Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 22, 2020

Daily Global Market Summary - 22 September 2020

US equity markets closed higher on the day, while APAC markets were lower and Europe was mixed. European government bonds closed mixed and US bonds were slightly lower on the day. iTraxx and CDX IG indices closed flat, while high yield was modestly wider. The US dollar and oil were higher on the day and gold sold off for a second consecutive day. Increases in COVID-19 infections in Europe are creating growing concerns that business closures may be required to slow the spread as we enter the fall season.

Americas

- US equity markets closed higher on the day, despite all major indices intermittently entering negative territory earlier in the day; Nasdaq +1.7%, S&P 500 +1.1%, Russell 2000 +0.8%, and DJIA +0.5%.

- 10yr US govt bonds closed +1bp/0.68% yield and 30yr bonds +1bp/1.43% yield.

- CDX-NAIG closed flat/52bps and CDX-NAHY +4bps/368bps.

- DXY US dollar index closed +0.4%/93.99.

- Gold closed -0.2%/$1,908 per ounce.

- Crude oil closed +0.7%/$39.80 per barrel.

- The U.S. House passed a stopgap funding bill to keep the government operating through Dec. 11 after both parties in Congress and officials at the White House struck a deal to provide aid to farmers and food assistance for low-income families. The 359-57 vote on Tuesday night now sends the temporary spending bill to the Senate for a vote before the fiscal year ends on Sept. 30. Final passage would avert a government shutdown just before the Nov. 3 general election. (Bloomberg)

- US existing home sales edged up 2.4% in August to a

6.0-million-unit annual rate—the highest reading since December

2006. Single-family sales increased 1.7% to a 5.37 million rate;

condo/coop sales shot up 8.6% to a 630,000 rate. Sales were up

10.5% from a year earlier and 4.2% from February—the month

before COVID-19 shut down vast swaths of the US economy. (IHS

Markit Economist Patrick Newport)

- Inventory of single-family homes dipped to 1.27 million, by far the lowest August reading on record. Our seasonally adjusted single-family homes inventory estimate, 1.19 million, was an all-time low. Unsold inventory of all homes amounted to a record-low 3.0-month supply at current sales pace. A 5.0-month supply is considered normal.

- Record-low interest rates and inventories have led to bidding wars, rising sales, and higher home prices. Fueling the flames are bidders who are re-entering the market after withdrawing earlier in the year. The median price has risen 11.4% from last August—and more than 10.0% in all four regions.

- High-end homes are driving the numbers. Sales of homes valued under $100,000 were down 20.5% from a year earlier, and those in the $100,000-250,000 range were down 8.9%; meanwhile sales in the $1.0-million-plus category were up 44% from last August, while those in the $750,000-1.0 million increased 34.5%.

- The Mortgage Bankers Association's seasonally adjusted purchase index remains elevated, suggesting that September's existing home sales numbers will remain near current levels.

- Next-generation sequencing (NGS) company Illumina (US) has entered into a definitive agreement to acquire cancer screening company GRAIL (US) for USD8 billion in a cash and stock transaction. GRAIL shareholders will also be eligible to receive a tiered single-digit percentage of revenues from GRAIL products, including Galleri, its multi-cancer screening test that is anticipated to launch in 2021. Specifically, shareholders will have contingent value rights that entitle them to 2.5% of the first USD1 billion in revenues each year for 12 years, and 9% for revenues above USD1 billion during the same period. According to Illumina, an earlier version of Galleri was able to detect over 50 cancer types, including more than 45 with currently no recommended screening test in the US. GRAIL also has other cancer diagnostic, and post-treatment monitoring blood-based tests in development. The transaction is anticipated to be accretive to Illumina revenue starting from 2021, and is expected to help accelerate revenue growth over time. It has been approved by the Boards of Directors of both companies and is anticipated to close in the second half of 2021, subject to customary closing conditions. (IHS Markit Life Science's Margaret Labban)

- Koppers (Pittsburgh, Pennsylvania) says strong demand for residential lumber drove year-over-year (YOY) sales growth in its performance chemicals segment during August. Sales in the carbon materials and chemicals segment and the railroad and utility products segment continued to fall short, however. Sales in performance chemicals totaled $46.5 million during August, up 8.4% YOY. Koppers says several trends related to the COVID-19 pandemic have helped boost demand for residential lumber in the US. "First, with virtual work environments becoming more prevalent, people now have more options regarding where to live and many appear to prefer a suburban environment," the company suggests. "That has helped to drive a robust market for existing-home sales, which closely correlate with home repair and remodeling projects." Homeowners who are not relocating are diverting spending from travel and leisure to home improvement, the company adds, while pent-up demand is driving growth in international markets. Sales in the railroad and utility products segment totaled $64.2 million, down 5.3% YOY, mainly on lower crosstie volumes in the US. Sales in carbon materials and chemicals totaled $31.4 million, down 10.3% YOY; primary markets served by the segment, such as aluminum, steel, energy, and construction, are likely to remain volatile into 2021, says Koppers.

