Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 23, 2020

Daily Global Market Summary - 23 September 2020

European equity markets closed higher, while APAC was mixed and the US sharply lower. iTraxx closed slightly wider across IG/high yield, while CDX had one of its worst days since June across both IG and high yield. US government bonds were almost unchanged on the day and the US dollar closed higher. Gold and silver continued to sell-off today, while Brent and WTI both closed higher on the day.

Americas

- Most major US equity indices began the trading session modestly higher, but all gradually sold off as the day progressed and ended the day sharply lower; Nasdaq/Russell 2000 -3.0%, S&P 500 -2.4%, and DJIA -1.9%.

- 10yr US govt bonds closed flat/0.68% yield and 30yr bonds -1bp/1.42% yield.

- CDX-NAIG +5bps/57bps and CDX-NAHY +24bps/392bps.

- DXY US dollar index closed +0.4%/94.34.

- Gold closed -2.1%/$1,868 per ounce.

- Silver closed -5.8%/$23.11 per ounce and is 23% below the 10 Aug recent peak of $29.26 per ounce.

- Crude oil closed +0.3%/$39.93 per barrel.

- California Gov. Gavin Newsom signed an order Wednesday that aims to end the sale of new gasoline and diesel-powered passenger cars in the state by 2035. More than 11% of all light vehicles in the U.S. last year were registered in California, according to IHS Markit. California is the first state in the nation to commit to such a goal, but could serve as a spark for other left-leaning states to follow, given its size and historic leadership on regulatory issues. Internationally, 15 other nations have committed to phasing out gas-powered cars according to Mr. Newsom, including Canada, the U.K. and France. (WSJ)

- The Federal Housing Finance Agency (FHFA) House Price Index

(HPI) increased 1.0% for the second straight month in July; the

2.1% increase over the last two months is a record (the index dates

back to 1991—but even if it dated back to 1891, the 2.1%

increase would still likely be a record.) (IHS Markit Economist

Patrick Newport)

- All nine Census divisions posted solid gains, ranging from 2.0% from the New England Division (Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island, and Vermont) to 0.6% from the West North Central Division (Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota, and South Dakota).

- For the first time since the mid-2000s, all nine division indexes are at all-time highs.

- Adjusted for inflation, the national index and four of nine divisions are at all-time highs.

- The index is up 6.5% from July 2019.

- Our seasonally adjusted estimates of the median and average single-family home prices have shot up 10.5% and 8.6% in the three months ending in August. This suggests that the FHFA index will post another strong gain next month. Indeed, the conditions are ripe for double-digit growth over the next few months: mortgage rates and inventories are at record lows, and demand from teleworkers has picked up.

- This last driver—telework, which is here to stay—is a wild card. Many teleworkers, particularly those living in cities where real estate is expensive, can now move to places where housing is less expensive (a bigger home, a smaller mortgage payment, and zero traffic). As this takes place, home sales and housing starts will pick up. It is difficult to quantify the exact impact of telework on the surging housing market today.

- Adjusted for seasonal factors, the IHS Markit Flash U.S.

Composite PMI Output Index posted 54.4 at the end of the third

quarter, down slightly on 54.6 seen in August. The index's

quarterly average was the highest since the opening three months of

2019. (IHS Markit Economist Chris Williamson)

- New orders increased for the second successive month, growing at the fastest rate since February 2019. The strong expansion was largely linked to an acceleration in the pace of new business growth at service providers. Companies continued to report a recovery in foreign client demand, notably for services, although the overall pace of new export order growth eased following a slowdown in manufacturers' foreign sales.

- The seasonally adjusted IHS Markit Flash U.S. Services PMI™ Business Activity Index registered 54.6 in September, down slightly from 55.0 in August. Nonetheless, the rate of expansion was the second-fastest since March 2019 and solid overall.

- Employment continued to increase solidly, albeit at a softer pace than in August following a slower upturn in backlogs of work. Business expectations also moderated amid election and COVID-19 uncertainty.

