Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 19, 2018

Asia auto sector booms but suffers tighter profit margins

- Asia auto sector PMI shows 2017 output growth strongest in seven years

- Order book growth near eight-year high

- Industry continues to struggle with higher costs

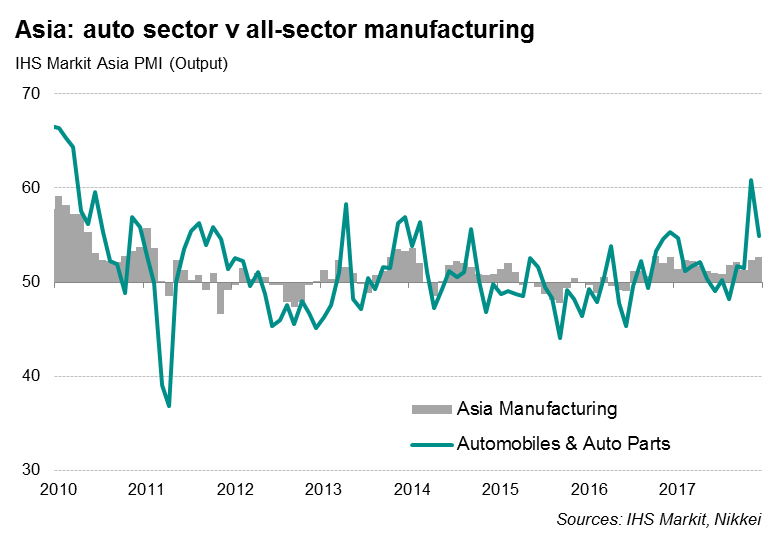

As 2017 drew to a close, Asia’s auto sector enjoyed its best growth spurt since 2010, according to PMI survey data. Forward-looking indicators suggest that the upturn is likely to continue in early-2018, and could even gather momentum.

However, the industry has been suffering sustained pressure on margins through higher costs in recent months, albeit with the extent of the squeeze moderating at the end of last year.

Best year since 2010

Despite easing from November’s peak, growth of Asia auto industry production in December was the second-fastest seen in 2017 amid strong inflows of new orders, according to the Nikkei Asia Sector PMI™, compiled by IHS Markit. The average PMI Output Index reading for 2017 was the highest for any calendar year since 2010.

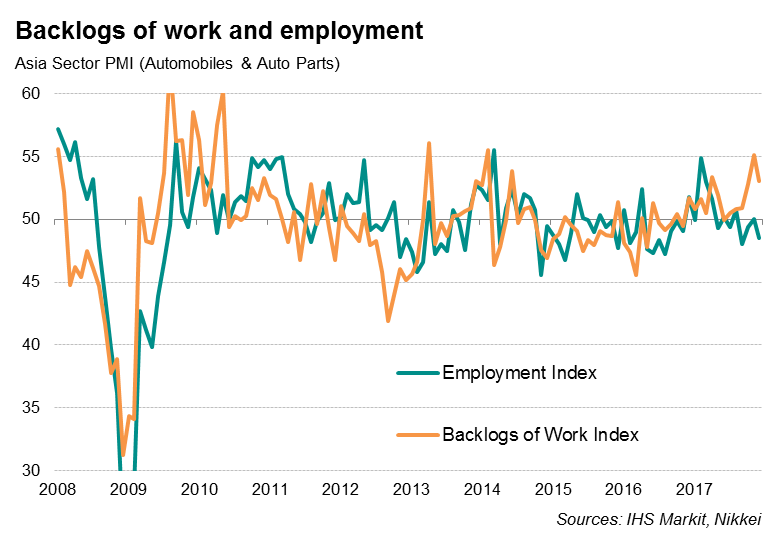

While the sector’s boom encouraged automakers to take on more workers on average in 2017, labour growth was meagre compared to that of both output and sales. Nevertheless, the employment gain is welcome after two years of net job losses.

