Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 21, 2020

Daily Global Market Summary - 21 September 2020

Global equity markets closed lower across all regions, with European markets coming under considerable pressure given the rapid rise in COVID-19 cases in the region. iTraxx Europe/Xover and CDX-NAIG all rolled today, with the IG indices entering the first day of trading at much tighter levels than the prior series after purging several fallen angel constituents. US/European benchmark government bonds and the US dollar were higher on the day, while gold and oil were sharply lower. One new factor weighing on the US markets is the apparent plan by President Trump and the Republican party to expedite the nomination and appointment process to fill the vacancy on the Supreme Court of the United States from last week's passing of the honorable Justice Ruth Bader Ginsburg, which is being met with significant Democrat opposition and appears to be rapidly deflating expectations of passing a second (and potentially essential) large US stimulus bill.

Americas

- US equity markets closed lower, but on the higher end of the day's range after a late-day rally; Russell 2000 -3.4%, DJIA -1.8%, S&P 500 -1.2%, and Nasdaq -0.1%. The S&P 500 had its fourth consecutive daily decline, which is the longest down streak since February.

- 10yr US govt bonds closed -3bps/0.67% yield and 30yr bonds -4bps/1.42% yield.

- CDX-NAIG Series 35.1 began trading today and closed at 53bps. CDX-NAHY (series 34.9) closed at +15bps/363bps.

- DXY US dollar index closed +0.7%/93.55.

- Gold closed -2.6%/$1,910 per ounce.

- Crude oil closed -3.8%/$39.54 per barrel.

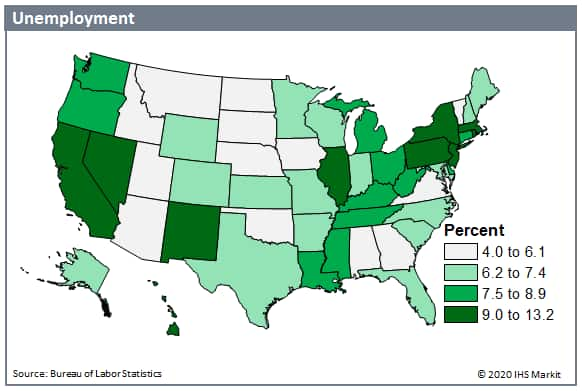

- Total nonfarm payroll employment increased in 49 states in

August 2020, gaining a net 1.4 million jobs from the previous month

on a seasonally adjusted basis, according to the most recent report

from the US Bureau of Labor Statistics (BLS). This was lower than

the gain of 1.6 million jobs in July 2020, and well below June's

increase of 4.6 million, indicating that the recovery spurred by

state reopenings is losing steam. Indeed, the August employment

numbers would have looked worse if not for the 239,000 jobs added

thanks to temporary Census 2020 workers. Outside of the public

sector, retail trade was the main driver of growth in August,

followed by professional and business services. Reflecting the

upward movement in labor markets, unemployment rates decreased in

45 states in August. The rate of change for unemployment was

remarkable this month, with 16 states declining by 2 points or

more. This unexpectedly sharp decline in the jobless rate relative

to the comparatively mild increase in employment is largely due to

a significant difference between the surveys of employer payrolls

and of household employment, each of which provides the data used

to calculate the unemployment rate. Regardless of the improving

jobless numbers, the dramatic impact that COVID-19 has had on

unemployment rates regionally is still apparent. Many of the states

that implemented strict lockdown measures still have the highest

unemployment rates in the country, while states that reopened early

are much lower. August was the second month in a row of slowing

payroll gains, despite a boost from temporary Census hiring during

the month. While employment and unemployment rates are still

improving, we remain cautious as to the strength of the rebound and

do not think that conditions will return to "normal" until there is

a reliable vaccine or treatment to control the virus. (IHS Markit

Economist Steven Frable)

