Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 15, 2020

Daily Global Market Summary - 15 September 2020

European and US equity markets closed higher across both regions, while APAC closed mix. iTraxx and CDX indices were tighter across IG and high yield, and oil and gold were also higher on the day. 10yr US government bonds and the dollar closed flat on the day, but the US Treasury curve did steepen slightly on the long end. All eyes will be on tomorrow's FOMC meeting statement for more updates on the Fed's economic projections and asset purchase programs, as well as the recently announced change in approach for targeting inflation.

Americas

- US equity indexes closed higher, but near the lows of the day; Nasdaq +1.2%, S&P 500 +0.5%, Russell 2000 +0.1%, and DJIA flat.

- 10yr US govt bonds closed flat/0.68% yield and 30yr bonds +2bps/1.43% yield.

- CDX-NAHY closed -1bp/68bps and CDX-NAHY -9bps/343bps.

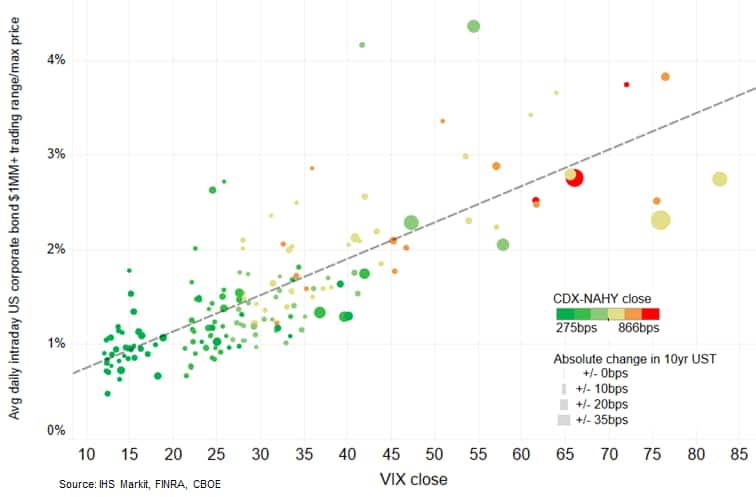

- The below chart compares intraday price dispersion for US

corporate bonds from January-August 2020 versus the VIX, CDX-NAHY

(color of markers), and absolute changes in 10yr US government

bonds (size of markers). The dataset averages the intraday price

ranges divided by the highest price of the day for all trades ≥$1

million, excluding bonds that traded less than five times on a

given day and those with zero price ranges. The chart highlights

the linear relationship between equity and corporate bond price

volatility (R2 = 0.61) in addition to wider CDX-NAHY spreads and

larger government bond yield movements (in both directions) that

further drive price volatility.

- DXY US dollar index closed flat/93.09.

- Gold closed +0.1%/$1,966 per ounce.

- Crude oil closed +2.7%/$38.28 per barrel.

- US total industrial production (IP) rose only 0.4% in August

following increases averaging 3.5% per month over the prior three

months. The details in this report that bear on our GDP tracking

raised our forecast of third-quarter GDP growth 0.1 percentage

point to 29.9%. (IHS Markit Economists Ben Herzon and Lawrence

Nelson)

- Increases in IP from May through August reversed just over one-half (57%) of the sharp contraction from February through April, leaving a substantial portion of recovery for future months.

- Hurricane Laura and Tropical Storm Marco caused sharp declines in oil gas extraction and well drilling in the Gulf of Mexico, contributing to a 2.5% decline in mining IP.

- Utilities IP was down only slightly, as (population-weighted) temperatures were elevated relative to recent historical norms in both July and August.

- Manufacturing IP rose 1.0% in August, down from increases averaging 5.1% per month over the prior three months. While up substantially from a low reached in April, manufacturing IP is still 7.6% below the pre-pandemic (February) level.

- Within manufacturing, both the auto sector and computers and electronics have fully recovered. Outside of autos and high-tech, manufacturing IP has reversed only 52% of the contraction from February to April.

- US import price growth rose at a solid rate in August even as

fuel price growth continued to cool down after a torrid three-month

period, increasing 0.9% month on month (m/m) after a 1.2% m/m rise

in July. (IHS Markit Economist Gordon Greer)

- Among fuel price categories, natural gas price growth outweighed a decline in petroleum prices, while import prices rose 0.7% m/m excluding petroleum.

