Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 18, 2020

Daily Global Market Summary - 18 September 2020

APAC equity markets closed mixed on the day, while major US and European indices closed lower. iTraxx and CDX indices closed slightly wider, and US and most benchmark European government bonds also closed lower. Brent crude closed lower, while WTI and gold closed higher on the day.

Americas

- US equity markets closed lower for a second consecutive day; S&P 500/Nasdaq -1.1%, DJIA -0.9%, and Russell 2000 -0.4%. The Nasdaq is -0.6% week-over-week.

- 10yr US govt bonds closed +1bp/0.70% yield and 30yr bonds closed +2bps/1.46% yield, which is +3bps and +4bps on the week, respectively.

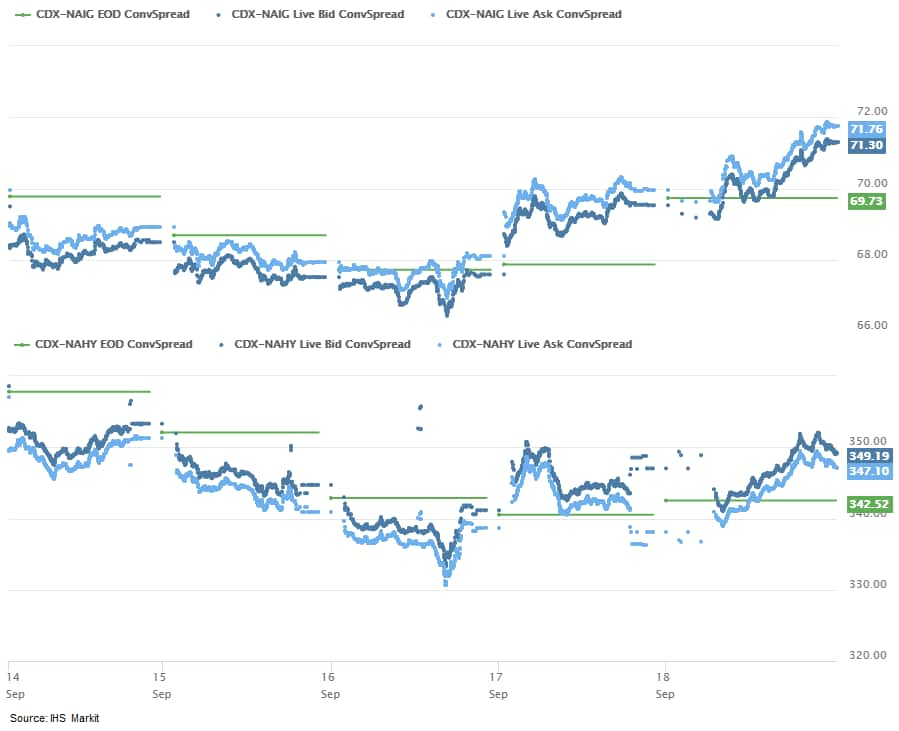

- CDX-NAIG closed +2bps/71bps and +6bps/348bps, which is +1bp and

-10bps week-over-week, respectively.

- DXY US dollar index closed flat/93.00.

- Gold closed +0.6%/$1,962 per ounce.

- Crude oil closed +0.3%/$41.11 per barrel, which is +10% on the week.

- For the past several weeks, as Henry Hub, TTF, and JKM forward curves climbed to levels not seen since late last year, we have warned that bullish speculators were pushing prices to levels that weren't yet supported by fundamentals. The likelihood of a downside correction before end-October appeared high. Yesterday's aggressive correction in HH has the potential to be the tipping point we have been warning of. The week started on a positive note for prices. NYMEX October futures climbed to an intraday high of $2.399/MMBtu on Monday. But the combination of uncertainty regarding the restart of the Cameron LNG export facility (leaves more gas in the US), lackluster temperatures for the remainder of September, and a larger than expected weekly natural gas storage injection, sent HH gas bulls searching for cover. At the end of trading yesterday (17 September), the October futures contract tumbled $0.23/MMBtu to close just above $2/MMBtu. It was the lowest settlement for NYMEX front-month contract since late July. Overnight action pointed to a soft open this morning below $2/MMBtu; today that $2/MMBtu threshold though was sticky. We expect some knock-on effect globally and for TTF and JKM, pressuring prices that had already looked weak the past couple of weeks. We do remind that the potential for a disconnect between HH and TTF/JKM exists as US LNG utilization maxes out - current maximum utilization is lower due to the ongoing outage of Cameron LNG related to damage from Hurricane Laura. This creates risk that TTF and JKM will not be as responsive to HH moves as it has been over the past few months when US LNG utilization was running below 100%. But even if not fully responsive to a downward move in HH, we see more downside than upside relative to current forwards on TTF and JKM through the end of the injection season, as the key benchmarks remain intertwined. (IHS Markit Energy Advisory's Roger Diwan, Breanne Dougherty, Justin Jacobs, and Sean Karst)