- Electric vehicle (EV) manufacturer Tesla hosted its Battery Day event on 22 September, outlining a new approach to battery-cell design and manufacturing, the type of materials used, and cell-vehicle integration. Among the benefits of the new approach, Tesla claims it will create opportunities for increasing EV range by 54%, reducing costs per kilowatt-hour by 56%, and reducing investment per gigawatt-hour by 69%. In addition, Tesla confirmed that it is working on a "truly affordable" USD25,000 compact electric car and a smaller version of the Cybertruck for international markets. Although Tesla announced what it said was a major step forward in vertical integration of some steps it has not previously been involved with, the company also stated it will continue to source battery cells and packs from current partners. Tesla expects demand to be high enough that it will not be able to meet the demand solely from taking this development in-house, although it does expect it will reduce costs. In a Twitter post ahead of the event, Musk wrote, "We intend to increase, not reduce battery cell purchases from Panasonic, LG & CATL (possibly other partners too). However, even with our cell suppliers going at maximum speed, we still foresee significant shortages in 2022 & beyond unless we also take action ourselves." The CEO continues to note the difficulties involved in reaching sufficient scale, stating that building a few prototypes is vastly easier than expanding that to production at sufficient scale and volume, a requirement of automotive development and manufacturing well known to traditional automakers. On Twitter, Musk also wrote, "The machine that makes the machine is vastly harder than the machine itself." (IHS Markit AutoIntelligence's Stephanie Brinley)

- Argentina's National Institute of Statistics and Census's

latest data show that GDP decreased by 19.1% year on year in the

second quarter of 2020. Despite the recent agreement with private

bondholders, there are no concrete signals of a boost in confidence

in Argentina's economic policy direction, thus keeping recovery

expectations down. (IHS Markit Economist Paula Diosquez-Rice)

- According to the latest data released by Argentina's National Institute of Statistics and Census (Instituto Nacional de Estadística y Censos: INDEC), GDP decreased by 19.1% year on year (y/y) in the second quarter of 2020. Correcting for seasonality, GDP during the quarter decreased by 16.2% quarter on quarter (q/q) after declining 4.2% q/q in the previous quarter, according to the revised figures.

- The estimate for the GDP deflator in the second quarter of 2020 shows a rise of 39.6% y/y, while the private-sector consumption deflator increased at a higher rate of 47.1% y/y during the same period.

- By sector, the GDP data show mostly double-digit declines in the second quarter of 2020. For example, the manufacturing sector decreased by 20.8% y/y, the wholesale and retail sales sector fell by 16.9% y/y, the construction sector shrank by 52.1% y/y, the transport and communication sector dropped by 22.5% y/y, the non-profit and social services sector contracted by 67.7% y/y, hospitality and restaurants posted a decline of 73.4% y/y, and fishing was down by 14.0% y/y.

- Only two sectors recorded a single-digit decline in annual terms. Activity in the financial intermediation sector decreased by 1.2% y/y, and the utilities sector declined by 3.3% y/y. The education sector also posted a slower decline in the second quarter.

- On the demand side, real exports of goods and services decreased by 11.7% y/y. There were declines in private-sector consumption, which fell by 22.3% y/y, driven by the country's COVID-19 virus-related lockdown and the high inflation rate; and public-sector consumption, which decreased by 10.1% y/y as the inflation rate outpaced the increase in nominal spending.

- Gross fixed-capital formation decreased by 38.4% y/y; this drop was driven by the construction sub-sector, which was down by 47.6% y/y, while the machinery and durable equipment category decreased by 27.9% y/y. The transport equipment sector declined by 25.1% y/y, with the most severe drop recorded in the imported transport equipment sub-component.

- Meanwhile, imports of goods and services decreased by 30% y/y in the second quarter of 2020 as the lockdown was compounded by the steep annual drop in the value of the local currency, which increased the cost of imported goods.

Europe/Middle East/Africa

- European equity markets closed higher; UK +1.2%, France +0.6%, Germany +0.4%, Italy +0.2%, and Spain +0.1%.

- 10yrEuropean govt bonds closed mixed; Italy -2bps, France -1bp, Spain/Germany flat, and UK +2bps.

- iTraxx-Europe closed +1bp/58bps and iTraxx-Xover +4bps/334bps.