- Shell eggs, certain fish, leafy greens, tomatoes, fresh-cut fruit and vegetables, and fresh herbs are among some of the commodities that would be considered high-risk and demand stricter recordkeeping requirements, according to a sweeping rule proposed by FDA and released Monday (Sept. 21). FDA rolled out the list of 16 high-risk foods and a nearly 200-page proposed traceability rule, all of which were required by the Food Safety Modernization Act (FSMA) and pushed out to meet a court deadline. The Center for Food Safety (CFS) sued the agency in 2018 for delaying the FSMA high-risk foods list that Congress required by January 2012, along with a recordkeeping rule by January 2013. Under the court settlement, FDA agreed to designate the foods by September 2020 and establish final reporting requirements by November 2022. The much-anticipated "Food Traceability List" includes the following foods the agency views as high-risk: Cheeses (except for hard cheeses); shell eggs; nut butter; cucumbers; herbs (fresh); leafy greens; melons; peppers; sprouts; tomatoes; tropical tree fruits; fruits and vegetables (fresh-cut); finfish (including smoked finfish); crustaceans; mollusks, and ready-to-eat deli salads. "While limited to certain foods, this proposed rule would create a first-of-its-kind standardized approach to traceability recordkeeping, paving the way for industry to adopt and leverage more digital, tech-enabled traceability systems both in the near term and the future," said Frank Yiannas, FDA's deputy commissioner for food policy and response. Yiannas has been a staunch proponent of leaning on technology to improve traceability to not only help consumers but also industry. The latest rule is a beachhead in his New Era of Smarter Food Safety plan. Officials arrived at the list by creating a risk-ranking model - also released by the agency - that scored factors such as frequency of outbreaks, likelihood of contamination, consumption patterns and illness costs. In the proposed rule, FDA recounted scores of investigations, such as those on leafy greens and papayas, where poor records hindered the agency's ability to identify specific lots or growers of contaminated product. The agency acknowledged traditional "one-up, one-back" recordkeeping methods have not offered enough information to quickly link food shipments throughout the supply chain. (IHS Markit Food and Agricultural Policy's Joan Murphy)

- Working with Electrify America, Volkswagen (VW) of America will provide an unlimited charging plan for owners of the 2021 ID.4 EV for three years. According to a VW of America statement, an unlimited number of DC fast charging sessions will come at no additional cost to the purchase price of the ID.4, whether the vehicle is leased or purchased. Owners will be able to charge at the existing 470 charging stations or more than 2,700 DC fast chargers, as well as new stations Electrify America is working on. VW owners will manage their charging plan through an Electrify America app. By December 2021, according to the statement, Electrify America plans to install or have under development 800 charging stations with about 3,500 DC fast chargers. Among the elements slowing EV adoption is the smaller charging infrastructure, for US buyers used to having access to many fuel stations and refueling in minutes. As a result, most automakers with new EVs are announcing various partnerships or efforts to make it as easy as possible for owners to be able to charge, going back as far as Nissan when it introduced the Leaf and charging was notably more difficult to find than today. Electrify America is one of several charging network companies, and was born from the settlement that VW came to with the US and the US state of California over its admission of diesel emissions test defeat, though the entity is automaker-agnostic, public and can be accessed by any vehicle with a compatible charger. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Uber CEO Dara Khosrowshahi is under pressure from investors over the progress of the self-driving unit, according to a media report. Bloomberg reports that the company's two largest shareholders, SoftBank and venture firm Benchmark, have encouraged Khosrowshahi to find more investors for the self-driving division. According to the Bloomberg report, citing people familiar with the situation, the division could run out of funds by the end of 2021. The report, which cites people speaking anonymously, says that Uber may consider accelerating the project's progress by open sourcing to coders, or continue building a proprietary car with funding from Toyota and Denso, existing partners, as well as new partners. In 2019, Uber put its self-driving business into the Advanced Technologies Group division, with its own set of investors, which took the project off of Uber's balance sheet. Uber's development of self-driving technology slowed because of a number of factors, including a fatal pedestrian accident in 2017 and a change of the company's leadership from founder Travis Kalaneck to Khosrowshahi. Uber has had partnerships with several companies, including Daimler, to move its technology development forward, although the report states that the work with Daimler has stalled. (IHS Markit AutoIntelligence's Stephanie Brinley)

- The Central Bank of Brazil (Banco Central do Brasil: BCB) has

left the policy rate at 2.0% and stated that it does not foresee

further cuts in the policy rate using the same forward guidance

language implemented in August. (IHS Markit Economist Rafael Amiel)

- Still, it did not say that the easing cycle had come to an end. Annual inflation has increased in the past three months and, although still low at 2.4%, it is higher than the policy rate.

- Prices in the food and beverages category jumped 0.8% in August, while the cost of services continued to decline (down 0.5%). Another driver of inflation in the past three months has been the correction of gasoline (petrol) prices, driven in turn by international oil prices.

- At current levels, the policy rate is at a record low. The BCB is targeting inflation of 4.0% +/-1.5 percentage points.

- The bank assesses that in the short term inflation will continue to increase, driven by higher food prices. The BCB assesses that the current policy rate is below its structural value; this value is relatively high as it is pushed up by a sizeable fiscal deficit and high debt that needs to be financed and rolled over, offering higher rates. However, the very weak state of the Brazilian economy justifies a strongly stimulative monetary policy. IHS Markit assesses that current monetary policy is only relatively stimulative as the rates commercial banks charge for their loans to corporations and consumers are still sizeable.

- Producer prices have increased substantially in the past three months and some of these increases may eventually pass onto consumer prices. On a positive note, a stable exchange rate with a slight bias towards appreciation may help the stability of consumer prices.

Europe/Middle East/Africa

- European equity markets closed mixed; Spain -0.7%, France -0.4%, Germany/UK +0.4%, and Italy +0.5%.

- 10yr European govt bonds closed mixed; Italy -7bps, Spain -2bps, Germany +3bps, and UK +5bps. 10yr Italian bond yields are near their lowest point in almost one year.

- iTraxx-Europe closed flat/58bps and iTraxx-Xover +4bps/331bps.

- Brent crude closed +0.7%/$41.72 per barrel.

- The BoE's Monetary Policy Committee (MPC) voted unanimously to

maintain the Bank Rate at 0.1% at its meeting ending on 16

September. (IHS Markit Economist Raj Badiani)

- The MPC voted unanimously for the BoE to continue with its existing programs of UK government bond and sterling non-financial investment-grade corporate bond purchases, financed by the issuance of central bank reserves, maintaining the target for the total stock of these purchases at GBP745 billion (USD964 billion) by the latter stages of this year. As of 16 September, the total stock of the Asset Purchase Facility (APF) was GBP662 billion, representing a rise of GBP230 billion as part of the programs of asset purchases announced on 19 March and 18 June.

- The BoE argues that the economy is less weak than had been expected in the August report. Nevertheless, the bank still expects the United Kingdom's GDP in the third quarter of 2020 to be around 7% below its fourth-quarter-2019 level.

