Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 03, 2020

Banking risk monthly outlook: December 2020

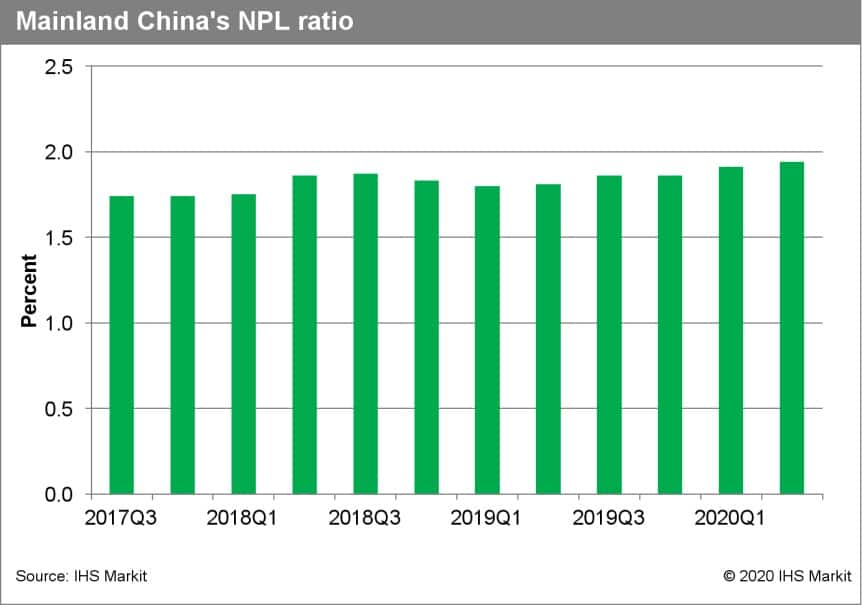

- More bad loans written off towards the end of the year in mainland China's banking sector