- Brent crude closed +0.1%/$41.77 per ounce.

- The flash IHS Markit Eurozone Composite PMI fell for a second

successive month in September, dropping from 51.9 in August to

50.1, indicating only a very marginal increase in business

activity. Having rebounded sharply in July and, to a lesser extent,

August from COVID-19 lockdowns during the second quarter, the PMI

has since indicated a near stalling of the economy at the end of

the third quarter as rising infection rates and ongoing social

distancing measures curbed demand, notably for consumer-facing

services. (IHS Markit Economist Chris Williamson)

- Employment was meanwhile cut for a seventh successive month. Although the rate of job losses moderated further from April's record peak, the pace remained higher than at any time since June 2013 prior to the pandemic. An easing in manufacturing job cutting to the lowest since February contrasted with a slight increase in the rate of job losses in services, reflecting the divergent business activity trends between the two sectors. Reduced staff cuts in Germany and France were partly countered by greater job losses in the rest of the region.

- Average prices charged for goods and services meanwhile fell at the steepest rate since June, down on average for a seventh month running as firms increasingly reported the need to offer discounts to stimulate sales.

- The drop in charges occurred despite costs rising again. Average input prices increased for a fourth consecutive month in September, albeit only modestly and at a slightly reduced rate compared to August.

- Looking ahead, business expectations about the coming 12 months hit the highest since February, improving in both manufacturing and services and across Germany, France and the rest of the euro area as a whole. But this optimism often rests on infection rates falling, which remains far from guaranteed for the coming months.

- At 55.7 in September, the headline seasonally adjusted IHS

Markit/ CIPS Flash UK Composite Output Index - which is based on

approximately 85% of usual monthly replies - remained above the

50.0 no-change mark for the third consecutive month, to signal a

sustained increase in private sector output. (IHS Markit Economist

Chris Williamson)

- The latest reading was down from a 72-month high of 59.1 in August and the lowest since June, indicating a marked slowing in the rate of expansion. Prior to the pandemic, the 3.4-point drop in the index was the largest seen since 2016.

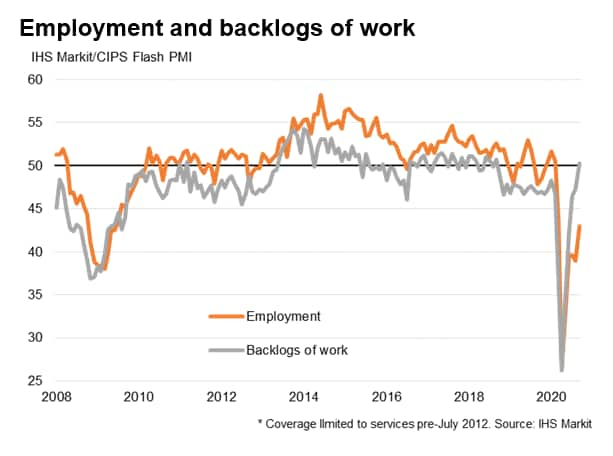

- Worryingly, jobs continued to be cut at a fierce rate in September as firms sought to bring costs down amid weak demand, meaning unemployment is likely to soon start rising sharply from the current rate of 4.1%.

- A steadying of backlogs of work after steep falls in prior months suggest that capacity and order books are now coming more into line, which would normally lead to a further easing in the need to cut jobs.

- The indication from the survey that recovery momentum is

quickly lost when policy support is withdrawn underscores our

concern over the path of the labor market once the furlough scheme

ends next month, and raises fears that growth could fade further as

we head into the winter months, especially as lockdown measures are

tightened further amid the recent rise in COVID-19 case

numbers.

- UK Prime Minister Boris Johnson has warned that the United

Kingdom could be heading into a second wave of the COVID-19 virus

pandemic and has introduced new restrictions, which could be in

place for the next six months. He has also warned that the

government will introduce further restrictions if the new measures

are not adhered to. (IHS Markit Economist Raj Badiani)

- The UK's COVID-19 virus alert level recommended by the Joint Biosecurity Centre has been raised from 3 to 4, signaling that the rate of transmission is "high or rising exponentially". Furthermore, the government's chief scientific adviser Sir Patrick Vallance warns that without further action there could be 50,000 new COVID-19 cases per day by mid-October, potentially leading to more than 200 deaths per day by mid-November.