- The bank expects the economy to contract by 9.5% in 2020 as opposed to the 14% figure published in May. The upward adjustment is because the recovery has occurred "earlier" and has been "more rapid" than it had assumed in May. Key factors are the faster easing of the lockdown restrictions and a return to pre-coronavirus disease 2019 (COVID-19) virus levels for spending on clothing and household furnishings. However, the BoE acknowledges that leisure spending and business investment remain subdued, which will weigh down on the recovery.

- The BoE advocates a relatively brisk recovery, with the economy projected to expand by 9% in 2021 and 3.5% in 2022, implying a return to its pre-COVID-19-virus level by the end of 2021. In addition, it is above market consensus for UK GDP growth, at -10.1% for 2020 and 6.1% for 2021 in August.

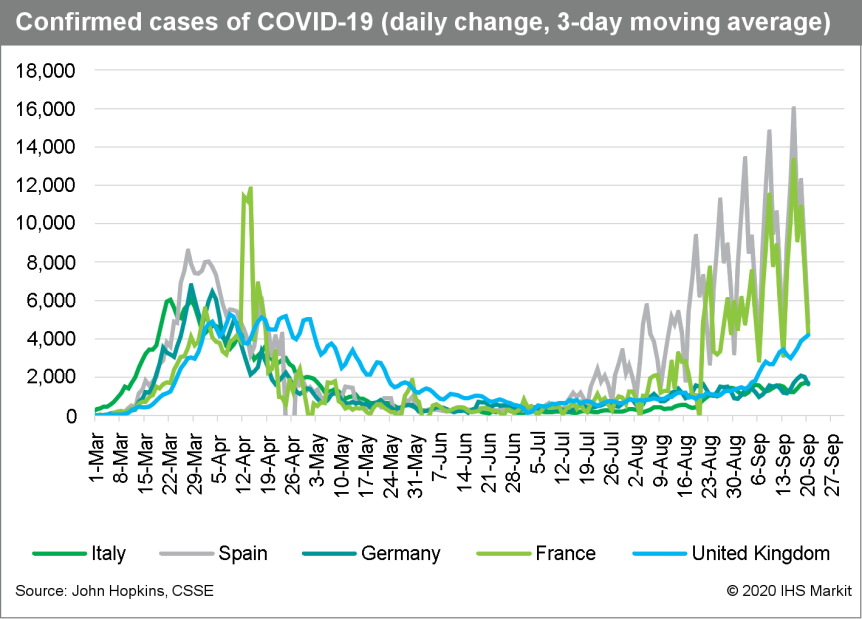

- The latest spike in infections in Spain again highlights the

continued uncertainty about how the COVID-19 virus will behave in

the next few months. In addition, lockdown in parts of Madrid

highlights considerable risks to the recovery after the economy

contracted by 22.7% in the first half of this year when compared to

end-2019. (IHS Markit Economist Raj Badiani)

- Spain has reported approximately 31,428 new COVID-19 infections since 18 September. Spanish health officials have warned that the country is in the middle of a second wave of the pandemic.

- The capital city Madrid is worst affected, and the regional government has told 850,000 people or 13% of the city's population told not to leave their local areas unless for essential reasons, namely for work, education or similar reasons.

- In addition, Health Minister Salvador Illa says all people in the city should "restrict to the maximum" their movement to stop further infection.

- Isabel Díaz Ayuso, the President of the Community of Madrid, argues the region has been worst affected because of "its population density, its style of life and its role as a transport and business hub."

- Troops could be deployed to Madrid to help enforce a strict new

lockdown after thousands of residents took to the streets in

protest. Prime Minister Pedro Sánchez has already put around 1,000

military officials at the disposal of the regions to help with

their struggling efforts to track and trace the virus.

- Groupe PSA will hire 40 more staff at its Vigo (Spain) site to support the assembly of battery packs. According to Metropolitano, the workers will be employed at the Vigo Center Battery Workshop on a new shift that is intended to lift output to 300 units per day. The new workers will result in 160 staff working. Assembly of battery packs at this site began in January, and despite a stoppage as a result of the coronavirus disease 2019 (COVID-19) virus pandemic, output has progressively increased. This reflects the demand for the battery electric vehicles (BEVs) in its line-up. The site supplies packs for the recently introduced Peugeot e-2008, Opel Corsa-e and Citroën e-C4, which are all built in Spain, and will also supply the battery electric versions of the Citroën Berlingo, Opel Combo and Peugeot Rifter/Partner. The latest intake should bring the site closer to its total capacity of 80,000 units per annum (upa). (IHS Markit AutoIntelligence's Ian Fletcher)

- Germany's Federal Statistics Office (FSO) reports that growth

of real monthly earnings in the whole economy in the first quarter

(including employees in the public sector, including bonus

payments, and assuming for analytical purposes that the employment

structure of the previous year has remained constant) plunged from

0.4% y/y in the first quarter to -4.7% y/y in the second quarter of

2020. This decline is almost twice as large as the previous record

of -2.7% measured in the third quarter of 1997 and it compares with

a historic (1992-2019) average of 0.5%. (IHS Markit Economist Timo

Klein)

- Nominal wage growth posted -4.0% y/y after 2.1% y/y in the previous quarter. Deterioration is therefore even more pronounced in nominal terms, reflecting the partially offsetting influence (for real wages) of a softening of consumer price inflation from 1.6% to 0.8%. The nominal drop of -4.0% compares to a previous record low of -0.7% (second-quarter 2009), a long-term average of 2.2%, and a series high of 4.0% (second-quarter 2011; this ignores 1992-93 data that are statistically distorted by unification-related structural adjustments).

- The breakdown for different types of employment shows that nominal wage growth (total: -4.0% y/y) was depressed the most for the holders of so-called mini jobs (-4.8%, down from -0.7% in the first quarter). This reflects that activities in the recreation and entertainment business, or in the catering sector, where a significant part of the workforce consists of such people, was hit particularly hard by administrative restrictions. Earnings of full-time employees declined by 4.3% (following an annual increase of 1.8% in the first quarter), whereas those of part-time employees fared best in relative terms (-2.1%, down from a rise of 3.4% in the first quarter).