- Coronavirus cases in the U.S. increased 0.7% as compared with the same time Thursday to 6.7 million, according to data collected by Johns Hopkins University and Bloomberg News. The increase compares with an average daily increase of 0.6% over the past week. Deaths reached 198,114. (Bloomberg)

- The University of Michigan US Consumer Sentiment Index rose 4.8

points (6.5%) to 78.9 in the preliminary September reading, the

highest since March. The reading is consistent with our expectation

for slowing growth in consumer spending heading into the fourth

quarter. (IHS Markit Economists David Deull and James Bohnaker)

- The Consumer Sentiment Index was 7.1 points above the April trough, but at 22.1 points beneath its February level, it continued to signal a substantially more pessimistic outlook among consumers in the COVID-19 era. Nevertheless, consumer sentiment has not plunged to the depths seen in some prior recessions. In November 2008, the index had bottomed at 55.3.

- The September increase was broad-based. The current conditions index rose 4.6 points to 87.5, while the expectations index increased 4.8 points to 73.3.

- Consumer sentiment rose 4.4 points to 76.2 among households earning less than $75,000 a year and rose 6.4 points to 81.8 among households with earnings above that threshold as equity markets posted strong gains through the end of August.

- The index of buying conditions for large household durable goods increased notably in September, rising 11 points to 117. The index for vehicles fell 2 points to 123 and that for homes fell 1 point to 132. Actual sales in all three categories have shown strength this year as consumers have shifted dollars away from services and toward products conducive to social distancing.

- The expected one-year inflation rate dipped sharply by 0.4 percentage point to 2.7% as many pandemic-induced price fluctuations have normalized. Expected five-year inflation edged down 0.1 percentage point to 2.6%.

- Among respondents asked to identify their main concern about the pandemic, the proportion of consumers citing social isolation has risen to overtake the proportion citing financial concerns.

- Some 3.5 million US home loans—a 7.01% share—were in forbearance as of Sept. 6, according to the Mortgage Bankers Association. Many more borrowers are behind on their payments but not in forbearance programs with their lenders. People behind on their payments aren't being kicked out of their houses yet because of federal and local restrictions on foreclosure enacted during the pandemic. Many with federally guaranteed mortgages have entered forbearance, which allows them to skip payments for up to a year without penalty and make them up later. (WSJ)

- The US current-account deficit widened by $59.2 billion to

$170.5 billion in the second quarter of 2020. As a percentage of

GDP, the current-account deficit grew to 3.5% of GDP—the

largest since the fourth quarter of 2008—up from 1.9% in the

first quarter. (IHS Markit Economist Patrick Newport)

- The goods and services deficit widened by $38.4 billion as exports fell more than imports.

- The surplus on primary income shrank by $22.8 billion to $29.2 billion; the deficit on secondary income (transfers) narrowed by $2.2 billion to $34.9 billion.

- One should not put too much stock in the first-quarter and second-quarter numbers because they were tainted by COVID-19, which shut down vast swaths of the global economy, resulting in plunging US imports and exports of goods and services and steep declines in earnings domestically and abroad.

- The US surplus on primary income is still positive, even though the US net international investment position surpassed $10 trillion this year. The reason: the US rate of return on its foreign holdings greatly exceeds the rest of the world's rate of return on US assets. Economists refer to this as "exorbitant privilege"—the windfall the US enjoys from having the dollar be the currency of choice for international transactions.

- Ford executives have described the negotiations on a new labor contract with the Unifor union in Canada as being "on track" and "going great". Unifor union leaders and Ford executives have provided comments on the progress of the talks, although the details remain under wraps. At a Ford event in Dearborn, United States, to celebrate a new advertising campaign for the F-150 and for its US production base, company executives were asked about the progress of the talks with the Canadian labor union. The contracts expire at midnight on 21 September. According to an Automotive News report, Ford chief operating officer COO Jim Farley said that discussions were "going great… I'm staying very close. I've talked with [Jerry Dias, head of Unifor] and all the political leaders in Canada. It's a very important negotiation for Ford. We're working through it now." The Automotive News report also quotes Ford's head of manufacturing and labor affairs, Gary Johnson, as saying he does not currently expect a strike over a new labor agreement in Canada. He said, "I wouldn't try to handicap it, but it's the last thing we want to do. We're going to do what's fair to the company and fair to employees, but I'm not expecting a strike. But you never know. Maybe things change and it's something you do, but that's not the goal." Johnson characterized negotiations as being "on track". On the Unifor suggestion of returning to a three-year contract term instead of the current four years, Johnson reportedly said that he would see what the Unifor "demand is related to and how it helps them and how it helps us. It was like that for 50 years, so we're used to that. I think there's advantages for both sides. We'll see where it comes out." On the other hand, Automotive News reports comments from Unifor leader Dias that seem somewhat less optimistic. Dias reportedly said the two sides remain "miles apart… We've got a ton of work to do. We are far apart right now on everything; products, economics. Ultimately, I realize we have several days yet to go, but the clock is starting to tick…As we start to get closer to the deadline, we're going to have a much better idea. There's still lots of time right now. Things can move quickly and can shift on a dime." The contract talks began in August and Unifor chose Ford as the first company to negotiate a specific deal with, aiming for Ford's contract to set a pattern for talks with Fiat Chrysler Automobiles and General Motors. The union's membership has approved potential strike action, enabling Unifor negotiators to call for action if they feel it is necessary to force an agreement. (IHS Markit AutoIntelligence's Stephanie Brinley)