- The government has announced new COVID-19 virus restrictions

but they fall short of a reintroduction of a national lockdown.

Boris and Chancellor of the Exchequer Rishi Sunak agree that a

second national lockdown would be a disaster for the economy and

are determined to keep businesses and schools open. The new

measures are as follows:

- All pubs, bars, restaurants, cafes, and other hospitality venues in England and Scotland must close at 10.00 pm from 24 and 25 September, respectively.

- All venues in England will only provide table service except for takeaways. A table booking is limited to six people.

- Businesses are legally required to take customers' contact details so that they can be traced if there is an outbreak.

- Businesses can be fined up to GBP10,000 (USD12,775) if they take reservations of more than six, do not enforce social distancing, or do not take customers' contact details.

- Staff in hospitality venues must wear masks, as must customers when not seated at their table to eat or drink. The penalty for not wearing one or breaking the 'rule of six' has doubled to GBP200 for a first offence.

- Shop workers will also have to wear a face covering.

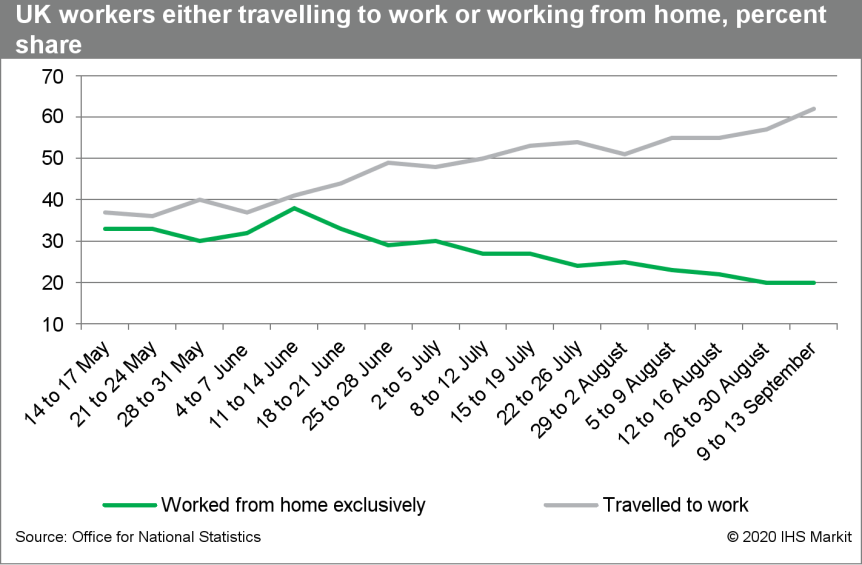

- Furthermore, the UK government now advises that people in England should work at home if they can. This represents an about-turn after Boris had pleaded people to "start to go back to work now if you can" in July followed by the government launching a campaign to encourage workers back to offices.

- The new COVID-19 virus restrictions, and the prospect that they

will remain in place for six months, provide support to our

assessment that the recovery will lose significant momentum from

the final quarter of this year.

- MG Motors has announced that it is launching the plug-in hybrid variant of the HS crossover in the UK. In a statement, the company said that the vehicle combines a gasoline (petrol) 1.5-litre turbocharged engine with a 90kW electric motor that together develop 258PS. The battery is said to offer a range of 32 miles on WLTP, while CO2 emissions on the WLTP cycle stand at 43 g/km. The vehicle is said to feature a 10-speed transmission which combines a six-speed automatic transmission for the internal combustion engine and a four-speed electronic drive unit for the electric motor, with the power being sent to the front wheels. The vehicle also includes many of the same features available in the standard HS, including the MG Pilot driver assistance system. The vehicle is available in two specifications: the Excite which costs GBP29,995 and the Exclusive price at GBP32,495. The company has also confirmed the specifications of the new MG 5 EV. The battery electric vehicle (BEV) uses a 115kW electric motor combined with a 52.2kWh battery pack to give a range under WLTP of 214 miles, while for city driving, this is said to rise to 276 miles. It can also achieve a charge of around 80% in around 50 minutes using a fast charger. The vehicle has an estate body that offers space for five and luggage space of up to 578 liters with the rear seats up, and 1,456 liters with them down. The Excite variant is priced at GBP24,495 including the UK government's GBP3,000 Plug-in Car Grant (PICG), while the Exclusive is priced at GBP26,995 including the PICG. MG has already had some success with the BEV variant of the ZS, and this has led it to expand its offering. The MG 5 EV is seen as a strong prospect for the company car market given that it will be eligible for a benefit in kind of 0% in the 2020/21 tax year, rising to 1% and 2% in the following years, at an exceptionally competitive price point. (IHS Markit AutoIntelligence's Ian Fletcher)

