Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 08, 2022

China's Greater Bay Area Becomes Key Mega Region in Global Economy

The Greater Bay Area comprises 11 major cities of the Pearl River Delta in southeastern China, including Hong Kong Special Administrative Region (SAR), Macao SAR, as well as nine key cities in Guangdong Province of mainland China, including Guangzhou and Shenzhen.

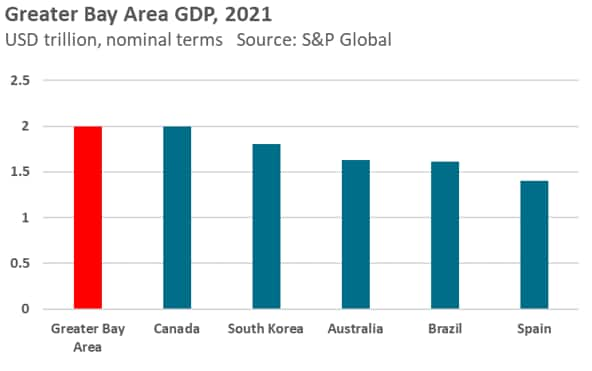

The Greater Bay Area has become one the three key mega-regions of China, with a total GDP that reached USD 2 trillion in 2021, equivalent to the GDP of Canada. Large-scale investment in key transport infrastructure such as bridges, ports, railways and highways has helped to drive the region's economic integration and economic development.

Mainland China's Economic Ascendance

The rapid growth of mainland China's economy over the past two decades has been a major driving factor for the increasing economic weight of APAC in the world economy. Mainland China's weight in world GDP has risen from 3.6% in 2000 to 18.6% by 2021, measured in nominal USD terms. The development of the Greater Bay Area as a key mega-region of the Chinese economy has been an important driver contributing to China's rapid economic growth since 2000. The Pearl River Delta has been an important industrial powerhouse for China's manufacturing exports over the past three decades. The other leading mega-regions of China are the Yangtze River Delta region centered on Shanghai and the Capital Economic Zone centered on the Beijing-Tianjin economic corridor.

By 2021, the Greater Bay Area's GDP was estimated at USD 2 trillion, which was equivalent to 11% of the combined GDP of mainland China, Hong Kong SAR and Macao SAR. When the Greater Bay Area GDP is benchmarked globally, its GDP was equivalent to Canada's GDP in 2021. When compared with large APAC industrial nations, the GDP of the Greater Bay Area exceeded the GDP of South Korea in 2021.

Hong Kong SAR and Macao SAR have also become important markets for Guangdong Province. Trade between Guangdong Province with Hong Kong SAR and Macao SAR accounted for 14.2% of Guangdong's total trade outside of mainland China in 2021.

However, the COVID-19 pandemic has also created tremendous disruptions to the pattern of mainland China's economic growth during 2020-22. In the first half of 2021, a number of cities in the Greater Bay Area have been hit by recent outbreaks of COVID-19 clusters. Shenzhen and Dongguan were among the cities that faced strict COVID-19 containment measures during March 2022, impacting on economic activity.

