All major APAC, European, and US equity indices closed lower. US government bonds closed sharply higher, while most benchmark European bonds closed lower. European iTraxx and CDX-NA closed wider across IG and high yield. The US dollar, oil, and gold closed higher, while natural gas, silver, and copper were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- All major US equity indices closed lower for a second consecutive day; Russell 2000 -1.0%, DJIA -1.4%, S&P 500 -1.9%, and Nasdaq -2.8%.

- 10yr US govt bonds closed -11bps/1.92% yield and 30yr bonds -6bps/2.24% yield, rallying significantly during the National Security Advisor Jake Sullivan's midafternoon press conference warning on a Russian invasion of Ukraine.

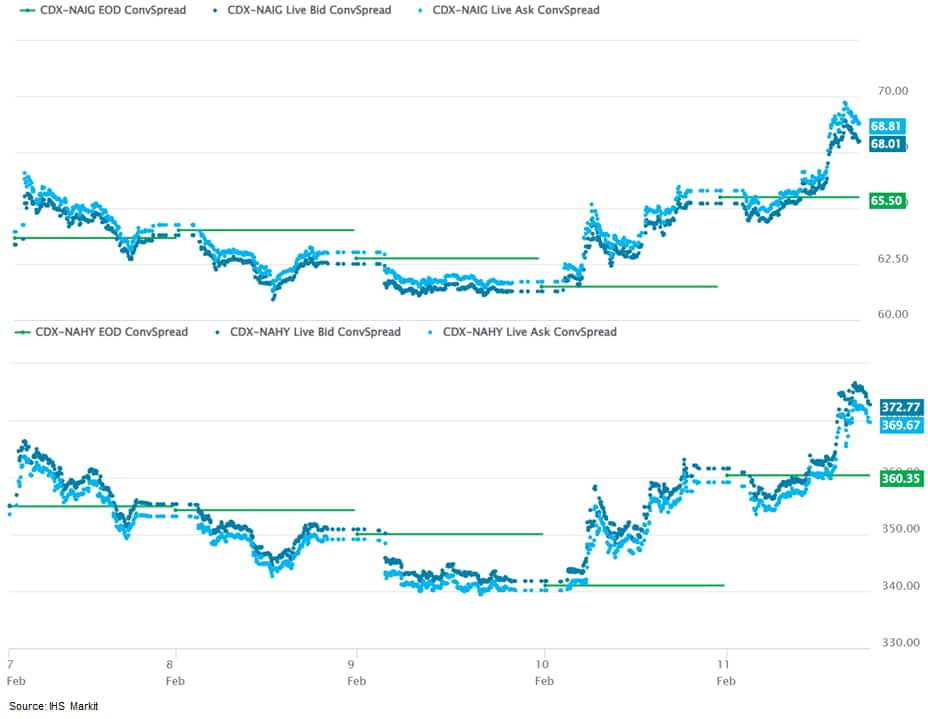

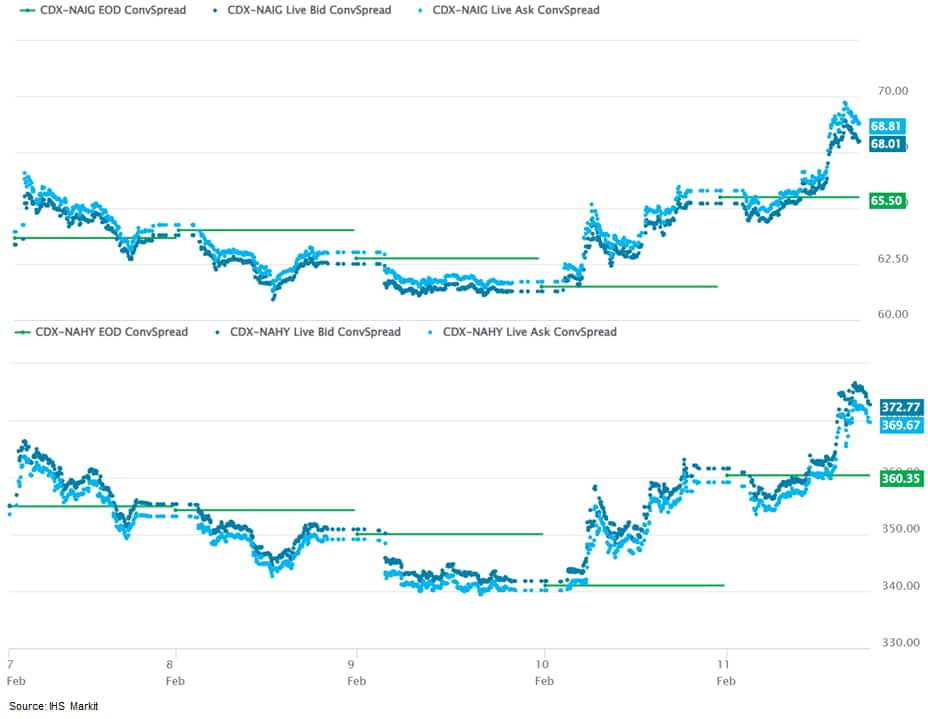

- CDX-NAIG closed +3bps/68bps and CDX-NAHY +11bps/371bps, which is +4bps and +16bps week-over-week, respectively.

- DXY US dollar index closed +0.6%/96.08.

- The U.S. believes Russia could take offensive military action or attempt to spark a conflict inside Ukraine as early as next week, before the Winter Olympics in Beijing wrap up, National Security Advisor Jake Sullivan said. Conflict "could begin during the Olympics despite a lot of speculation that it could only happen after" the Winter Games end, Sullivan told reporters at the White House on Friday. "What we can say is that there is a credible prospect that a Russian military action would take place even before the end of the Olympics." (Bloomberg)

- Gold closed +0.3%/$1,842 per troy oz, silver -0.7%/$23.37 per troy oz, and copper -3.3%/$4.51 per pound.

- Crude oil closed +3.6%/$93.10 per barrel and natural gas closed -0.5%/$3.94 per mmbtu.