- Petroleum price growth slowed to a 2.9% m/m rate in August after a strong 16.5% showing in July, while natural gas price growth swung back into the green, rising 12.2% in August following a 9.1% decrease the month prior.

- Excluding fuels, imported goods prices increased 0.7% in August, while 12-month growth came in at 0.8%.

- Industrial supplies and materials price growth registered at 3.5% m/m. Prices of automotive goods and capital goods both ticked up 0.1% m/m.

- The value of the US nominal trade-weighted dollar slipped 1.4% m/m in August and as of 14 September had given up practically all the appreciation seen starting in March during the initial response to COVID-19. Still, in historical context it remains elevated, which will continue to weigh on import price growth. The import price index excludes tariffs.

- The index of exported goods prices increased in August, with the index's month-on-month change falling back to 0.5%. The increase in this index was driven by nonagricultural commodities prices.

- Agricultural export prices growth came in at -2.2% m/m and marked a 2.9% 12-month decrease, while nonagricultural commodities growth registered at 0.8% m/m and was -2.8% versus August in the prior year.

- Industrial supplies and materials export prices increased 2.2% m/m. Capital goods prices increased 0.1% m/m, consumer goods prices rose 0.3% m/m, and automotive goods prices were flat.

- Merck & Co (US) and Seattle Genetics have announced two new strategic oncology collaborations, one for ladiratuzumab vedotin - an investigational antibody-drug conjugate (ADC) targeting LIV-1 - and the other for tyrosine kinase inhibitor Tukysa (tucatinib). Under the terms of the agreement, Merck has entered into a joint development program for mid-stage candidate ladiratuzumab vedotin as a monotherapy and in combination with Keytruda (pembrolizumab) in triple-negative breast cancer (TNBC), hormone receptor-positive (HR+) breast cancer (BC), and other LIV-1-expressing solid tumors. Seattle will receive a USD600-million payment upfront, and Merck will purchase five million shares of the company at a price of USD200 per share for a USD1-billion equity stake in Seattle. Furthermore, Seattle will be eligible to receive up to USD2.6 billion in milestone payments, including USD850 million for development achievements and USD1.85 billion in sales milestones. Both companies will share global development costs for ladiratuzumab vedotin and other LIV-1-targeting ADCs, as well as jointly commercializing the product, and will share future costs and profits equally. Seattle will record sales in the United States, Canada, and Europe, while Merck will record sales in all other regions. Separately, the companies signed a license agreement that grants Merck exclusive commercialization rights for HER2-positive cancer treatment Tukysa (tucatinib) in Asia, the Middle East, and Latin America, as well as other regions outside the US, Canada, and Europe. Seattle will receive USD125 million upfront for the license agreement, and potentially up to USD56 million in milestone payments. Merck will co-fund part of Tukysa's global development, including several trials in HER-positive cancers (such as breast, colorectal, and gastric cancers, among others), including an USD85-million research payment. Seattle will also be eligible for tiered royalties on Tukysa's sales in Merck's territories. The strategic collaborations will notably strengthen and diversify Merck's oncology portfolio, while leveraging the company's development and commercialization expertise to maximize their market potential. Furthermore, for Seattle the deal will provide notable financial support for its ongoing pipeline, with the company eligible to receive up to USD4.2 billion in upfront, milestone, and investment proceeds from the ladiratuzumab vedotin deal alone. (IHS Markit Life Sciences' Margaret Labban)

- Based on the swift increase in demand recorded during the pandemic lock-down, the US blueberry industry does not expect a consumers' U-turn. Sales are projected to remain high through the end of the year and into 2021. "We have seen strong increase in demand for all frozen blueberries (wild and cultivated)," Kasey Cronquist, president of the US Highbush Blueberry Council (USHBC) and North American Blueberry Council (NABC), told IHS Markit "For March through June (weeks ending 03/07 through 06/27) Nielsen reports that frozen blueberry volume sales increased 44% relative to the same period year ago. Dollar sales of frozen blueberries were up +49% during the same period. Given that US consumers increased consumption of food at home, and a refocus on healthy eating we expect strong growth for fresh and frozen blueberries through the end of the year and into 2021." The harvest is over in Mississippi, Georgia, Florida, California, New Jersey and Indiana. In Washington state, the USA's largest producer of frozen cultivated blueberries, harvesting continues. In a report released by NABC on 2 September, the industry reported that between the end of August and the beginning of September little was harvested in eastern Washington, with the exception for a small amount of Rabbiteyes for the fresh production. In western Washington growers were on the last pick of Liberty, on the second or third pick of Legacy and in the middle of picking Elliots. Most harvested fruit is for the processed market but growers with Elliots are trying to harvest for the fresh sector, chasing the current high prices. Overall quality was average to above average, the report read. The USDA reported 5.91 million pounds of conventional and 17.64 million pounds of organic for a total of 23.55 million pounds shipped so far this season. (IHS Markit Food and Agricultural Commodities' Cristina Nanni)