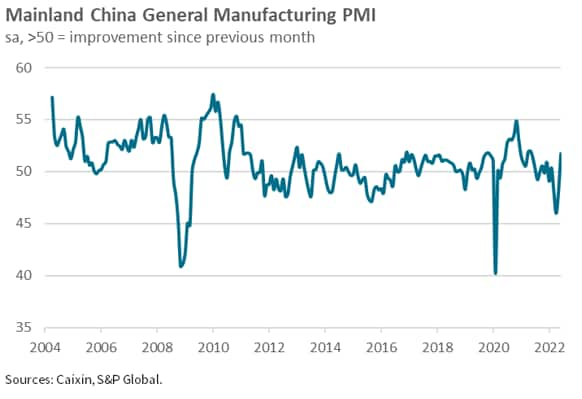

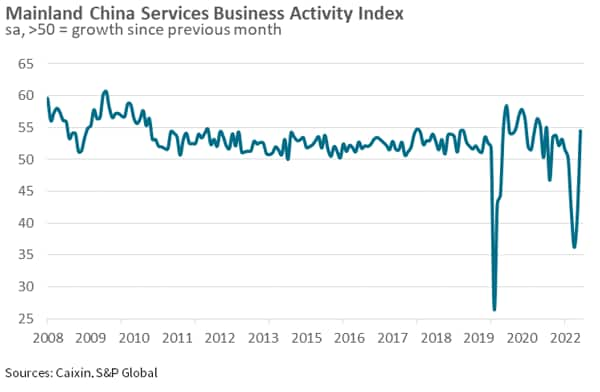

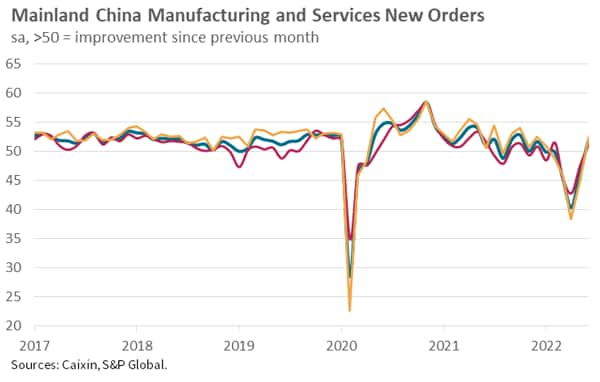

However, the latest Caixin PMI surveys of manufacturing and services in mainland China showed a strong rebound in economic activity for the month of June. Business confidence regarding the 12-month outlook for manufacturing output improved to a four-month high in June. Companies were generally upbeat in their forecasts as they anticipated more increases in production and further improvements in client demand as the recent pandemic outbreaks recede.

The Role of Hong Kong SAR

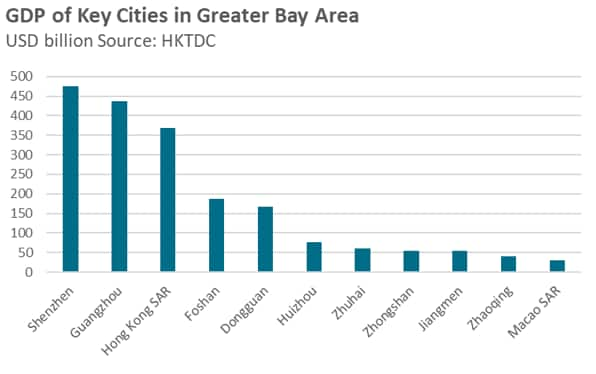

Hong Kong SAR has the third largest economy amongst the major cities of the Greater Bay Area, after Shenzhen and Guangzhou. Hong Kong's international financial centre plays an important role in the economic development of the Greater Bay Area, as an international banking and insurance hub, as well as an important international capital markets centre. This has helped to facilitate international financing flows for the Greater Bay Area, complementing the role of Shenzhen and Guangzhou as important domestic financial centres in mainland China.

Hong Kong SAR continues to play a key role in capital markets financing for mainland Chinese companies, through bank lending, debt issuance and equity capital raising.

Hong Kong SAR also continues to be an important logistics hub for the Greater Bay Area for shipping and commercial aviation.