- Dutch consumer confidence improved by just one point in

September and remains at very low levels; and the new restrictions

on activity present a downside risk for our forecast for the

tail-end of the year. (IHS Markit Economist Daniel Kral)

- The consumer confidence index compiled by Statistics Netherlands (Centraal Bureau voor de Statistiek: CBS) improved marginally from -29 in August to -28 in September. There were no notable changes compared to August in any of the sub-categories, with several remaining at extreme lows.

- The assessment of the current economic climate is at -58, compared to -59 in August. The forward looking sub-categories improved marginally with expectations of economic situation in the next 12 months at -40, up from -43, and expected financial situation in next 12 months at 0, up from -2 in August.

- In a separate release, the monthly indicator measuring domestic household consumption improved further in July. Based on shopping-day-adjusted data from the CBS, it was down by 6.2% year on year (y/y). However, this is a marked slowdown compared to the improvements between April-May and May-June.

- The number of employed people rose in August by 4,000, the third consecutive month of growth. However, the unemployment rate increased marginally from 4.5 to 4.6% between July and August, as the participation rate continued to recover earlier losses.

- The weak consumer confidence and expectations may further deteriorate in October, as new restrictions to contain the spread of the COVID-19 virus without an end-date were recently imposed in six regions, including Amsterdam and Rotterdam. More regions may face similar restrictions in the coming weeks, weighing down on confidence and spending in the coming months.

- Elderberry concentrate prices have jumped this year and supplies are all but obtainable, except for a few stray tons here and there. According to one source, who described the situation as a "disaster", there are two main reasons for the shortage. The first is a report which appeared in the US, extolling the health benefits of elderberry and the second was a poor harvest in Austria. This was apparently due to the depredations of an insect pest, and the harvest is reported to be just 40% of the expected volume. "It's nice to see elderberry finally being appreciated for what it is," he observed, "but demand tripled just as supplies shrank." He added that 65 brix elderflower concentrate (55 brix is also made) was now priced around EUR9.00-10.00 per kilo (USD10.65-11.84/kg) ex-works for bulk standard concentrate. Another source reckoned that prices were even higher, quoting EUR11.00/kg. Last year's prices were around EUR6.00-7.00/kg. Blackcurrant concentrate prices are also extremely high. At the end of last year, concentrate was around EUR3.00/kg but has now doubled. IHS Markit has been told that Poland is sold out, though (again) there may be a few tons here and there. There are no quotes yet for new season Canadian blueberry concentrate. The harvest has been dogged by the same problems that struck Poland (a late frost followed by a long hot dry period) and suppliers are assessing the situation before offering. (IHS Markit Food and Agricultural Commodities' Neil Murray)

- Kenyan banks have reported a pre-tax profit decline of 23%.

Profit before tax fell from KES70 billion (USD645.8 million) in May

2019 to KES53.9 billion in May 2020. The main reason cited by banks

for the decline in earnings is an increase in impairments owing to

challenging macroeconomic conditions, forcing banks to increase

their loan loss provisions. The sector's provisions also increased

from KES10 billion to KES39 billion between January and June 2020.

(IHS Markit Banking Risk's Ana Souto)

- As previously noted, IHS Markit expects non-performing loans (NPLs) to increase as economic hardship stemming from measures to contain the spread of the COVID-19 virus pandemic ripples through key sectors such as manufacturing, trade, real estate, and financial services, thus reducing borrowers' ability to service their debts.