- The breakdown by skill level (which excludes the mini-job segment) shows that the largest annual declines were registered for semi-skilled workers (-8.9% y/y), followed by unskilled workers (-7.4%) and employees with average skills (-4.8%). Skilled employees with special qualifications (-2.4% y/y) and leading employees (-2.0%) fared best, signaling a sharp rise in income inequality.

- A separate data set for earnings of full- and part-time employees (including bonus payments) that is not adjusted for structural shifts in employment - based on euro amounts instead of indices - shows a similar plunge in nominal monthly gross earnings from 2.2% y/y in the first quarter to -3.4% y/y in the second. The split between full-time employees (-3.7%) and part-time employees (-0.4%) shows a large divergence this time, reflecting the much greater need to put full-time employees on short-time work programs.

- The equivalent concept in hourly rather than monthly terms (for full- and part-time employees combined) actually shows a marginal increase from 2.8% to 2.9% y/y, proving that - at least in the short run - only the sharp drop in hours worked caused earnings to decline, not softer wage agreements. It is important to keep in mind that short-time work subsidies are not included in the earnings aggregate, and employees who were furloughed, i.e. effectively put on 0% short-time, were ignored in this statistic altogether.

- BASF says it will reduce the number of employees in its global business services unit, which it established at the start of this year, by up to 2,000, almost 24% of the unit's total, by the end of 2022. The decision follows the bundling of services and resources and the implementation of a wide-ranging digitalization strategy, BASF says. From 2023, the unit expects to achieve annualized cost savings of more than €200 million ($235 million) from the move, the company says. Details of the planned worldwide workforce reduction will be worked out in the coming months with employee representatives involved, according to local rules and regulations, it says. "Overall, with these planned measures, we will make a considerable contribution to BASF group's efficiency," says Marc Ehrhardt, head/global business services at BASF. As part of the restructuring, more services than before will be bundled in hubs, which will offer as many services as possible for the units in the BASF group, the company says. BASF's global business services unit was established on 1 January 2020 as part of the implementation of BASF's corporate strategy. As of that date, about 8,400 employees worldwide transferred to the new unit and since then have been providing services for BASF's other business units, ranging from financial and logistical processes to services in the areas of communication, human resources, environment, health and safety, the company says.

- As expected, the Riksbank announced that it will continue with

the support measures announced earlier in the year, while keeping

the repo rate and path at zero. It notes that extensive fiscal and

monetary policy support will be needed for an extended time. (IHS

Markit Economist Daniel Kral)

- The Swedish central bank (Riksbank) kept the policy rate (repo rate) unchanged; the last move was a rise of 25 basis points, to 0%, in December 2019. The emergency liquidity operations and large-scale asset purchases from earlier in the year are to continue as planned.

- The Riksbank assesses that the Swedish economy "seems to have left the acute crisis situation of the spring and started to recover slightly faster than expected" although it also notes that "the situation on the labor market is worrying" due to a sharp drop in employment.

- The Executive Board assesses that "the combination of measures taken by the Riksbank during the spring and summer is the most effective way" of preventing a tightening in financial conditions. These measures include, among others, a lower interest rate on its standing facility and large scale asset purchases of not just government bonds.

- As in its previous communications, the Riksbank stresses that it is prepared to use all tools at its disposal, including a repo rate cut back to negative territory "if this is assessed to be an effective measure, particularly if confidence in the inflation target were to be threatened."

- Next year, Russians may face a limited of ice cream range or higher prices, due to the introduction of mandatory labelling, drafted by the agriculture ministry, on products weighing less than 100 grams. Market players sent a request to the ministry to exclude ice cream weighing up to 100g from the labelling system for economic and technological reasons, the Izvestia newspaper reports. It cites a letter from Unilever chief executive Regina Kuzmina, supported by the Chistaya Liniya company, as well as the Union of Ice Cream Manufacturers, whose members include, in particular, the Iceberry and Aiskeik-ECO companies. According to the draft government decree prepared by the Ministry of Industry and Trade, ice cream will be included in the labelling scheme from January 20, 2021. Already in operation for several other agricultural products, such as dairy, labelling should minimize the proportion of illegal and counterfeit products on the market, with a special barcode allowing to track the product's full manufacturing cycle. Gennady Yashin, deputy chairman of the board of the Ice Cream Union, said the introduction of labelling would lead to 2.5-6% increases in production costs, while the final cost of ice cream may increase by 25-30%. The total costs for companies involved in ice cream production in the first year would reach RUB9.0 billion (USD 101 million). Kuzmina indicated that most of the ice cream produced in Russia (around 80%) weighs less than 100g, and profit margins are extremely low: 90% of the market comprises products that cost no more than RUB70, while the level of counterfeiting in the industry is negligible, the letter says. Unilever's estimated cost of introducing ice cream to the labelling system could reach RUB1.2 bln, and a further RUB300,000 yearly, slowing down the company's production. (IHS Markit Food and Agricultural Commodities' Jana Sutenko)

- ODE, part of the DORIS Group, has been awarded a contract by Baltic Power to undertake the initial technical design and building permit design for the Baltic Power offshore wind farm. Baltic Power holds a license to construct wind farms in the Baltic Sea with an aggregate capacity of up to 1.2 GW. The license area is located approximately 23 km north of the Polish coastline. ODE will be supporting Baltic Power across multiple technical areas, including technical designs of the offshore site, turbines layout, energy production calculations, budget and schedule of the project and supporting analysis. The offshore site includes wind turbine generators (WTG), WTG foundations, inter-array cables and the offshore substation platform, among other infrastructure. This contract will be executed from ODE's London (Wimbledon) headquarters with local technical support in both Warsaw and Gdansk. Design work is due to start immediately, with construction targeted to start in 2024. (IHS Markit Upstream Costs and Technology's Jie Sheng Aw)