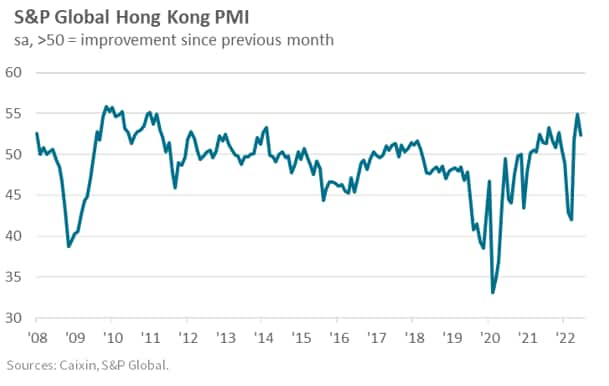

Despite severe disruptions to economic activity in 2020-22 during the COVID-19 pandemic, the headline seasonally adjusted S&P Global Hong Kong SAR Purchasing Manager's Index™ (PMI™) posted 52.4 in June, down from 54.9 in May. June data indicated a third consecutive month of expansion in output amid looser pandemic restrictions. New order volumes increased for a third successive month, but at a slower rate than in May. The recent COVID-19 outbreaks weighed negatively on new business, as firms recorded a thirteenth successive month of contraction in new orders from mainland China. The effects of COVID-19 also continued to impact vendor performance, according to surveyed firms. June data signaled a fourteenth consecutive month in which delivery times lengthened.

Economic Outlook for the Greater Bay Area

The COVID-19 pandemic has created tremendous disruptions to the pattern of economic growth worldwide during 2020-22, including for China. In the near-term, a key downside risk for China's economic outlook is from new COVID-19 outbreaks, which could continue to act as a significant drag on economic growth momentum, including for the Greater Bay Area. Even though economic activity has rebounded in June after pandemic restrictions in Shanghai and Beijing were eased, new COVID-19 cases have been reported in early July in some cities.

The city of Xi'an, capital of Shaanxi Province in Northwestern China, with a population of 13 million, has escalated pandemic restrictions for the week starting 6 July, after detecting domestic cases of Omicron BA.5.2 variant. Shanghai has announced plans to complete two rounds of mass testing for most residents in 12 out of 16 districts over 5-7 July, aiming to stamp out further transmission after a number of new infections were detected.

However, despite the uncertainties caused by near-term disruptions due to the pandemic, over the medium to long-term, the Greater Bay Area will continue to be a key driver of China's economic growth. The Greater Bay Area will continue to be a leading APAC mega-region for manufacturing production, financial services as well as for shipping and logistics.

Nevertheless, the Greater Bay Area will also face structural economic challenges. The pace of mainland China's economic growth has slowed significantly since 2010, as ageing demographics and the declining marginal productivity of capital have contributed to a gradual moderation in the pace of growth.

As mainland China's ageing demographics increasingly impact on the nation's long-term potential growth rate, the outperformance of mainland China's economic growth relative to world growth is expected to gradually narrow over the next decade and beyond. Whereas mainland China's GDP growth rate significantly exceeded world GDP growth over the period from 2000-21, this gap is forecast to narrow significantly over the next two decades.

This will also impact upon the future development path of the Greater Bay Area, increasing the competitive challenges to transition its manufacturing sector from being a low-cost "factory of the world" to a higher value-added manufacturing hub. Consequently, large-scale investment in physical infrastructure such as bridges, railways, ports and airports have been an important priority for government spending, in order to build competitive advantage. Investment in technology and innovation has also been an important driver for improving competitive advantage, through development of universities and research institutes.

Despite these competitive challenges, the GDP of the Greater Bay Area is projected to reach USD 5.8 trillion by 2040. This would be equivalent to around 2.3% of world GDP in 2040 and would slightly exceed the GDP of France. Within the APAC region, the Greater Bay Area will have an even larger economic footprint, with its GDP projected to be 5.5% of total APAC GDP by 2040.

Rajiv Biswas, Asia Pacific Chief Economist, S&P Global Market Intelligence

Rajiv.biswas@spglobal.com

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchinas-greater-bay-area-becomes-key-mega-region-in-global-economy-June22.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchinas-greater-bay-area-becomes-key-mega-region-in-global-economy-June22.html&text=China%27s+Greater+Bay+Area+Becomes+Key+Mega+Region+in+Global+Economy+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchinas-greater-bay-area-becomes-key-mega-region-in-global-economy-June22.html","enabled":true},{"name":"email","url":"?subject=China's Greater Bay Area Becomes Key Mega Region in Global Economy | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchinas-greater-bay-area-becomes-key-mega-region-in-global-economy-June22.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=China%27s+Greater+Bay+Area+Becomes+Key+Mega+Region+in+Global+Economy+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchinas-greater-bay-area-becomes-key-mega-region-in-global-economy-June22.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}