- The Central Bank of Paraguay (Banco Central del Paraguay: BCP)

has released its latest report on key banking sector figures,

covering July. (IHS Markit Banking Risk's Alejandro Duran-Carrete)

- Credit grew by 10% year on year (y/y), mostly driven by local currency loans increasing by 11% y/y.

- Most of the recent growth stems from corporate loans guaranteed by the state through the Guarantee Fund of Paraguay (Fondo de Garantía del Paraguay: FOGAPY).

- Foreign currency loans decreased by 6% y/y in US dollar terms, but this was largely offset by the depreciation of the guarani when measured in local currency.

- Impairments remain contained, with the non-performing-loan (NPL) ratio standing at 3.0% (versus 3.1% in July 2019), with a coverage ratio of 125%.

- The capital adequacy ratio and the tier-1 capital ratio stood at 19.5% and 14.9%, respectively, a stronger position than the 18.4% and 13.9% reported in July 2019.

- Liquidity indicators have improved slightly: the loan-to-deposit ratio stood at 86% (versus 93% displayed a year previously), and liquid assets were at 42.7% of deposits and at 22.1% of total assets.

Europe/Middle East/Africa

- European equity markets closed higher across the region; UK +1.3%, Spain +1.2%, Italy +0.8%, France +0.3%, and Germany +0.2%.

- 10yr European govt bonds closed mixed; Italy -3bps, France/Spain -1bp, Germany flat, and UK +2bps.

- iTraxx-Europe closed -1bp/54bps and iTraxx-Xover -14bps/306bps.

- Brent crude closed +2.3%/$40.53 per barrel.

- Eurozone manufacturing output rose 4.7% m/m in July, according

to the latest official statistics from Eurostat, building on prior

expansions seen in both May and June. The recent gains have pushed

output in the latest three months 0.9% higher than the prior three

months, representing the first increase on this measure since April

2019. The July level of production was also some 16.1% above the

average seen in the second quarter, underscoring the likelihood of

the third quarter registering a strong rebound from the 17%

collapse in production which took place during the second quarter.

(IHS Markit Economist Chris Williamson)

- Production remains some 7.7% below the pre-pandemic peak seen in February, and 7.9% below the level of a year ago. Moreover, the 4.7% gain seen in July was far weaker than the 13.4% and 10.3% gains seen in May and June respectively.

- Historical comparisons indicate that, at 55.7 in August, the latest PMI output index is broadly indicative of output rising at a quarterly rate of 1.0%, which is only modestly higher than the 0.9% gain (correctly) indicated in advance for July. Note that the index gained merely 0.4 index points in August, signaling only a very marginal acceleration in growth.

- With the initial rebound from the height of the pandemic having now taken place, further gains in production in coming months are likely to be modest and to a large extent dependent on the path of the pandemic.

- Further concerns about the sustainability of the recovery are raised by some of the PMI's sub-indices. Although new order inflows continued to rise in August, the rate of increase slowed. Inventories and employment also continued to fall as companies remained heavily focused on cost cutting.

- According to the Office for National Statistics (ONS), the

number of UK workers on payroll plunged by 695,000, or 2.4%,

between March and August (see chart below). The new release is

based on experimental data of the number of employees on payroll

using the HM Revenue and Customs' Pay As You Earn Real Time. (IHS

Markit Economist Raj Badiani)

- The claimant count, which measures the number of people claiming benefit principally for being unemployed, was 2.7 million in August and represented an increase of 120.8%, or 1.5 million, since March. The claimant count also includes the increasing number of people becoming eligible for unemployment-related benefit support despite still being employed.

- The ONS also published its traditional headline employment and unemployment data in the three months to July. According to the ONS, total UK employment (all aged 16 plus) shrunk by 12,000 to 32.924 million in the three months to July compared with the three months to April.