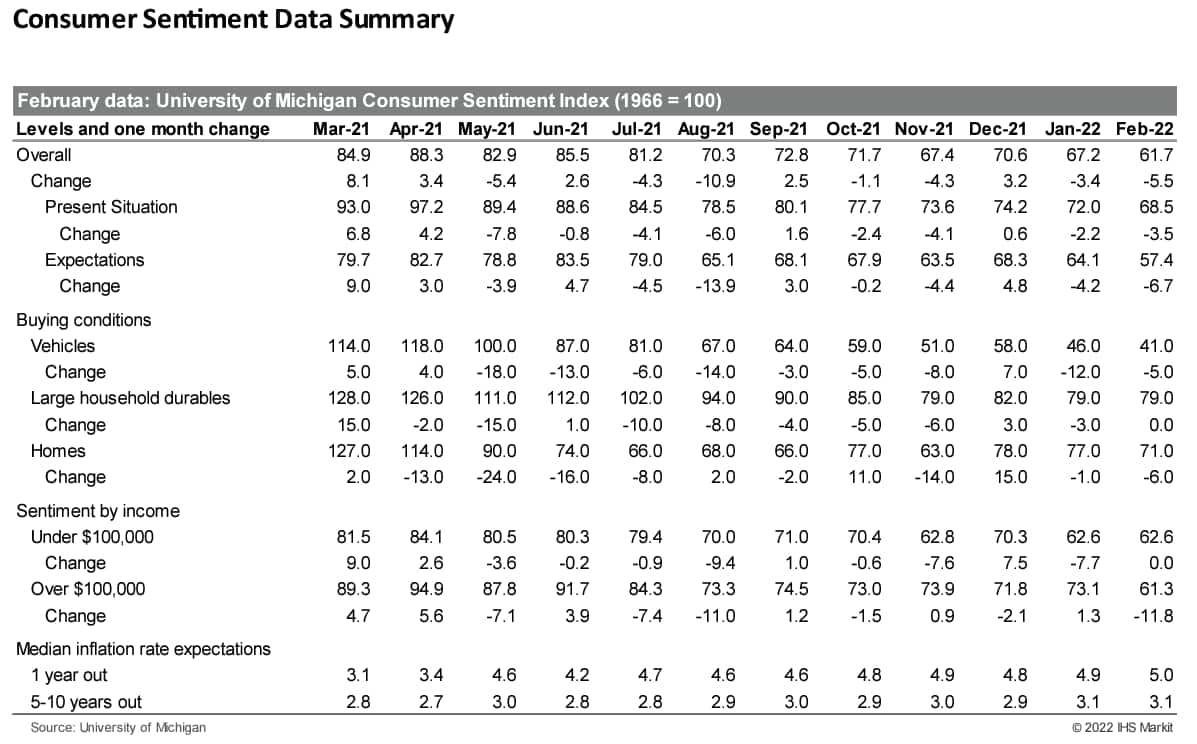

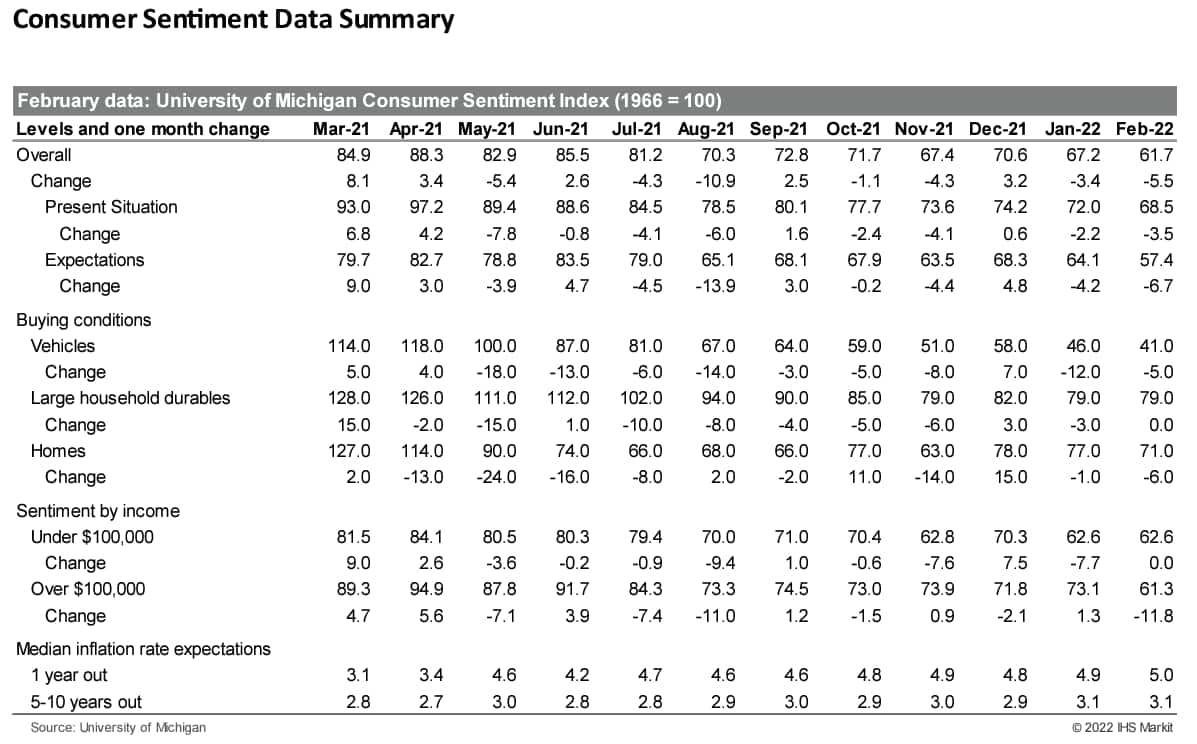

- The US University of Michigan Consumer Sentiment Index fell 5.5 points to 61.7 in the preliminary February reading—crashing to its lowest level since November 2011. A combination of rising inflation, low confidence in government economic policies, and a dim view of the long-term economic outlook has created the perfect storm for consumer sentiment—sentiment is down 30.1% since April 2021. (IHS Markit Economists Akshat Goel and William Magee)

- While there are myriad factors pulling down sentiment, escalating inflation appears to be the foremost source of drag. At 7.5%, the 12-month increase in the consumer price index (CPI) in January was the highest in nearly four decades. The median expected one-year inflation rate in the University of Michigan survey edged higher 0.1 percentage point to 5.0%, its highest level since 2008.

- While households with incomes below $100,000 per year are more sensitive to higher consumer prices, households with incomes above $100,000 are also feeling the impact. Indeed, the decline in sentiment in February was driven entirely by households earning more than $100,000, with their sentiment index falling 11.8 points to 61.3.