- Saudi Industrial Investment Group (SIIG; Riyadh) and National Petrochemical Co. (Petrochem; Jubail, Saudi Arabia) say they have started talks over a potential merger of the two companies. SIIG and Petrochem have issued statements saying their boards have approved initial discussions between the companies to study the "economic feasibility" of a possible merger. No agreement has been reached on the final structure of any merged business, they note. SIIG currently owns 50% of Petrochem. The two companies are listed on the Saudi stock exchange. Entering into the talks "does not necessarily mean that the deal will take place between the two parties," they state separately. If a deal is agreed on, it will be subject to the conditions and approvals of the competent authorities, and the approval of the extraordinary general assembly of each company, they say. Any developments in the talks will be announced later, they say. The two companies previously held merger discussions in 2011, with those talks eventually postponed to allow Petrochem's petchems facility at Jubail to reach production capacity and provide better valuations of the companies, SIIG said at the time. SIIG was established in 1996 and Petrochem was formed in 2008. SIIG had total assets of 19.2 billion Saudi riyals ($5.1 billion) at the end of June, and Petrochem had SR16.4 billion in total assets. Petrochem owns 65% of Saudi Polymer Co. at Jubail, which produces more than 1.7 million metric tons/year (MMt/y) of polymers, it says. The complex at Jubail is designed to produce 1.22 MMt/y of ethylene, 440,000 metric tons/year of propylene, a combined 1.1 MMt/y of high-density polyethylene (HDPE) and low-density polyethylene (LDPE), 400,000 metric tons/year of polypropylene (PP), and 100,000 metric tons/year of hexene-1. The units are fed by a steam cracker using ethane and propane as feedstock.

- Cameroon plans to build a USD3-billion hydropower plant, which

is expected to start generating power by 2028. The Grand Eweng

hydropower plant is expected to gradually increase capacity from an

initial 810 megawatts (MW) to more than 1,000 MW by 2035, making

Cameroon an electricity exporter. (IHS Markit Economist Archbold

Macheka)

- The country plans to export power to its regional counterparts such as the Central African Republic, Chad, and Nigeria.

- The hydro dam will be constructed on the Sanaga River. The project is a partnership venture between the Cameroonian government and Hydromine, a US-based energy company. It was initially earmarked to provide electricity to the aluminum sector, but rising nationwide demand has meant the plant will also supply electricity to the general public.

- The project is expected to be financed through a combination of equity, ranging between 20% and 25%, and about 80% debt. National utility provider Energy of Cameroon (ENEO) will be the sole offtaker of the power, with the bulk likely to be sold to the aluminum sector, which has been restricted by a power deficit for some time.

- Opposition to the project stems from concerns around environmental damage and the potential hazard to Cameroon's fauna and flora. The Grand Eweng hydropower plant will be the fifth project on the Sanaga River, with the fourth being the 420-MW Nachtigal hydropower plant currently under construction. Nachtigal is expected to begin operations in 2023. Strong support for the project include the need to eliminate the country's polluting thermal power projects.

- Cameroon currently boasts 1,300 MW of installed power capacity, with most of the output coming from hydropower plants. With demand for electricity rising, the Ministry of Water Resources and Energy forecasts that demand will to grow to 3,000 MW by 2035, the government has done well to prioritize new large-scale hydropower plants such as Grand Eweng and Nachtigal. Nonetheless, hydropower generation remains susceptible to adverse weather conditions that could undermine electricity production and supply. Other downstream effects include affecting manufacturing, commercial agriculture, services, and mining activities.

Asia-Pacific

- APAC equity markets closed lower across the region for the second consecutive day; South Korea -2.4%, Mainland China -1.3%, Hong Kong -1.0%, India -0.8%, and Australia -0.7%.

- The headline au Jibun Bank flash Composite PMI, compiled by IHS

Markit and based on 85-90% of responses received from the monthly

surveys, edged up from 45.2 in August to 45.5 in September. The

index signaled a further marked decline in private sector output

across both manufacturing and services but with the rate of decline

easing slightly. (IHS Markit Economist Bernard Aw)

- While the latest survey data pointed to a slow pace of recovery from the COVID-19 downturn, particularly in light of stronger recoveries observed in other advanced economies, the picture for Japan's economy was much improved in the third quarter when compared to the height of the pandemic during the second quarter.

- At 45.2, the average PMI for the three months ending September was the highest so far this year, and noticeably higher than the 31.5 recorded in the second quarter.

- The survey also revealed some positive signs:

- Overall employment moved closer to stabilization in September, with only a marginal drop in workforce numbers that was the weakest fall seen in the current sequence of job shedding.

- Business sentiment improved to the strongest since the start of the year, rising especially among manufacturing firms.

- The level of optimism in the manufacturing sector rose to the highest for just over two years.

- The resumption of business activity in Japan remains gradual, as uncertainty over the course of the pandemic trajectory continues to weigh on investment and poses as a key risk for Japan's economic recovery. Meanwhile, weakened labor market prospects and wage declines (due partially to reduced working hours), alongside social distancing practices, will constrain consumer spending in the months ahead.

