Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 16, 2020

Daily Global Market Summary - 16 September 2020

Global equity markets closed mixed across each region, with the US trading session ending the day with a brief surge in volatility driven by the FOMC statement and press conference. The FOMC indicated in their statement that they expect to keep rates accommodative through their forecast horizon of 2023, which coincided with an immediate sell-off in long US treasury bonds. CDX and iTraxx credit indices were close to unchanged on the day, while oil and gold both closed higher. Tomorrow morning's US unemployment insurance weekly claims will be watched very closely by the markets for further clarity on the degree of improvement or deterioration in the US labor market.

Americas

- The discussion during today's FOMC meeting press briefing centered on topics related to the inclusion of forward guidance on interest rates in the September FOMC statement and the implementation of the FOMC's new monetary policy framework. Throughout the press briefing, Chairman Powell emphasized that forward guidance was a "powerful" tool and that the Committee was "confident" and "committed" to reaching their goals. These goals include eliminating shortfalls from maximum employment and achieving inflation averaging 2% over time, as highlighted in the update to the 'Statement on Longer-Run Goals and Monetary Policy Strategy' released on 27 August. He emphasized the importance of credibility and that today's action was a first step to supporting the new policy framework. Overall, today's press briefing was consistent with our expectations and implied no change to our forecast. During the briefing, the Chairman referred to the new forward guidance as "durable," implying it would be included in the statement for the foreseeable future. He also noted that the guidance was consistent with the latest FOMC projections, which anticipate inflation gradually approaching 2% and expectations for monetary policy to remain accommodative through the forecast horizon (now 2023). (IHS Markit Economists Kathleen Navin and Ken Matheny)

- US major equity indexes closed mixed, with all closing near the lows of the day after selling off in tandem 40min post-FOMC statement; Russell 2000 +0.9%, DJIA +0.1%, S&P 500 -0.5%, and Nasdaq -1.3%.

- 10yr US govt bonds closed +2bps/0.70% and 30yr bonds closed +3bps, with 30yr bonds selling off the most on the FOMC's statement and were out as much as 6bps by 2:50pm EST (10yr bonds were only +2bps during that same time period).

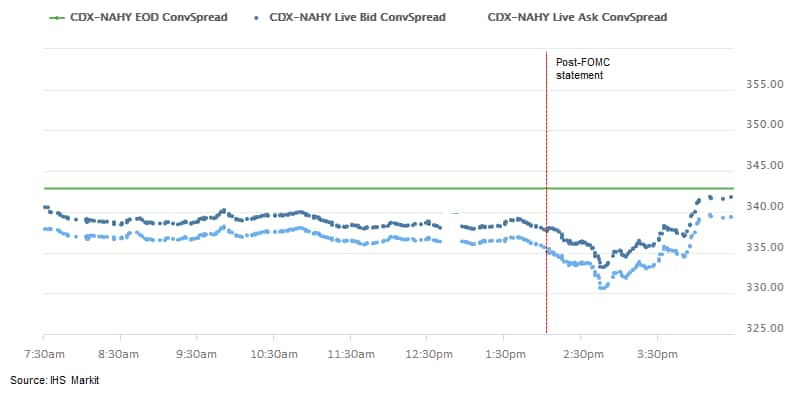

- CDX-NAIG closed flat/68bps and CDX-NAHY -3bps/339bps, with the

latter (chart below) being as tight as -10bps before widening

alongside equities post-FOMC.

- DXY US dollar index closed +0.1%/$93.10.

- Gold closed +0.2%/$1,971 per ounce.

- Crude oil closed +4.9%/$40.16 per barrel.

- Offshore drilling contractor Seadrill has entered into forbearance agreements with certain creditors in respect of its senior secured credit facility agreements, senior secured notes, and guarantee facility agreement. The agreements are to allow Seadrill and its stakeholders more time to negotiate on the head terms of a comprehensive restructuring of its balance sheet. Seadrill stated that the restructuring may involve the use of a court-supervised process. The company is continuing to evaluate capital structure proposals from its financial stakeholders. While no agreement has been reached at this point, Seadrill expects the potential solutions will lead to significant equitization of debt which is likely to result in minimal or no recovery for current shareholders. As part of the forbearance agreements, the creditors have agreed not to exercise any voting rights to, or otherwise take actions, in respect of certain events of default that may arise under the senior secured credit facility agreements, senior notes and guarantee facility agreement as a result of Seadrill not making certain interest payments falling due in September 2020 under the group's senior secured credit. Forbearance has not yet been agreed upon with respect to termination events that may arise under leasing agreements for semisubmersible West Hercules, jackup West Linus and semisubmersible West Taurus. (IHS Markit Upstream Costs and Technology's Matthew Donovan)

- Total US retail trade and food services sales increased 0.6% in

August, following a downwardly revised 0.9% gain in July. (IHS

Markit Economist James Bohnaker and David Deull)

- The level of core retail sales was revised lower for July and was below our prior assumption for August. We revised down our forecast for third-quarter real personal consumption expenditure (PCE) growth 0.7 percentage point to 37.9%.