Furthermore, based on historical relationships, the extent to which backlogs of uncompleted orders have accumulated in recent months suggests auto sector recruitment should pick up in early-2018. In 2017, backlogs of work rose on average to the greatest extent since 2010.

Supply shortages

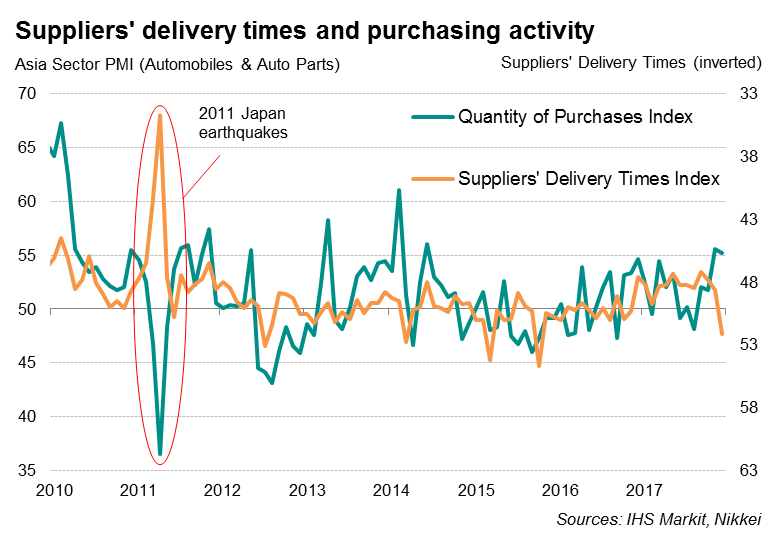

Supply chains in the auto sector were also under pressure during 2017. Although an improvement in supplier performance was recorded in December, this is likely to be short-lived given that growth in purchasing activity at Asia auto companies continues to run at one of the highest rates seen for four years. High order book volumes have also resulted in a persistent drawdown of post-production inventories as auto sector firms struggled to meet current demand.

Profit margins under pressure

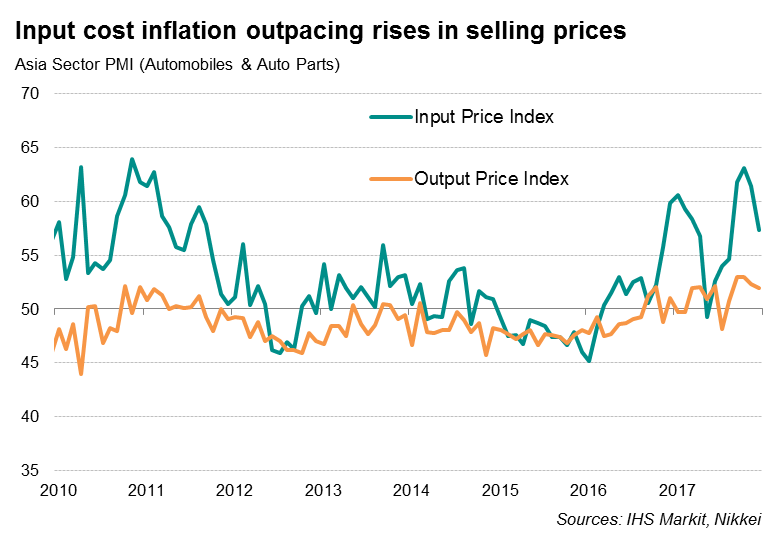

With high demand leading to increased numbers of bottlenecks and delays in auto supply chains, suppliers have been regularly able to push through price hikes. At the same time, higher global commodity prices, notably for energy and metals, also lifted production costs. Average cost burdens consequently continued to rise at a marked pace in December.

The sharp rise in input costs has led auto firms to raise selling prices at a faster rate in recent months, but the rate of inflation continues to be much lower compared to that of costs. As a result, the implied squeeze on auto profit margins remained higher than the historical average.