- The NPL ratio stood at 13.1% in June 2020, compared with 12% in December 2019. In March, the Central Bank of Kenya (CBK) granted banks flexibility with regards to loan classification to borrowers affected by the COVID-19 virus pandemic. Such forbearance measures will contain the increase in NPLs in the near term.

- However, owing to increased credit risks, we assess that growth in private-sector lending by banks is also likely to ease. We project that year-on-year (y/y) credit growth will be muted in 2020, at about 8.6%, compared with 8.1% in 2019, mostly supported by public-sector lending.

- The muted y/y loan growth, increasing impairments and provisions, coupled with the fact that banks have also had to restructure loans and grant temporary holiday payments to support borrowers and the low interest-rate environment, will continue to put pressure on the sector's earnings.

Asia-Pacific

- APAC equity markets closed lower mixed; Australia +2.4%, Mainland China +0.2%, Hong Kong +0.1%, South Korea flat, Japan -0.1%, and India -0.2%.

- Chinese president Xi Jinping, in an address delivered by video link Tuesday to the United Nations (UN) General Assembly, declared that China would aim to become carbon neutral by 2060. He also said that the country would reach peak greenhouse gas (GHG) emissions before 2030. "We aim to have CO2 emissions peak before 2030 and achieve carbon neutrality by 2060," Xi told the assembly. "We call on all countries to pursue innovative, coordinated, green, and open development for all. "China is the biggest emitter of GHGs mainly due to its widespread use of coal and accounts for an estimated 28% of worldwide CO2 emissions. The country had not, until now, committed to a long-term emission-reduction target. Xi called for all countries to honor the 2015 Paris climate agreement. He said that China would increase its nationally determined contributions under the agreement by adopting new policies and measures. The UN's climate negotiations are currently stalled with the next UN climate meeting, called COP26, postponed until 2021 due to COVID-19. Xi also said that a "green revolution" was needed to preserve and protect the environment as the world recovers from COVID-19. "The Paris agreement on climate change charts the course for the world to transition to green and low-carbon development," he said.

- Beijing has announced plans to finish setting up a connected cloud-controlled high-level demonstration zone for autonomous vehicles (AVs) by the end of 2020, according to Gasgoo. The project began on 19 September. The plan is to create an industrial ecosystem at the zone to develop Level 4-or-above AVs, integrating various businesses of electronics, communications, artificial intelligence, big data, and automotive manufacturing. The demonstration zone is expected to feature mature systems of intelligent roads, smart vehicles, real-time cloud control, a reliable network, and precise maps by 2022, and will possess a city-level engineering testing platform so as to make the AV technologies commercially viable. The Chinese government is heavily backing the use of AV technology and has authorized the testing of autonomous cars, taxis, and buses, among other vehicles. The overall aim is for China to showcase to the world that it is a leading player in new technology, with a focus on electric vehicles (EVs) and AVs. Beijing was one of the earliest of China's cities to implement policies for AVs, first announcing them in December 2017. Currently, Beijing has a total of 151 roads allocated for AV operation in four districts, covering a total distance of 503.68 kilometers (km). In 2019, road tests covering a total of more than 1.04 million km were driven by 77 AVs from 13 companies in the city. The city has established three closed testing grounds for AVs. (IHS Markit Automotive Mobility's Nitin Budhiraja)

- Groupe PSA has repurchased 10 million of its own shares from China's Dongfeng Motor Group. According to a statement released by the French automaker, the deal fulfills a share repurchase agreement signed last year, and represents 1.1% of the share capital in PSA. The company added that it paid EUR16.385 per share today (23 September) through an off-market transaction, and said that the shares will be cancelled following settlement, in accordance with its buyback program. The agreement to repurchase shares from Dongfeng was made to support the merger between PSA and Fiat Chrysler Automobiles (FCA) to create the new Stellantis organization. The terms of the merger required Dongfeng to sell 30.7 million shares to give it an ownership stake of 4.5% in the merged business; it is hoped this will allow the deal to overcome certain regulatory hurdles. At the time, the agreement said that PSA would acquire all the shares, which would then be cancelled by the company. The latest statement states that subject to final approval by the boards of Dongfeng, PSA, and FCA, the agreement will be amended for the remaining 20.7 million shares, Dongfeng will be able to sell these shares to one or more third parties in one or more transactions by the end of 2022 if these shares have not been acquired by PSA or to one or several third parties before the end of 31 December 2020. (IHS Markit AutoIntelligence's Ian Fletcher)