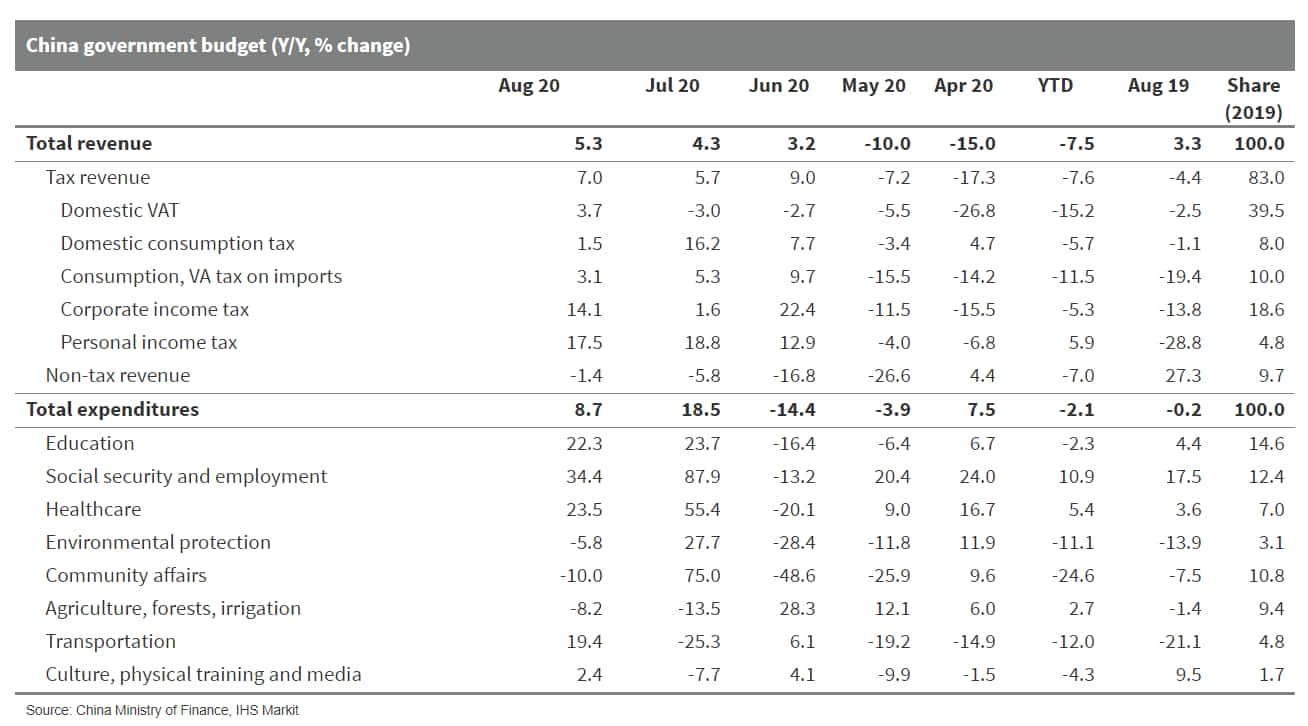

- China's public fiscal revenue increased 5.3% year on year (y/y)

in August, the third consecutive month of expansion, according to

release by the Ministry of Finance (MOF) on 18 September. Tax

revenue increased by 7% y/y with broad based expansion across tax

items. Domestic value-added tax increased for the first time since

the beginning of the year, reflecting continuous recovery in

industrial production. Corporate income tax accelerated to 14.1%

y/y, driven by the acceleration in industrial profit growth.

Individual income tax kept double-digits growth. Non-tax income

contracted at a slower pace and the third consecutive month of

recovery. (IHS Markit Economist Yating Xu)

- Public fiscal spending growth slowed from 18.5% in July to 8.7% year on year in August with deceleration in both central and local government spending. Particularly, people's livelihood spending such as social security and healthcare slowed following rebound in July, and spending on environmental protection, community affairs and agriculture fell. Positive aspect is that spending on transportation improved to double-digit expansion as the negative from flood gradually fades.

- By the end of August, CNY735.8 billion of direct support funds for local government amid the CNY1.7 trillion quota has been allocated and used, with city and county level governments accounting for 96.8% of the spending.

- The year-to-date fiscal revenue stayed in 7.5% year on year

contraction with continuous decline across all sub-tax items except

individual income tax and stamp tax, as well as vehicle tax

improving from contraction to expansion. Fiscal spending declined

by 2.1% year on year through August with decline in all

sub-spending items except increase in people's livelihood related

spending and debt payment.

- Mainland China's State Council approved three new pilot

free-trade zones (FTZ) in inland regions including Beijing, Hunan,

and Anhui, as well as the FTZ expansion plan in eastern coastal

Zhejiang Province on 21 September. (IHS Markit Economist Lei Yi)

- Each of the newly approved FTZ will have its own policy focus tailoring to its comparative advantage. Specifically, the Beijing FTZ will focus on scientific innovation, services trade, and high-end industries, while supporting the coordinated development in the Beijing-Tianjin-Hebei region. Cross-border finance will be facilitated with further financial sector opening-up, and fintech innovations will be promoted including setting up an experimental zone for the fiat digital currency.

- Located in the midstream Yangtze River and on the north of Guangdong Province, the Hunan FTZ will better leverage its strength in equipment manufacturing to boost investment along the Yangtze River Economic Belt and the Greater Bay Area. Additionally, the Hunan FTZ also aims to promote international economic cooperation especially with African countries.

- The Anhui FTZ, part of the Yangtze River Delta, plans to further develop local "strategic emerging" sector. This covers high-end manufacturing, integrated circuit, artificial intelligence, and cross-border e-commerce. While the expanded area of Zhejiang FTZ will build the zone into a global shipping hub as well as an allocation base for oil and gas resources.

- Chinese electric vehicle (EV) startup WM Motor has raised CNY10 billion (USD1.47 billion) in its latest funding round, reports Reuters. Investors in WM's latest funding round include the Shanghai state-owned asset regulator's investment firms, as well as SAIC Motor. WM did not disclose its valuation after the funding. WM currently has two electric sport utility vehicles (SUVs) on the market. The EX5 and EX6 are both targeted at mass-market EV buyers. The startup is expected to unveil a mid-size electric SUV later this month, followed by an electric sedan slated for market launch in 2021. The funds raised in the funding round will help WM further develop intelligent vehicle technologies and expand its sales channels. Bloomberg reported earlier that the WM Motor is planning an initial public offering (IPO) on the Shanghai Stock Exchange Sci-Tech Innovation Board, also known as the STAR Market. WM's rivals, including Xpeng, Li Auto, and NIO, have successfully launched IPOs in the United States. (IHS Markit AutoIntelligence's Abby Chun Tu)

