Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 01, 2019

Caixin China PMI signals stabilisation in manufacturing, but no signs of recovery yet

- Caixin China manufacturing PMI rises to 49.9 in July, up from 49.4 in June

- Rebound seen in both output and new orders

- Backlogs continues to rise as job losses increase

- Business confidence strengthens

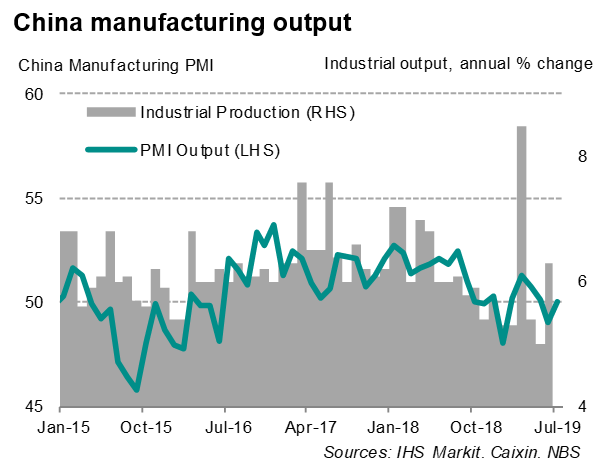

Caixin PMI data, compiled by IHS Markit, indicated that China's manufacturing sector was close to stabilisation at the start of the third quarter. However, forward-looking data underscore how it is far from certain whether a recovery will materialise in coming months, providing food for thought for Chinese policymakers whether additional stimulus measures are needed.

Third quarter clues

At 49.9, rising from 49.4 in June, the Caixin China Manufacturing PMI remained only marginally below the 50 no-change level in July, signalling broadly unchanged business conditions in the sector.

This raises the question whether a sustained recovery will emerge. However, survey sub-indices were not convincing in showing whether manufacturing conditions will improve in coming months.

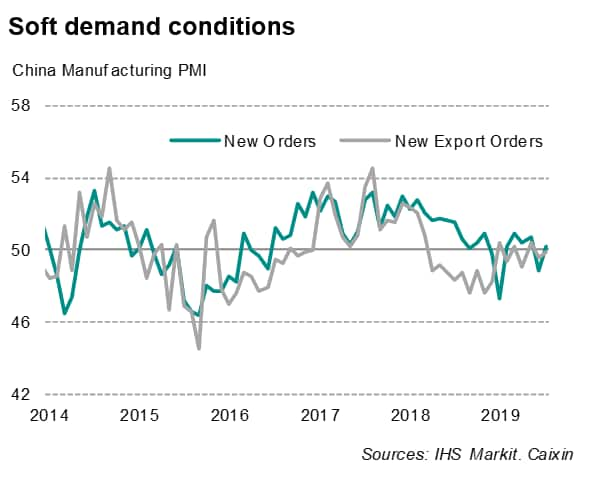

Demand conditions in the sector remained muted. While new orders returned to growth, the rate of expansion was only marginal and among the weakest seen so far this year. The order book situation was not helped by a sluggish external sector, as reflected by the PMI export orders index signalling stagnant export order volumes. Respondents continued to highlight the ongoing US-China trade war as the predominant factor weighing on foreign demand.

In normal circumstances, subdued sales growth would not stress operating capacity. However, Chinese manufacturers continued to report increasing levels of unfinished work. This rise in backlogs of work was linked to insufficient manpower after years of job shedding. Indeed, firms have been continually reducing manufacturing staff numbers over the past five-and-a-half years, with the sole exception of March this year.

In July, the survey's employment index indicated a steeper downturn in factory jobs, with job losses running higher than the average seen over the first half of the year. Employment fell in response to disappointing order intakes as firms seek to reduce operating overheads.

Business confidence about the year-ahead outlook meanwhile rose to the highest since April yet remained subdued in the context of the series history, with many expressing worries over the impact of the US trade dispute on future output. The recent weakness of business expectations also weighed on hiring and capital investment plans, as indicated by the tri-annual China Business Outlook, compiled by IHS Markit.

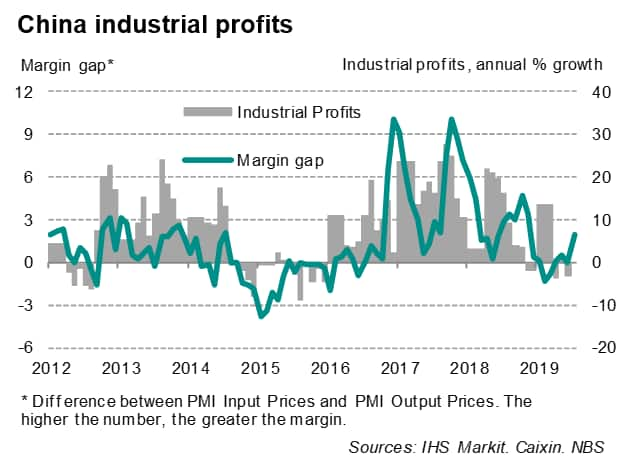

Discounting drives prices lower

The July survey found little evidence of inflationary pressures in the manufacturing sector. Costs rose marginally overall, though the vast majority of firms reported no change in input costs. Meanwhile, prices charged for Chinese manufactured goods fell in July, with the rate of decline the steepest in six months. An increasing number of firms mentioned that price discounts were given to boost competitiveness and attract new business.

Fiscal stimulus

PMI surveys in the coming months will provide important clues for policymakers who are grappling with whether additional stimulus measures are needed to fend off a sharper slowdown. At the mid-year Politburo meeting held recently, the decision-making body of the ruling Communist Party acknowledged that downside pressure on the Chinese economy has increased, but did not announce any new fiscal stimulus measures, other than pledging to boost domestic demand through stepping up reforms in the manufacturing sector.

Current fiscal measures, especially infrastructure spending, may have so far only benefitted certain manufacturing industries, which are typically larger enterprises. A major development in recent months had been the stronger performance of larger manufacturers (over 1,000 employees) in the Caixin PMI survey, where the average reading over the first half of the year indicated modest growth, diverging from the deteriorating fate of small and medium-sized companies. However, a decline of larger firms signalled in July brings their performance more in line with their smaller counterparts.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

© 2019, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcaixin-china-pmi-signals-stabilisation-in-manufacturing-but-no-signs-of-recovery-yet-aug19.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcaixin-china-pmi-signals-stabilisation-in-manufacturing-but-no-signs-of-recovery-yet-aug19.html&text=Caixin+China+PMI+signals+stabilisation+in+manufacturing%2c+but+no+signs+of+recovery+yet+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcaixin-china-pmi-signals-stabilisation-in-manufacturing-but-no-signs-of-recovery-yet-aug19.html","enabled":true},{"name":"email","url":"?subject=Caixin China PMI signals stabilisation in manufacturing, but no signs of recovery yet | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcaixin-china-pmi-signals-stabilisation-in-manufacturing-but-no-signs-of-recovery-yet-aug19.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Caixin+China+PMI+signals+stabilisation+in+manufacturing%2c+but+no+signs+of+recovery+yet+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcaixin-china-pmi-signals-stabilisation-in-manufacturing-but-no-signs-of-recovery-yet-aug19.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}