Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 27, 2018

Capital inflows have returned to Turkey, but remain precarious

- In October, Turkey attracted a net inflow of portfolio investment for the first time since January. The net inflows are a key inflection point that show a slow return of investor sentiment.

- In recent months, Turkey has also enjoyed success in international financial markets (albeit at higher costs) and the lira has re-appreciated.

- This stabilization and return of capital investment inflows remain tenuous, however, international investor confidence in the country remain low.

- Even with a modest return of capital investment inflows and a sharp narrowing of the current-account deficit, the external financing gap remains dangerously large.

In October 2018, Turkey attracted a net inflow of portfolio

capital for the first time since January. Although the net inflow

was modest - just USD491 million - it nonetheless represents a key,

potential inflection point after the country lost a total of

USD8.702 billion in net portfolio outflows from February-September

2018. The strong shift of global sentiment towards developed

markets, combined with self-aggravated lack of investor confidence

in Turkish economic policy-making sent portfolio investment rushing

out of the country during most of 2018. After a sharp hike to

interest rates, a tightening of monetary policy, and promises of

stabilization measures - including scaling back fiscal stimulus -

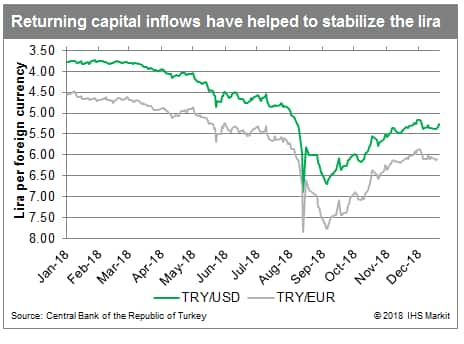

has helped to recapture capital inflows.  The return of capital inflows

helped to buoy the value of the lira. From 24 September to

end-October, the lira regained 12% of its value against the US

dollar. Continued lira gains in November suggest that portfolio

investment remained inward on a net basis that month. By 3

December, the lira had reached 5.162 per US dollar, nearly 18%

stronger than it had been as of late September. So far in December,

the lira has fallen back somewhat, likely in anticipation that the

Central Bank of the Republic of Turkey (TCMB) would decline to

raise interest rates at its 13 December meeting. With the TCMB

following through on expectations and keeping interest rates

unchanged, the lira has remained stable, at a slightly weaker

level, in the week since.

The return of capital inflows

helped to buoy the value of the lira. From 24 September to

end-October, the lira regained 12% of its value against the US

dollar. Continued lira gains in November suggest that portfolio

investment remained inward on a net basis that month. By 3

December, the lira had reached 5.162 per US dollar, nearly 18%

stronger than it had been as of late September. So far in December,

the lira has fallen back somewhat, likely in anticipation that the

Central Bank of the Republic of Turkey (TCMB) would decline to

raise interest rates at its 13 December meeting. With the TCMB

following through on expectations and keeping interest rates

unchanged, the lira has remained stable, at a slightly weaker

level, in the week since.

Improving net inflows of capital have gone hand-in-hand with the country's recent success in the international capital markets. Banks have been increasing their capital buffers, attracting willing partners. Banks have also been successful in rolling over their external debt obligations, albeit at elevated costs. Sovereign debt sales have been well subscribed, raising USD7.7 billion in 2018 as a whole, nearly half of which within the last month. Bond spreads - having soared in August-September - have re-narrowed significantly in October-December.

Meanwhile, the current account balance has turned around. Turkey

posted a current-account surplus for the third consecutive month in

October. Depressed domestic demand due to weaker buying power,

higher interest rates, and lack of business confidence have

severely curtailed imports. In the period August-October 2018,

total merchandise imports plunged by 21.2% year on year (y/y).

Service imports have also dropped sharply in recent months, down by

11.3% y/y in the most recently reported three months. The strong

y/y improvements since August have finally pushed the cumulative

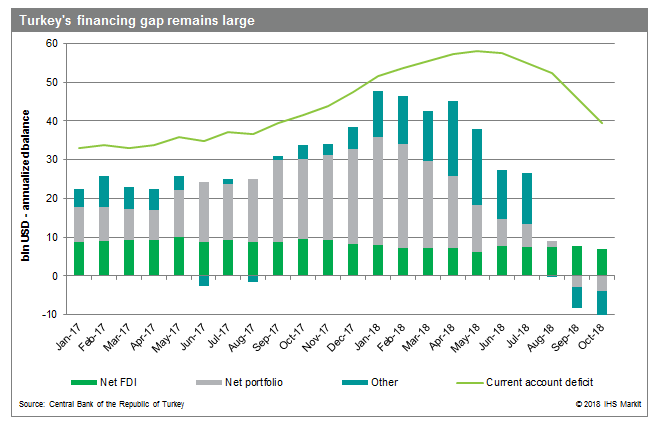

current-account deficit below what it had been a year earlier.  Even with the rapid turnaround

of the current-account balance - we are now forecasting a

current-account deficit of only around 2.5% of GDP in 2019 as a

whole -- and the return of net inflows of portfolio investment,

Turkey has substantial external vulnerability. On an annualized

basis, the financing gap between net capital inflows and

current-account deficits is yawning. The financing gap must be met

through a combination of errors and omissions, new borrowing and

drawing down what are already depleted reserves. By end-October,

total foreign currency reserves were more than USD20 billion down

from where they had been at the end of 2017, covering only 3.8

months of imports.

Even with the rapid turnaround

of the current-account balance - we are now forecasting a

current-account deficit of only around 2.5% of GDP in 2019 as a

whole -- and the return of net inflows of portfolio investment,

Turkey has substantial external vulnerability. On an annualized

basis, the financing gap between net capital inflows and

current-account deficits is yawning. The financing gap must be met

through a combination of errors and omissions, new borrowing and

drawing down what are already depleted reserves. By end-October,

total foreign currency reserves were more than USD20 billion down

from where they had been at the end of 2017, covering only 3.8

months of imports.

While the return of capital inflows in October may be an inflection point, with modest net inflows expected to continue throughout 2019, downside risks to overall stability remain substantial. Given a low level of international confidence in the country's economic policy-making, another crisis could once again trigger instability. The just-announced US withdrawal from Syria that may reignite regional violence; a major US fine against the Turkish banking sector; and the Iranian sanctions are all potential triggers. Of greatest concern, though, is with the country on the verge of a recession, President Erdoǧan may be tempted to abandon stabilization policies in pursuit of stimulating growth, launching another crisis. As the US Fed continues to raise its rates and the TCMB holds its rates unchanged (or begins to lower them at the direction of Erdoǧan), the potential for destabilization increases.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcapital-inflows-returned-turkey-remain-precarious.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcapital-inflows-returned-turkey-remain-precarious.html&text=Capital+inflows+have+returned+to+Turkey%2c+but+remain+precarious+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcapital-inflows-returned-turkey-remain-precarious.html","enabled":true},{"name":"email","url":"?subject=Capital inflows have returned to Turkey, but remain precarious | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcapital-inflows-returned-turkey-remain-precarious.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Capital+inflows+have+returned+to+Turkey%2c+but+remain+precarious+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcapital-inflows-returned-turkey-remain-precarious.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}