- The index of buying conditions for automobiles and homes fell by 5.0 points and 6.0 points, respectively, in February as high prices and limited inventories continue to be a drag on buying sentiment.

- The recent trend in consumer sentiment underscores the downside risks related to a prolonged period of above-trend inflation. However, inflation risks are balanced by the IHS Markit expectation for solid job and wage growth in the coming months, which should continue to support ongoing growth of consumer spending. Sentiment will track spending more closely as inflation subsides, although these may not align until 2023.

- A new study from state health officials in Minnesota has turned up data raising concerns about children's exposure to arsenic from rice. The study, which tested urine samples from more than 230 preschool children from one urban and one rural area in the state, found evidence that children who consumed rice more frequently, invariably had a higher concentration of arsenic in their urine. (IHS Markit Food and Agricultural Policy's Margarita Raycheva)

- In fact, children who ate rice three or more times per day had urine arsenic levels that were over twice as high as kids who did not eat rice.

- According to the study, children who ate no rice for three days before testing had 3.7 mg/L of arsenic in their urine, compared to 4.5mg/L of arsenic in children who reported eating rice twice and 8.1 mg/L for children who ate rice three times or more before testing.

- The Minnesota data also pointed to possible inequities for children in certain groups, as it indicated that urban area children who came from lower income families were more likely to consume rice more often than their rural counterparts and, therefore, have higher arsenic concentrations.

- Asian children, who represented 21% of the urban study group and just 1% of the rural group, were also more likely to eat rice frequently and had higher levels of arsenic in their urine.

- While the study raises concerns about arsenic exposure for Minnesota health officials, it has also caught the attention of public health advocates who have been urging FDA to take a more aggressive approach to reducing the presence of toxic heavy metals in foods.

- Speaking to IHS Markit on Thursday (February 10), Tom Neltner, the chemicals policy director of the Environmental Defense Fund (EDF), said the findings of the study are valuable and generally confirm what is already known about the presence of arsenic in rice.

- California's Department of Motor Vehicles (DMV), which administers the US state's program on autonomous vehicle (AV) testing, has released the latest annual company reports on testing results. The DMV requires automakers and others testing AVs in the state to report annually the number of disengagements (when the car required a human to take over) and miles driven, although only those with licenses to operate for the full year are required to file a report. Most reports are broken down by month and contain some explanation of why disengagements happened, although there is no prescribed format for these reports. The DMV does not publish its own commentary. In 2021, 50 companies held AV testing permits, out of which only 22 companies tested their AVs on public roads during the reporting period. In 2021, these companies' AV fleets with human safety drivers behind the wheel travelled nearly 4.1 million miles, an increase of more than 2 million miles from the previous reporting cycle. About 25,000 additional miles were travelled by driverless vehicles with no human safety driver behind the wheel. In 2021, Waymo's AVs recorded the most miles at 2.3 million, and its disengagement rate stood at 0.128 per 1,000 autonomous miles, or one per 7,800 miles. General Motors' (GM) Cruise followed with 882,471 miles driven with a human safety operator and travelled 6,365 miles by driverless vehicles in 2021. Cruise disengagement rate dropped to 0.024 per 1,000 autonomous driven miles, or one per 42,022 miles, in 2021. These two companies carried out the most miles of testing by far. Pony.ai came in third place with 305,617 miles, followed by Zoox with 155,125. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- On February 10, the Alberta Utilities Commission approved applications from Buffalo Plains Wind Farm Inc. to construct and operate the 514.6-MW Buffalo Plains Wind Farm and the Amber 611S Substation. (IHS Markit PointLogic's Barry Cassell)

- In December 2020, Buffalo Plains filed applications for these approvals. The project would consist of eighty-three 6.2-MW Siemens Gamesa SGRE 6.0-170 wind turbines with a hub height of 115 meters, a rotor diameter of 170 meters and an overall blade tip height of 200 meters. Buffalo Plains will submit a separate application requesting approval to build a transmission line and associated infrastructure to connect the project to the Alberta Interconnected Electric System.

- The project is located on approximately 17,500 acres of private land in Vulcan County, about two kilometers west of Lomond.

- Unless otherwise authorized by the Commission, the approval mandates that construction of this facility needs to be completed by April 30, 2024. Notably, the Commission pretty routinely grants extensions of such deadlines, when asked for. Buffalo Plains anticipates that construction of the project would be completed in the summer of 2023.

- Buffalo Plains is a wholly-owned subsidiary of ABO Wind AG, a power producer that acquires, develops, builds, owns, and operates wind, solar, and biogas facilities across North America and the world.