- In August, pandemic-induced food purchasing trends began to reluctantly unwind. Food services and drinking places posted the strongest gain of any major retail category with a 4.7% increase, yet remained down 15.4% on a 12-month basis. Conversely, retail sales at food and beverage stores were down 1.2% but remained 10.0% higher than a year earlier.

- Retailers saw a slight bump in August from back-to-school shopping despite widespread adoption of remote learning for students this fall. Electronics and appliance stores (up 0.8%), furniture and home furnishing stores (up 2.1%) and clothing and clothing accessory stores (up 2.9%) each posted increases in sales.

- Nonstore retail sales were unchanged in August but strongly elevated from a year earlier—up 22.4%. As a share of total retail trade and food services, nonstore sales held steady at 15.5%, down from an April peak of 19.2% but above the pre-pandemic February rate of 13.1%.

- Retail sales are indeed losing steam as indicated by high-frequency credit-and debit-card data. This sets up for a sharp deceleration in consumer spending in the fourth quarter, especially if federal legislation fails to deliver additional income support to households.

- It is mind-boggling: five months after a historic collapse, the

National Association of Home Builders (NAHB) housing market index,

its three subindexes, and three of the four regional indexes are at

record highs. What accounts for the sharp reversal? Part of the

story is mortgage rates dropping to all-time lows; another is that

social distancing is possible in building homes; a third is bidding

wars brought about by record-low interest rates and inventories,

and pent-up demand from bidders displaced from the market earlier

this year. And a fourth, perhaps pivotal—but hard to

measure—part is demand from people working remotely because of

the pandemic wanting to relocate. Despite these impressive numbers,

we believe that the recent strength in the single-family market for

new construction is temporary and that housing starts will

overshoot their long-run trend over the next three quarters before

dipping and stabilizing to a level set by increases in the number

of households. (IHS Markit Economist Patrick Newport)

- The headline US builder confidence index increased five points to 83—the highest reading in its 35-year history.

- All three sub-indexes set record highs. The current sales conditions index climbed four points to 88, the index measuring sales prospects over the next six months rose six points to 84, and the traffic of prospective buyers' index shot up nine points to 73.

- Three of the four regions set monthly and three-month average record highs; the West—the region with the highest index reading—was the exception.

- The three-month moving average for the Northeast jumped 11 points to 76, the Midwest moved up nine points to 72, and the South edged up eight points to 79.

- The index for the West rose to 87, approaching the record high of 91 set in October 2005; its three-month moving average climbed seven points to 85.

- Americas Styrenics (AmSty), Ineos Styrolution, and Trinseo have

signed a joint development agreement (JDA) under which the

companies will explore options for recycling polystyrene (PS). "All

three companies have done their own independent research and have

invested in various projects to further the commercialization of

advanced recycling capacity," says a statement issued by the

partners. "This new joint effort allows all participants to share

best practices and optimize recycling technologies for large-scale

commercial use." Trinseo on Monday announced the commercialization

of recycled PS for food packaging with German packaging

manufacturer Fernholz. In December 2018, Ineos Styrolution,

Trinseo, Total, and Versalis (ENI) founded Styrenics Circular

Solutions, a European initiative aimed at the development of PS

recycling. Ineos Styrolution and AmSty, a joint venture between

Trinseo and Chevron Phillips Chemical (CPChem), each have about

750,000 metric tons/year of PS production capacity in North

America, making them the largest producers in the region, according

to data from IHS Markit. Total Petrochemical follows with about

570,000 metric tons/year of capacity.

- The Kraft Heinz Company has announced that it has entered into a definitive agreement to sell its Natural, Grated, Cultured and Specialty cheese businesses to a US affiliate belonging to France's Groupe Lactalis. "We believe these cheese and dairy businesses will thrive in the hands of a global dairy company like Groupe Lactalis," said Kraft Heinz chief executive Miguel Patricio. The USD3.2 billion deal includes Kraft Heinz's Natural, Grated, Cultured and Specialty cheese businesses in the US, Grated cheese business in Canada, and the entire International Cheese business outside these two countries, including some of Kraft Heinz's leading brands in the US and Canada. In addition, Kraft Heinz will partner with Lactalis on a perpetual license for Kraft in Natural, Grated and International cheeses and Velveeta in Shredded and International cheeses. Kraft Heinz will retain the Philadelphia Cream Cheese, Kraft Singles, Velveeta Processed Cheese and Cheez Whiz Processed Cheese businesses in the US and Canada, the Kraft, Velveeta and Cracker Barrel Mac & Cheese businesses worldwide, and the Kraft Sauces business worldwide. Under the terms of the agreement, Kraft Heinz will sell production facilities located in Tulare, California; Walton, New York; and Wausau, Wisconsin, and a distribution center in Weyauwega, Wisconsin. The cheese businesses being sold contributed approximately USD1.8 billion to Kraft Heinz's net sales for the twelve months ended June 27, 2020. Kraft Heinz expects to use post-tax transaction proceeds primarily to pay down debt. The sale of part of the cheese business is part of Kraft Heinz's cost cut plan, whereby it said it is looking to capitalize on consumers' rediscovered interest in store-bought food. Kraft Heinz targets to shave USD2 billion in costs through to 2024 and invest some of that in marketing of its products. The billions of dollars in savings are expected to come from integrated business planning for more efficiency between its manufacturing, procurement and logistics operations. Its procurement division alone is supposed to see USD1.2 billion in savings over five years, in part due to closer collaboration with suppliers. The company is expecting long-term organic sales growth of 1-2%, with the financial targets reflecting its confidence in its ongoing recovery. Last year, Kraft Heinz's organic sales were down 1.7%. (IHS Markit Food and Agricultural Commodities' Jana Sutenko)