- In annual terms, the number of employed in the three months to July was 0.6% higher compared with a year earlier.

- The number of unemployed people on the Labour Force Survey (LFS) or the International Labour Organization (ILO) measure increased by 62,000 in the three months to July, standing at 1.398 million. The unemployment rate edged up at 4.1%, with a larger rise expected due to falling payroll employment during the period. The statistics department argues that lower-than-expected unemployment rate during the coronavirus disease 2019 (COVID-19) virus crisis is caused by these factors:

- A larger number of people who left their jobs are not currently looking for a new one and are therefore becoming economically inactive, rather than unemployed.

- The current unemployment rate is lagging, with some information gathered before the lockdown began.

- The highest incidence of rising unemployed was among those aged 16 to 24 years, which increased by 76,000 year on year (y/y) to 563,000. In the three months to July. Other age groups experienced falls or very little change over the year.

- Worryingly, the overall unemployment rate rose more notably to 4.4% in July and to 4.8% in the final week of the month, which is likely to be the start of a sustained rise in unemployment.

- The average annual weekly earnings (total pay including bonuses) growth stood at -1.0% in the three months to July. In addition, regular pay (which excludes bonus payments) growth rose for the first time in 12 months but was at a historical low of 0.2% y/y in the three months to July.

- Total pay in real terms fell by an acute 1.8% y/y in the three months to June, which was the fourth drop since January 2018.

- Overall, IHS Markit expects the unemployment rate to climb notably in the second half of 2020, probably close to 10.0% during the latter stages of this year and early 2021, which is equivalent to over 3.0 million people being unemployed.

- The Association of the British Pharmaceutical Industry (ABPI) has welcomed certain aspects of the recently negotiated UK-Japan post-Brexit free trade agreement, released on 11 September. A UK Department for International Trade release on the agreement may be accessed here. In a separate statement on the deal, the ABPI particularly highlighted certain crucial sections that incorporate functions of the existing European Union-Japan mutual recognition agreement (MRA) for medicines, which should allow acceptance by both the United Kingdom and Japan of each other's safety testing and inspection data for medicines intended for export. This should avoid unnecessary administrative duplications of procedure, and may help avoid disruption to supply chains or patient access to medicines traded between the UK and Japan. The ABPI has noted that this should allow UK pharma companies to trade with Japan "largely as they do now" after 1 January 2021. (IHS Markit Life Sciences' Janet Beal)

- Fiat Chrysler Automobiles (FCA) and Groupe PSA have announced a revision to certain terms of their pending merger, as a result of the impact of the COVID-19 pandemic on economic conditions. The merger is expected to be completed by the end of the first quarter of 2021. Although most of the terms of the merger agreement are unchanged, those relating to an FCA special dividend and PSA's stake in supplier Faurecia have been revised. According to the statement, the amendments will "address the liquidity impact on the automotive industry of the COVID-19 pandemic while preserving the economic value and fundamental balance of the original Combination Agreement". The boards of directors of the two companies have approved the changes, the statement says. In the first version of the agreement, FCA had planned a special dividend of EUR5.5 billion (USD6.5 billion); however, this has been reduced to EUR2.9 billion. In addition, PSA's 46% stake in Faurecia will be distributed to all shareholders of the new company, Stellantis, rather than PSA divesting the supplier prior to the merger. The two companies say that FCA and PSA's respective shareholders will receive an equal 23% stake in Faurecia; their 50:50 stake in Stellantis remains unchanged by the retention of Faurecia. In addition, the boards of both companies will consider a potential distribution of EUR500 million to shareholders of each company prior to the merger or of EUR1 billion to all Stellantis shareholders after the merger; however, the boards of both companies will need to approve the distribution when it is appropriate. The distribution will depend on the "performance and outlook of both companies, market conditions and performance in the intervening period". In addition, the companies have increased their estimate of potential run-rate synergies, and now expect Stellantis to see annual run-rate synergies of EUR5 billion per year, up from an initial estimate of EUR3.7 billion. However, the one-time implementation cost to achieve the synergies has increased from EUR2.8 billion to EUR4 billion. The revisions to the terms of the merger agreement are not a surprise given the backdrop of the COVID-19 pandemic on economies and the auto industry, regionally and globally. Because of the COVID-19 pandemic, both companies have lost production, delayed program launches, and seen soft sales impact on their financial results in 2020. (IHS Markit AutoIntelligence's Stephanie Brinley)