- Nikola founder Trevor Milton has resigned as executive chairman and from the board of directors, according to a company statement. Stephen Girsky has been appointed chairman of the board, effective immediately. Mark Russell serves as Chief Executive Officer and Kim Brady continues as Chief Financial Officer. The change in management comes after a research firm accused Nikola's management of a number of issues. In stepping down, Milton did not address or acknowledge any personal wrongdoing. Hindenburg Research issued a report into the company on 13 September, days after General Motors (GM) and Nikola announced a strategic partnership. The US Securities and Exchange Commission (SEC), which oversees companies that trade on the stock exchange to ensure accurate and comprehensive financial disclosures, is reported to have begun a probe into Nikola, although Nikola also issued a statement following the Hindenburg Research report saying that it had gone to the SEC as well. The SEC has not announced a formal investigation, although it is not required to do so. Milton's departure is an effort to distance the company from the scandal, although it is not clear whether the SEC will be able to prove wrongdoing. Relative to criminal charges, the US Department of Justice (DOJ), is also reported to be looking into the issue. The decision by Milton to step down should enable the board and management team to focus on moving forward, although it does not resolve the issue for Nikola. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Chinese automaker JAC Motors has announced the start of imports of the iEV 330P electric pick-up and iEV 1200T electric light truck into Brazil, reports Automotive Business. According to the report, the iEV 330P has a manufacturer's suggested retail price (MSRP) of BRL289,900 (USD53,750) and the iEV 1200T has an MSRP of BRL349,900. Sergio Habib, president of JAC Motors Brazil, said, "We decided to take on the vocation of seeking a better world and we seriously invested in a significant evolution of our business model. Our family of five electric vehicles takes center stage in the brand. The idea is to shake up the market and instantly give you several shopping options in diversified segments." According to automaker, the JAC iEV 330P has a range of 320 kilometers (km) and a payload capacity of 800 kilograms (kg). The iEV 1200T light truck has a total gross weight (peso bruto total: PBT) of 7.5 tons, can carry up to 4 tons of cargo, and has a range of 200 km. Both vehicles come with lithium-iron-phosphate batteries (suitable for cargo operations due to a relatively high charge density) and a JAC Monitor system for performing diagnosis of all electronic control units (ECUs) and high-voltage circuits. In September 2019, JAC Motors revealed five electric vehicles (EVs) in Brazil, which include three passenger cars, a double-cabin pick-up truck, and an urban truck. Brazil is making efforts to improve its infrastructure and encourage increased use of EVs in the country. Brazil's latest program for encouraging automotive industry efficiency and investment, Rota 2030, will see fuel-efficiency requirements become stricter in three phases, with new targets set for 2022, 2027, and 2032, although only the 2022 target has been set so far. In February 2020, Brazil's National Consortium Unifisa launched a consortium offering a financing plan for purchasers of EVs in the country to aid in expanding the accessibility of EVs to customers who require more-affordable vehicle financing plans. (IHS Markit AutoIntelligence's Tarun Thakur)

Europe/Middle East/Africa

- European equity markets closed sharply lower; Germany -4.4%, Italy -3.8%, France -3.7%, and Spain/UK -3.4%.

- European govt bonds closed higher across the region; Germany -5bps and France/UK/Italy/Spain -3bps.

- iTraxx-Europe and iTraxx-Xover series 34.1 began trading today and closed at 57bps and 325bps, respectively.

- Brent crude closed -4.0%/$41.44 per barrel.

- Eurostat's release of trade and construction output data for

July completed the set of main eurozone indicators for the month

and confirm a strong post-lockdown rebound across the board. (IHS

Markit Economist Ken Wattret)

- Eurozone exports rose strongly for the third straight month in July, with the 6.6% month-on-month (m/m) increase taking the cumulative increase since May to more than 28% (in values, not volumes). Despite the strong rebound, exports remained 12.5% below their pre-pandemic February level.

- The recovery in eurozone imports has been less pronounced, with July's 4.2% m/m rise taking the cumulative increase since May to just under 14%.

- As a result, the eurozone trade surplus has started to climb again. Having dropped to virtually zero at the height of the coronavirus disease 2019 (COVID-19) virus shock in April, the surplus reached EUR20.3 billion (USD24.03 billion) in July.

- Although this was still well below February's recent high of EUR26.2 billion, the large widening of the surplus points to a return to positive net trade contributions to GDP growth from the third quarter of 2020.

- On a less upbeat note, eurozone construction output rose only marginally in July, by 0.2% m/m. Still, as this followed exceptionally strong gains in the two prior months, it contributed to a cumulative increase of over 36% between May and July.

- As of July, the level of construction output in the eurozone was more than 5% below where it was back in February. This compares with a 7% net decline in industrial production between February and July.

- The strong gains in exports and construction output in the three months to July followed very large increases in industrial production (28%) and retail sales (25%), implying exceptionally strong "carry over effects" for third-quarter-2020 growth rates. The initial preliminary 'flash' estimate of third-quarter-2020 GDP growth in the eurozone will be released on 30 October.

- Monthly momentum across all the main activity data releases is starting to diminish, as the post-lockdown rebound is already well advanced.