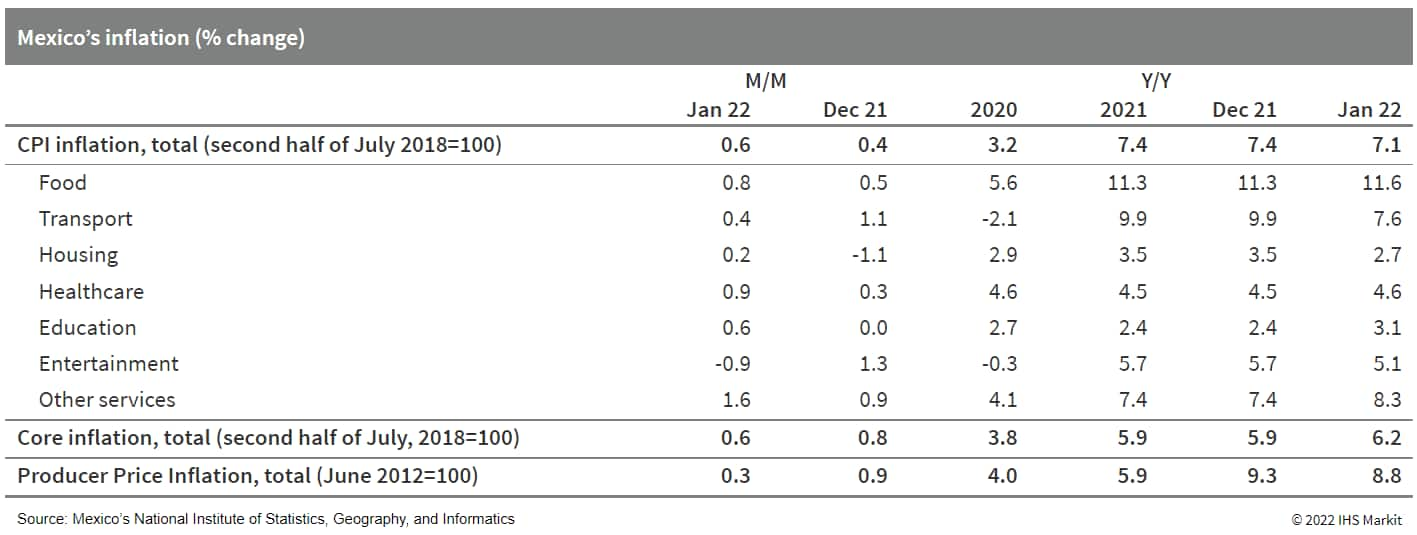

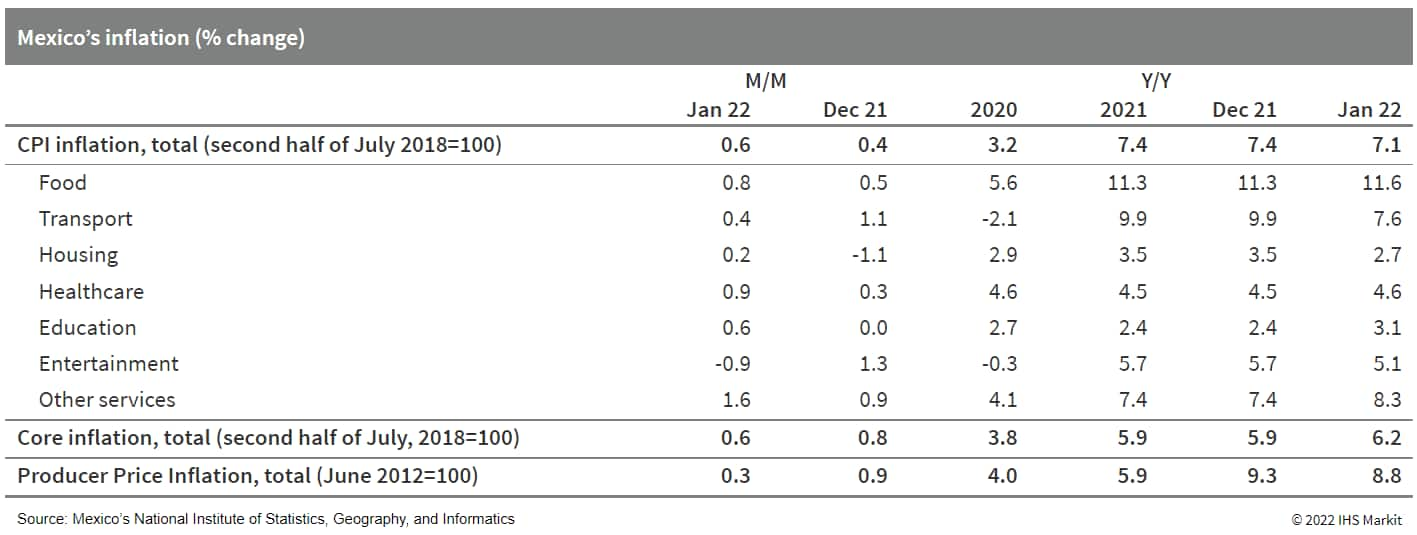

- The Bank of Mexico (Banco de México: Banxico) during its 10 February policy meeting increased the policy rate from 5.5% to 6.0%. This marks the sixth time in as many consecutive meetings that the monetary authority has increased the policy rate as it battles against high inflation. (IHS Markit Economist Rafael Amiel)

- In recent quarters, similar to most regions in the world, the drivers of inflation in Mexico have been high energy and food prices, supply chain disruption, and shortages. At the end of January, annual inflation amounted to 7.1%, well above Banxico's target of 3.0% +/- 1 percentage point.

- A major concern is that core inflation, which excludes items with high price volatile such as agricultural products and energy-related goods, has increased to 6.2%, revealing that there have been second-round effects or contagion from the price escalation that began in the energy and food sectors.

- In terms of risks, the bank highlights several upside risks: external inflationary pressures, the depreciation of the exchange rate, increases in costs, persistently high core inflation, and high energy and food prices.

- Banxico has also highlighted downside risks to inflation: a higher impact from the slack of the economy, the appreciation of the Mexican peso, and possible social-distancing measures that may reduce further demand for services.

Europe/Middle East/Africa

- All major European equity markets closed lower; UK -0.2%, Germany -0.4%, Italy -0.8%, Spain -1.0%, and France -1.3%.

- Most 10yr European govt bonds closed lower except for France flat; Germany +1bp, Spain/UK +2bps, and Italy +4bps.