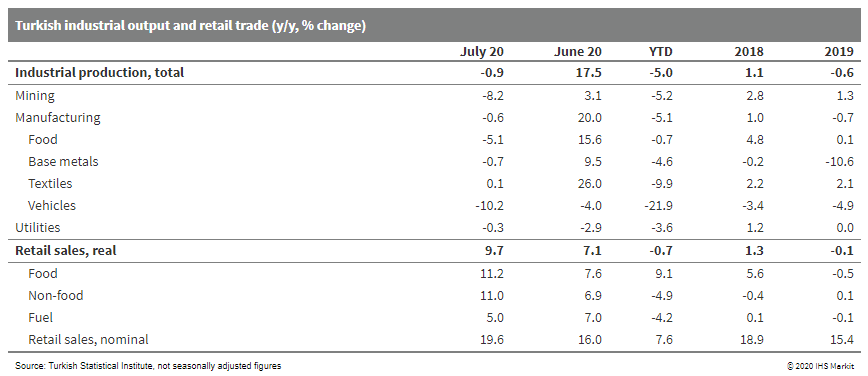

- In July 2020, total industrial production in Turkey grew by

8.4% m/m in seasonally adjusted terms. Although total monthly

output has surged by 51.0% since April, total production remained

1.6% lower than it had been in February, immediately before the

ramping up of social-distancing requirements to fight the spread of

the COVID-19 virus. (IHS Markit Economist Andrew Birch)

- Leading confidence indices previously suggested that the m/m recovery for industrial production remained strong through July. After falling to 33.4 as of April, the IHS Markit Purchasing Managers' Index (PMI) had rallied to 56.9 as of July. The index had surpassed 50 - the demarcation of anticipated growing or shrinking activity - as of June.

- Similarly, the easing of restrictions has led to retail trade activity surging in recent months, with total retail trade 37.6% higher in July than it had been in April. Nonetheless, total retail trade activity was still 2.0% lower than in February.

- The central bank was encouraging rapid credit growth to stimulate consumer activity, so as to counter the negative impact of the COVID-19 virus. The Banking Regulation and Supervision Agency reported that as of end-July, total annual credit growth had more than tripled to 34.5% - compared with the 10.8% credit growth that was reported to have expanded in 2019 as a whole.

- The August leading indicators reflect that recovery is cooling

off. The PMI slipped to 54.3, still strong but down from July

nonetheless. Similarly, confidence in the retail trade and

construction sectors has stalled, while consumer confidence slipped

somewhat. The sharp depreciation of the lira throughout the month

is likely to have undermined confidence. Moreover, the central bank

tightened monetary policy modestly to stabilize the currency.

- On 11 September, Moody's downgraded its Turkey issuer and

senior unsecured debt ratings by one notch, to B2 (equivalent to

57.5 on the IHS Markit scale of 0-100). With the move, Moody's

sovereign risk rating is one half notch better than that of IHS

Markit's. In March 2020, IHS Markit downgraded its medium-term

sovereign risk rating by one notch. (IHS Markit Economist Andrew

Birch)

- In its press release alongside the move, Moody's listed three primary reasons for the downgrade. The first was a growing possibility of a balance-of-payments crisis. Throughout 2020, Turkey's current-account deficit has been rapidly rising (see Turkey: 14 September 2020: Turkey's current-account deficit continues rapid growth at beginning of H2).

- Meanwhile, net capital inflows have faltered, undermining a key source of financing for the current-account deficit. Sustained, expansionary monetary policy from the Central Bank of the Republic of Turkey (Türkiye Cumhuriyet Merkez Bankası: TCMB) has fuelled strong credit growth and negative real interest rates, providing little incentive for portfolio investment. Through the first seven months of 2020, Turkey suffered almost USD12.5 billion of net portfolio investment outflows.

- The growing balance-of-payments vulnerability undermined the value of the lira, which has faltered particularly badly since late July. The TCMB's defense of the lira has severely depleted its foreign-currency reserves. The bank has attempted to rebuild these reserves through a rapid escalation of the use of short-term forward swaps with domestic banks. Although this has raised headline reserve levels, it has done so at the expense of short-term debt.

- Depleted foreign-currency reserves severely compromise Turkey's ability to finance its external obligations. Lost tourism revenues during the third quarter will only intensify the worsening of the country's current-account deficit.

