Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 20, 2020

Daily Global Market Summary - 20 May 2020

Most equity markets closed higher across the globe, as a large portion of the world, including all 50 US states, have reopened to varying degrees. European and US credit indices, oil, and most benchmark government bonds were also higher on the day.

Americas

- US equity markets closed higher on the day; Russell 2000 +3.0%, Nasdaq +2.1%, S&P 500 +1.7%, and DJIA +1.5%.

- 10yr US govt bonds closed -2bps/0.68% yield.

- US credit indices closed higher across the credit spectrum, with CDX-NAIG closed -4bps/86bps and CDX-NAHY -35bps/612bps.

- The minutes from the meeting of the Federal Open Market Committee (FOMC) held on 28 and 29 April were released this afternoon. (IHS Markit Economists Ken Matheny and Chris Varvares)

- At that meeting, interest rates were held at the effective lower bound (ELB) near zero, with only qualitative guidance about how long the target for the federal funds rate would be kept near zero and regarding the pace of asset purchases, which had been reduced in preceding weeks as conditions in securities markets had improved.

- The minutes revealed that policymakers are continuing to assess the impacts of policy steps and are prepared to adjust those plans, including elements of its various emergency lending programs, in response to evolving financial conditions.

- The minutes are broadly consistent with our expectations for Fed policies, including our expectation that the target for the federal funds rate will be kept near zero for several years.

- Rising floodwaters have forced Dow to completely shut down operations at its Midland, Michigan, headquarters facility. Other companies with production at the site include Cabot, Corteva Agriscience, and Trinseo."Dow has activated its local emergency operations center and is implementing its flood preparedness plan, which includes the safe shutdown of operating units on site," says a company spokesman. "Only essential Dow staff needed to monitor the situation and manage any issues as a result of the flooding remain on site." The Tittabawassee River, which runs through Midland, surpassed major flood stage Tuesday morning following heavy rains, according to the National Weather Service (NWS). One dam upstream of Midland breached Tuesday evening, and another is at risk. The NWS expects the flooding to rise another 10 feet by the end of Wednesday, and 10,000 area residents have been evacuated amid warnings of flash floods.

- Dow produces a wide range of products at Midland, including polyvinylidene chloride copolymer resins (SARAN), ion-exchange resins, cellulose derivatives, silicones, methyl chloride, and monochloroacetic acid, according to the IHS Markit Directory of Chemical Producers.

- Cabot produces fumed silica at Midland.

- Corteva produces chlorpyrifos, diclosulam, 2,4-dichlorophenoxy acetates (2,4-D), and several other agrichemicals. Trinseo produces acrylonitrile-butadiene-styrene (ABS) and styrene-butadiene latex.

- As per IHS Markit's Commodities at Sea, during week-20, coal shipments from Baltimore continue to remain weak for the third consecutive week. (IHS Markit Maritime and Trade's Rahul Kapoor and Pranay Shukla)

- Shipments from Hampton Roads (where majority of cargoes are coking coal) in the last three weeks were mostly stable at 650kt (2.5mt on 30-day basis).

- Overall coal & petcoke shipments from USEC, USG and USWC during the reported week are calculated at 3.4mt, 1.9mt and 126kt, resp (on 30-day basis).

- Last year from Baltimore out of total coal exports more than a third were shipped to Indian cement factories. However, on back of lockdown in India which has significantly reduced demand for fuel in the cement factories there has been no coal shipments from Baltimore in the month of May 2020 till date to India.

- There were multiple vessels loaded with NAPP coal anchored outside Indian West coast and East coast waiting to find buyer; however, on back of high coal inventories at the factories demand is not expected to pick up significantly in near future. Anticipating it two of the vessels earlier planned to discharge in India have been moved to Singapore. One of the vessel could find a buyer in Korea and is now sailing towards Gwangyang port.

