicle production volume somewhat for the 28 April tracker, but further shutdown information has driven the expected production loss up to about 435,000 units. With this 5 May tracker, we are reporting on extended production suspensions in Brazil, including by CAOA-Chery, GM, and Land Rover. (IHS Markit AutoIntelligence's Stephanie Brinley)

Europe/Middle East/ Africa

- The Volkswagen (VW) Group has warned that the global COVID-19 virus outbreak is set to put significant pressure on its cost base as suppliers look to pass on rising expenses to OEMs, according to a Financial Times (FT) report. One of the main issues that suppliers are facing is that they are currently running at a fraction of their usual capacity and order intake as the OEMs operate a gradual and staged production restart. Given the notoriously tight margins in the supplier business most suppliers have to run at very high utilization levels usually in order to make profits. Therefore, if utilization levels are significantly lower, then it stands to reason that component prices need to rise. Although there are likely to be significant benefits to suppliers from cheaper raw materials and lower oil prices, medium-sized and smaller suppliers will be less well placed to benefit from this trend. (IHS Markit AutoIntelligence's Tim Urquhart)

- Vodafone is building 5G infrastructure along country roads and highways in Germany to support connected driving. The company is using dynamic spectrum sharing technology that enables it to share 700 MHz spectrum between 4G and 5G services. Vodafone is a leading integrated telecoms company and a key contributor to the development of Germany's 5G infrastructure. Last year, the company provided 5G connectivity to electric microcar company e.GO Mobile to launch 5G car manufacturing in Germany. In 2018, the company partnered with mapping and location services provider HERE to develop autonomous cars and smart cities. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Turkish annual inflation decelerated in April, although it remained in double digits at 10.9%. The collapse of global energy prices was the leading cause of the deceleration. (IHS Markit Economist Andrew Birch)

- Annual consumer price inflation in April slowed by approximately one full percentage point compared to a month earlier, seemingly supportive of the Central Bank of the Republic of Turkey's (TCMB) ongoing interest rate cutting cycle.

- Despite having decelerated for two consecutive months, annual consumer price inflation remains at its recent nadir of 8.6% in October 2019.

- The higher risk of lira depreciation heightens the difficulty in servicing the country's nearly USD200 billion in external obligations - approximately 60% in short-term debt and the rest in servicing medium-term debt, maturing short-term debt, and other external financing - that are due within the next 12 months.

- Most recent, weekly data report that overall foreign currency reserves were down to USD52.7 billion on 24 April, down by nearly USD28.6 billion from the beginning of the year. If short-term external liabilities such as swaps that were undertaken to build those reserves are omitted, total foreign currency reserves are nil or negative.

- The Turkish Lira closed above ₺7.00/USD for the first time yesterday and reached a new low of ₺7.10/USD earlier today.

- Turkey's Vakifbank has secured USD950 million in funding from international lenders in a one-year, two-tranche syndicated loan deal, Ahval reported. The United Arab Emirates' Emirates NBD and Abu Dhabi Commercial Bank were the lead arrangers on the deal that saw 33 banks participate to lend Vakifbank USD312 million and EUR589.5 million (USD644 million) with a financing cost of 225 basis points over Libor on the US-dollar portion and 200 basis points over Euribor on the euro portion. Ahval reported that the rollover ratio on the deal was 86% as the bank had borrowed USD1.1 billion in a similar syndicated loan last April. (IHS Markit Banking Risk's Alyssa Grzelak)

- Germany's constitutional court rules that ECB must demonstrate asset purchases are proportionate. If such proportionality is not demonstrated, then the Bundesbank would no longer be allowed to participate in the purchases under the PSPP. As those purchases are allocated across national central banks under the Eurosystem capital key, the Bundesbank currently accounts for around 26% of total purchases. Note that assets held under the PSPP are currently around EUR2.2 trillion, which is around 80% of total purchases under the ECB's Asset Purchase Programme or APP. It is very likely that the ECB will demonstrate that the PSPP is indeed proportionate. It is operating with explicit issue and issuer limits, complying with the ruling of the European Court of Justice (ECJ) in 2018 that such purchases are legal, but again subject to proportionality. (IHS Markit Economist Ken Wattret)