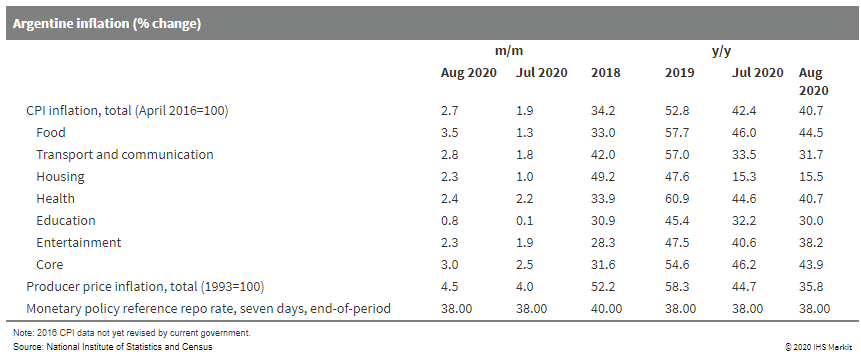

- Argentina's consumer price index increased by 2.7% month on

month during August. The increase in consumer prices was most

pronounced in the food and beverages, leisure and culture, and home

furnishings and maintenance sectors. (IHS Markit Economist Paula

Diosquez-Rice)

- Argentina's inflation rate in August was driven by price increases in the food and beverages category, with significant price rises for beef and deli meats, dairy products, fresh fruit, and canned tomatoes, as well as rises in the recreation and leisure, clothing and apparel, and home furnishings and maintenance sectors. The communications and education sectors reported small increases compared with July.

- Prices of regulated items increased by 1.0% month on month (m/m), while prices of seasonal items rose by 4.0% m/m. The core inflation rate stood at 3.0% m/m. Meanwhile, wholesale prices climbed by 35.8% year on year (y/y) in August. The annual consumer price inflation rate in August was 40.7%, a slight deceleration compared with July.

- Inflation expectations for the next 12 months remained stable in August; Torcuato Di Tella University reported a median of 40% y/y, the same as in the previous two months. The average expected annual inflation rate is 45%. However, the inflation expectation survey by the Central Bank of the Argentine Republic (Banco Central de la República Argentina: BCRA) shows a median of 51.2% in August.

- Although the monthly growth rate of monetary aggregates

decelerated in August, Argentina continues with its expansionary

monetary approach while the monetary policy rate remains in

negative territory in real terms. Monetary aggregates have expanded

by nearly 54% since December 2019, when the President Alberto

Fernández administration took office.

Europe/Middle East/Africa

- European equity markets closed lower across most of the region; Spain -2.2%, France -1.2%, Italy -1.1%, and Germany/UK -0.7%.

- Most 10yr European govt bonds closed slightly lower, except for UK flat; Spain +3bps and Italy/France/Germany +1bp.

- iTraxx-Europe closed +1bp/56bps and iTraxx-Xover +1bp/298bps,

which is flat and -29bps week-over-week, respectively.

- Brent crude closed -0.3%/$43.15 per barrel.