- The second highlighted reason for the downgrade was the deterioration of institutional integrity. Since President Recep Tayyip Erdoğan replaced the TCMB governor in mid-2019, the bank has acted as an extension of the government, pursuing political goals of stimulating domestic demand, abandoning its official duties to stabilize the currency and manage inflation.

- South African pharmaceutical firm Aspen Pharmacare Holdings plans to expand its product portfolio in emerging markets through a combination of organic growth and acquisitions, according to the company's deputy chief executive Gus Attridge. Attridge reportedly told Reuters that, as part of a new strategy, "The focus of the business is to take it to a significant level in countries where we are well established with a strong base." Reuters quoted Attridge saying that "the company preferred exiting from developed markets where it lacked scale". Specifically, Aspen will seek acquisition opportunities for its commercial pharmaceuticals business in countries such as China, South Africa, and in Latin America, as well as in Australia, according to Reuters. Aspen's emerging-market expansion plans come after it last week announced an agreement to sell its European thrombosis business to Mylan (US/Netherlands) for EUR642 million (USD756 million), while retaining the business unit in emerging markets. Funds from the sale will be used to ease Aspen's existing debt levels, although Mylan has said that it will only make an initial upfront payment of EUR263.2 million upon completion of the deal in late 2020, while the remainder will be deferred until mid-2021. (IHS Markit Life Sciences' Sacha Baggili)

Asia-Pacific

- APAC equity markets closed mixed; Japan -0.4%, Australia -0.1%, Hong Kong +0.4%, Mainland China +0.5%, and India/South Korea +0.7%.

- Mainland China's industrial value-added growth accelerated by

0.8 percentage point to 5.6% year on year (y/y) in August and the

up-to-date growth recovered to expansion for the first since

beginning of the year. Meanwhile, the month on month (m/m) growth

edged up to 1.02%, compared to 0.98% a month ago and notably above

the three-year average of 0.2% in August. (IHS Markit Economist

Yating Xu)

- 29 out of 41 surveyed sectors reported y/y production growth in August, up from 25 in July. The headline growth was driven by acceleration in mining and utilities as the negative impact of flood fades, while manufacturing growth was unchanged from a month ago. Equipment and high-tech manufacturing continued to lead the manufacturing growth, while auto manufacturing growth declined with high base effect a year ago.

- By product, consumption and infrastructure related production led the acceleration with cement iron ore, non-ferrous metals and coal all expanding faster and construction machinery such as excavators and scrapers maintained growth rate above 30% y/y. Moreover, power generation growth surged to 6.8% y/y from 1.9% y/y in July. However, auto production growth slowed by 19.2 percentage points from July to 7.6% y/y in August.

- All ownerships reported acceleration in y/y industrial value-added growth from a month ago, with private sector leading the growth; eastern area continued to lead the national growth.

- Service production index rose 0.5 percentage points to 4.0% in August, but it remained far below the three-average level of 7.3% and the year-to-date index stayed in 3.6% y/y contraction.

- By sector, service production index of information and software, real estate, transportation and post led the headline acceleration.

- Contraction of the year-to-date FAI narrowed by 1.3 percentage points from July to 0.3% y/y in August and the estimated de-cumulative FAI growth continued to accelerate to 9.3% year on year from 8.3% y/y in July. Particularly, private investment However, the month-on-month FAI growth further slowed to 4.2%.

- Real estate and manufacturing were the main drivers to August investment growth. Year-to-date real estate investment accelerated to 4.6% year on year and the estimated de-cumulative growth rose to 12.1% year on year, the fastest since May 2019. Although year-to-date manufacturing investment remained in contraction, the de-cumulative growth recovered to expansion for the first time in the year as industrial profits stayed in expansion for two consecutive months and overseas demand rebounded. Additionally, low base in the same period last contributed to the recovery. Electronic equipment and pharmaceutical led the manufacturing. However, de-cumulative infrastructure investment growth slowed to 4% year on year from 7.9% year on year in July.

- Supported by the steady increase in housing price inflation and decline in mortgage rate, housing sales market continued to improve. Decline in floor space of commercial housing sold soften by 2.5 percentage points to 2.5% year on year through August and housing sales value registered a 4.1% year on year expansion, with the estimated de-cumulative figures accelerating to 13.7% and 27.1% respectively, the highest level in three years.