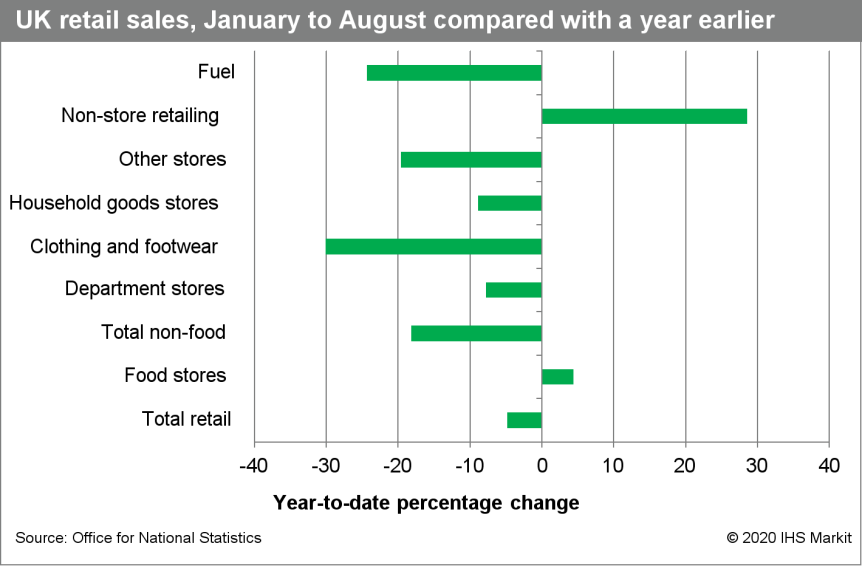

- UK retail spending continued to recover in August after the

reopening of non-essential shops from mid-June. Nevertheless, parts

of the high street continued to lag behind the recovery, weighed

down by protocols to combat the spread of the COVID-19 virus

pandemic. (IHS Markit Economist Raj Badiani)

- Retail sales (including fuel sales) in volume terms increased for the fourth straight month, rising by 0.8% month on month (m/m) in August. This was preceded by m/m gains of 12.1% in May, 13.9% in June, and 3.7% in July, standing 4.0% above their February's pre-COVID-19-virus level.

- In annual terms, they were 2.8% higher than in August 2019.

- August's monthly gain was primarily driven by increased spending for home improvements, highlighted by spending in household goods stores increasing by 1.9% m/m. In addition, textile, clothing, and footwear stores reported reviving sales for the fourth straight month, rising by 13.5% m/m. However, they remained 15.9% below their February's pre-COVID-19-virus levels.

- Non-store retailing fell back in volume terms during both July and August, contracting by 7.0% m/m, but was still 46.8% higher than February's pre-COVID-19-virus levels and accounts for around one-third of all retail spending.

- Sales on the high street, or in physical shops, remained short of pre-lockdown levels, with spending in non-food stores in August remaining 2.7% lower than February's level.

- The recovery in retail sales continued to unfold during August, but we still argue that the immediate outlook for retail spending remains challenging.

- Footfall after the reopening of non-essential shops has been

uneven, affected by retailers having to limit the number of

customers to meet social-distancing requirements. Indeed, retail

analyst Springboard reports that footfall in the week ending 20

September was up by 2.4% compared with the previous week but was

still 28.7% lower than a year earlier.

- The UK government is said to be planning to pull forward a ban on sales of internal combustion engine (ICE) light vehicles to 2030. The Guardian has been told by sources in the automotive and energy industry that Prime Minister Boris Johnson had been planning to make the announcement this week, but this will now be delayed as the government focuses on tackling the ongoing coronavirus disease 2019 (COVID-19) virus pandemic. According to the newspaper, the decision to ban ICE sales sooner than the 2035 timeframe already proposed is on the back of assurances that the UK's infrastructure will be prepared to cope with the transition. The government has already been consulting on banning ICE light-vehicle sales from 2035, rather than banning non-electrified light vehicles from 2040. However, even at this point there was talk of a move by 2032 (see United Kingdom: 13 February 2020: Light-vehicle ICE ban could come as early as 2032, says UK government minister), and in recent weeks there have been growing calls for a deadline to be set for 2030. While the charging infrastructure is equipped to cope with the relatively small number of vehicles on the country's roads at the moment, despite previous concerns, the National Grid believes that it will not be as much of a struggle to deal with the additional electricity demand, despite the UK typically adding over 2.5 million new light vehicles a year to the country's roads. Indeed, Graham Cooper, the director of the electricity infrastructure company's project for battery electric vehicles (BEVs) told the newspaper that the operator was "confident that a faster transition is possible" and that it is "suitably robust" to cope with a rise in electricity demand. It suggested that this would require less than one-third more energy than current demand levels, which Cooper said that "the grid could easily cope with". He went on to say that the increase at peak may only climb by 10% if owners charged vehicles overnight. However, he did note that "some targeted investment will be needed to ensure there are appropriate places where drivers can access sufficient high-power charging away from home." (IHS Markit AutoIntelligence's Ian Fletcher)