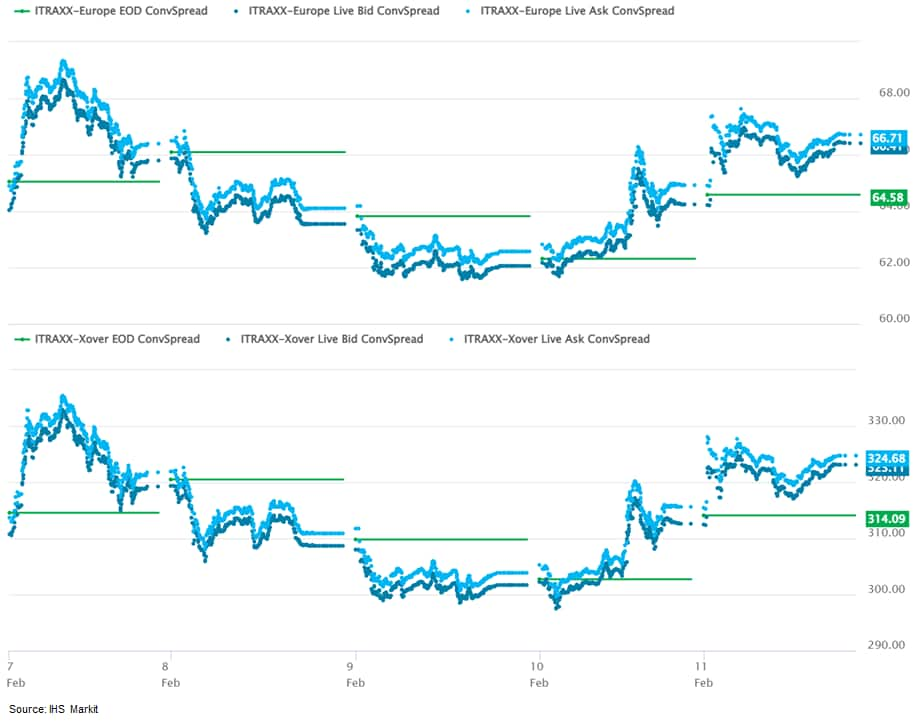

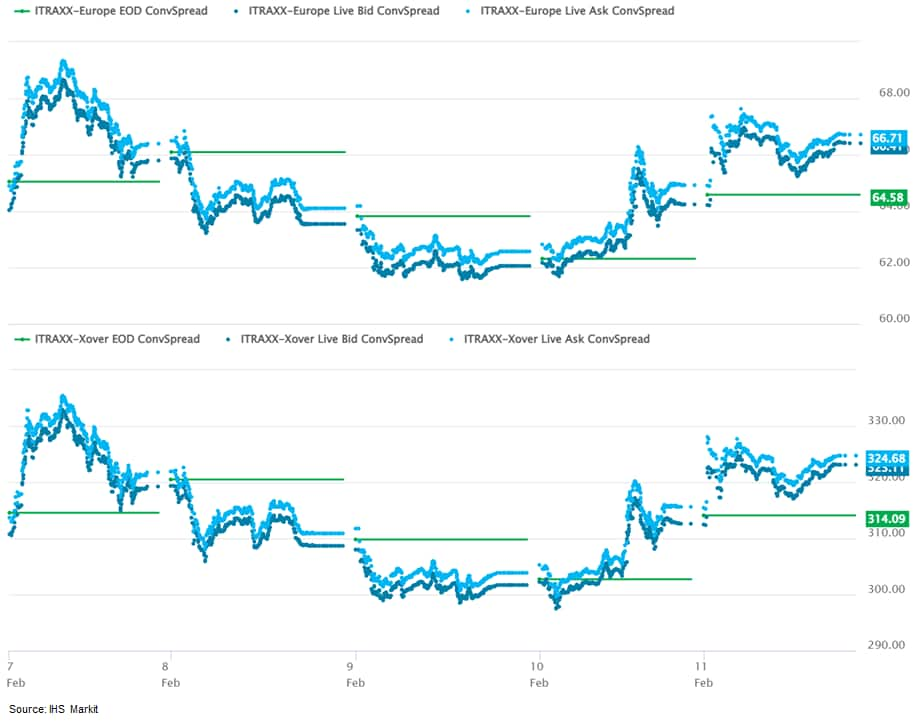

- iTraxx-Europe closed +2bps/67bps and iTraxx-Xover +10bps/324bps, which is +2bps and +9bps week-over-week, respectively.

- Brent crude closed +3.3%/$94.44 per barrel.

- Despite the emergence of the Omicron variant of COVID-19 and some renewed restrictions during December 2021, the UK's real GDP growth was resilient during the fourth quarter of 2021. However, the immediate real GDP outlook is more challenging because of intensifying pressure on UK households from shrinking real incomes in line with soaring energy prices alongside increased tax burdens from 1 April. (IHS Markit Economist Raj Badiani)

- The Office for National Statistics (ONS) has reported that UK real GDP in volume terms grew by 1.0% quarter on quarter (q/q) in the fourth quarter of 2021, compared with an identical rise in the third.

- This was broadly in line with our estimate of a 0.9% q/q gain prior to the release.

- Real GDP in the final quarter of 2021 was still 0.4% below its pre-pandemic level in the final quarter of 2019. Meanwhile, real GDP losses endured in the United States, China, and the eurozone during the pandemic have been reclaimed.

- In annual terms, the economy rose by 6.5% year on year (y/y) during the fourth quarter of last year, which implied that the economy grew by 7.5% in 2021, the largest gain since the Second World War. However, this was after a 9.4% contraction in 2020, with the UK enduring a larger-than-average hit from COVID-19 and public health restrictions.

- A breakdown by expenditure reveals that household consumption yet again provide a falling but still solid boost to activity between the third and fourth quarters of 2021, despite the return of some COVID-19 restrictions during December 2021.

- Aston Martin is said to be in talks with startup Britishvolt about the supply of batteries, reports The Daily Mail. Discussions are said to be in the early stages, but the report added that a "firm deal" could be announced within weeks. The announcement comes in the wake of Lotus signing a memorandum of understanding (MoU) with Britishvolt on "the co-development of an innovative new battery cell package to power the next generation of electric sports cars from Lotus. Britishvolt has indicated that there might be further announcements made about both customer MoUs and research and development (R&D) collaborations. This coincides with Aston Martin confirming plans to electrify its entire range to some degree by 2026, and such a relationship could make a big contribution towards this. However, while deals with both Aston Martin and Lotus would be important steps for Britishvolt, they would require relatively low battery volumes compared to that which can be eventually manufactured by its under-construction facility in Blyth. (IHS Markit AutoIntelligence's Ian Fletcher)

- After a landmark year for edible insects in 2021, with the first two approvals under the EU's 2015 novel foods regulation (2283/2015), 2022 is promising to be just as momentous after the European Commission approved the third and fourth insect product ranges on 9 and 11 February. (IHS Markit Food and Agricultural Policy's Sara Lewis)

- Dutch producer Fair Insects, which is the edible insect arm of Protix, produces both the yellow mealworm (Tenebrio molitor) and house cricket (Acheta domesticus) authorised in Commission regulations updating the Union list of approved novel foods under a 2017 implementing law (2017/2470) to the framework novel foods legislation.

- The implementing regulation authorizing dried and powdered yellow mealworm (Tenebrio molitor) as a novel food was published in the EU's Official Journal (OJ) on 9 February, while the implementing regulation authorizing whole Acheta domesticus in frozen, dried, and powder (ground) forms to be used as snacks and as food ingredient was published in the OJ two days later. Both are authorized "in a number of food products for the general population".

- The two applications have travelled through the EU authorization procedure together, with member states greenlighting approval on 8 December following a week-long written procedure in the Standing Committee on Plants, Animals, Food and Feed (PAFF) novel foods and toxicological safety of the food chain section.

- However, IHS Markit learned that the time lag between the Commission adopting the two implementing regulations and subsequent publication in the OJ was down to translation delays, rather than reluctance to approve the house cricket, or any other problem with the application.