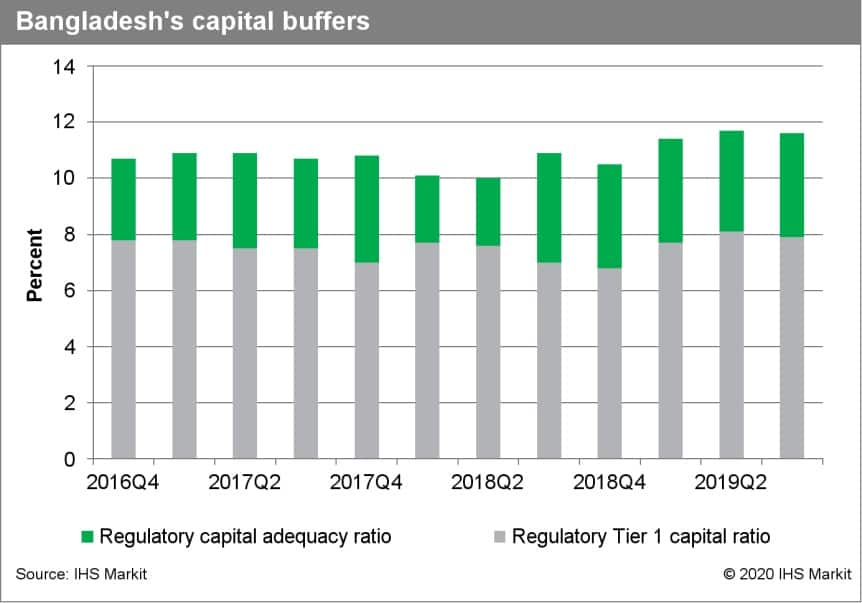

- Capital injections by Bangladesh's authorities into state-owned banks

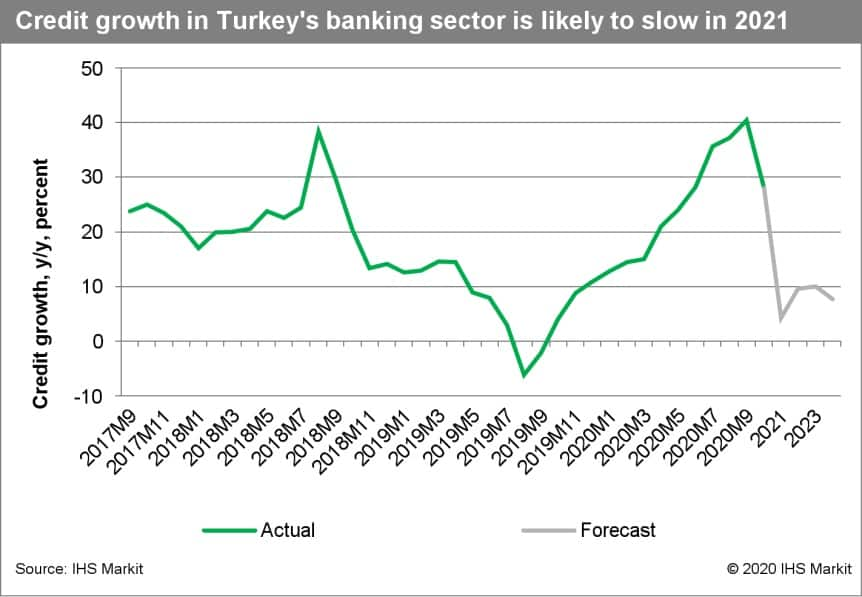

- Slower pace of lending in Turkey following sharp monetary tightening

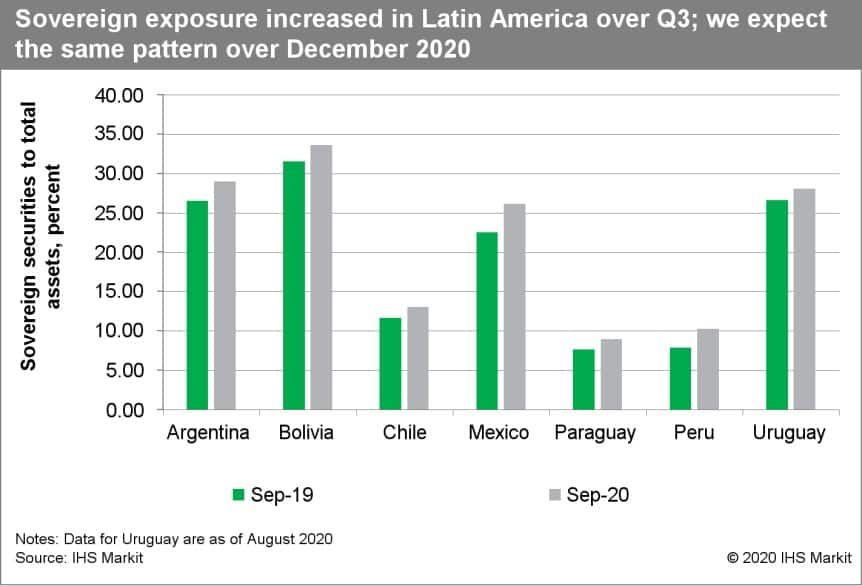

- Increasing sovereign exposure for banks in Latin America

- Reduction in the required reserve ratio for banks in Lebanon

- Weaker credit growth in South Africa as banks brace for significant asset-quality deterioration

Increasing write-offs of bad loans in mainland China's banking sector to keep non-performing loan (NPL) ratio steady.

The NPL ratio in mainland China's banking sector has been kept steady in recent quarters despite rising since the start of the year; meanwhile, the special mention loan ratio has been falling. More loans are likely to be written off in the next few quarters, ahead of the end of the loan moratorium in March 2021 for micro, small, and medium-sized enterprises (MSMEs). This likely means more losses and an impact on profitability towards the end of the year.

Capital shortfalls in Bangladesh will limit credit growth.

State-owned banks in Bangladesh are amongst the largest banks; however, their capital ratios are almost all below minimum requirements. Although the low capital buffers will not immediately trigger insolvency issues at banks, the rising bad loans as a result of COVID-19 will likely push the government to start injecting capital into banks, or alternatively to allow these banks to raise capital from the private market, but the local financial market is relatively underdeveloped.

The Central Bank of the Republic of Turkey (Türkiye Cumhuriyet Merkez Bankası: TCMB)'s policy rate hike likely does not signal an outright change in monetary policy, but credit growth likely to slow nonetheless.

Although the TCMB's move to tighten its main policy rate in its first rate-setting meeting under new Governor Naci Agbal was received positively by the markets initially, the central bank's institutional independence remains undermined by presidential interference, in our view. The chance for policy missteps by the new TCMB and Finance Ministry leaders remains very high. Confidence in the TCMB's independence remains compromised, and the strong recovery of the lira seen initially after the rate hike is unlikely to continue. But it should be enough to provide some stability and prevent the lira from dropping back below TRY8/USD1 by the end of 2020, in turn providing some breathing space for battered foreign currency loan borrowers. The appointment of new technocrats within both the TCMB and the Finance Ministry would signal a change in policy direction favouring market-oriented policies and would be a positive indicator for near-term banking sector risks, while the appointment of party loyalists to key posts within either institution or continued pressure on state-owned banks to ramp up credit would be a signal of higher risks.

Further increase in exposure to the sovereign in the whole Latin American region.

As a result of liquidity injections from central banks across Latin America, banks have seen a sharp rise in their assets. Over the first three quarters of 2020, these sectors tried to split the allocation of these funds between loan disbursement and the purchase of sovereign assets. However, as economic prospects for the region have worsened, we expect banks to opt further for a higher allocation of their funds towards sovereign assets over December. This will likely limit credit risk stemming from the macroeconomy, but it will, nevertheless, accentuate asset-concentration risks in the region.