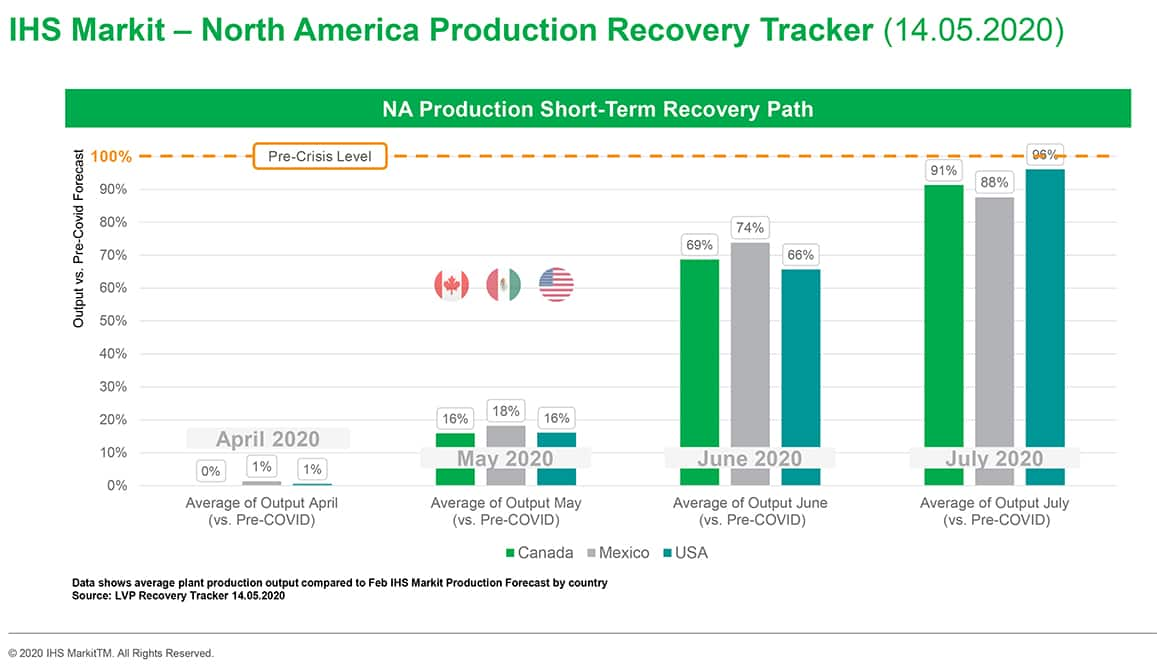

- In North America, automakers largely were able to execute production resumptions by 18 May at US and Canadian plants; Mexico's restart is more fluid. Along with efforts to contain the pandemic and slow the spread of the COVID-19 virus having suspended production for about two months, supply-chain issues and weak sales demand may affect the pace of production as it resumes. Automakers and suppliers have determined the measures needed to safely return to production, successfully executing them in markets including China, South Korea, and Europe and adapting these for operations in the Americas. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Volvo Cars is suspending production at its assembly plant in South Carolina (United States) on 20 May over inadequate parts supply, with no restart date scheduled, reports Automotive News. It is unclear which parts Volvo has run out of. Volvo's US production had restarted on 11 May, after being suspended on 19 March. IHS Markit estimates that the company lost about 5,100 units of production during the initial shutdown period. Volvo produces the S60 sedan at its sole US plant, both for sale in the US and for export. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Canada's consumer prices declined 0.7% month on month (m/m) on a seasonally adjusted basis (sa) and non-seasonally adjusted basis (nsa). The annual inflation rate sharply dropped to -0.1% year on year (y/y) sa and -0.2% y/y nsa, nearly matching IHS Markit expectations. Core inflation readings edged lower as well, ranging from 1.6% y/y to 2.0% y/y. The massive decline in the energy price index more than offset the large uptick in food prices, which contributed the biggest upward pressure on total prices. (IHS Markit Economist Arlene Kish)

- The Brazilian Federation of Banks (FEBRABAN) on 15 May sent a protest note to senators regarding several bills affecting the financial sector, on which they are to vote next week. The bills include an increase in Contribuição Social sobre o Lucro Líquido (CSLL), an income tax on banks, from 20% to 50% of net profits, along with caps on interest rates levied on credit cards and overdraft facilities. The sponsors of the bills claim that banks in Brazil are making robust profits - the three largest banks reported USD15 billion of profits in 2019, while most Brazilians are struggling with recession and job losses because of the COVID-19-virus outbreak. The banks, however, have warned that the bills are self-defeating because they would result in a marked reduction in credit provision. (IHS Markit Country Risk's Carlos Caicedo)