Strong outlook

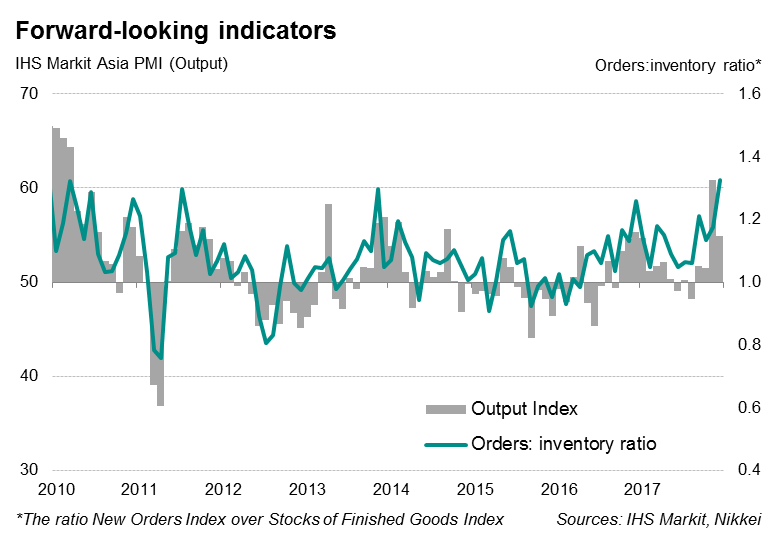

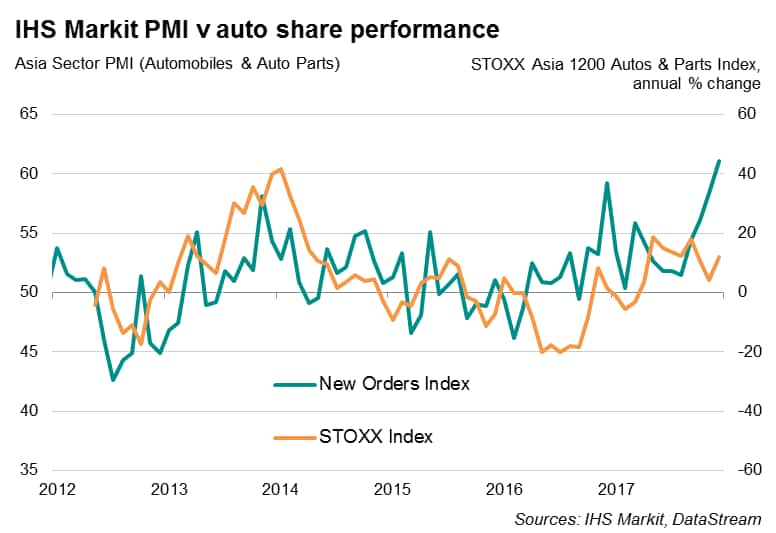

Other survey indicators suggest that the auto industry upturn will likely continue in early-2018. Inflows of new orders into the autos and parts industry surged in December, rising at the fastest rate since March 2010, a period when automaker incentives were boosting car sales worldwide.

Inventories of finished goods meanwhile continued to fall, with December’s decline being one of the steepest in two-and-a-half years, suggesting that auto companies will need to ramp up production to replenish stocks in coming months. Moreover, confidence about the outlook for the next 12 months in the auto sector remained upbeat.

The recent strong performance in the Asia auto sector bodes well for earnings, dividends and share price movements of Asian automakers. A comparison between the PMI New Orders Index for the Asia auto sector and STOXX Asia 1200 Autos & Parts index reveals a positive relationship, and points to some upside for equities.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19012018-Asia-auto-sector-booms.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19012018-Asia-auto-sector-booms.html&text=Asia+auto+sector+booms+but+suffers+tighter+profit+margins","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19012018-Asia-auto-sector-booms.html","enabled":true},{"name":"email","url":"?subject=Asia auto sector booms but suffers tighter profit margins&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19012018-Asia-auto-sector-booms.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Asia+auto+sector+booms+but+suffers+tighter+profit+margins http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19012018-Asia-auto-sector-booms.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}