- Both insect ranges will benefit from five years' proprietary data protection because the European Food Safety Authority (EFSA) judged that it could not have reached the conclusions on their safety without the studies that Fair Insects provided in each case.

- Protection means that a competitor cannot put a generic product on the market using Fair Insects data until 1 March 2027 for the yellow mealworm and two days later for the house cricket.

- Valeo has announced that it has agreed to acquire Siemens' stake in their Valeo Siemens eAutomotive joint venture (JV). According to a statement, the French supplier will acquire the 50% stake for a cash amount of EUR277 million on a debt-free basis, which will lead to a EUR741-million increase in Valeo's net debt. The company said it will be integrated into its "Powertrain Systems" business group after 1 July 2022, which will be renamed Valeo Powertrain Systems". (IHS Markit AutoIntelligence's Ian Fletcher)

- ZITY by Mobilize, a joint venture (JV) between Ferrovial and Renault, has plans to launch its electric car-sharing service in Lyon (France) next month. The company also plans to expand its service to other European cities later this year and sign more strategic agreements with Mobility as a Service (MaaS) suppliers. Javier Mateos, Zity's CEO, said, "The pandemic has resulted in much less traffic in cities like Madrid, and journey times, averaging 10km/trip, are five minutes shorter than they were before COVID-19. This not only translates into less congestion and a better commuting experience, but also into a much lower cost when people use the carsharing service." ZITY by Mobilize, which is available in Madrid (Spain) and Paris (France), has a fleet of 1,300 electric vehicles (EVs) including the Renault Zoe and Dacia Spring. To date, the company has more than 500,000 registered customers. Mobilize, which was created as part of Renault's new Renaulution transformation strategy, aims to develop profitability in new areas such as data, mobility, and energy-related services for vehicle users. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- RWE has selected Atlantique Offshore Energy for the engineering, procurement, construction, installation, and commissioning (EPCIC) scope for the offshore substation of its 350 MW F.E.W. Baltic II wind farm in the Polish Baltic Sea. The substation will collect and export power from the wind farm through high voltage submarine cables. Design activities have begun and early permitting activities are expected this year. Atlantique Offshore Energy, the marine energy business of Chantiers de l'Atlantique, said that full installation of the substation is schedule for 2025. Following the delivery of the Arkona offshore substation in 2018, this is the second offshore wind project that Chantiers de l'Atlantique and RWE are working together on. In April 2021, the Polish Energy Regulatory Office awarded a Contract for Difference (CfD) to the F.E.W. Baltic II. The CfD award is subject to final approval from the European Commission, which is expected in 2022. (IHS Markit Upstream Costs and Technology's Monish Thakkar)

- Geospatial intelligence solutions provider Bayanat, a G42-owned company, has completed the first-phase trial of its autonomous taxi service, called TXAI, in Abu Dhabi, UAE. WeRide is providing Level 4 autonomous full stack software and hardware solutions for the service. Between 23 November and 27 December 2021, over 2,733 passengers booked autonomous taxi rides through the TXAI app to take part in public trials on Yas Island (Abu Dhabi). The autonomous vehicle (AV) trials in the first phase completed over 16,600 kilometers. Currently, Bayanat is working closely with its partners and the UAE authorities to launch the second phase of the program, scheduled for mid-2022, which will include 10 autonomous taxis operating across numerous Abu Dhabi locations. Hasan Al Hosani, CEO of Bayanat, said, "The launch of TXAI is the first of its type in the MENA region, and underpins the strength of our partnership with WeRide, a global tech leader in the autonomous driving space. We are committed to continuing to work closely with the UAE authorities to build innovative transport systems by making strategic investments across the smart mobility value chain." (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The Cameroonian government on 4 February signed a EUR150-million multi-tranche loan agreement for budgetary support with France. The signing of the agreement enables an immediate disbursement of about USD80 million for budgetary support in 2022. (IHS Markit Economist Archbold Macheka)

- According to a report by Agence Ecofin on 8 February, the loan secured from the French Development Agency (FDA) is to be used to supplement the International Monetary Fund (IMF) program, which Cameroon secured in July 2021 (see Cameroon: 30 July 2021: Cameroon secures USD689.5-mil. loan under the IMF's ECF/EFF to support economic and financial reform efforts).

- Funding under the arrangement is to be disbursed gradually until 2024, supporting the country's efforts to attain rapid post-COVID-19 pandemic recovery, while anchoring medium-term external and fiscal sustainability. The FDA is a prominent financier in Cameroon. The agency is currently involved as a lender of EUR150 million in the 420-MW Nachtigal hydroelectric dam project, which is expected to be completed in July 2024.

- IHS Markit expects France to tie the disbursement of the remaining funds under the arrangement to positive review of the country's Extended Credit Facility (ECF)/Extended Fund Facility (EFF) program by the IMF. IHS Markit assesses that the funding will support the country's short-term liquidity profile, which benefited from the successful issuance of a EUR685-million Eurobond, a USD689.5-million loan under the IMF's ECF/EFF, and the IMF Special Drawing Rights (SDR265 million) allocation in 2021.

Asia-Pacific

- All major APAC equity markets closed lower; Hong Kong -0.1%, Mainland China -0.7%, South Korea -0.9%, Australia -1.0%, and India -1.3%.