- Ford and Fiat Chrysler Automobiles (FCA) have restarted operations in Argentina and Brazil. In Argentina, Ford resumed production at its General Pacheco complex and FCA restarted production at its Cordoba complex on 20 May, reports NG News Center. The restart of production by the automakers will be carried out gradually and will follow new health and safety protocols. The Ford plant will operate on one shift to produce the Ranger pick-up, while the spare parts and accessory distribution centers are starting operations at full capacity. Ford had previously planned to restart production at the General Pacheco complex in Argentina on 26 May and at the Camacari plant in Brazil on 1 June. (IHS Markit AutoIntelligence's Tarun Thakur)

Europe/Middle East/ Africa

- European equity markets closed higher across the region; Germany +1.3%, Italy/Spain/UK +1.1%, and France +0.9%.

- 10yr European govt bonds closed higher across most of the region; France/UK -2bps, Italy -1bp, and Germany/Spain flat.

- European credit indices closed higher on the day; iTraxx-Europe investment grade index closed -4bps/78bps and iTraxx-Xover high yield-28bps/462bps.

- Brent crude closed +3.2%/$35.75 per barrel, which is the highest close since 11 March.

- Car finance companies, including the financial services arms of the major OEMs, operating in Germany will have to report capital metrics and liquidity on a more regular basis as a result of new legislation introduced by the German financial services regulatory authority, Bafin. According to a Bloomberg report, the regulatory authority is preparing the new guidelines to ensure book values and capital reserve are more accurately reported as a result of the current instability in the country's passenger car market as a result of measures taken in response to the COVID-19 virus outbreak by both government and companies. Given the increasing importance that the OEM's financial arms have in terms of overall performance, these new measures will presumably have a negative impact on these lenders. (IHS Markit AutoIntelligence's Tim Urquhart)

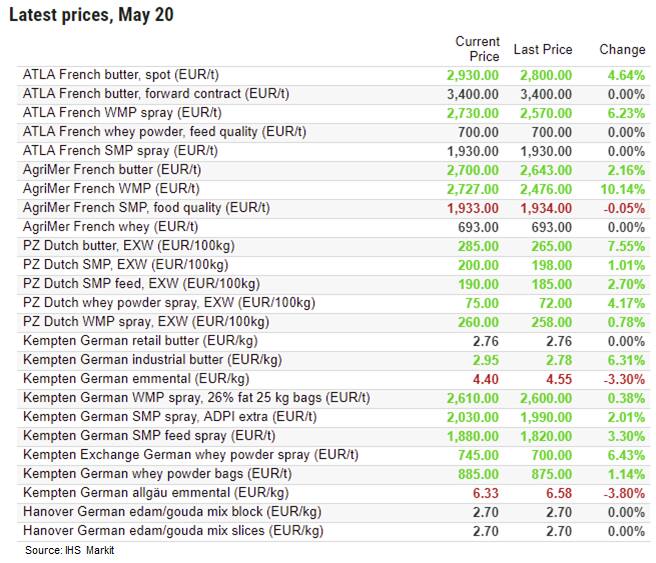

- The post-coronavirus bounce in European dairy prices has continued over the past week, despite puzzlement from some traders as to what is fueling positive sentiment. Prices are up almost across the board on major western European markets, with SMP leading the way. "There is definitely a more positive wind blowing through dairyland," commented Robert Schorsij of Dutch trade Greenmark Dairy, although he added: "How sustainable that is remains to be seen." German sources report strong demand for milk powder, with some buyers reported to be seeking to lock in current SMP market prices before they rise higher. The imminent end of the Ramadan festival (on 23 May) may also have fueled SMP purchases. The market may be anticipating the restoration of demand from the out-of-house eating sector as a result of the gradual relaxation of COVID-19 lockdown regulations across Europe, although for now this process is patchy and limited in scope. (IHS Markit Agribusiness' Chris Horseman)