- Two European automakers, Volkswagen (VW) Group and Fiat Chrysler Automobiles (FCA), have announced that they have sought external support to finance their low-emission vehicle development pushes. VW Group has said that it has placed EUR2 billion (USD2.35 billion) worth of bonds, the funds from which are being used to refinance the development costs of not only its modular battery electric vehicle (BEV) architecture, MEB, but also the ID.3 and ID.4 models that are based on it. The bonds have terms of eight and 12 years, with annual interest rates of 0.875% and 1.25%, respectively. Separately, FCA has announced that it has been given support for investments in BEVs and plug-in hybrid electric vehicles (PHEVs) from the European Investment Bank (EIB). According to a statement, EUR485 million has been allocated to supporting the production of PHEVs at FCA's Pomigliano (Italy) facility, as well as the development of electrification, connectivity, and automated driving systems in Turin (Italy). The credit line is said to cover around 75% of the total value of FCA's investments between 2020 and 2023, involving a five-year loan term at "particularly favourable interest rates provided thanks to the AAA rating of the EIB's bond issues". The EIB has also contributed a further EUR300 million to support production of PHEVs at Melfi (Italy) and BEVs at Mirafiori (Italy), with this investment covering the period to 2021. FCA has a longstanding relationship with the EIB, from which it has loan EUR3.2 billion since 2010. The EIB has been a source of funding in the areas of research and development (R&D) and manufacturing of low-emission vehicle technologies, while in this instance, the funding will also be used to support employment, specifically in southern Italy. As for VW Group, these are said to be the first 'green bonds' that have been placed by the business, but follows the company's Porsche unit using a traditional German floating- or fixed-rate debt instrument known as a Schuldschein to refinance the development expenditure on the Taycan. However, this latest offering is based on the Green Finance Framework (GFF) for sustainability-orientated financial instruments, which was presented in March. Annual reporting on the use of the proceeds and the environmental effects achieved will create transparency for investors. Among the specific areas that the automaker has said that the funds have been used in are conceptual design, infrastructure, development, and production of the MEB, the vehicles that are based on it, and the production facilities required for it, alongside tooling and systems from suppliers and key components, including batteries. The company has said that investors showed considerable interest in the new bonds, including both international and specialist investors, which is likely to mean that the automaker will offer further bonds like this to underpin its aggressive strategy. (IHS Markit AutoIntelligence's Ian Fletcher)

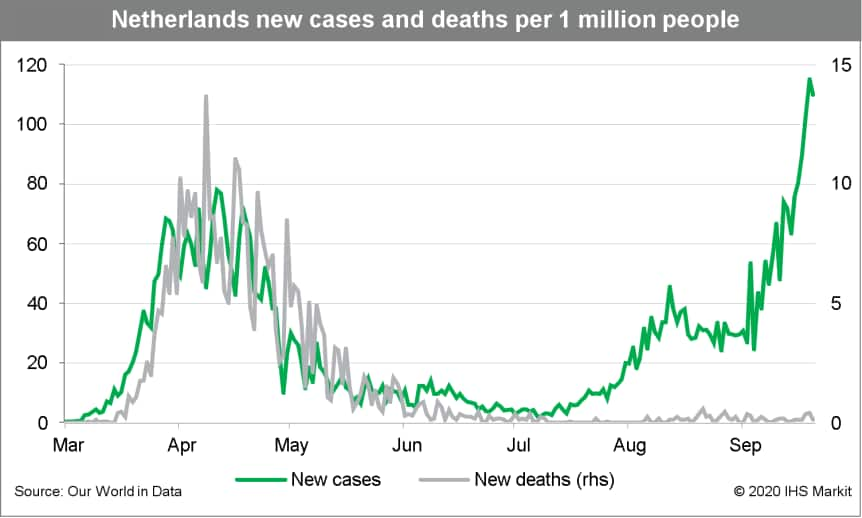

- Due to the increasing number of new COVID-19 cases, the Dutch

government announced new restrictions for six regions, effective

from 20 September. These include Amsterdam-Amstelland,

Rotterdam-Rijnmond, Haaglanden, Utrecht, Kennemerland, and Hollands

Midden, which have seen the largest increase in new COVID-19

infections and hospital admissions. (IHS Markit Economist Daniel

Kral)

- The six regions were put on Level 2 or "Worrisome" on the government's three-stage warning system. The remaining 19 regions are at Level 1 or "Vigilance."

- Three general measures apply to the six regions. First, establishments with a catering license cannot allow customers in after midnight and must close by 1am. Second, no more than 50 people can meet inside or outside, barring some exceptions, including demonstrations, religious gatherings, funerals, or theatre. Third, organizers of gatherings of more than 50 people, such as concerts in a park, must notify authorities in advance. This does not apply to situations with a continuous flow of people, such as shops or religious services.

- In addition to the three general measures, the six regions have each adopted their own targeted restrictions. For Amsterdam, this includes keeping a safe distance of 1.5 meters from others in all public places and disinfecting hands upon arrival; increased checks by police to prevent over-crowding; and the closing of parks and other public places at night to prevent illegal parties; additional communication campaigns targeted different groups.

- This is in addition to basic rules, valid for the whole country, requiring everyone to work from home if possible; avoiding crowds; and a ban on more than six visitors in a single house.

- The new restrictions are intended to slow the spread of the

virus, after the latest estimate put the R rate, the rate of virus

reproduction, at 1.4, meaning an exponential rise. Although deaths

remain low, the number of people in hospital care has risen to

almost 300, doubling in 10 days.

