Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 08, 2022

Week Ahead Economic Preview: Week of 11 July 2022

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

A busy week sees the release of a series of GDP data for the UK, China and Singapore, which will no doubt take centre stage. At the same time, industrial production data for Japan, Eurozone, India, China and the UK will be eyed for clues as to whether growth rates have slowed. The week will end with retail sales and sentiment data for the US.

The global trend of aggressive monetary policy tightening meanwhile looks set to continue, with Bank of Canada widely expected to deliver a 75 basis point rate hike this week, following two consecutive 50 basis point rises.

The spotlight however likely lays with China, which has seen lockdowns persist into the second quarter, for which GDP data are released. While the latest PMI revealed a return to growth following some recent relaxations of COVID-19 restrictions, demand growth remains weak amid the ongoing zero-COVID policy. Our forecasts currently see China (mainland) contracting in Q2 at an annualised quarterly rate of 0.17%, taking the year-on-year growth rate to 0.8%, the weakest since the pandemic lockdowns of Q1 2020.

The UK will also issue Q2 GDP estimates on Wednesday, alongside services and industrial output data, which are also likely to show an economy in decline. Although recent PMI data for the UK pointed to business activity growth, the surveys also show the cost of living crisis having hit demand growth, adding to the risk of a further UK economic contraction, and technical recession, in Q3.

A relatively quiet week for the US with only retail sales and sentiment data due on Friday. That said, retail sales figures will be watched intently to assess whether surging fuel costs have added to price pressures and forced consumers to cut back on spending, as hinted by the latest PMI data.

Elsewhere, industrial production data for the Eurozone, Japan and India will be closely watched. The former two have seen industrial production contract in recent months which is expected to be the case yet again. Meanwhile, India's manufacturing sector continues to perform strongly.

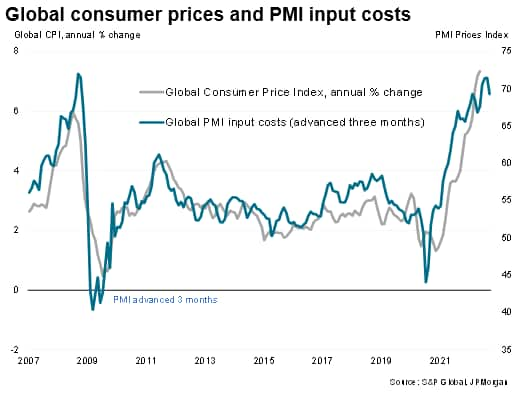

Has inflation peaked?

The latest global PMI data compiled by S&P Global showed companies' input costs rising at the slowest rate for four months, signalling a cooling of global consumer price inflation. While input cost inflation has moderated on previous occasions during the pandemic only to reaccelerate again, this time looks different.

First, the recent slowing of demand is greater than at any time during the pandemic other than the initial lockdowns and, importantly, has this time not been caused by pandemic containment.

Second, the recent easing of price pressures is associated with a substantial moderation of supply chain delays.

Third, the cooling of final demand is being accompanied by a shift away from inventory building, which will further reduce demand-pull pressure in input prices.

Fourth, the recent slowdown is driving a steep pull-back in firms' expectations of growth prospects, which have now fallen to their lowest since September 2020. This drop in confidence is in turn likely to take pressure off labour demand, and wages, as well as feeding through to weaker output growth in coming months, all of which will further help reduce inflationary pressures

A key uncertainty remains the energy prices, especially in Europe, but even energy prices are now coming under pressure from the worsening economic outlook, providing further evidence to suggest that the annual rate of CPI inflation will start to moderate - potentially substantially - in the second half of 2022.