- France's daily coronavirus cases topped 13,000, the highest since the end of lockdown in May. Health officials blame the increase on social gatherings, especially among younger people, and on travelers bringing the virus back from vacation. (Bloomberg)

- The European Banking Authority (EBA) on 17 September published an online survey, targeting larger EU banks, on their current practices and perspectives on the disclosure of environmental, social, and governance (ESG) risks. The survey forms part of the EBA's policy work on disclosure and its efforts to "develop a robust policy framework in the area of sustainable finance". Submissions are requested by 16 October. The survey has 33 main questions with multiple subsets, focusing on the current ESG disclosure practices and plans, together with details of the classifications and metrics employed. In late 2019, the EBA published an Action Plan on Sustainable Finance requesting financial institutions to develop and specify tools providing transparency on how they are addressing climate change-related risks, noting that this should include a "green assets ratio". Under its Action Plan, the EBA specified that its initial phase would be to analyze climate-related risks in banks to "account for their materiality" and "other ongoing initiatives" to increase focus on ESG-related risks. The plan also specified that banks should "consider taking steps" in areas including strategy, risk management, disclosure, and scenario analysis. Subsequently, the European Union plans to have its legal framework "formally updated" and the "EBA regulatory mandates delivered". (IHS Markit Economist Brian Lawson)

- As expected, the Bank of England (BoE) made no changes to the

record-low interest rates and kept in place its wide support for

the economy in its September meeting. Although the economy appears

to be less weak than previously anticipated, the BoE acknowledges

that significant downside risks to the growth outlook could trigger

further monetary policy support. (IHS Markit Economist Raj Badiani)

- The BoE's Monetary Policy Committee (MPC) voted unanimously to maintain the Bank Rate at 0.1% at its meeting ending on 16 September.

- The MPC voted unanimously for the BoE to continue with its existing programs of UK government bond and sterling non-financial investment-grade corporate bond purchases, financed by the issuance of central bank reserves, maintaining the target for the total stock of these purchases at GBP745 billion (USD964 billion) by the latter stages of this year.

- As of 16 September, the total stock of the Asset Purchase Facility (APF) was GBP662 billion, representing a rise of GBP230 billion as part of the programs of asset purchases announced on 19 March and 18 June.

- The BoE argues that the economy is less weak than had been expected in the August report. Nevertheless, the bank still expects the United Kingdom's GDP in the third quarter of 2020 to be around 7% below its fourth-quarter-2019 level.

- The bank expects the economy to contract by 9.5% in 2020 as opposed to the 14% figure published in May. The upward adjustment is because the recovery has occurred "earlier" and has been "more rapid" than it had assumed in May. Key factors are the faster easing of the lockdown restrictions and a return to pre-COVID-19 virus levels for spending on clothing and household furnishings. However, the BoE acknowledges that leisure spending and business investment remain subdued, which will weigh down on the recovery.

- The BoE advocates a relatively brisk recovery, with the economy projected to expand by 9% in 2021 and 3.5% in 2022, implying a return to its pre-COVID-19-virus level by the end of 2021. In addition, it is above market consensus for UK GDP growth, at -10.1% for 2020 and 6.1% for 2021 in August.

- However, the BoE accepts that the outlook for growth is "unusually uncertain", and the projections are "indicative" or "a less informative guide than usual".

- Labor market risks are acute. The BoE reports falling employment since the COVID-19 virus outbreak but acknowledges that job losses have been curtailed "by the extensive take-up of support from temporary government schemes". However, it worries that the end of the Coronavirus Job Retention Scheme (CJRS) in October could push the unemployment rate to around 7.5% by the end of 2020.

- The BoE will continue to adopt a wait-and-see approach over the next few months, monitoring the height of the GDP bounce-back in the third and fourth quarters of 2020. Critically, the MPC will evaluate consumer behavior following the reopening of non-essential shops (from 15 June) and most consumer-facing services (4 July).

- The European Union is set to reject a proposal by the UK that would allow OEMs producing vehicles in the country to use suppliers in other countries while still allowing tariff free vehicle imports into the trade bloc after Brexit. The Financial Times (FT) reports that the plan would hugely ease rules requiring goods to have locally produced content, relaxing a requirement compared to similar trade agreements for preferential access. It added that the proposal would apply to "electrified vehicles", and that Japanese components should count as "British" as both the EU and UK now have trade agreements with the country. It has also suggested that a starting point for non-UK components could be around 70% initially, which would gradually drop in the coming years, reaching 50% in the seventh year after the agreement takes effect. While this is not the only proposal of this type to be outlined in this reported 85-page document, with aspects said to include industrial chemicals and candles, it will be hugely important given the importance of the EU to UK light vehicle production. The specific focus on Japanese components and electrified vehicles would seem to relate specifically to Nissan and Toyota. The former builds the Leaf battery electric vehicle (BEV) locally and will soon add the Qashqai, which will be offered as a plug-in hybrid and a BEV, while Toyota manufactures the Corolla with a hybrid powertrain, which will be joined soon by the Suzuki Swace. These vehicles will have a large number of specific components shipped from Japan which would have a detrimental effect on any preferential access arrangement for locally produced components, which typically stands at 50% for many trade deals. However, other OEMs planning to produce BEVs and other electrified vehicles in the country, such as Jaguar Land Rover (JLR), are also likely to import sophisticated components related to the powertrain from Japan as well. (IHS Markit AutoIntelligence's Ian Fletcher)