- Panasonic is evaluating options for new electric car battery production with Tesla after the latter announced a plan to increase output and halve the cost of the batteries, according to Reuters. A Panasonic spokesperson said, "We are considering a variety of options, but nothing has been determined at this time… We value our relationship with Tesla and look forward to enhancing our partnership." Tesla hosted a Battery Day event yesterday (22 September), outlining a new approach to cell design, materials, and vehicle integration. Tesla claims that the new approach will create opportunity for a 54% increase in range, a 56% reduction in cost per kWh, and a 69% reduction in investment per GWh. Tesla also said that getting to full electric vehicle (EV) penetration will require TWh-scale battery production, compared with today's GWh factories. Recently, Panasonic announced plans to add a 14th production line at the Tesla Gigafactory in Nevada (United States), which will start operations in 2021, increasing the plant's capacity by about 10%. Along with the new production line, Panasonic is reportedly planning upgrades to the existing facilities to accommodate new battery technology. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Indian Oil Corp. Ltd. (IOCL; Delhi) plans to invest about $2.4 billion to boost crude-processing capacity at its Gujarat refinery at Vadodara, India, as well as build polypropylene (PP) and base oil plants to integrate the complex better. The project will raise refining capacity to 18 million metric tons/year (MMt/y), or about 360,000 b/d, from 13.7 MMt/y and also add a 500,000-metric tons/year PP unit as well as a 235,000-metric tons/year lube oil base stock plant, says the company. It has not specified a start date. Market sources earlier predicted a March 2023 completion. "The project would be a building block for production of niche chemicals in future with a potential to increase petchem and specialty products integration index on incremental crude oil throughput, which would enhance the corporate margins of IOC," it adds. The company says that more focus will be paid to better integrate its refining facilities to improve profitability by moving further down the value chain in embracing petrochemical production. To this end, with an outlay of about $3.9 billion, the company is working on an ethylene glycol project and a para-xylene/purified terephthalic acid (p-xylene/PTA) plant at its Paradip site. It is also working on an acrylics/oxo-alcohol facility at the Gujarat facility and expansions to the naphtha cracker and p-xylene/PTA complex at Panipat. The company's refining complexes at Panipat and Barauni are also slated for a similar petchem integration and capacity boost with crude processing soaring to 500,000 b/d from 300,000 b/d at Panipat and to 180,000 b/d from 120,000 b/d at Barauni. The Panipat project is likely to begin construction in 2023 and works at Barauni may be completed in the same year. The company expects gasoline and diesel demand to reach pre-COVID-19 levels this quarter following strong growth in the first half of September. Diesel sales by the company rose 22% from the previous two weeks but were down 9% from a year ago while gasoline gained 9% month on month and 1% from a year ago, according to local media. As a group, diesel sales by Indian Oil, Bharat Petroleum Corp. Ltd. (BPCL), and Hindustan Petroleum Corp. Ltd. (HPCL) edged up 19.7% from the first half of August to 2.13 MMt, and gasoline and jet fuel rose 7.2% and 21.3% to 965,000 metric tons and 125,000 metric tons, respectively, data from the suppliers showed.

- The Philippine current account reversed to a surplus during the

second quarter of 2020 for the first time in three years, mainly

prompted by a sharp narrowing of the goods trade shortfall. The

collapse in domestic demand amid strict COVID-19 virus-containment

measures and severe disruption to business activities led to a

worse contraction in imports than exports. The strong result for

the second quarter suggests that an upward revision to the forecast

for this year could be possible. (IHS Markit Economist Ling-Wei

Chung)

- The current-account balance returned to a surplus in the second quarter of this year, amounting to USD4.4 billion, reversing a deficit of USD23 million posted during the first quarter and also marking a turnaround from a shortfall of USD930.7 million recorded during the same quarter of 2019. The revised figures show that the current account recorded its first surplus since the third quarter of 2017 and the largest since the central bank's statistics began in 1999.