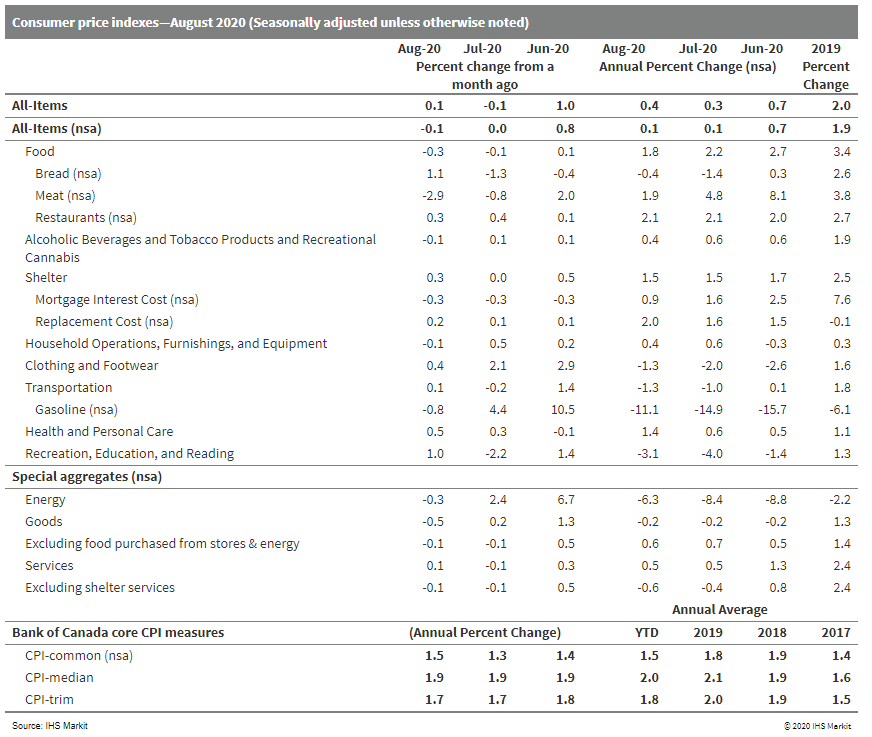

- Canada's consumer prices were relatively unchanged from a month

earlier. Annual inflation is just 0.1% year on year (y/y) on a

non-seasonally adjusted basis (nsa) and 0.4% y/y on a seasonally

adjusted basis. (IHS Markit Economist Arlene Kish)

- The core consumer price index (CPI)-common (nsa) firmed a bit while the other measures were steady.

- Upward and downward price pressure contributors are unchanged from last month; prices related to passenger vehicles and insurance premiums exerted upward pressure and gasoline and traveler accommodation exerted downward pressure.

- Goods inflation (-0.2% y/y) and services inflation (0.5% y/y) rates are unchanged from last month, indicating that the economy did little to nothing in terms of absorbing excess capacity as more restrictions are lifted.

- Falling gasoline prices continue to make the biggest negative impact on annual inflation rates. However, excluding gasoline prices, the CPI decelerated 0.1 percentage point to 0.6% y/y in the month.

- Monthly price movements of some items were affected by global markets, like the large upswing in gold prices lifting jewelry prices.

- Food purchased from stores inflation eased below 2% y/y with the dramatic deceleration in meat price inflation as supply-chain challenges softened.

- Pandemic safety-related costs are being passed on to consumers as personal care services inflation spiked 7.2% y/y, making hair cuts much more expensive. Hairdressers were permitted to open earlier this year, but costs seem to be too high for businesses to absorb.

- The devastated travel industry has been offering heavy discounts through the summer months to stimulate travel, but given the two-week self-quarantine restrictions when returning to Canada, the hefty 16% y/y discount on air transportation prices may not be enough to lift travel demand to pre-pandemic levels any time soon.