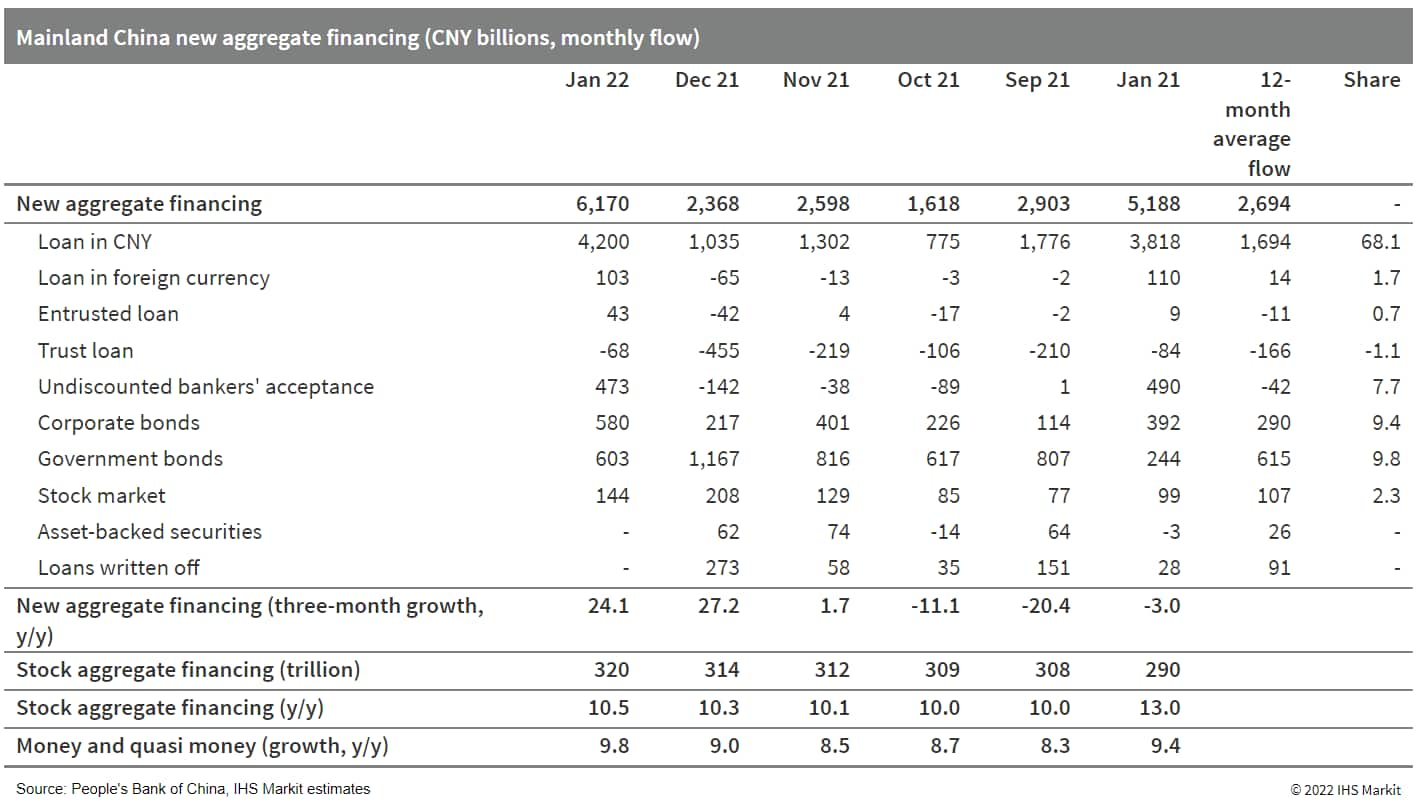

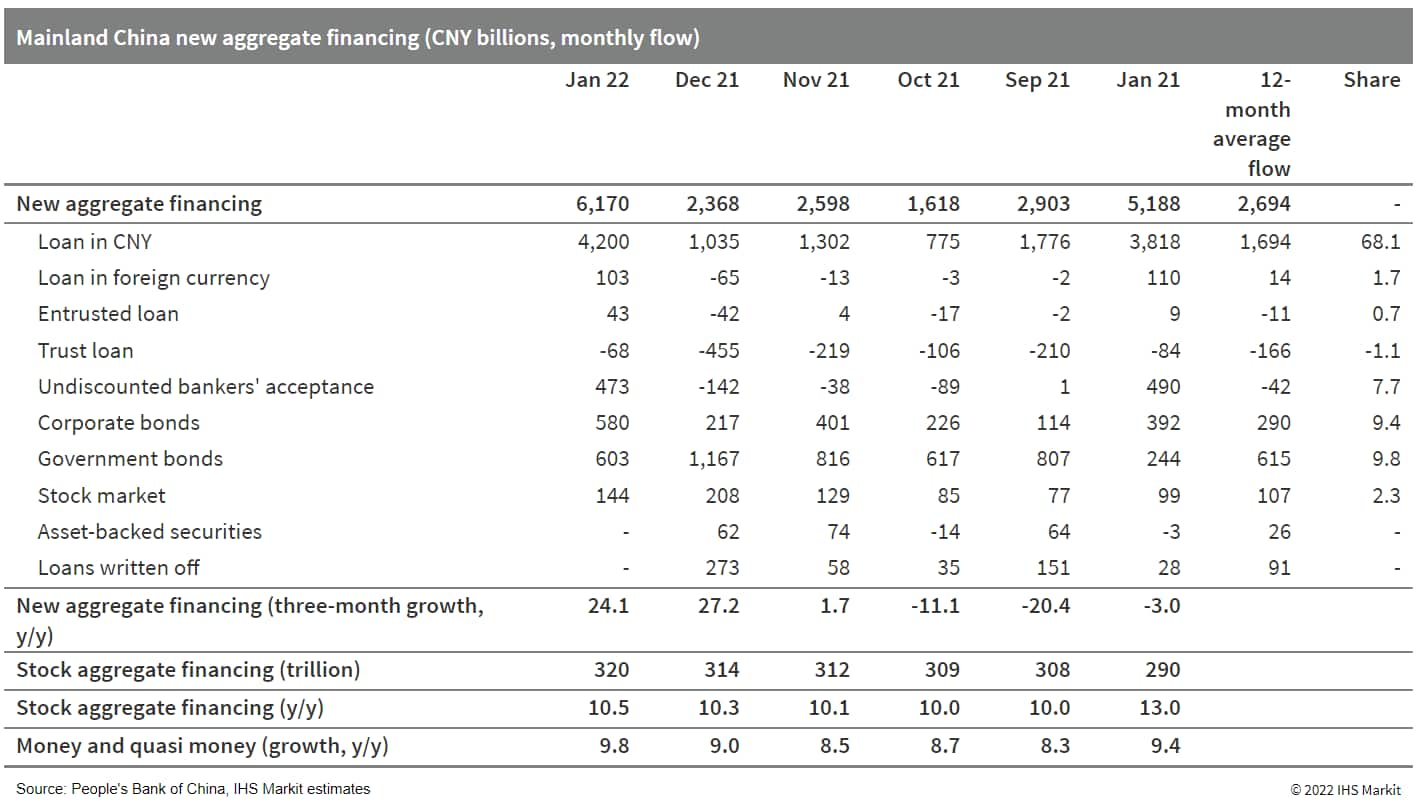

- Mainland China's new total social financing (TSF), the broadest measure of net new financing to the real economy, amounted to CNY6.17 trillion (USD970.67 billion) in January, up by CNY984.2 billion year on year (y/y), according to the People's Bank of China (PBOC). Stock TSF expanded by 10.5% y/y, up by 0.2 percentage point from the December 2021 reading. (IHS Markit Economist Lei Yi)

- While strong government bond issuance continued to contribute to the year-on-year gains in January's new TSF, bank borrowing also logged notable improvement even compared with the relatively high base in January 2021. New bank loans came in at a monthly high of CNY3.98 trillion in January, higher by CNY394.4 billion y/y. By sector, medium-to-long-term borrowing by corporates increased from year-ago level, ending the six-month-long year-on-year contraction in the second half of 2021; yet on the household front, medium-to-long term borrowing posted deeper year-on-year contraction in January, likely indicating still sluggish home sales during the start of the year.