- This year, Scandinavia was poised to have a bumper wild blueberry crop, but labor shortages have forced some processors to leave the fruit on the plant. The right proportion of warmth and rain had lifted industry expectations for wild blueberry yields in Finland and Sweden this season, following last year's small crop when extreme caused fruit losses. The Ukrainian government closed its borders in March amid the pandemic peak, while the Thai ministry of labor decided to ban seasonal work in the Nordic country. Thai workers account for 90% of the harvest in both Finland and Sweden. Swedish media reported that after tough negotiations, the Thai government eventually allowed a group of berry pickers to make the trip to Sweden and Finland, but it demanded a two-week period of paid quarantine for the workers upon return, as well as stringent corona safety measures on locations where Thai citizens had to work. Those requirements proved to be such a financial burden that many businesses declined. Fewer than 3,000 seasonal workers have been invited to travel to Scandinavia, less than half of what would be needed to refill the blueberry's stocks, The Local Sweden reported. According to industry representatives, the pickers shortage might have halved the Finnish crop. This has caused prices for IQF wild blueberry to stay high, around EUR3.50-3.90 (USD4.14-4.62) per kilogram for the few volumes sold in the food industry, lifting prices across the whole European market. Even in countries were the crop was higher, such as Ukraine and Belarus, prices were in the range of EUR2.65-2.70/kg for class I, while for radioactivity below 100 becquerels, prices were higher and about EUR2.85-2.90/kg ex-works. In Poland, where the wild blueberry crop is limited as farmers are investing more on cultivated for the fresh market, prices were above EUR3.0/kg ex-works. (IHS Markit Food and Agricultural Commodities' Cristina Nanni)

- Turkey's leading pharmaceutical manufacturer Abdi Ibrahim on Friday (18 September) announced that it had acquired a 28.5% stake in the Switzerland-based biotech company OM Pharma. According to Turkish newspaper Daily Sabah, the transaction is valued at USD530 million, and will render Abdi Ibrahim the second-largest shareholder in OM Pharma. Citing Nezih Barut, the chairperson of Abdi Ibrahim, the source states that the investment will see the two companies "jointly produce some chemicals and biotechnological drugs". Abdi Ibrahim's investment in OM Pharma, which is the Geneva-based biotech unit of the Vifor Pharma Group, will increase the Turkish player's presence in the international biopharmaceutical market and will add valuable biotech drugs to the company's offering in the domestic Turkish market. The acquisition of the stake reflects Abdi Ibrahim's focus on expanding its biotechnology products portfolio; it also reflects the Turkish government's focus on increasing the share of R&D-intensive biological drugs in the domestic pharmaceutical market and on boosting pharmaceutical sector exports. OM Pharma has a strong global presence in the market for drugs used in the prevention of recurrent respiratory and urinary tract infections, and is also active in the vascular diseases therapeutic segment. The company has a network of international partners, and R&D investment is focused on immunotherapeutic products for acute and chronic immunological disorders resulting from infections and inflammation. (IHS Markit Life Sciences' Sacha Baggili)

- Renewed pressures on the rouble and rising inflation deterred

the Bank of Russia from cutting its key interest rate on 18

September, in line with IHS Markit's expectations. (IHS Markit

Economist Lilit Gevorgyan)

- In a press note and a follow-up statement by Governor of Bank of Russia, Elvira Nabiullina, the central bank of Russia (CBR) gave the reasons behind its decision to keep the policy rate unchanged at 4.25%.

- The Board of Directors admitted during its rate setting meeting that there was room for more monetary easing. However two short-term developments have put this process on hold.

- Inflationary developments have been stronger than previously projected by the Central Bank of Russia (CBR). Specifically, annual consumer price inflation rose to 3.6% in August, from 3.4% in July.

- Unwinding the anti-pandemic restrictive measures has boosted spending on both services and non-food products. Food prices also contributed to rising inflation, according to the CPI breakdown by the Russian federal state statistical service.

- The pro-inflationary trend will continue. As of 14 September the CBR estimates the CPI year-on-year changes will inch upwards to 3.7%. The CBR also noted that consumer and business expectations remain elevated.

- In addition, the real GDP fell only by 8.0% y/y in the second quarter, which was milder than CBR expected. Smaller dip in the second quarter and the ensuing rebound in the economic activity are also adding to the inflationary pressures (see Russia: 11 September 2020: Russian Q2 real GDP 'flash' estimate revised upwards, but no quick recovery in prospect).

- The CBR referred to increased pressure on the rouble due to the global financial markets' volatility and fresh geopolitical risks. Nabiullina particularly highlighted the bank's concerns over the pace of the global recovery, which is causing the volatility on financial markets.

- The CBR maintains its view that the consumer price inflation will reach the full-year range of 3.7- 4.2% in 2020, before easing to 3.5%-4.0% in 2020.