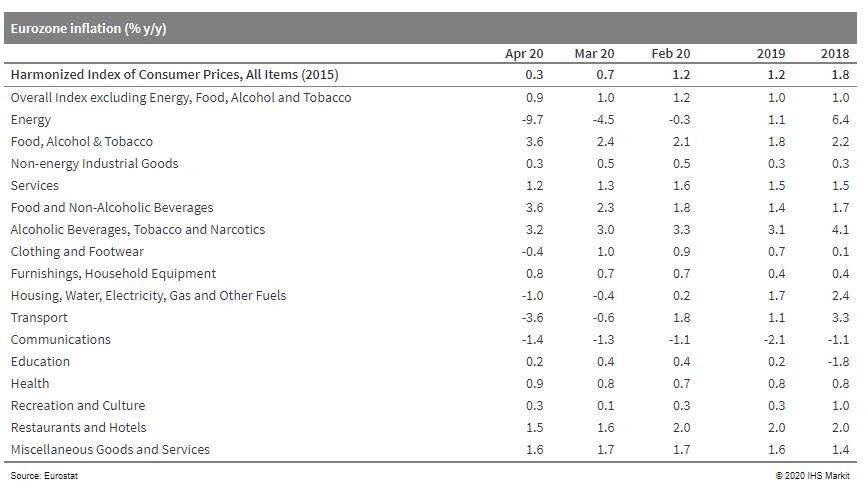

- April's 'flash' harmonized index of consumer prices (HICP) inflation rate of 0.4% in the eurozone was revised down to 0.3% in the final release (see table below), its lowest level since August 2016. Deeply negative energy inflation remains the main cause, partly offset by higher inflation for unprocessed food. Given the expected surge in debt burdens after the COVID-19 virus and the rapid expansion of the central bank's balance sheets, there has been a recent increase in speculation about a return to much higher inflation rates in future. This is understandable in some respects, including incentives to reflate debt burdens away, disinflationary forces from globalization ebbing, and supply-chain disruptions owing to the current COVID-19 virus crisis. (IHS Markit Economist Ken Wattret)

- According to the Office for National Statistics (ONS), UK consumer price inflation halved to 0.8% in April, its lowest level since August 2016. It sits below the Bank of England's (BoE's) inflation target of 2.0%. (IHS Markit Economist Raj Badiani)

- Falling automotive fuel prices were a major drag on the overall inflation rate in April. Specifically, fuel and lubricant prices dropped by 12.2% year on year (y/y), after a 2.4% y/y drop in March (see chart below). The lever was the tumbling crude-oil prices, with Dated Brent being 74.1% lower than a year ago to average USD18.47 per barrel (pb) in April.

- Lower electricity and natural gas prices also contributed to lower inflation in line with the regulator Ofgem lowering its default tariff cap. It came into force on 1 January 2019 as a temporary measure and applies an upper limit to what suppliers can charge customers on either standard variable or default energy tariffs.

- The UK has started building a 186-mile test road for connected and autonomous vehicle (AV) trials in the West Midlands, reports Autocar. The road stretches from Coventry to Birmingham and involves inner-city, suburban and rural roads with infrastructure such as smart CCTV, weather stations, communications units, and GPS. Connected vehicles will be the first to use the route, and autonomous technology will be tested in the future. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The autonomous car industry is expected to see 'great consolidation' in future, according to Amnon Shashua, CEO of Mobileye. He added that companies should look for collaboration instead of competing with one another in developing overlapping technology in the autonomous vehicle (AV) sector. Shashua also said it is not sustainable for companies to focus on developing one component as the technology is an "end-to-end system", which cannot be broken down. Mobileye develops advanced perception systems that enable drivers to detect nearby vehicles, other road users, and unexpected hazards. Mobileye is Intel's Israel-based autonomous vehicle (AV) subsidiary, which was acquired in 2017. Recently, Intel acquired Israel's public transit app Moovit for USD900 million to develop robotaxis, with plans to launch them in early 2022 in countries such as Israel, France, and South Korea. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Statistik Austria data reveal that consumer prices stagnated month on month (m/m) in April, which is just modestly softer than the 0.2% long-term average for this month. Only prices for energy and furnishings & household goods had a significant dampening impact on inflation, whereas several categories, including food, provided an offset to the upside. Headline inflation thus edged down only slightly from 1.6% to 1.5% year on year (y/y), remaining well above the recent three-year low of 1.1% in November 2019. The spread of Austria's harmonized rate (1.5%) with that of the eurozone average (0.3%) has widened anew to a four-year high of 1.2 percentage point, having averaged only 0.3 points between mid-2018 and end-2019. This is also clearly higher than the long-term average of 0.7 percentage point observed during 2011-17. (IHS Markit Economist Timo Klein)