- According to data from the Colombia National Administrative

Department of Statistics (Departamento Administrativo Nacional de

Estadística: DANE), industrial production contracted 10.8% year on

year (y/y) in July. Retail sales fell 12.4%. (IHS Markit Economist

Lindsay Jagla)

- All four industrial sectors contracted, with manufacturing driving the decline and falling by 8.5% primarily due to reductions in beverage production and fuel refining. Mining and quarries also played a significant role, contracting 21.6% as carbon extraction dropped by 34.1%.

- Only two out of 26 activities expanded; these were the production of wood products and the manufacturing of electrical equipment. Neither had a significant effect on the overall industrial production.

- Retail sales also fell, driven mainly by a decline in fuel purchases for motor vehicles as well as a decrease in purchases of motor vehicles themselves. Six merchandise groups expanded, with computer and telecom equipment driving growth the most, at 56.9%.

- Despite industrial production remaining in contractionary territory, the numbers have bottomed out since reaching the lowest point of -29.6% in April. This comes as Colombia gradually reopens the economy, including recently allowing restaurants to reopen and permitting domestic flights.

- The August manufacturing purchasing managers' index (PMI) reflects some of this economic reactivation, remaining in expansionary territory for the third straight month, at 51.2. However, while output and quantity of purchases grow, other indicators such as new orders and employment continue to contract.

Europe/Middle East/Africa

- European equity market closed higher except for the UK -0.4%; Spain +1.1%, Germany +0.3%, France +0.1%, and Italy flat.

- 10yr European govt bonds closed mixed; Italy +3bps, Germany flat, and UK/France -1bp.

- iTraxx-Europe closed flat/54bps and iTraxx-Xover rolled to 33.3 and closed 292bps.

- Brent crude closed +4.2%/$42.22 per barrel.

- A second estimate shows the French EU-harmonised price index

rising by 0.2% year on year (y/y) in August. This matches a

provisional estimate released late last month. (IHS Markit

Economist Diego Iscaro)

- Inflation eased from 0.9% in July, which had been the highest reading in five months. Both the July and August readings were affected by the change in timing of the summer sales, which were postponed by four weeks in 2020 because of the COVID-19 virus pandemic (they usually start during the last Wednesday of June).

- Prices of clothing and footwear (which have a weight of 4.4% in the overall index) fell by 1.7% y/y, following a rise of 10.1% y/y during the previous month. The postponement of the summer sales also led to a deceleration in the growth of prices of "other" manufactured products, which rose by 0.4% y/y following an increase of 1.1% y/y in July.

- Food prices also eased in August, although they continued to increase substantially more than the average (by 0.9% y/y in August, following 1.1% y/y in July). Meanwhile, energy prices declined for the sixth consecutive month, but their rate of contraction eased from 7.4% y/y in July to 7.1% y/y (see chart below).

- Service price inflation remained stable in August. It stood at 0.9% as sharper falls in transport (-4.4% y/y, compared with -0.8% y/y in July) and health services (-0.3% y/y, compared with +0.6% y/y in July) prices were offset by rising prices of "other" services (+1.6% y/y, compared with +1.2% y/y in July).

- Core inflation, meanwhile, declined from 1.4% in July to 0.5%. Core inflation had ranged between 0.3% and 0.7% in the three months to July.

- The later timing of the summer sales injected substantial volatility into the July/August figures. However, the trend suggests that underlying inflationary pressures remain muted and we expect this to remain the case over the coming months, despite a likely rebound in headline inflation in September.

- Merck KGaA has provided an update on progress made in realizing

the growth and expansion phase of its strategy for the period until

2022. It expects to deliver continued profitable growth in the

coming years despite a challenging market environment. All three

business sectors of Merck have moved forward in delivering on their

strategic priorities in recent years, the company says.

- Meanwhile, for 2020, "as previously reported, Merck expects slight-to-moderate organic growth of net sales and EBITDA pre[-exceptionals] in 2020. The company continues to expect group sales of between €16.9 billion [$20.1 billion] and €17.7 billion as well as EBITDA pre in a range of €4.45 billion to €4.85 billion," says Stefan Oschmann, chairman and CEO of Merck.

- The company's healthcare business has accelerated its organic growth in recent years, making good progress with its development pipeline and toward its sales' target of about €2 billion for 2022, Merck says. The company expects sales performance in its core business to remain at least stable through 2022 with potential for further growth beyond 2022.

- Merck's life science division is expected to record average annual organic sales growth of 6-9% in the medium term, significantly above the expected growth of the life science industry of 5-6%, the company says. Life science's margin is also likely to be significantly higher than the market average, Merck says. The company attributes the above-market growth to its portfolio as well as to a continued favorable business performance.