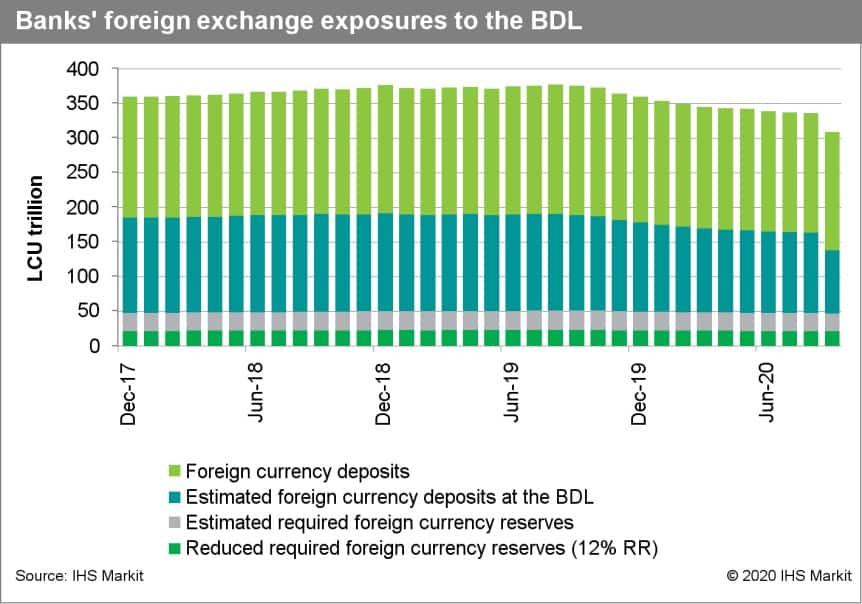

Reduction in Lebanese banks' reserve requirements.

As early as August 2020, the central bank of Lebanon (Banque du Liban: BDL) announced it would have to cease subsidisation of vital imports at the official exchange rate (LBP1,507.5 per USD1) at end-November because of a shortage in official foreign exchange reserves. To contend with the foreign exchange shortage, the BDL is reportedly considering lowering banks' required reserve ratio from 15% to the 10-12% range. Although the reduction is a relatively small dent in banks' extensive reserve holdings, the move indicates the government already utilised banks' voluntary reserves at the BDL.

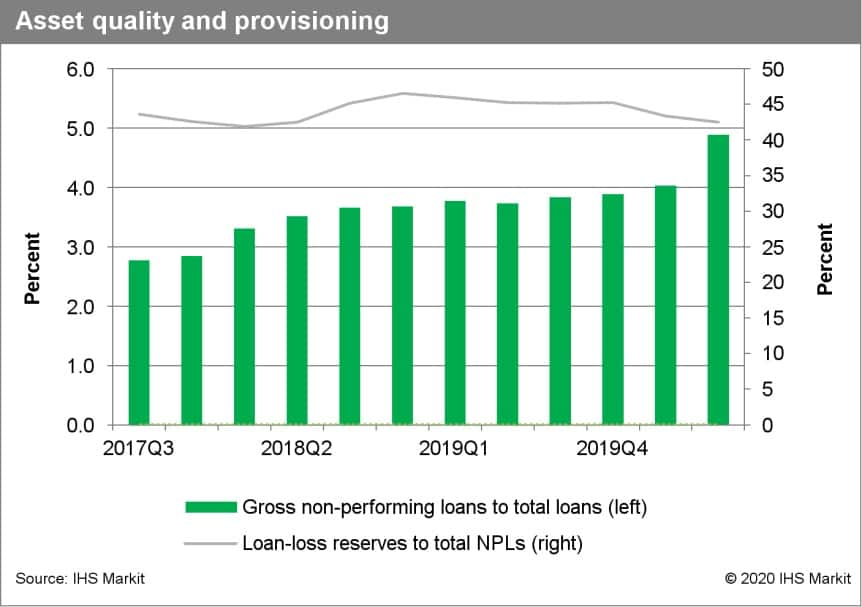

South African banks bracing for significant asset-quality deterioration, likely to constrain credit growth.

IHS Markit projects the South African economy to experience a deep contraction in 2020 owing to a prolonged lockdown to contain the COVID-19 pandemic and recent sovereign downgrades. Non-performing loans deteriorated to 5% in September 2020 (a ceiling not reached since 2011), up from 3.9% in December 2019, with further deterioration expected as macroeconomic conditions remain challenging. Credit growth remained resilient during the first two quarters of 2020 owing to government stimulus; however, third-quarter data show a deceleration in loan growth, a trend likely to continue in the near term as borrowers' debt-service capacity remains under pressure.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-december-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-december-2020.html&text=Banking+risk+monthly+outlook%3a+December+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-december-2020.html","enabled":true},{"name":"email","url":"?subject=Banking risk monthly outlook: December 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-december-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Banking+risk+monthly+outlook%3a+December+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-december-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}