- The Turkish lira has been rallying in recent days, buoyed by rumors of possible swap deals that would provide the country with critically important access for foreign currency. On 19 May, the lira rally gained even further strength, ending that day trading at 6.78 per US dollar, the strongest it had been in over a month (chart below). The additional surge of confidence in the lira came after reports began circulating - emanating from the Habertürk website, without citing any sources - that the country was on the verge of inking deals worth USD20 billion in currency swaps with central banks in Japan and the United Kingdom. Other news sources were unable to corroborate the report. Turkey's own Treasury and Finance Ministry reported through the state-run Anadolu news agency that they were negotiating with four countries regarding swap deals, offering no other information. Turkey missed the opportunity to participate in the US Fed's swap deals due to its low level of US Treasury holdings. (IHS Markit Economist Andrew Birch)

Asia-Pacific

- Most APAC equity markets closed higher except for China -0.5%; India +2.1%, Japan +0.8%, South Korea +0.5%, Australia +0.2%, and Hong Kong +0.1%.

- Japan's private machinery orders, excluding volatiles - a leading indicator for capital expenditure (capex) - fell by 0.4% month on month (m/m) in March following two consecutive months of increases. (IHS Markit Economist Harumi Taguchi)

- The softer-than-expected decline for March was due to a continued rise in orders from non-manufacturing, excluding volatiles (up 5.3% m/m), largely offsetting an 8.2% m/m drop in orders from manufacturing.

- Private machinery orders, excluding volatiles, fell by 0.7% quarter on quarter (q/q) in the first quarter of 2020 for the third straight quarter of decline.

- Although orders from manufacturing rose by 1.8% q/q, orders were 11.0% below the industry's outlook for the first quarter. The decrease in orders from manufacturing was largely due to lower orders from electrical machinery, automobile and accessories, and general-purpose and production machinery.

- The industry expects private machinery orders, excluding volatiles, to drop by 0.9% q/q in the second quarter of 2020, with a 3.6% q/q drop in orders from manufacturing.

- Tesla is on track with its Gigafactory Shanghai expansion plan despite the COVID-19 virus pandemic. The second phase (Phase 2) of the Shanghai Gigafactory is expected to be completed by the end of 2020, according to Grace Tao, Tesla China vice-president of foreign affairs. During an interview with Xinhua News, the Tesla executive said the Gigafactory Shanghai is on track to reach a weekly capacity of 4,000 vehicles as early as June. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Chinese city Beijing is to open a 100-square-kilometre area for testing of autonomous vehicles (AVs) carrying passengers by the end of this month, reports the China Daily. The pilot test zone is in the city's Haidian district and covers over 244 km, involving 52 roads. This test zone has been built to support AV operations during the 2022 Beijing Winter Olympic Games. Beijing was one of the earliest to implement policies for AVs among China's cities and announced these in December 2017. Currently, Beijing has a total of 151 roads allocated for AV operation in four districts, covering a total distance of 503.68 km. In 2019, road tests over a total of more than 1.04 million km were driven by 77 AVs from 13 companies in the city. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- On 18 May, China's Central Committee of the Communist Party and the State Council released its Guideline for Improving Socialist Market Economy in New Era. This Guideline outlined China's economic restructuring reforms in the seven aspects, including SOE reforms, market access, property rights, factors markets, etc. (IHS Markit Economist Yating Xu)

- Seven major reforms are outlined in the Guideline.