- Broad money supply (M2) increased by 9.8% y/y in January, up 0.8 percentage point from the month-ago reading. M1 growth came in at -1.9% y/y, or 2% y/y if adjusted by the Spring Festival holiday impact, as compensation dispersions ahead of the holiday transferred deposits from corporates to households.

- Chinese plant-based protein company Starfield Food Science & Technology has raised USD100 million, the largest investment round for plant-based protein in the country to date. Beijing's Primavera Capital Group led the round and other investors included Alibaba's chief strategy officer Ming Zeng and existing investors Joy Capital, Lightspeed China Partners, Sky9 Capital, and Matrix Partners China. (IHS Markit Food and Agricultural Commodities' Eugene Ong)

- Starfield says the funding will be used to significantly increase production capacity, improve research and development capabilities to enhance taste and texture profiles of plant-based proteins as well as financing team expansion, wider marketing, and brand awareness campaigns.

- To increase production, Starfield is building its first commercial-scale manufacturing plant in Xiaogan, Hubei with the capacity to produce hundreds of vegan meat variations including whole-cuts, chunks, mince, steaks, patties, sausage, meatballs, and hams. The company says that bringing the manufacturing process in-house will reduce both manufacturing and logistics costs, and in turn bring product pricing below other animal meats.

- Starfield also plans to launch new products such as braised beef, chicken thigh steaks, and pork chops. "Starfield will continue to launch more affordable, delicious, and healthy plant-based green foods based on plant protein technology, to create a better eating experience for our target Generation Z consumers, thereby delivering more sustainable lifestyles" chief executive officer Kiki Wu said in a statement.

- This funding makes Starfield the fastest growing plant-based proteins company in China. The company, which manufactures self-branded products that are sold by retailers, has partnered with over 100 local and foreign food suppliers and is present in more than 14,000 retail outlets in China, such as fast-food chains Tim Hortons and Dicos; convenience stores 7-Eleven, FamilyMart, and Lawson; supermarket Hema; as well as beverage chains Heytea, Luckin Coffee, and Nayuki.

- Starfield has pursued its R&D through collaboration with academic research teams from the Beijing University of Technology and Industry, Jiangnan University, and Wageningen University in the Netherlands. It also has submitted about 30 patents for products developed through its proprietary "enzymatic cross-linking" techniques that can replicate textures and support whole-cuts.

- Tesla plans to locate its China design center in Beijing, reports Reuters citing a government document issued by the government of Beijing. According to the report, the Beijing municipal government in late January made the disclosure in a work report in which it listed key projects for the city in 2022. Tesla CEO Elon Musk said during the fourth-quarter earnings call in January that Tesla is not working on any new entry-level model at the moment, as its focus is on current products and projects. This ruled out the possibility of roll-out of a freshly designed new model in the near team for the Chinese market. In previous announcement, the automaker said, "We look forward to soon seeing China-designed and China-made Tesla models sold in the world". This suggests the China design studio may have a wider scope beyond designing a "Chinese-style" model. From a longer-term point of view, the China design center will still add value to Tesla's growth in China and help the electric vehicle (EV)-maker stay competitive in the market in the face of fierce competition from local startups, especially NIO and Xpeng. Although we do not expect Tesla to launch a new model beyond what has been announced so far, it is possible that the trends of Chinese auto market may be reflected in new model-year versions of its EVs in the form of new features or styling tweaks. (IHS Markit AutoIntelligence's Abby Chun Tu)

- New energy vehicle (NEV) sales, including battery electric vehicles (BEVs) and plug-in hybrid vehicles (PHEVs), accounted for 43% of new vehicles sold in Shanghai during 2021, according to data released by the Shanghai Economy and Informatization Commission. In 2021, sales of NEVs reached 254,000 units in Shanghai, up 105% year on year (y/y), and Shanghai leads the way on EV adoption. By the end of 2021, cumulative sales of NEVs in Shanghai reached over 677,000 units, the highest number among Chinese cities. The goal of the local government is not just to electrify its transportation system but also make Shanghai a production hub for EVs. Mayor Gong Zheng said during a recent press conference held by the municipal government of Shanghai, that the city aims to bring its total NEV production output to 1.2 million units by 2025 and for BEVs to account for more than 50% of new vehicle sales. Official data suggest that Shanghai's new vehicle production output totaled 2.833 million units last year, marking an increase of 7% y/y. Of this total, production volume of NEVs reached 632,000 units, an improvement of 160% from 2020. The NEV sector also contributed significantly to Shanghai's manufacturing industry in terms of industry value increase. In 2021, total industry value of NEV manufacturing surpassed the CNY100-billion mark for the first time, reaching CNY177.26 billion (USD278 billion). (IHS Markit AutoIntelligence's Abby Chun Tu)

- China's Hainan Yisheng plans to shut its 2 million mt/yr purified terephthalic acid (PTA) unit for servicing in April this year, a source close to Yisheng told OPIS. (IHS Markit Chemical Market Advisory Service's Chuan Ong)

- The company did not specify how long this unit will be shut, the source said.

- Hainan Yisheng's PTA unit was also shut around the same period in 2021 - it was unexpectedly taken off-stream from Feb. 11 to Mar. 16 last year due to a glitch.

- Started up in 2013, this PTA line has been Hainan Yisheng's only unit in its Danzhou City base, within China's Hainan Province.

- The company's second PTA unit is in the works, scheduled to come onstream in 2023 with a 2.5 million mt/yr capacity.

- Yisheng's affiliated companies together have the largest PTA production capacity in the world. They are hence also the world's largest consumer of paraxylene (PX) collectively.

Posted 11 February 2022 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.