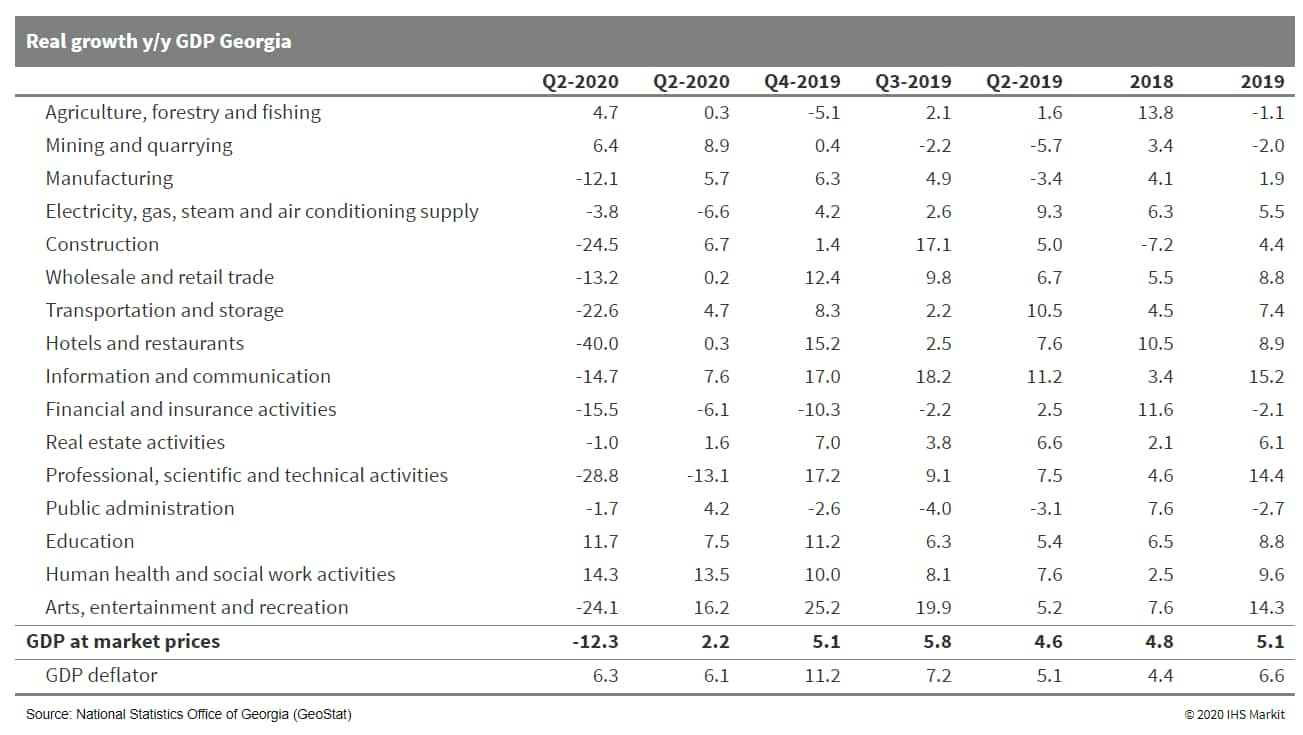

- According to the latest national accounts data from the

National Statistics Office of Georgia (GeoStat), the economy in the

second quarter of 2020 contracted by 12.3% y/y, following growth of

2.2% y/y in the first quarter. Growth of the GDP deflator modestly

accelerated, to 6.3% y/y from 6.1% y/y in the first quarter. (IHS

Markit Economist Venla Sipilä)

- The growth result comes just marginally above GeoStat's flash estimate of -12.6%, while it implies contraction of around 5.6% for the first half of the year.

- Unsurprisingly taking into account of the timing of the global spread of the COVID-19 virus pandemic, economic contraction was extremely widespread. Manufacturing output registered a fall in line with overall economic contraction, even against a favorable base effect, while construction activity suffered a decrease of around a fourth y/y.

- Among key goods output sectors, the only bright spot was agricultural output, which managed to growth at an accelerating rate of 4.7% y/y. Also the mining and quarrying sector managed to expand y/y; however, with this field only accounting for less than 2% of total value added, this had little impact on overall growth.

- The latest national accounts results come shortly after the International Monetary Fund (IMF) announced on 15 September that it had concluded a virtual staff visit to Georgia. While noting that the health impacts of COVID-19 in Georgia have been well contained, the pandemic has shown a considerable negative impact on the economy, with the external position suffering particularly as tourism revenues have all but dried up.

- At 12.3% y/y, the second-quarter contraction comes very near

expectations; in our August forecast, we outlined contraction of

12.8% for April-June. Our current forecast of GDP contraction of

4.9% for Georgia this year still seems valid.

- The South African Reserve Bank (SARB) left its key policy rate,

the repo rate, unchanged at 3.5% during the September meeting of

its monetary policy committee (MPC), held on 17 September. (IHS

Markit Economist Thea Fourie)

- The MPC lowered the central bank's expectation for South Africa's GDP in 2020 to a contraction of 8.2%, from a contraction of 7.2% previously. In addition, headline inflation is expected to average 3.3% in 2020, 4.0% in 2021, and 4.4% in 2022. The overall risk to the inflation and growth outlooks appear to be balanced for now, the SARB stated, but warned that global economic and financial conditions could change rapidly in the current environment. This combined with monitoring of the transmission effect of recent policy adjustments to the broader economy and temporary price shocks, and its second-round impact on prices, underlined the unchanged interest rate stance, the MPC reported.

- Future policy decisions will continue to be data dependent, the MPC stated.