- To deepen state-owned enterprise (SOE) reform through capital market.

- To improve technical innovation system and encourage enterprises' scientific research.

- To open up some state-controlled natural monopoly sectors with clear reform measures. Those sectors include power, railway, postal, tobacco as well as oil and gas pipeline network.

- To improve property right system and negative list system. The guideline emphasizes protection for private sectors' property right, clarifies the 30-year postpone of due rural land contract and promotes negative list in service sector.

- To deepen factor market reform in land, labor, capital, technical and data. Interest rate marketization and RMB exchange reforms are emphasized in the guideline.

- To optimize fiscal reform and resolve local governments' debt problem. Central government will take more responsibilities in intellectual property protection, pension funds and cross-region environmental protection.

- To build an opening up economy at a higher and comprehensive level. China will further reduce tariffs and non-tariffs trade barriers, expanding imports of goods and services to improve the balance of trade.

- The emergence of around 40 new coronavirus cases in the northeastern Chinese manufacturing city of Jilin and a suburb, Shulan, has prompted authorities to lock down the area and replace some officials, initiating a limited return to strict controls. (WSJ)

- Vehicle manufacturing in major Indian auto hubs has picked up pace since last week after the Indian government eased the COVID-19 virus lockdown restrictions, first on 4 May and then again on 17 May, although the lockdown has been extended until 31 May. The relaxations have also resulted in reopening of sales and service dealerships across different regions in the country as local restrictions ease. (IHS Markit AutoIntelligence's Isha Sharma)

- The latest to join the list of automakers is Fiat Chrysler Automobiles (FCA), which has opened its Ranjangaon facility in Maharashtra.

- With the Indian government relaxing lockdown restrictions on economic activities in lockdown 4.0 on 17 May and lockdown 3.0 on 4 May, several automakers have been able to restart operations while others such as Renault-Nissan-Mitsubishi Alliance, Volkswagen (VW), Honda, Toyota, and General Motors are to follow suit soon. Despite receiving official approval, the automakers are currently restarting only gradually and at lower capacity, as the entire enabling ecosystem of suppliers, vendors, dealers, and customers comes up to speed.

- IHS Markit's latest production forecast expects India's light-vehicle production volumes to drop by 27.7% y/y during 2020 to around 2.98 million units. We currently expect a rebound of 22% in production in 2021 as the impact of COVID-19 weakens.

- Petronas Chemicals (Kuala Lumpur), Malaysia's leading petrochemicals player, today reported profit after tax was down 39.4% to 493 million Malaysian ringgits ($113.2 million), while operating profit slipped 36.4% to RM606 million. Lower product spreads and margin compression led to a decline in EBITDA margin to 20%. EBITDA stood at RM764 million, 39% down on the first quarter in 2019. Revenue was down 6% to RM3.89 billion. Despite the unprecedented environment, Petronas Chemicals recorded high plant utilization rates and sales volume. Plant utilization rates averaged 94% and were comparable with the year-earlier quarter.

- New Zealand's Labour government unveiled the 2020 budget on Thursday 14 May, which established a NZD50-billion (USD30 billion) COVID-19 Response and Recovery Fund to counter the pandemic's economic impact - the largest single budget in modern history -with debt expected to rise accordingly over the next four years. Based on the outlined budget plans, New Zealand officials expect the Operating Balance before gains and losses (OBEGAL) fiscal deficit for the current fiscal year (year-end 30 June 2020) to rise to 9.6% of GDP, or NZD28.3 billion, up tremendously from the shortfall of 0.3% of GDP projected in December's mid-year forecast update. Additionally, the deficit is expected to average 9.3% of GDP over the next two years before narrowing more substantially in subsequent years. (IHS Markit Economists Bree Neff and Andrew Vogel)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-20-may-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-20-may-2020.html&text=Daily+Global+Market+Summary+-+20+May+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-20-may-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 20 May 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-20-may-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+20+May+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-20-may-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}