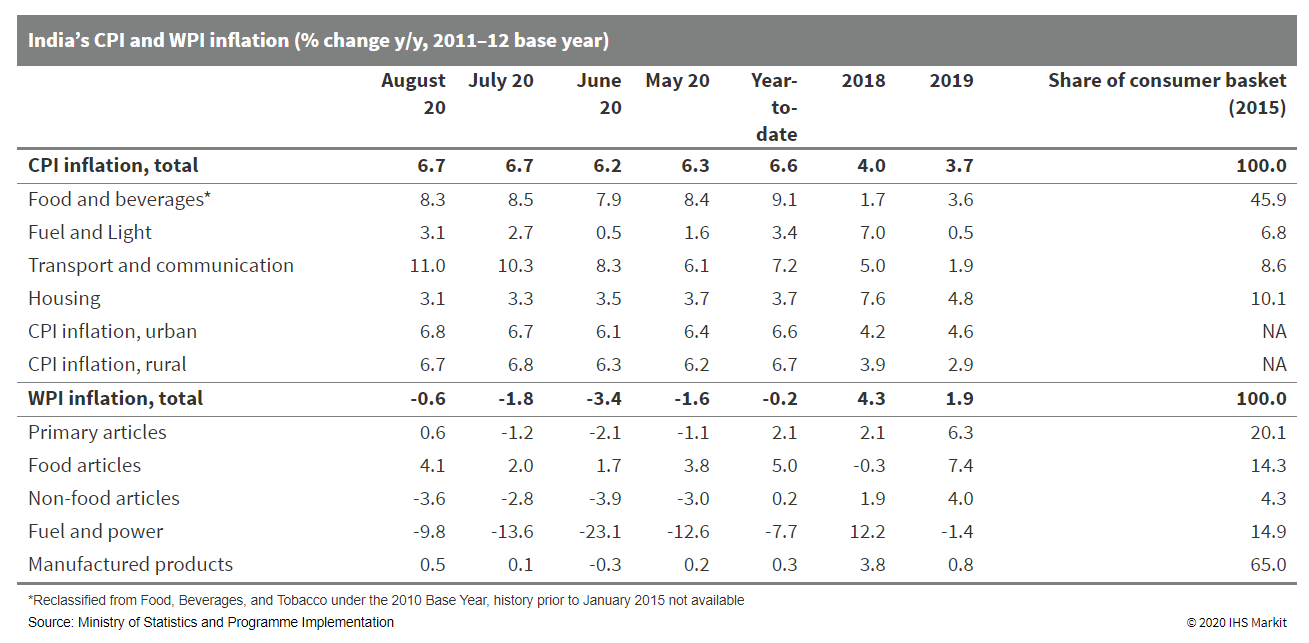

- India's headline Consumer Price Index (CPI) inflation came in

at 6.69% y/y in August, which was marginally lower than July's

6.73% y/y but was still above the upper band of the central bank's

6% inflation target range. (IHS Markit Economist Hanna

Luchnikava-Schorsch)

- The food component of the CPI (excluding beverages) stood at 9.1% y/y as a result of recent floods in eastern India and coronavirus disease 2019 (COVID-19) virus pandemic-related supply and transportation issues. A good summer crop after a favorable monsoon season may ease some of these pressures, but rising COVID-19 infections in rural areas may yet lead to spikes in food prices.

- Wholesale Price Index (WPI) inflation turned positive in August for the first time since March, edging up to 0.6% y/y from a negative 1.8% y/y in July and thus indicating some recovery in producer pricing power. The latest IHS Markit India Manufacturing PMI survey also reported rising input prices during August due to higher raw material costs stemming from supplier shortages and transportation delays amid the COVID-19 virus pandemic.

- In a separate data release, the double-digit contraction in industrial output continued for a fifth consecutive month in July - although the pace of contraction slowed to 10.4% y/y from June's 15.8% y/y. On a use-based approach, production of consumer non-durables was the only category that recorded growth but it has more than halved since June. Production of capital goods and consumer durables remained in deep contraction, which suggests that any meaningful recovery in discretionary spending and investment could still be months away.

- India's industrial capacity has been slowly recovering

alongside the gradual lifting of restrictions after a strict

national lockdown in March-May. The recovery in July may well

expand into August, with IHS Markit's India manufacturing PMI for

August showing expansion at 52 points, up from 47 in July. However,

the pace of recovery will flatten from the second half of 2020 with

domestic demand remaining weak and India facing another rise in

COVID-19 infections, together with a wave of new localized

lockdowns in several areas.

- Tata Motors rolled out a limited-period subscription offer for the Nexon electric sport utility vehicle (SUV), according to company statement. The Nexon is available for an all-inclusive fixed rental price starting at INR34,900 (USD474.4) per month. Available for the first 100 subscribers, the offer is valid until 30 November. Tata Motors has partnered with Orix Auto to offer the subscription package in Delhi-NCR, Mumbai, Pune, Hyderabad, and Bengaluru. Launched in January, the Nexon electric vehicle (EV) features Tata's new ZIPTRON EV technology and is powered by a 30.2-kWh lithium-ion battery that generates 129 PS of power and 245 Nm of torque. Earlier this month, Tata won a tender floated by Energy Efficiency Services Ltd (EESL), a joint venture (JV) between public-sector undertakings under the Indian Ministry of Power, to supply 150 Nexon EVs to the Indian government. The automaker also recently passed the 1,000-unit production milestone for the Nexon EV. (IHS Markit AutoIntelligence's Isha Sharma)