- The Quarterly Projection Model implies a policy path of no further repo rate reductions in 2020, and two rate increases in the third and fourth quarters of 2021.

- IHS Markit assumes no further cuts in the SARB's policy rate for the remainder of 2020, with a 25-basis-point increase in the second half of 2021. Headline inflation is expected to trend upwards from the low of 2.1% in May to close to 3.4% at the end of 2020. For 2021 onwards, headline inflation is expected to edge up further, averaging around 4.4% next year, higher than the SARB's current inflation expectation of 4.0% in 2021.

- Gabon's public-debt service cost is forecast to rise by 71% in

2020, driven by "higher amortization and financial expenses",

putting pressure on the country's liquidity position. Direct Infos

Gabon (DIG), referencing data from the Bank of Central African

States (Banque des États de I'Afrique Centrale: BEAC), the

Directorate-General of Debt (DGD), and the public Treasury

services, reported that Gabon's costs on servicing domestic and

external debt obligations are expected to increase to XAF1.28

trillion (USD2.31 billion) in 2020 from XAF749.2 billion in 2019.

(IHS Markit Economist Archbold Macheka)

- External debt service is projected to jump from XAF404.9 billion in 2019 to XAF876.9 billion in 2020, owing to a 161.3% growth in principal payments. Interest payments on external debt obligations are expected to rise from XAF140.6 billion to XAF186.3 billion, representing a 32.5% surge between 2019 and 2020.

- Domestic debt service is forecast to increase to XAF403.7 billion in 2020 from XAF344.3 billion in 2019, owing to debt restructuring and new financial disbursements. Principal payments will rise to XAF313.5 billion in 2020, representing a 20.6% jump. Meanwhile, interest payments will grow by 7%, from XAF84.3 billion in 2019 to XAF90.2 billion in 2020.

- The DGD has estimated that Gabon's public debt was XAF5.6 trillion at the end of the first quarter of 2020. However, the International Monetary Fund (IMF) expects total public debt to jump to about 74.7% of GDP in 2020 and 74.4% of GDP in 2021, driven by "the inclusion of validated past domestic arrears in the debt stock in 2019", widening budget deficits, and weaker growth. The IMF forecasts Gabon's economy to contract by 2.7% in 2020, before registering a modest recovery of 2.1% in 2021 owing to the dual COVID-19-virus pandemic and the terms-of-trade shocks.

- IHS Markit assesses that Gabon's liquidity position remains under pressure despite the USD1 billion Eurobond issuance in February 2020 and the IMF's USD299.61-million Rapid Financing Instrument disbursement to help to address urgent balance-of-payment needs stemming from the COVID-19-virus pandemic. Numerous external and domestic debt obligations falling in 2020, renewed pressure on foreign reserves because of depressed oil prices, the pandemic, and failing government revenues from weaker economic activity will intensify liquidity pressures.

Asia-Pacific

- APAC equity markets closed lower across the region; India -2.1%, Hong Kong -2.1%, South Korea -1.0%, Australia -0.7%, and Mainland China -0.6%.

- China has announced new policies to support hydrogen fuel cell vehicle (FCVs) sales and the development of the industry's supply chain and technologies, reports Reuters citing information from the Ministry of Finance. Local governments and companies need to prove their joint projects are able to lower the price of hydrogen fuel, increase the number of hydrogen-charging stations, enlarge FCV fleets and improve related technologies. Authorities will offer rewards to the projects after an assessment of these key performance areas, the ministry said. FCVs have long been enjoying subsidies from the government. Under policy guidance announced last year, local governments are encouraged to provide subsidies to promote the sales of FCVs and support the construction of hydrogen refueling stations. According to the Reuters report, funds are likely to be provided by the central government to support specific FCV-related programs. The renewed effort will help China to boost the number of FCVs on its roads to 100,000 units, a target set for 2025. Encouraged by government incentives, Chinese automakers, including SAIC Motor, Great Wall Motor and Geely Auto, have announced plans to introduced FCVs to the market. SAIC Motor, for instance, has planned 10 new FCVs by 2025 in an effort to achieve a market share of 10% in the segment in China. In May 2019, Geely Auto launched its first hydrogen fuel-cell bus, The F12. The model, the first commercial FCV under Geely's Yuan Cheng brand, was developed by Geely's new energy commercial vehicle division. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Hyundai Motor, Hyundai Engineering and Construction (E&C), South Korea's telecom company KT Corporation, and the country's Incheon International Airport Corporation have signed a memorandum of understanding (MOU) to work together on developing the urban air mobility (UAM) project, with plans to launch flying cars by 2025, reports Korea JoongAng Daily. Under the latest MOU, Hyundai Motor will develop, produce and commercialize UAM vehicles. Hyundai E&C will build the infrastructure for vertiports, while KT will construct the necessary telecommunications infrastructure, including a traffic management system for unmanned aerial vehicles (UAVs). The state-run airport corporation will build the relevant infrastructure at Incheon International Airport and connect existing air traffic management systems with the UAM traffic management system. They will also jointly design a road map for the urban air transportation industry. The latest development is in line with the South Korean government's aim to commercialize UAM services in 2025 in a bid to overcome the country's worsening traffic congestion problem in 2040 and believes that UAM services will help to transport passengers faster than buses and subways. UAM services are designed to travel 30-50 km in urban areas while providing interconnectivity with other modes of transport. The sector will require a complete industrial ecosystem to promote its growth, along with the provision of services such as repairs and insurance. (IHS Markit AutoIntelligence's Jamal Amir)