- Performance materials has shifted its portfolio to focus on the high-growth semiconductor business following the acquisition of Versum Materials. The company confirms a cost-synergy target of €75 million as of 2022 and expects faster realization this year, together with additional sales synergies as of next year. Merck also expects average annual organic sales growth of 3-4% for its performance materials segment together with an EBITDA pre-exceptionals margin of about 30% in the medium term.

- The company has announced a further development of its portfolio strategy. "We don't rule out large transformative deals as of 2022, yet in view of our strong business portfolio, at present the likelihood is higher that we will complement our businesses through a number of smaller-to-medium-sized acquisitions after 2022," Oschmann says.

- The Dutch government unveiled on 15 September (the third

Tuesday of September, as every year) its draft budget for 2021. The

context for the budget is the unprecedented economic downturn

following the coronavirus disease 2019 (COVID-19) virus and the

parliamentary election in March 2021. (IHS Markit Economist Daniel

Kral)

- Contrary to public statements made earlier this year by Finance Minister Wopke Hoekstra, the budget extends fiscal support to the economy and avoids premature fiscal tightening. It contains selective tax breaks for small companies and savers, and significant new investment plans. It also confirms that the fiscal support measures to protect incomes and employment introduced in the wake of COVID-19, which were set to expire on 1 October, will be extended until mid-2021.

- On the revenue side taxes and social contributions will be reduced by EUR5 billion (0.6% of 2019 GDP) in 2020-21. The lower band of the corporation tax will be reduced from 16.5% to 15%, while the higher rate will remain at 25% (contrary to earlier plans to lower it). A tax credit scheme will also be introduced to encourage businesses to invest.

- Employers will not be paying tax and national insurance on training costs for employees to facilitate the reallocation of labor. Tax allowances for the self-employed will be lowered, but with compensation in the short term.

- The tax allowance for savings and investments will be raised to EUR50,000 (EUR100,000 for partners), which should benefit a million people. First-time buyers will not pay the transfer tax, while the levy on landlords will be lowered to put downward pressure on rents.

- On the expenditure side, the budget was preceded by an announcement of a EUR 20 billion (2.5% of 2019 GDP) Growth Fund, which should make investments to promote sustainable growth over the next five years (0.5% of GDP per year). The details about types of investment projects and the basis for the selection process are not clear yet.

- Major additional investments are envisaged to accelerate the transition to green energies, including the phasing out of gas production, CO2 reduction initiatives, and habitat remediation. Investment to maintain railways, roads and waterways worth EUR2 billion will be brought forward.

- A further EUR500 million goes to childcare benefits, EUR450 million for education and EUR32 million to address a teacher shortage. Healthcare will get an additional EUR130 million.

- More than EUR500 million will be spent to fight crime and address the growing requirements of the criminal justice and asylum system.

- The government also earmarked EUR500 million to help fight the COVID-19 virus in the most vulnerable countries.

- The budget will be debated in the lower house of the parliament with likely amendments tabled. The final budget is expected to be passed by November or early December this year.

- Accompanying the budget is the government's forecast for growth, employment and fiscal stance. The government expects the economy to shrink by 5% this year and grow by 3.5% in 2021 with unemployment reaching 5.9%, almost fully in line with our forecast.

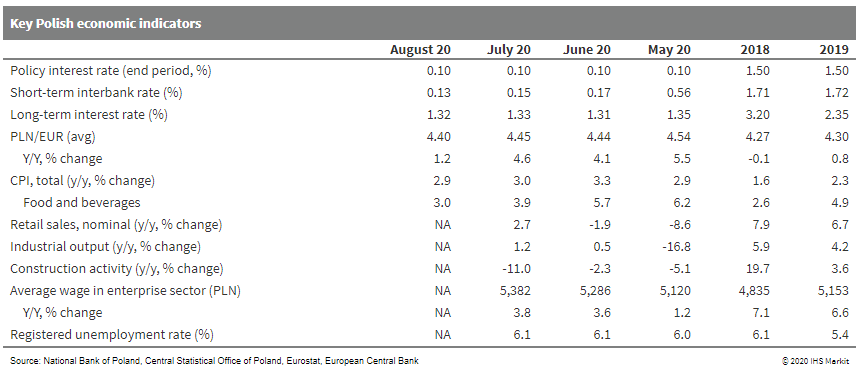

- As expected, Poland's monetary policy council (MPC) kept the

base interest rate on hold at its session on 15 September. The

interest rate has remained at a historic low of 0.1% since May.

(IHS Markit Economist Sharon Fisher)

- Consumer price inflation slowed to 2.9% year on year (y/y) in August, boosted by a modest strengthening of the zloty exchange rate in comparison with the April-to-May lows.

- In a separate release, Poland's current-account surplus continued to expand in July, driven mainly by y/y improvements on the goods, income, and current-transfers accounts. Services exports were close to year-earlier levels in July (down just 3.1% y/y in local currency terms), after plunging by 30% or more in April to June.