- The second quarter's record current-account surplus was mainly down to a sharp moderation in the goods trade shortfall, which narrowed by 55.2% year on year (y/y) to just USD5.4 billion in the second quarter from USD12.1 billion a year earlier. This came on the back of an abrupt decline in imports that outpaced the drop in exports.

- Goods imports plunged 43.6% y/y in the second quarter as the COVID-19 virus pandemic and the extended virus-containment measures during most of the quarter severely disrupted business operations and dampened consumer and business sentiment. The resulting collapse in all-important domestic demand in turn led to a plunge in import demand across the board.

- Imports of capital goods slumped 47.2% y/y in the second quarter, driven by a 48.4% y/y drop in power-generating machines and a 79.2% y/y plunge in land transport equipment. This was followed by a 46.1% y/y drop in imports of consumer goods as imports of passenger cars tumbled 82.7% y/y and purchases of miscellaneous manufactures slumped 60.0% y/y.

- Imports of raw material and intermediate goods contracted 31.9% y/y in the second quarter, dragged down by falling imports of manufactured goods, chemicals, and petroleum crude.

- Concurrently, exports of goods dropped 33.3% y/y in the second quarter as the worldwide city lockdowns amid the COVID-19 virus pandemic severely disrupted global supply chains and resulted in serious damage to overseas demand.

- Exports to the country's major trading partners, from the United States and mainland China, to Europe, all reported double-digit contractions, ranging between 10% y/y and 50% y/y.

- By product, the major drag on exports of goods came from a 37.5% y/y slump in exports of manufactures, driven by a 32.5% y/y drop in shipments of electronic products, including semiconductors and electronic data processing, and a 59.1% y/y plunge in shipments of other electronics.

- Exports of other manufactures, including machinery and transport equipment, chemicals, and garments, contracted at a double-digit pace as well, although they were partly offset by a surge in shipments of petroleum products.

- Monthly figures show that the trade deficit has slowly widened once again after hitting the lowest reading in five years in April. On the external front, the gradual reopening of business activities in other parts of the world has helped slow the decline in exports, which narrowed to 9.6% y/y in July, compared with a 13.3% y/y drop in June and as much as a 50.8% y/y plunge in April. Although a further improvement could be possible in the coming months, worries about the new wave of global infections, the fallout of the pandemic, and lingering geopolitical tensions will remain the main downside risks.

- The Indonesian government has approved LG Chem and Hyundai Motor Group's joint plan to set up an electric vehicle (EV) battery plant in the country, reports The Korea Times. LG Chem is close to announcing its plan to build the EV battery plant in which Hyundai will have a sizeable stake. General terms of the plan have been agreed upon, but some details need to be fine-tuned before an official announcement, highlights the report. The investment will be substantial as the Indonesian government has guaranteed preferential tax treatment for startups. The government plans to grant both LG Chem and Hyundai tax exemptions on imported construction materials for at least seven years. Both LG Chem and Hyundai also requested for preferential customs-procedure treatment, which has also been approved. Hyundai's plans to produce EVs at its new Indonesian plant are in line with the Indonesian government's aim to increase the adoption of electrified vehicles in a bid to reduce the country's carbon footprint (see Indonesia: 9 August 2019: Hyundai to build vehicle manufacturing plant in Indonesia). It is no surprise to see the joint venture (JV) with LG Chem, as the automaker needs to procure battery cells and packs. LG Chem has been an important partner of Hyundai for EV production. The company has supplied lithium-ion (Li-ion) car batteries to Hyundai's all-electric vehicles, such as the Kona EV and the Ioniq Electric. (IHS Markit AutoIntelligence's Jamal Amir)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-23-september-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-23-september-2020.html&text=Daily+Global+Market+Summary+-+23+September+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-23-september-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 23 September 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-23-september-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+23+September+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-23-september-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}