- According to the State Secretariat for Economic Affairs (SECO), the quarterly index of the Swiss consumer sentiment - seasonally and calendar adjusted and compiled from a survey of around 1,900 randomly chosen households (although structured across language regions) - plummeted from -9 in January to -39 in April, broadly confirming an interim survey published in mid-April (then -40). The index had never been this low, even during the real-estate crisis in the early 1990s (-37 in January 1992). The most noteworthy development among sub-indices not contained in the headline index is that expected unemployment increased massively by 95 points to 128 (almost on par with the April 2009 peak of 130; the long-term average is 49) - which is not surprising. Furthermore, expected price developments actually increased by 5 points to 60 (the long-term average is 67), which is surprising given the deflationary developments in recent months. (IHS Markit Economist Timo Klein)

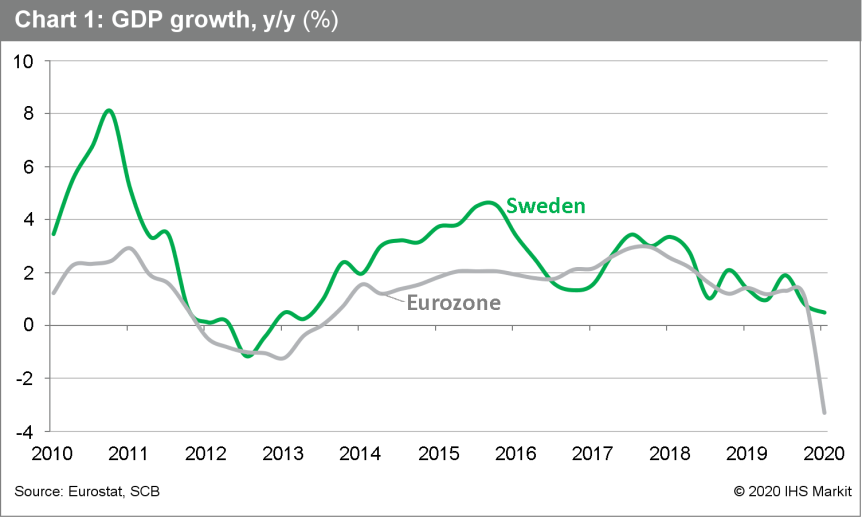

- Statistics Sweden (SCB) has published a 'flash' estimate of Sweden's GDP for the first quarter. According to the release, the Swedish economy contracted by 0.3% quarter on quarter (q/q) and grew by 0.5% year on year (y/y). There is no breakdown available accompanying the release, but it represents a much better performance compared with the eurozone, which contracted by 3.8% q/q and 3.3% y/y (see chart below). (IHS Markit Economist Daniel Kral)

- According to the latest Labor Force Survey published by Statistics Finland, the unemployment rate in the first quarter averaged 7.1%, remaining unchanged from the same period in 2019 (seasonally adjusted rate slid to 6.5% from 6.7%). In March, the unemployment rate stood at 7.3%. The average number of unemployed people increased by 1.4% year on year (y/y) in the first quarter. Meanwhile, the average number of employed people in the first quarter increased by a slower rate of 0.6% y/y. The number of hours worked fell by 0.2% y/y. IHS Markit expects the unemployment rate to climb above 10% in 2020, as both domestic and external demands suffer amid the COVID-19 virus crisis. According to the Ministry of Economic Affairs and Employment, about 429,000 employees are already under co-operation talks with their employers owing to the crisis. (IHS Markit Economist Venla Sipilä)

