Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 19, 2018

China economic growth at a resilient 6.9% in 2017

- China’s GDP rises at annual rate of 6.8% in Q4, bringing 2017 growth to 6.9%

- Fixed asset investment growth slips to 7.2%, slowest since 1999

- Survey data point to robust start in 2018, but structural issues remain key risks to growth

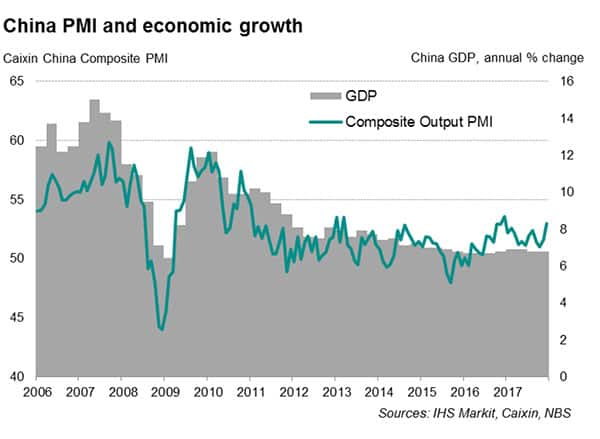

China’s economy expanded by 6.8% on an annual basis in the final quarter of 2017, unchanged on the pace seen in the previous three months and reflecting the stabilisation of economic activity in the country. So far, however, there are mixed messages in relation to growth momentum heading into 2018.

The official data are broadly in line with PMI survey data, which has been showing a trail of steady readings in recent months. The Caixin China Composite PMI Output Index, compiled from the manufacturing and service sector PMI surveys, averaged 51.9 in the last three months of 2017, which was the same as the third quarter average.

Overall, the surveys suggest that growth momentum may strengthen at the start of the year. Notably, growth in total new business in December was the strongest for close to five years, pointing to a robust start to 2018.

Optimism towards future activity remains subdued

However, IHS Markit’s Business Outlook Survey indicated that business confidence remains fragile in China. Business optimism about activity levels and new orders stayed at historically low levels in both manufacturing and service sectors. Another area of concern is the near-stagnation seen in the labour market. PMI surveys showed total net employment, on average, broadly unchanged in 2017, though this marked an improvement on the decline in 2016. The Business Outlook survey likewise showed hiring intentions down to their weakest for a year and the lowest among all surveyed countries.

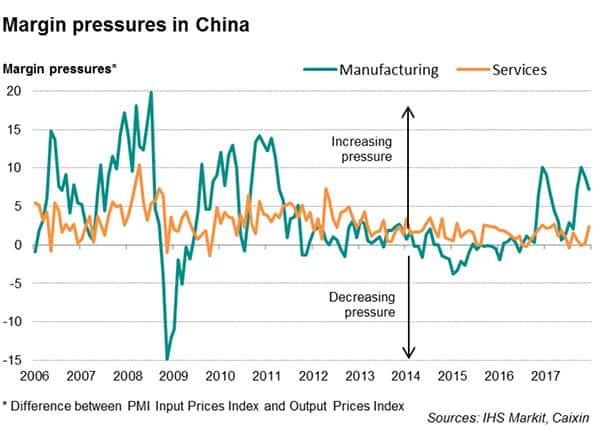

Margin pressures and corporate debt

But perhaps more important is a sustained rise in inflationary pressures, with input costs continuing to increase at a sharper pace than output charges, resulting in further pressure on profit margins. Firms generally do not expect the price trend to become favourable this year, with the Business Outlook survey showing optimism towards profitability at its lowest since June 2016. Lower company profits could raise the risk of loan defaults just as the government seeks to reduce high levels of corporate debt as part of efforts to transition to less debt-dependent growth.

At 7.2%, fixed asset investment growth in 2017 was the slowest annual pace since 1999, and running below the government’s 9% target. Nevertheless the Chinese economy still achieved a GDP growth rate of 6.9% last year, well above the target of ‘around 6.5%’. While the November Business Outlook survey showed that capital investment plans were slightly higher than seen earlier in 2017, firms pointed out policies around environmental protection and greater market competition as possible barriers to expansion.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-economic-growth-resilient-2017.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-economic-growth-resilient-2017.html&text=China+economic+growth+at+a+resilient+6.9%25+in+2017","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-economic-growth-resilient-2017.html","enabled":true},{"name":"email","url":"?subject=China economic growth at a resilient 6.9% in 2017&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-economic-growth-resilient-2017.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=China+economic+growth+at+a+resilient+6.9%25+in+2017 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-economic-growth-resilient-2017.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}