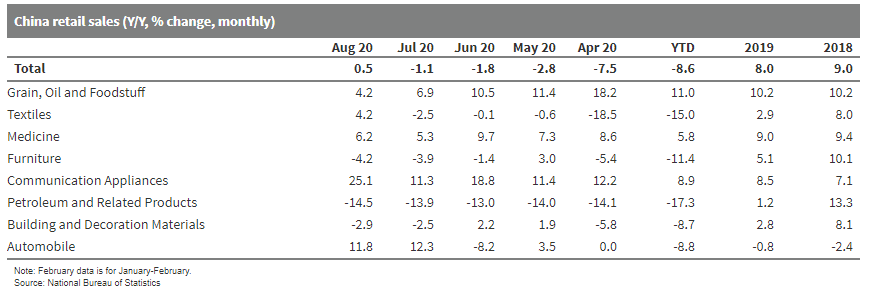

- Nominal retail sales increased 0.5% year on year in August from 1.1% year on year contraction in July. Retail sales growth in large firms improved to 4.0% year on year expansion. However, the figure remained in 8.6% year on year contraction excluding auto sales.

- Although major indicators of industrial and service production, investment, consumption, exports, total social financing and surveyed unemployment rate all accelerated in August in year on year terms, the overall level remained below the tree-year average and the month on month momentum moderated. Adding to the low core inflation, final demand remains weak, which indicates that further tightening of monetary policy seems unlikely.

- Positive factors include an expected rebound in infrastructure investment with the acceleration of local bond issuance and fiscal spending and recovery in private investment supported by industrial profits. Supported by exports and consumption, industrial production and manufacturing investment may continue to accelerate over the near term.

- IHS Markit expects a continuing but slower recovery to the year

end. The full-year GDP growth for 2020 is likely to be revised up

from the current 1.5% year on year.

- Nongfu Spring's high-profile Hong Kong IPO have again raised investors' interest in China's bottled water market. This special report discusses the state of the market, providing a snapshot of competition landscape in the high-end market. Everyday European bottled water brands such as San Pellegrino, Evian and Perrier water are marketed as upmarket lifestyle products in China. There is still growth opportunity for European brands, but competition from local products is persistent. The country's total production of soft drinks was around 177.6 million tons in 2019, which included bottled water, juices, carbonates, RTD coffee and RTD tea, functional drinks, sports drinks and some other specialty drinks. Guangdong is the largest producing region, accounting for around 18% of the total output. Retail soft drinks sales were USD82.7 billion, according to Euromonitor's data. Bottled water generated the most value sales. Functional beverages saw strong growth. Attracted by high profit margins, an increasing number of companies in the soft drinks market introduced functional beverages. Even dairy companies made an inroad into the functional arena. Uni-President has Gouran brand; Yili has introduced Huanxingyuan sport drinks. Essentially, high-end bottled water, functional beverages and NFC juices are the bright spots. The retail channel saw rapid development of vending machines and e-commerce. However, bricks & mortar stores continued to account for 90% of the retail sales. Although the government has set industry standards to differentiate natural mineral water from other waters such as purified water and distilled water, consumers are still confused about the definition. The number of natural mineral water sources is limited. Acquisition of quality natural water resources give competitive advantages. Thus, the marketing and story-telling of a source is an ongoing task. According to Qcc.com, a leading Chinese company house, there are about 64,000 relevant bottled water companies (10 September), including 7,300 new registrations in 2019, up 103% compared with 10 years ago. In H1 2020, new entries grew by 8.5% compared with a year ago. Among these, 71% of the companies have a registered capital of less than CNY1.0 million. That means that bottled water has a low entry bar. By geographical location, Shandong leads the industry with 6,000 companies, followed by Guangdong and Henan. (IHS Markit Food and Agricultural Commodities' Hope Lee)