- S&P Global Ratings has downgraded South Africa's long-term foreign-currency sovereign credit rating to BB- and the long-term local-currency sovereign credit rating to BB. The outlook for both ratings is set at Stable. South Africa's net public-sector debt level is expected to reach over 75% of GDP by end-2020. By 2023, S&P expects the net public-sector debt burden to reach 84.7% of GDP, raising questions about debt sustainability over the medium term. By 2023, interest payments could take up 22% of government revenue and amount to 6.5% of GDP, while the ZAR200 billion of government guarantees in a loan scheme to embattled small and medium-sized enterprises increases the government's contingent liability risks. (IHS Markit Economist Thea Fourie)

- Moody's revised the rating outlook for Saudi Arabia from 'stable' to 'negative', but left the rating unchanged at 'A1' (equivalent to A+ on the generic or 15 on IHS Markit's rating scale). The recent decline in oil prices, the weak outlook for the oil market, and the impact of the COVID-19 pandemic on the non-oil economy has put Saudi Arabia's fiscal resiliency to the test and forced Moody's to change the rating outlook. The change in outlook signals that Moody's now believes a rating downgrade is likely within the next six months, if current projections prevail. (IHS Markit Sovereign Risk's Ralf Wiegert)

- According to the latest data published by the Society of Motor Manufacturers and Traders (SMMT), United Kingdom vehicle registrations contracted by 97.3% year on year (y/y), from the 161,064 units recorded during April 2019 to just 4,321 units. Of this total, private demand took the biggest hit with a retreat of 98.7% y/y to 871 units. However, fleet registrations dropped by 96.6% y/y to 3,090 units and registrations to business customers fell 88.3% y/y to 360 units. (IHS Markit AutoIntelligence's Ian Fletcher)

- Italy's passenger car registrations dropped by 97.6% year on year (y/y) during April, according to the latest data published by the National Association of Foreign Vehicle Makers' Representatives (Unione Nazionale Rappresentanti Autoveicoli Esteri: UNRAE), with demand falling from 174,924 units in April 2019 to just 4,279 units. The latest data published by the Spanish Association of Passenger Car and Truck Manufacturers (Asociación Española de Fabricantes de Automóviles Turismos y Camiones: ANFAC), show that registrations have dropped by 96.5% y/y to 4,163 units. (IHS Markit AutoIntelligence's Ian Fletcher)

- Ferrari has recorded a solid financial performance during the first quarter of 2020 despite the COVID-19 virus pandemic. During the three months ending 30 March, sales revenues slid by just 0.9% year on year (y/y) to EUR932 million, with some benefit from currency exchange rates. In light of the situation that has emerged this quarter, Ferrari has shown significant resilience, although this is partly by virtue of the type of customer that it targets. Sales revenues at its core cars and spare parts business have grown by 7.2% y/y to EUR788 million, underpinned by an increase in shipments of 4.9% y/y to 2,738 units. Despite falling 88.7% y/y to just 37 units in mainland China, Hong Kong and Taiwan which was the epicentre of the pandemic early in 2020 and significant restrictions across the region, all other regions have improved. (IHS Markit AutoIntelligence's Ian Fletcher)

- Brent crude closed +13.9%/$30.97 per barrel.

- 10yr European govt bonds closed mixed; Italy +11bps, Spain +2bps, France -1bp, Germany -2bps, and UK -3bps.

- European equity markets closed higher across the region; Germany +2.5%, France +2.4%, Italy +2.1%, UK +1.7%, and Spain +1.1%.