- Germany should produce 8.86 million hectoliters of wine this season, up from 8.32 million hectoliters in 2019. However, this season's production will still be slightly (0.4) lower than the 2014-19 average, according to Statistisches Bundesamt, the German national statistics office. The two large wine regions of Rheinhessen and Pfalz produce more than half (55%) of all German wine. Baden-Württemberg makes 24% and the remaining 21%. production is spread across nine other cultivation areas. Some 66% of Germany's wine grape harvest will go to white wine production and the remainder to red. The harvest of the grapes for the production of Rieslingis expected to increase by 22% this year, to make 2.0 million hl. The second-largest white grape variety in terms of area, Müller-Thurgau, will yield 1.13 million hl of wine. German wine exports peaked at 402.6 million liters in 2013 and since then has stuttered slightly. This year, exports look like being down on those in 2019. In the January-July 2020 period (the most recent data available), Germany exported just over 190 million liters of wine, down some 17 million liters from January-June 2019. (IHS Markit Food and Agricultural Commodities' Neil Murray)

- ZF has announced that it is providing the eight-speed plug-in hybrid electric vehicle (PHEV) transmission for the upcoming Jeep Wrangler 4xe, including a compact electric motor with peak output up to 100 kilowatts and 245 Nm of torque. In a company statement, head of ZF Car Powertrain Technology Division Stephan on Schuckmann said, "The Jeep Wrangler is an iconic vehicle and to be part of the first plug-in Wrangler is symbolic of where the industry and ZF are headed. We believe plug-in-technology is a good solution for customers in the near-to-midterm, and we are committed to mobility that generates considerably less CO2, with the long-term goal of zero emissions." The company also noted that production of the eight-speed plug-in has begun at its facility in Saarbrucken (Germany). Jeep revealed the Wrangler 4xe PHEV earlier in September, noting that its system will use the FCA 2.0-litre turbo four-cylinder engine, the eTorque belt-starter generator and the integrated transmission motor, though had not identified ZF as the supplier. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Powertrain component manufacturer Mahle has become the latest Tier-1 supplier to announce a major restructuring program, according to a company statement. The company is reacting to both the changing technological landscape of the automotive industry and the economic impact of the COVID-19 virus pandemic. As a result Mahle has identified 7,600 jobs on a global basis that it wants to cut from its overall headcount and the company's management will now discuss redundancy and early retirement programs with the relevant works councils and labor representatives. Commenting Mahle's chairman and CEO Dr. Jörg Stratmann said, "We're currently facing a crisis, the like of which we've never experienced before. Despite the economic challenges that this entails, we must continue to drive forward and invest in our future topics as part of the transformation so that we remain competitive with the right know-how and product range. So it's now particularly important that we maintain our efforts to reduce costs consistently and focus even further on our strategic goals. The capacity adjustments already implemented are not sufficient." Mahle is facing the perfect storm of the deteriorating global economic situation and the changing automotive technological landscape. (IHS Markit AutoIntelligence's Ian Fletcher)

- The Greek non-seasonally adjusted unemployment rate stood at

16.7% during the second quarter of 2020. It rose from 16.2% during

the first quarter of the year, but it remained below the rate of

16.9% recorded during the second quarter of 2019. (IHS Markit

Economist Diego Iscaro)

- Employment fell by 2.8% year on year (y/y), following a rise of 1.0% y/y during the first quarter. The Greek statistical office highlights that employees subject to a suspension of their contract due to the COVID-19 virus pandemic were still included in the employed population, assuming their suspension was for a period of less than three months and/or they received at least 50% of their remuneration.

- Under the government's furlough scheme, firms affected by the COVID-19 crisis are allowed to suspend the contracts of employees, who receive a payment of EUR534 (USD632) per month (the minimum monthly wage currently stands at EUR650). The scheme is currently expected to remain in place until the end of September.

- The impact of the COVID-19 virus pandemic on the unemployment rate was also limited by the government support for workers affected by the crisis, which led to a large increase in the number of economically inactive people (i.e., those not working or looking for a job). This metric rose by 3.4% y/y during the second quarter, while the number of people classified as unemployed declined by 4.6% y/y.

- A combination of the different support schemes for the labor market and difficulties gathering data as a result of the containment measures put in place to limit the spread of the COVID-19 virus has cushioned the impact of collapsing activity on the unemployment rate. Given the timing of some of these measures and the usual lag between activity and labor market indicators, we expect the unemployment rate to peak during the first half of 2021.