- Poland's short-term economic outlook is improving, presenting upside risks to IHS Markit's latest GDP forecast, which we upgraded slightly in September (to -4.6%). Although recent monthly data have shown signs of recovery, the COVID-19-virus pandemic brings continued uncertainty amid external and domestic challenges.

- According to a statement issued after its September session, the NBP will continue to purchase government securities and government-guaranteed debt securities on the secondary market, while also offering discount credits aimed at refinancing bank loans granted to enterprises. Nevertheless, the NBP warned that the recovery could be limited by the lack of a visible exchange rate adjustment to the COVID-19-virus shock and monetary easing measures.

- With the zloty strengthening and public-sector borrowing

requirements heightening in 2021, IHS Markit expects the NBP policy

interest rate to remain unchanged, at least through early 2022.

- New vehicle production in Turkey increased by 44.5% year on year (y/y) during August, with year-to-date (YTD) production down 20.5% y/y, according to Daily Sabah, citing the Automotive Industry Association (Otomotiv Sanayii Derneği: OSD). In August, 45,211 new cars were produced. Passenger car imports during the month increased 106.3% y/y to 27,880 units, while exports of passenger cars declined 22% y/y to 26,393 units. (IHS Markit AutoIntelligence's Tarun Thakur)

- Israel's Tactile Mobility will offer its sensing technology for BMW's next-generation vehicles beginning in 2021. As part of this partnership, BMW will equip its vehicles with Tactile's VehicleDNA software, which has the ability to analyze the road surface attributes under the tires and enable accurate detection of road conditions. Tactile Mobility's technology uses existing sensors including those measuring wheel speed, steering angle, RPM, and gear position, to help vehicles to collate data relating to vehicle-road dynamics and road conditions. Rani Plaut, executive board member of Tactile Mobility, said, "We are appreciative of the support the BMW Startup Garage and the entire team at the BMW Group has given us and look forward to working together to provide smart and connected vehicles with a more comprehensive picture of the driving environments around them, which will now include the tactile sense". The long-term co-operation between BMW and Tactile Mobility began through the BMW Startup Garage, the venture client unit of the BMW Group. Tactile Mobility was founded in 2012 to offer missing tactile sensing and data to enable vehicles to be smarter. In 2019, Tactile Mobility raised USD9 million in funding from a group of investors that included Porsche. This year, Tactile Mobility announced that it will embed its technology in Porsche cars to enable a safer and smarter driving experience. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Algerian state-owned oil company Sonatrach has signed USD521 million in contracts with six domestic companies to develop gas gathering and transportation lines in the country's southwest. The companies include ENGCB, SARPI, ENGTP, ENAC, KANAGHAZ and COSIDER Canalisations. The construction will include over 700 km of new pipeline and once constructed will have a gas capacity of 389 MMscf/d and a crude oil capacity of 6,000 bbl/d. Sonatrach estimates a combined 3,000 jobs will be created by the work. (IHS Markit Upstream Costs and Technology's Chris Alexander)

Asia-Pacific

- APAC equity markets closed mixed; Australia +1.0%, India +0.7%, Japan +0.1%, Hong Kong flat, South Korea -0.3%, and Mainland China -0.4%.

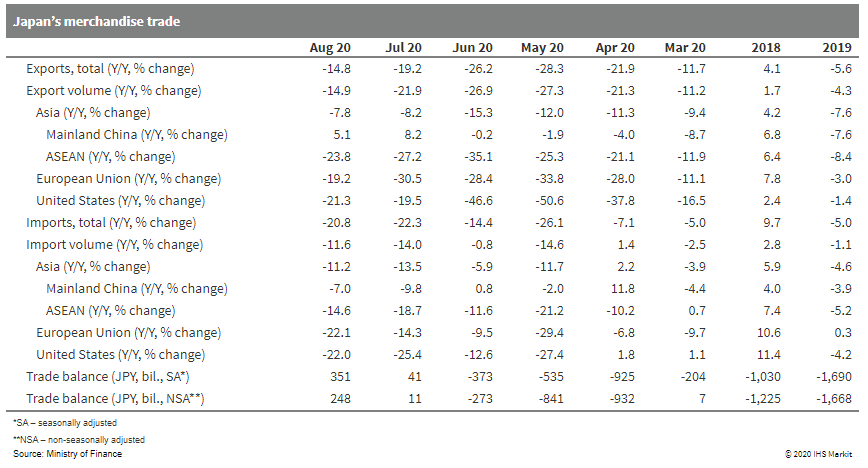

- Japan's trade balance improved in August because of continued

gradual improvement in exports. However, the COVID-19 virus

pandemic could continue to suppress recovery of trade. (IHS Markit

Economist Harumi Taguchi)

- Japan's trade surplus widened to JPY248 billion (USD2.4 billion) on a non-seasonally adjusted basis and JPY351 billion on a seasonally adjusted basis in August. The improvement of the trade balance reflected a softer decline in exports (down 14.8% year on year [y/y]) while the contraction of imports widened to 20.8% y/y.