- The Chinese city of Shanghai plans to promote intelligent connected vehicles (ICVs) by expanding the scope of road testing, reports SHINE News. The city plans to expand the length of roads for ICV testing to nearly 1,300 kilometers in Jiading district, covering an area of 464 square kilometers. This will enable automakers and tech companies to make use of varied scenarios such as robotaxis, 5G smart heavy trucks carrying cargo, and smart public transport, as well as urban and tourism scenarios. The city also plans to co-operate with Jiangsu, Zhejiang, and Anhui provinces in the Yangtze River Delta region to promote integrated development of ICVs. Shanghai opened its first road section for testing of ICVs in March 2018. The city has launched road testing of these vehicles in Jiading, Lingang, and Fengxian districts, and the test zones span over 131 km. To date, Shanghai has issued 119 license plates for autonomous car testing to 20 companies. Recently, AutoX opened a robotaxi service for the public in Shanghai after conducting trials with signed-up users. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Alibaba Group, the Chinese e-commerce giant, is in talks to invest USD3 billion in ride-hailing firm Grab by acquiring some stock currently owned by Uber, reports Bloomberg. The deal may represent one of Alibaba's biggest investments in Southeast Asia since its first investment in Lazada in 2016. Alibaba's potential investment would give access to data of Grab's users and this might also boost Lazada's user base through integration of Grab's delivery network. This latest development comes at a time when ride-hailing services have been hit by the COVID-19 virus pandemic and demand for digital retail transactions has gone up. This year, Grab laid off 360 employees, representing 5% of its total workforce, owing to the pandemic. Since the start of the pandemic, Grab has added food-delivery and insurance services to its platform. Recently, the company raised USD200 million in funding from South Korean private equity firm STIC Investments. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Chinese autonomous vehicle (AV) startup Idriverplus has raised over CNY100 million (USD14.6 million) in a Series C+ funding round, reports VentureBeat. The round was led by Xin Ding Capital and Huaxia Weiming Investment and the proceeds will be used towards research and development of the startup's AV technology, deploying robotaxi fleets, and accelerating production of cleaning robots and other specialised robotics products. In addition, the infused capital will be used to recruit top talents from the AV domain and to expand into overseas markets. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The Indian government has sought parliament's approval to

inject INR200 billion (USD2.8 billion) into state-owned banks,

according to various Indian newspapers. The proposal does not list

which banks will receive the injection and an unnamed government

official noted that although the funding is being sought, the

government has now decided not to 'front-load' the capital into

banks and the injection will depend on the need to satisfy

regulatory requirements towards the end of the year. (IHS Markit

Banking Risk's Angus Lam)

- IHS Markit had expected the Indian government to inject capital into banks after the likelihood of this happening in April 2020 at the height of the COVID-19-virus lockdown. Although the INR200-billion injection is at the lower end of the government's own estimate of INR200-250 billion, this is a departure from the budget announcement that there will be no capital injection into banks in FY2020/21 following the bumper injection in the last several years and ahead of the banking sector merger.

- Faced with a loan moratorium that originally ended at the end of August but has since been extended to end-September after a Supreme Court ruling in mid-September and also the delayed implementation of the last tranche of the capital conservation buffer, banks did not encounter significant capital pressure in much of 2020. However, when the moratorium ends and the one-off loan restructuring is implemented, banks are likely to face capital pressure to provision for loans despite the provisioning standards already being lower for loan restructuring than those of classifying the loans as non-performing.

- New vehicle sales in the Philippines fell by 39.5% year on year

(y/y) during August to 17,906 units, reports The Philippine Star,

citing data released by the Chamber of Automotive Manufacturers of

the Philippines Incorporated (CAMPI) and the Truck Manufacturers

Association (TMA). (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Sales of passenger vehicles (PVs) stood at 5,454 units during the month, down by 38% y/y, while commercial vehicle (CV) sales were down by 40% y/y to 12,452 units.

- On a year-to-date (YTD) basis, total sales were down by 47.6% y/y to 123,489 units, comprising 35,523 units of PVs, down by 50% y/y, and 87,966 units of CVs, down by 47% y/y.

- CAMPI president Rommel Gutierrez said, "Spending remains a challenge, especially for big-ticket items such as cars. Any restrictive policies such as safeguard duty will only limit the industry's capability to navigate the current crisis." Gutierrez expects to achieve a revised sales forecast of 240,000 units in 2020 on the back of aggressive promotions by automakers.

- The plunge in the Philippines' new vehicle market during the first eight months of 2020 can be attributed to the fact that the country was in a state of public health emergency and that the government had imposed the enhanced community quarantine (ECQ) order from the second half of March owing to the COVID-19 virus pandemic.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-15-september-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-15-september-2020.html&text=Daily+Global+Market+Summary+-+15+September+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-15-september-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 15 September 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-15-september-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+15+September+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-15-september-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}