- The monetary policy committee (MPC) of the Democratic Republic

of the Congo (DRC)'s central bank decided to keep the key interest

rates unchanged in September, having last raised the rates in

August, wary of double-digit rate inflation and a depreciating

Congolese franc. (IHS Markit Economist Alisa Strobel)

- The MPC of the DRC's central bank, the Banque Centrale du Congo (BCC), met on 10 September to discuss the latest developments in the domestic economy and the implications of current global economic conditions for the country's macroeconomic growth performance.

- The MPC decided at the meeting to maintain the BCC's key policy rates, after hiking the discount rate from 7.5% to 18.5 in August. The committee continued to highlight that much further progress on sectoral reform is needed to reboot the economy, besides monetary policy adjustments, with the BCC committed to implementing all of its monetary policy tools. Furthermore, the MPC also highlighted that more fiscal adjustments and revenue mobilization are required to stabilize macroeconomic fundamentals.

- As IHS Markit suggested it would in August, the MPC decided to keep its rates unchanged in September after the move to raise the central bank rate in the previous meeting. Limited fiscal space coupled with steady high inflation and a depreciating currency constrain further rate cuts. Furthermore, we expect the BCC to continue to intervene in the country's exchange market via direct and indirect measures, such as changing the obligatory reserve requirement to improve currency offerings in the market and stabilize the Congolese franc.

Asia-Pacific

- APAC equity markets closed mixed; Mainland China +2.1%, Hong Kong +0.5%, South Korea +0.3%, Japan +0.2%, and Australia/India -0.3%.

- Mainland China's sustained economic recovery and successful

pandemic control, along with expansion of opening-up policy will

continue to help keep China's role as one of the most attractive

investment places in the world. (IHS Markit Economist Yating Xu)

- Foreign direct investment (FDI) into China grew 15% year on year to USD12.3 billion in August, accelerating from a 12.2% year on year expansion in July, according to the Ministry of Commerce (MOC). The decline in year-to-date FDI narrowed to 0.3% year on year and the CNY dominated FDI recorded 2.6% year on year expansion,

- By sector, the increase in headline CNY dominated FDI was entirely driven service sector, which rose 12.1% year on year through August, accounting for 76.8% of the total. Particularly, investment in the high-tech service sector surged 28.2% year on year.

- By country, Hong Kong, Singapore, England and Netherlands are main investors, with investment from Netherlands surging 73.6% year on year.

- Outbound investment declined by 12.5% year on year through August in terms of USD, weakening from a 12.2% year on year contraction in the first seven months and a 2.6% year on year contraction the same period last year.

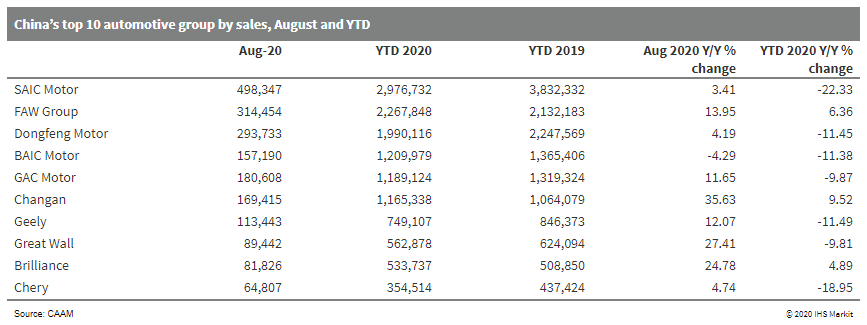

- The auto market of mainland China continued to gain traction in

August, the fifth consecutive month of growth since a rebound began

in April. According to data from the China Association of

Automobile Manufacturers (CAAM), China's new vehicle sales, on a

wholesale basis, increased 11.6% year on year (y/y) to 2.19 million

units last month, and production rose 6.3% y/y to 2.12 million

units. (IHS Markit AutoIntelligence's Abby Chun Tu)

- In the year to date (YTD) for August, China's new vehicle sales were down 9.7% y/y at 14.55 million units, and production volumes contracted 9.6% y/y to 14.43 million units.

- In August, passenger vehicle (PV) sales increased 6.0% y/y to 1.76 million units, and PV production fell by 0.1% y/y to 1.69 million units.

- In the YTD, sales of PVs were down 15.4% y/y at 11.29 million units, while production of PVs fell 15.5% y/y to 11.18 million units.

- The new energy vehicle (NEV) market saw growing demand in August, underpinned by new entries in the market. Sales of NEVs, which include battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and fuel-cell vehicles (FCVs), increased 25.8% y/y to 109,000 units in August, while NEV production rose by 17.7% y/y to 106,000 units.

- Sales of BEVs grew by 25.6% y/y to 88,000 units in August, while production of BEVs increased 7.6% y/y to 82,000 units.

- Sales of PHEVs were 21,000 units in August, up 26.1% y/y, while production of PHEVs increased 73% y/y to 24,000 units.