- Although seasonally adjusted exports increased from the previous month for a third consecutive month, export volumes remained below the March level. Recoveries in exports to all regions lagged behind exports to mainland China (up 5.1% y/y). Exports of motor vehicles, auto parts, and ships remained major contributors to sluggish exports. Exports of non-ferrous metals and semiconductor machinery rose because of increased exports to mainland China.

- Declines in imports of mineral fuel remained a major factor behind the contraction of imports, contributing 9.9 percentage points to the decrease. While larger declines in imports of chemical products and iron and steel products suggest destocking, continued substantial falls in imports of motor vehicles and clothing and accessories imply weak recovery in consumer spending.

- The August results suggest that improvement in external demand

is likely to contribute to recovery of real GDP in the third

quarter of 2020. IHS Markit maintains its view that recovery is

likely to be at a modest pace, given that uncertainties over the

pandemic will persist until effective vaccines are available.

- Australian unemployment unexpectedly fell in August as government and central bank stimulus allowed the economy's recovery to withstand Victoria's renewed lockdown. The jobless rate dropped to 6.8% from 7.5% in July vs economists median estimate of an increase to 7.7%, data from the statistics bureau showed Thursday in Sydney. Employment surged by 111,000 in August vs an expected 35,000 drop. The participation rate gained to 64.8%, compared with an estimated fall to 64.6%. (Bloomberg)

- Baidu demonstrated its Apollo robotaxis operating without human safety drivers at Beijing's Shougang Park in China. This was presented during its annual Baidu World 2020 conference, which was streamed online this year because of the coronavirus disease (COVID-19) virus pandemic. Baidu refers its artificial intelligence (AI)-based system as an "experienced AI driver", which allows vehicles to independently drive without human intervention. The company claims that safe driverless operation is a result of its "5G remote driving service", deployed with vehicle-to-everything (V2X) technology that enables human operators in remote location to intervene in case of emergencies. The hardware is deployed in FAW Group's Hongqi E-HS3 sport utility vehicles (SUVs) and Baidu claims these vehicles are the first mass-produced robotaxis in China. The hardware for the fully autonomous robotaxis is mass produced and pre-installed at the factory during the assembly. This follows launch of Baidu's robotaxi service for public in Beijing. The company has also launched the Apollo Go Robotaxi service for the public in Cangzhou and Changsha. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- BMW Brilliance Automotive (BBA), BMW's joint venture with Brilliance Auto, has expanded its battery factory in Tiexi with a new battery center. The automaker celebrated the official opening of this new high-voltage battery facility on 14 September and claimed that the new center will enable it to double its capacity for battery production in China. The High-Voltage Battery Centre will be the first location in BMW's production network to manufacture its fifth-generation high-voltage batteries, which will be used in BMW's iX3 electric sport utility vehicle. BMW is expected to ramp up production of electrified vehicles over the course of the next three years through to 2023. By 2023, BMW's plants in China are expected to produce around 160,000 electrified vehicles, primarily battery electric vehicles and plug-in hybrid vehicles, up from around 35,000 units forecast in 2020. This will make China the second-largest production center in BMW Group's manufacturing network for new-energy vehicles. As well as the new battery center in Tiexi, BMW's production facility in Dingolfing (Germany) is also gearing up to produce the new fifth-generation high-voltage batteries that will be installed in BMW's upcoming electric vehicles, including the BMW iNEXT and BMW i4. (IHS Markit AutoIntelligence's Abby Chun Tu)

- China's Dongying Weilian Chemical has achieved on-spec paraxylene production at its integrated refining complex on Sep 15, market sources said. Located in Shandong province's Dongying Port Economic Zone, the RMB14 billion ($2.05 billion) project has a crude refining capacity of 84,000 b/d, 2 million mt/year of paraxylene and 553,400 mt/year of benzene. It is also building a 2.5 million mt/year purified terephathalic acid (PTA) unit which is expected to be completed in Q2 2022. Phase 1 of PX production (1 million mt/year) has been completed and phase 2 is expected to start up in 2022, sources said. As the integrated complex is in Shandong, its closest end-user will be the mega PTA producers in Dalian, Liaoning province. Sinopec North China will be the off-taker for Dongying Weilian's PX output, sources said. Hengli Petrochemical, one of its customers with 11.6 million mt/year of PTA, told IHS Markit that it will receive its first PX shipment from Dongying Weilian on 20 Sep. However, no long-term contract has been signed and the purchase will be in US dollar, based on a floating spot price formula. The PX spot price has already come under pressure as more Chinese PX facilities start up and supply turned long. The average PX spot price in August was $539.83/mt CFR China, down 32% compared to same time last year and the spread against naphtha is now at less than $150/mt. Negative production margin have already led to lowered operation rates among Asian producers, according to IHS Markit reports, and more cuts would be expected. Ashish Pujari, IHS Markit research and analysis director said: "The startup of this project has been factored in the pricing over the recent past so the news may not adversely impact prices in the short run. However, this will certainly put pressure on exporters of PX who now need to plan for further cuts in the near term," Furthermore, Sinochem Quanzhou is expected to start up its 800,000 mt/year PX facility around October, market sources said, potentially bringing China's total PX capacity to 26.6 million mt/year by end 2020, up from 11.6 million mt/year in 2015. (IHS Markit Chemical Market Advisory Service's Sok Peng Chua)