- Tesla has reportedly initiated talks with the Karnataka state government to establish a research and development (R&D) center in Bengaluru, reports the Economic Times. A follow-up meeting is scheduled to take place by the end of this month, during which the state officials could discuss a detailed proposal for the research center. "Tesla has shown initial interest to invest in a research and innovation center in Karnataka and the talks are at a preliminary stage," said an unnamed source with knowledge of the matter. India has emerged as an ideal investment destination for R&D thanks to factors such as policy support from the government, cost efficiency, technical competency and a highly scalable and low-cost workforce. Karnataka state seeks to become the electric vehicle (EV) capital of the country and was the first state to roll out an EV policy, called the Electric Vehicle and Energy Storage Policy 2017, hoping to attract investment worth INR310 billion (USD4.2 billion) in R&D and manufacturing of EVs. The state government has been exploring plans to set up EV clusters in nearly 600 acres of land around Bengaluru. In 2018, Mahindra Electric opened a new electric technology manufacturing hub in Bengaluru (see India: 16 November 2018: Mahindra Electric opens new electric technology manufacturing hub in Karnataka). If finalized, India will become the second country outside the United States where Tesla will have a research center. (IHS Markit AutoIntelligence's Isha Sharma)

- The IHS Markit Flash Australia Composite PMI, covering both the

manufacturing and service sectors, rose just one point from 49.4 in

August to 50.5 in September. That said, by registering above the

no-change 50.0 level, the latest reading indicated a marginal

increase in private sector output, bringing welcome signs of

stabilization after a brief slide back into contraction in August.

Furthermore, the average PMI reading for the third quarter (52.5)

not only showed a marked improvement from the severe downturn seen

in the second quarter (34.2), but also represented the first

quarterly growth for a year. (IHS Markit Economist Bernard Aw)

- The overall upturn in the Australian private sector economy was driven by a sustained recovery in the manufacturing sector during September. Production and sales both rose solidly, with the latter increasing at the sharpest pace since January 2019, supported by renewed growth in export orders.

- With the widening performance gap in business activity and sales between manufacturing and services, their employment trends also diverged in September. Cuts to workforce numbers were limited to the service sector, while manufacturers added more workers. Factory employment rose for the first time in ten months, increasing at the fastest rate since early 2019 amid a growing lack of operating capacity.

- Australian private sector firms faced a further increase in input costs during September, with manufacturing reporting a noticeably sharper rate of input price inflation due to greater costs of raw materials and increased freight fees. Goods producers were able to pass some of the rise in costs on to their customers. On the other hand, services providers not only had to absorb higher expenses amid subdued demand, but anecdotal evidence suggested that some firms even provided discounts to boost sales.

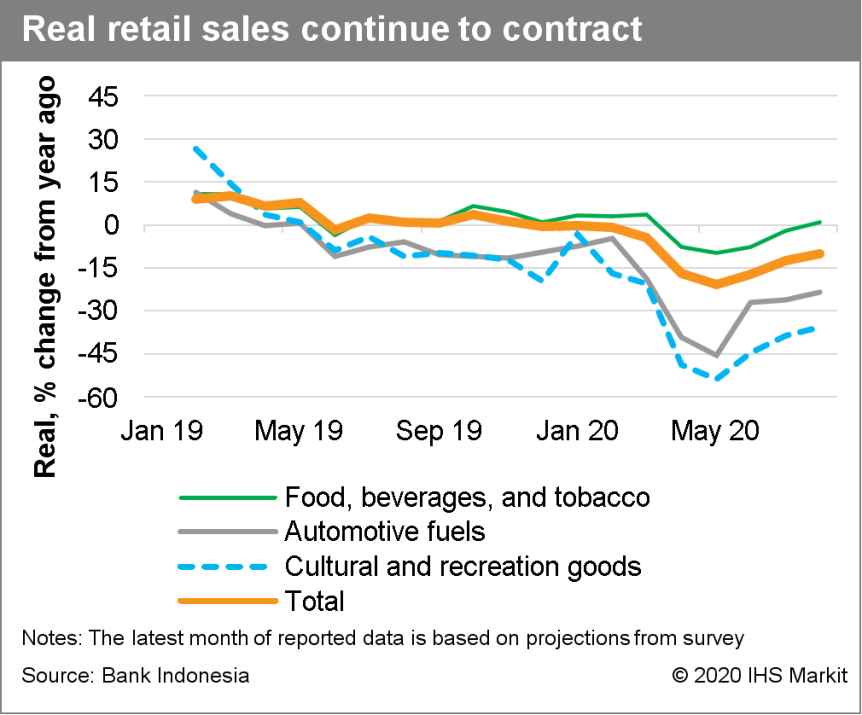

- Bank Indonesia (BI)'s Board of Governors has left the seven-day

reverse repo rate on hold at 4.00% following its September meetings

in the interest of maintaining rupiah stability, indicating that it

will continue to focus its efforts on boosting economic growth

through existing liquidity-boosting measures. With elevated fiscal

deficits and debates around the central bank's future in

parliament, BI is unlikely to ease monetary policy further in 2020.

(IHS Markit Economist Bree Neff)

- While the Board of Governors assessed that it was prudent to leave the policy rate on hold, it indicated that the central bank would continue to focus on its efforts to ensure adequate liquidity to the economy. These include the various means through which it is providing liquidity to the government, with the central bank indicating that it has purchased IDR143.5-trillion (USD98.1 million) worth of debt through 15 September as part of the debt burden sharing arrangement agreed to with the government in July.

- As for liquidity to other parts of the economy, the central bank announced a six-month extension of the 50 basis-point cut to the reserve requirement ratio to June 2021 for lending by banks to micro, small, and medium-sized enterprises (MSMEs), non-MSMEs in priority sectors, and export-oriented firms.

- The central bank highlighted in its statements that the near-term economic outlook is highly dependent on the public getting out and about again, the speed of government (local and central) budget spending, and progress in loan restructuring and guarantee programs. However, it refrained from providing current GDP growth estimates.

- Considering private consumption accounts for 55-58% of GDP

annually, BI is hoping that improvements in consumer sentiment and

government social aid disbursements over the past month will

translate into improved spending. Considering the sustained

weakness in real retail sales (still down an estimated 10% year on

year [y/y] in August) and consumer price inflation (fresh low of

1.3% y/y in August), private consumption is still struggling to

gain momentum.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-22-september-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-22-september-2020.html&text=Daily+Global+Market+Summary+-+22+September+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-22-september-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 22 September 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-22-september-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+22+September+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-22-september-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}