- In the YTD, sales of NEVs were 596,000 units, down 26.4% y/y, while NEV production volumes were down 25.2% y/y to 602,000 units.

- The Chinese automotive market will continue to benefit from the

government's policy incentives to spur domestic consumption in an

effort to cushion the impact of the coronavirus disease 2019

(COVID-19) virus pandemic on international trade. Faced with

uncertainties associated with the ongoing pandemic and a fragile

trading environment, Chinese automakers that intended to venture

into the global market are realigning their businesses to focus on

the domestic market.

- Uber Technologies is reportedly in talks to divest part of its USD6.3-billion stake in Chinese ride-hailing firm Didi Chuxing (DiDi) to raise cash. Uber CEO Dara Khosrowshahi is in discussions about the sale with DiDi and SoftBank Group, a Japanese conglomerate that is a major shareholder in both companies. The deal would probably see SoftBank teaming up with other investors to acquire a minority of Uber's 15% stake in DiDi, reports Bloomberg. This month, Uber agreed to sell its European freight business and some of its stock in Russia's Yandex. The sale of DiDi's stake would be the latest divestiture by Uber as it aims to boost its own shares, which have been impacted severely by the COVID-19 virus pandemic. Globally, Uber laid off 6,700 employees in two phases and has now reduced its workforce by 25% since the pandemic began. Uber's revenues shrunk to USD2.24 billion in the second quarter, a decrease of 29% year on year (y/y), as the number of monthly active users declined to 55 million, compared with 99 million a year earlier. Due to the pandemic, Uber announced in April that it expects an impairment charge of up to USD2.2 billion against the carrying value of some its minority equity investments. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Baidu Apollo, in partnership with bus manufacturer King Long, has launched a Level 4 autonomous bus during a ceremony in Chongqing (China). Apollo is an open platform launched by Baidu in 2017 that supports all the major features and functions of an autonomous vehicle (AV). In addition, Baidu received 10 license plates that allow its AVs to conduct road tests with passengers in Chongqing, reports Xinhua News Agency. Li Zhenyu, vice-president of Baidu, said, "Baidu Apollo will work together with Chongqing to set a benchmark for the self-driving industry in west China, and provide R&D test services and rich application scenarios for carmakers and auto parts manufacturers in the autonomous vehicle field". This bus is the third model that has come from the joint efforts of Baidu and King Long; Baidu has launched its Apollo Go Robotaxi service for the public in Beijing, Cangzhou, and Changsha. The company has obtained 150 licenses to test AVs and has conducted road tests in 24 cities, covering more than 6 million km. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Cadillac has launched the model year 2021 XT4 sport utility vehicle (SUV) in the Chinese market. The 2021 XT4 features several updates including optimal Face ID keyless entry that enable the vehicle to identify the driver through facial recognition. When the user approaches the vehicle, the high-definition touchscreen on the B-pillar is activated automatically through their mobile phone's Bluetooth recognition wake-up function. "With a dual-infrared camera, infrared imaging technology and an adaptive flashing light, the system can carry out all-weather face recognition day and night, indoor and outdoor, and even in some extreme weather", said Cadillac in a company statement. After entering the vehicle, the user can start the vehicle without a key. To appeal to young consumers, the XT4 also feature voice command system powered by Baidu and Cadillac's new Cadillac User Experience (CUE) that support wireless Apple CarPlay. (IHS Markit AutoIntelligence's Abby Chun Tu)

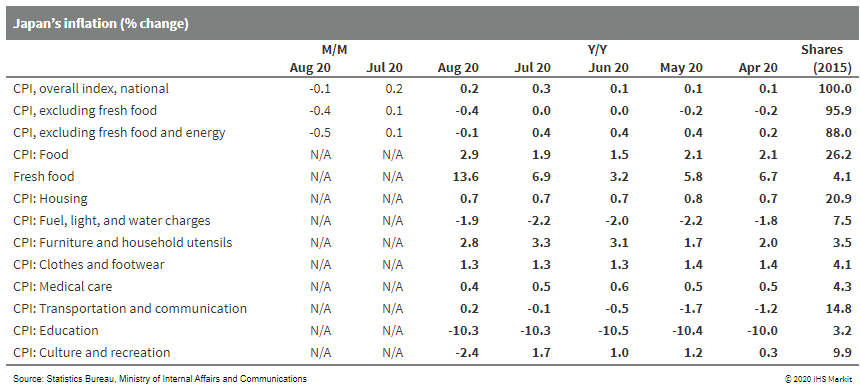

- Japan's CPI fell by 0.1% from the previous month on a

seasonally adjusted basis in August, and year-on-year (y/y) growth

softened to 0.2%. The CPI, excluding fresh food (core CPI), a

reference series for the Bank of Japan (BoJ), fell by 0.4% month on

month (m/m) and 0.4% y/y. The CPI, excluding food and energy

(core-core CPI), also dropped by 0.5% m/m and 0.1% y/y, the first

y/y decline since March 2017. (IHS Markit Economist Harumi Taguchi)