Asia-Pacific

- New vehicle sales in Australia posted a 48.5% year-on-year (y/y) decline during April to 38,926 units, according to data from the Federal Chamber of Automotive Industries (FCAI). The sport utility vehicle (SUV) segment posted a decline of 45.7% y/y to 18,023 units during the month, while sales of passenger cars declined by 61.6% y/y to just 9,157 units. Light commercial vehicle (LCV) sales totalled 9,436 units, down by 39.5% y/y. During April, Toyota was the leading automaker with a 26.5% market share and sales of 10,325 units, followed by Mazda with a 7.8% market share and sales of 3,022 units, and Hyundai with a 5.8% market share and sales of 2,247 units. (IHS Markit AutoIntelligence's Tarik Arora)

- General Motors (GM) Korea is planning to reduce production in May as COVID-19 pandemic impacts on US exports and disrupts part supplies, reports Reuters. According to the report, GM Korea will run its BP1 plant for seven business days in May and idle it for 11 other days. The parts disruption is reportedly related to the supply of wire harnesses from the Philippines. The Reuters report states that expected weak demand for the Chevrolet TrailBlazer is one of the factors affecting production at GM Korea's Pupyong plant; however, the facility also produces the Chevrolet Trax, Buick Encore, and Encore GX for the US market. Production of the TrailBlazer started in January 2020, while the Encore GX's production started in late 2019. The Trax is also sourced for the US market from GM's production plant in Mexico. (IHS Markit AutoIntelligence's Stephanie Brinley)

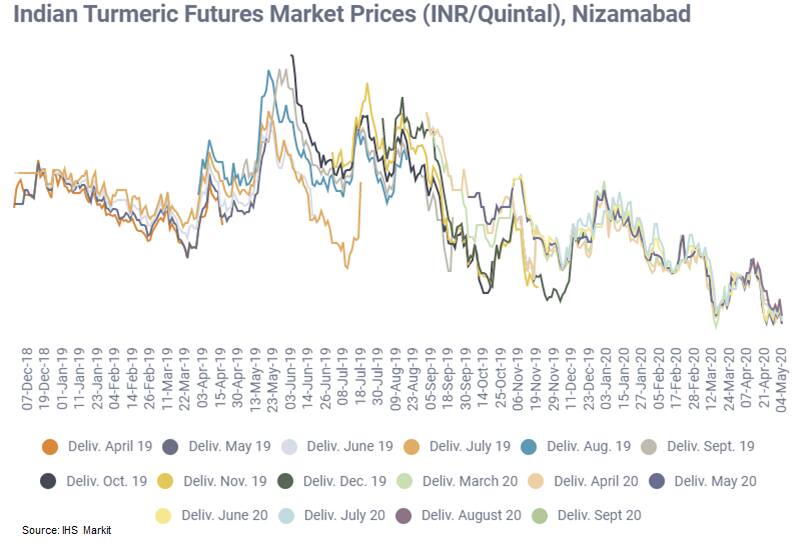

- The Indian spot fob turmeric price fell to INR5,344.2 per quintal (USD71.12/quintal) at Nizamabad market (Telangana state, South Central) on May 4 2020, 2% less than on April 24, when the wholesale market resumed activity after closure between March 21-April 23 due to the COVID-19 pandemic. There are still transport bottlenecks, slowing supply between southern origins and processors in central India. In addition, processors have slowed purchases as turmeric may be well preserved for several months, without losing its organoleptic characteristics. The country's global sales closed 2019 with 132,862 tons worth USD196.5 million, 2,000 tons less in volume and 21.2% less in value compared with the previous year, according to the Indian government. (IHS Markit Agribusiness' Jose Gutierrez)

- IHS Markit has downgraded Samoa's short-term sovereign risk rating from 20 to 25 while maintaining its short-term risk rating at 50, equivalent to BB- on the generic scale. Although Samoa has a negative external liquidity gap, the figure is distorted by its position as an offshore financial center. Although Samoa's tourism-related industries account for about 20% of GDP, inward remittances from migrants are also a major factor, as liquidity inflow as a share of GDP was equivalent to 18.4% in 2019. (IHS Markit Economist Harumi Taguchi)

- APAC equity markets closed mixed; Australia +1.6%, Hong Kong +1.1%, and India -0.8%.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-5-may-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-5-may-2020.html&text=Daily+Global+Market+Summary+-+5+May+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-5-may-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 5 May 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-5-may-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+5+May+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-5-may-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}