Key diary events

<span/>Monday 11 July

Singapore Market Holiday

Japan PPI (Jun)

Italy Retail sales (May)

Norway Consumer Price Index (Jun)

Canada Manufacturing Sales (May)

China New Yuan Loans, Loan Growth (Jun)

United States Budget Statement (Jun)

Tuesday 12 July

Philippines Exports, Imports (May)

United Kingdom Retail Sales Monitor (Jun)

Germany ZEW Economic Sentiment, ZEW Current Conditions (Jul)

United States NFIB Business Optimism Index (Jun)

India Industrial Output, Manufacturing Output (Jun)

Australia Business Confidence (Jun)

Wednesday 13 Jul

New Zealand Food Price Index (Jun)

South Korea Unemployment Rate (Jun)

New Zealand Cash rate (Jun)

China (Mainland) Imports, Exports (Jun), Trade Balance USD (Jun)

Germany CPI Final, HICP (Final) (Jun)

United Kingdom GDP (May), GDP Estimate (Jun) Services (May), Industrial Output (May), Goods Trade Balance GBP (May)

Euro Zone Industrial Production (May)

France CPI (Jun)

United States Mortgage Market index (Jul), Core CPI (Jun)

Canada BoC Rate Decision (Jul)

Thursday 14 Jul

Singapore GDP Growth Rate (Q2)

Australia Consumer Inflation Expectations (Jul),

Unemployment Rate, Employment Change (Jun)

Japan Industrial Production (May)

India WPI Inflation, CPI (Jun)

China FDI (Jun)

United States PPI (Jun)

New Zealand Business PMI (Jun)

Friday 15 Jul

China GDP Growth Rate (Q2), House Price Index (Jun), Industrial Production (Jun), Retail Sales (Jun)

Indonesia Balance of Trade, Imports, Exports (Jun)

Japan Tertiary Industry Index (May)

Italy CPI (Jun)

Euro Area Balance of Trade (May)

United States Retail Sales (Jun), Michigan Consumer Sentiment (Jul)

India Balance of Trade (Jun)

What to watch

China, UK and Singapore GDP data to reveal economic performance for Q2

Second quarter GDP data are set to shed light on economic performance for the UK, Singapore and China this week. Last week's PMIs pointed to diverging trends across the three economies with China recording a return to expansion in June, the UK registering sluggish growth and Singapore seeing a weaker - albeit marked - improvement. This week will reveal how these economies are faring in the midst of supply chain disruptions and a worsening cost of living crisis. Our forecasts point to slowdowns in growth rates across the three countries for Q2 with growth in China expected to have ground to a near halt.

Americas: US Retail Sales, Sentiment, PPI and Canada Rate decision

This week will see the Bank of Canada (BOC) update its monetary policy and is set to raise its rate by a hefty 75 basis points. The latest tightening follows back-to-back 50 basis point hikes with the overnight rate set to be 2.25%. The market's pricing of the Fed's interest rate path could meanwhile be influenced by new US retail sales, consumer confidence and PPI data.

Europe: UK GDP, Industrial Production, Eurozone Industrial Production, France CPI and Germany CPI

In Europe, second quarter growth indicators will be eagerly assessed for recession risks. May's GDP data, including Q2 estimates, and Industrial production, services and construction output data will reveal how the UK has been faring with the cost of living crisis. Eurozone Industrial production data will follow with the latest PMI having indicated a slowdown in activity. Meanwhile, CPI figures are set to be released for France and Germany.

Asia-Pacific: China GDP, Industrial Production, Retail Sales, Japan Industrial Production and Singapore GDP

There will be lots to digest this week following the release of a plethora of Chinese data on Friday. GDP figures for Q2 will arguably be the most closely followed after China's economy suffered from lockdowns for the bulk of Q2, which hit production hard.

At the same time, Singapore has performed well in recent months with a strong upturn expected in Q2 GDP figures.

Special reports:

China - Rajiv Biswas

Global Economy - Chris Williamson

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-11-july-2022.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-11-july-2022.html&text=Week+Ahead+Economic+Preview%3a+Week+of+11+July+2022+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-11-july-2022.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 11 July 2022 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-11-july-2022.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+11+July+2022+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-11-july-2022.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}