- Evergrande Auto, a subsidiary of Evergrande Group, has raised HKD4 billion (USD5.2 billion) from a group of investors through a share issuance to fund the development of its electric vehicle (EV) business, reports Xcar. The group of investors includes Chinese technology giant Tencent, the country's leading mobility service operator Didi, and Sequoia Capital, a major venture capital firm. Evergrande Group intends to invest CNY20 billion (USD29.6 billion) to advance its EV business between 2019 and 2021, according to Automotive News China, citing a statement by the company's chief financial officer (CFO), Pan Dalong. Investment in 2019 alone was reported at around CNY14.7 billion. Most of the new funds raised will go towards the development of its new EV models. The company plans six battery electric models under its Hengchi brand. The Hengchi 1, an electric sport utility vehicle (SUV), is scheduled to enter into production in 2021. The model will be followed by a compact SUV planned for 2022. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Thailand's energy drink market was worth TBH30 billion (USD960 million) in 2019, up 5.7% year-on-year. In Thailand, approximately 400 million liters of energy drinks are sold per year. Osotspa Group occupies 53.5% of the total market, followed by Carabao Group (28%). The third player is TC Pharmaceutical Group. In terms of brands, Osotspa's M-150 has a 37.5% share, followed by Carabao Red (22.6%) and Krating Daeng and then others. The giants hold the multi-brand strategy with a variety of products as minor brands lose market share. To be an alternative to consumers in all groups, Osotspa offers many other brands such as Lipovitan-D, White Shark, Som In Sum, M Storm while TC Pharmaceutical supplies Ready Plus, Ready Mix and Ready Original. Osotspa's products cover both key segments. The mass market, which comprises about 80% of total sales, is a beverage that costs TBH10 and the premium market with the remaining 20% share consists of beverages priced at TBH12 or more. Major customers of energy drink products are laborers. Carabao group is expanding its customer base to cover all target groups, including the new and millennial generation. (IHS Markit Food and Agricultural Commodities' Mainbayar Badarch)

- Hyundai has started shipping its proprietary fuel-cell system to Europe for use by non-automotive companies. The system will be delivered to GRZ Technologies Ltd, a Swiss-based company specializing in energy storage in the form of hydrogen, and an unidentified European energy solutions startup. Using Hyundai's fuel-cell system, GRZ plans to produce a stationary power supply system to be used for building electricity at peak times, while the energy solutions startup will use it to produce mobile hydrogen generators. The 95-kW fuel-cell system is currently used for the Hyundai Nexo hydrogen fuel-cell electric vehicle (FCEV). Hyundai is one of the few automakers that already has a successful fuel-cell offering in the market: it launched the Tucson FCEV in 2013, one of the first mass-produced FCEVs globally, followed by the next-generation Nexo FCEV in 2018. (IHS Markit AutoIntelligence's Jamal Amir)

- South Korea's paraxylene export for August hit a 34-month low of 450,858 mt, according to the latest data released by Korea Customs Service. The volume is down 86,908 mt or 16% from July and down 134,213 mt or 23% year-on-year. Exports to China, which has always been South Korea's biggest PX buyer, plummeted to a 63-month low of just 365,271 mt. Compared to July, the volume is down 91,126 mt or 20% and down 123,284 mt or 25% compared to same time last year. For the first half of 2020, average monthly export to China was 445,276 mt and even when major Chinese cities were under lockdown in Q1 because of the coronavirus disease (COVID-19), it took in an average of 543,505 mt, the data showed. South Korea's total PX capacity is 9.9 million mt/year but producers have already reduced operation rate by around 15-20% in August due to poor spread against feedstock naphtha and isomer mixed xylene. The average spread against naphtha was at just $145/mt and the spread against MX was around $100/mt, according to IHS Markit data. Most producers are finding it difficult to break even had maintain run rate at around 80-85% to meet contractual volumes. With new Chinese PX capacities starting up later this year, the China is expected to even further reduce its import requirement, market observers said. (IHS Markit Chemical Market Advisory Service's Sok Peng Chua)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-16-september-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-16-september-2020.html&text=Daily+Global+Market+Summary+-+16+September+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-16-september-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 16 September 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-16-september-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+16+September+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-16-september-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}