- The weakness in the CPI largely reflected larger declines in accommodations and softer increases in overseas package tour charges, household durable goods, and non-fresh foods. Continued weakness for travel expenses during vacation seasons weighed on tourism-related prices while the introduction of the government's domestic travel subsidies lowered accommodation fees, pushing down the CPI by 0.42 percentage point. The weakness in the CPI was partially offset by a softer decline in gasoline prices and a surge in fresh food prices because of bad harvests caused by heavy rains.

- The August results suggest that weak demand and the

government's measures suppressed prices. Japan's inflation is

likely to remain weak over the near term, given that declines in

wages because of lower working hours and performance-linked bonuses

as well as social distancing practices will keep consumers cautious

about spending. In addition, new prime minister Yoshihide Suga

intends to lower mobile phone charges, which is a potential

downside driver for prices.

- New Zealand's real GDP dropped by a record -9.8% q/q in the

June quarter, caused by the domestic lockdown measures implemented

to combat the COVID-19 virus pandemic and the broader global

economic slowdown. The current account also recorded its first

surplus since 2009 during the June quarter, albeit due to a

sizeable drop in imports from collapsed domestic demand. (IHS

Markit Economist Andrew Vogel)

- In real (inflation-adjusted), seasonally adjusted, quarter-on-quarter (q/q) terms, expenditure-side GDP growth contracted at by far the fastest pace on record during the June (second) quarter, surprising on the downside versus market expectations.

- Although the expenditure and production measures of GDP are theoretically equivalent, media and government agencies usually focus on production-side GDP as Statistics New Zealand has determined that the production measure is less volatile. In real gross value-added terms, economic activity plunged by a seasonally adjusted 12.2% q/q during the June quarter.

- Private consumption fell for the second straight quarter, reaching -12.1% q/q, with expenditures on transportation, retail, restaurants and accommodations collapsing as a result of the COVID-19 virus pandemic and the strict associated lockdown measures and travel bans. Spending fell considerably on durable goods (-11.1% q/q), non-durable goods (-14.1% q/q), and services (-12.1% q/q).

- Government consumption spending was up during the quarter due to a 1.9% q/q increase in central government spending as fiscal stimulus measures were undertaken to try to combat the negative effects of the COVID-19 slowdown. Meanwhile, local government spending fell 0.2% q/q for the quarter.

- Gross fixed capital formation also saw a sharp decline for the quarter, as non-essential businesses (including construction) shut down for much of April due to the government's alert level 4 restrictions. The largest drivers were collapses in residential building construction (down 22.8% q/q) and plant, machinery, and equipment (down 19.1% q/q) spending, although the drops in non-residential and other construction also contributed significantly as they also declined in excess of 20% q/q.

- The inventories and discrepancy component of GDP was relatively muted, detracting only 0.8 percentage points from growth - almost negligible when compared to the other components.

- New Zealand's current account recorded a surplus for the first time since 2009 - only the 11th time on record, and the largest surplus since 1971 - driven by the sharp decline in real imports relative to the smaller drop in real exports. This leaves New Zealand with the smallest year-to-date current-account deficit since 2010.

- In real terms, exports fell considerably in the June quarter, driven by a huge 39.9% q/q collapse in services exports, with travel services in particular down 48% q/q after the border was closed to overseas visitors to contain the spread of the COVID-19 virus. Goods exports dropped 7.0% q/q, as every sector except for hydrocarbons suffered some degree of decline. However, the dairy, meat, fishing and agriculture sectors only recorded minor drops likely due to global food stockpiling related to the pandemic.

- Real imports fell even more sharply than exports in the June quarter, with a 33.0% q/q collapse in services imports and a 21.2% q/q drop in goods imports. Intermediate goods imports fell 26.7% q/q, and capital goods imports fell 25.4% q/q. Additionally, vehicle imports were down an unprecedented 50.9% q/q, coinciding with drastically reduced domestic demand for crude oil, resulting from the drastically reduced road and air travel caused by the COVID-19 lockdown measures.

- The June quarter results were weaker than IHS Markit's expectations, but we are unlikely to revise our 2020 GDP forecast much further below the -5.5% growth rate in our August forecast, as high frequency data is pointing to a reasonably healthy recovery in economic activity.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-18-september-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-18-september-2020.html&text=Daily+Global+Market+Summary+-+18+September+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-18-september-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 18 September 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-18-september-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+18+September+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-18-september-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}