- Stradvision will use BlackBerry's QNX Software Development Platform for advanced driver assistance systems (ADAS) and autonomous vehicles (AVs) from South Korean automakers, according to a company statement. BlackBerry is set to license its QNX technology, including its QNX Software Development Platform (SDP) 7.0 to StradVision, for use in SVNet, an AI-based camera perception software tool. It is expected to be adopted by automotive companies in South Korea. "We are excited to work with StradVision to help our automotive customers surpass their competition with our reliable and secure QNX Neutrino Real-time Operating System. This relationship further cements our leadership as a provider of secure operating systems and foundational software solutions designed to meet the evolving needs for connected, and autonomous vehicles across the South Korea automotive industry," said John Wall, SVP and cohead, BlackBerry Technology Solutions. SVNet, made up of Stradvision's Deep Neural Network, allows vehicles to detect objects, cars on the road, lanes, pedestrians, animals, signs, and traffic lights. SVNet is operational even in harsh climate conditions. The QNX Software Development Platform contains the QNX Neutrino RTOS, QNX Momentics Tool Suite, and QNX Software Center to provide a real-time OS and development tools. Last month, StradVision teamed up with Japan-based system-on-chip (SoC) supplier Socionext to bring its deep learning-based camera perception software to SVNet to the global market. (IHS Markit AutoIntelligence's Jamal Amir)

- Mitsubishi Motors plans to end the production of the i-MiEV electric vehicle (EV) as early as the end of fiscal year (FY) 2020 (April 2020 to March 2021), according to Nikkei Asian Review. The decision is related to low sales volumes of the i-MiEV in recent years and a lack of investment to support the development of EVs. Mitsubishi Motors will be joining forces with Nissan to develop a new electric mini-car to replace the i-MiEV. The two plan to release the new model in 2023 at the earliest. Mitsubishi has begun sales of the i-MiEV since 2009. However, according to IHS Markit data, cumulative sales of the i-MiEV only reached around 24,000 units in the global market as of the end of 2019. With a range of less than 200 km, the i-MiEV has lost its appeal to mainstream EV buyers. To share hefty investment costs related to EV development, the Renault-Nissan-Mitsubishi Alliance is formulating a plan to strengthen their alliance by jointly developing EVs and autonomous vehicle technologies. The Alliance aims to increase the number of EV models to be launched through joint development across four segments by FY 2023: mini-vehicles, compact vehicles, and large and small sport utility vehicles (SUVs). The models are expected to share electric motors and batteries, in addition to the chassis. As part of the plan, Nissan will be responsible for the development of a dedicated EV platform, which will be used by all Alliance brands. (IHS Markit AutoIntelligence's Abby Chun Tu)

- The Bangko Sentral ng Pilipinas (BSP) on 18 September asked

banks to implement a one-off 60-day loan moratorium before the end

of 2020. This is a blanket moratorium for all loans for individuals

and businesses, and banks will not be allowed to charge interest

during the moratorium. Borrowers can repay the interest for the

loans under moratorium in a "staggered" manner. The Inquirer

newspaper reported that the House of Representatives initially

wanted to implement a one-year loan moratorium. (IHS Markit Banking

Risk's Angus Lam)

- Although the BSP has implemented Resolution 570 - which allows banks to not classify bad loans as such until March 2021 for loans located in areas affected by the COVID-19 virus, - some banks have already unofficially awarded a loan moratorium to borrowers. This recent official blanket loan moratorium is likely to reduce instalment payment pressure for borrowers while the country is experiencing its worst slump in history, with GDP plunging by 16.5% year on year.

- This is, however, likely to have an impact on banks' profitability, especially in the fourth quarter of 2020 as banks will have low interest income and repayments, which may affect banks' ability to extend lending, despite the various policies to boost lending, including the recent interest rate cut to 2.25% and the various reserve requirement ratio cuts.

- The advantage is that the moratorium will delay banks' need to classify bad loans, especially since forward-looking data such as past-due ratio, which take into account loans that are even one-day overdue, had risen to 5.3% in July 2020 (compared with 2.9% at the start of 2020), suggesting that more loans will be classified as non-performing in the fourth quarter. However, since the central bank has already introduced a calamity clause that reduced banks' immediate capital needs from bad loans, the capital pressure is likely to be limited, following the current mandated moratorium.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-21-september-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-21-september-2020.html&text=Daily+Global+Market+Summary+-+21+September+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-21-september-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 21 September 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-21-september-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+21+September+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-21-september-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}