Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 27, 2023

Australian economic growth moderates due to tighter monetary policy

Australian economic growth momentum has softened during 2023 due to the cumulative impact of monetary policy tightening since May 2022. The Judo Bank Flash Australia Composite PMI Output Index for October 2023 posted below the 50.0 no-change mark for the third time in the past four months during October, reflecting weak domestic demand, continuing high inflation pressures and the impact of monetary policy tightening.

Australian economy moderates in 2023

GDP growth rose by 3.4% year-on-year (y/y) in the 2022-23 financial year ending June 2023, helped by strong growth during the second half of 2022. However, growth momentum slowed down in the first two quarters of 2023, with GDP growth of 0.4% quarter-on-quarter (q/q) in both quarters, as rising interest rates having acted as a drag on growth.

Reflecting the impact of higher inflation and rising interest rates, total final consumption expenditure grew by just 0.1% q/q in the June quarter, although up 1.4% y/y.

However gross fixed capital formation showed positive momentum, rising by 4.7% y/y, despite the downturn in residential investment, which fell by 1.1% y/y. Total gross fixed capital formation rose by 2.4% q/q in the June quarter of 2023, helped by a 8.2% q/q increase in public investment, reflecting investment spending on large public infrastructure projects such as Snowy 2.0, the Western Sydney Airport, Inland Rail, Sydney's new metro and Brisbane's Cross River Rail.

Exports of goods and services were up 9.8% y/y in the June quarter, rising by 4.3% q/q. The healthy growth in real exports during the second quarter helped mitigate the impact of the 8.2% q/q fall in export prices due to moderating iron ore and energy prices. Rebounding exports of services from education and tourism helped to support export growth. Travel services exports reached 88 per cent of pre-pandemic levels in the June quarter of 2023, with total exports of travel services rising by 18.5% q/q.

Australian business conditions have weakened

October saw a renewed decrease in business activity in Australia, according to the Judo Bank Flash Australia Composite PMI Output Index, which posted below the 50.0 no-change mark for the third time in the past four months. At 47.3, down from 51.5 in September, the reading was the lowest in 21 months and represented a solid monthly decline in activity. Output was down across both the manufacturing and services sectors, with lower new orders and a drop in confidence in the business outlook, while cost pressures remained elevated.

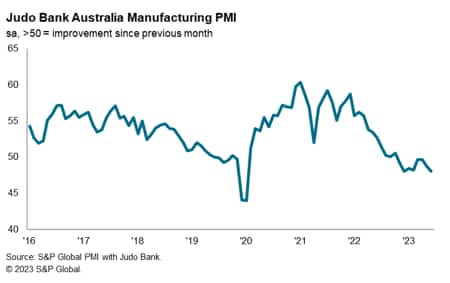

The Judo Bank Flash Australia Manufacturing PMI for October weakened to 48.0 in October from 48.7 in September, moving further below the 50.0 no-change mark and signalling an eighth successive monthly deterioration in business conditions. Latest data pointed to weaker output and new orders as demand conditions deteriorated. However, employment continued to increase, extending the current sequence of job creation to three years.

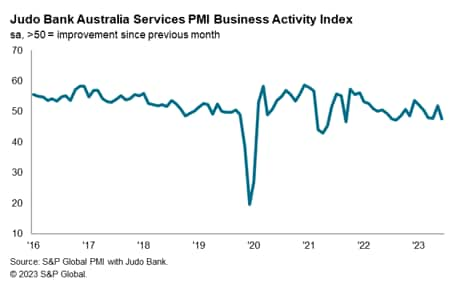

The Judo Bank Flash Australia Services PMI Business Activity Index showed a significant drop in October, falling back below the 50.0 no-change mark to 47.6, compared with 51.8 in September. Service sector activity has now decreased in three of the past four months, with the October decline the most marked in the year-to-date. The October survey results showed renewed reductions in total new business and new orders from abroad, amid challenging market conditions and the impact of higher interest rates.

Inflation pressures remain high

The Judo Bank Flash Australia Composite PMI survey for October showed that input costs continued to rise rapidly, with the rate of inflation ticking up to a three-month high. Increased fuel costs pushed up input prices across both monitored sectors, while service providers also highlighted rising wages. Output prices also increased, but weaker customer demand impacted pricing power, resulting in the softest pace of charge inflation since March 2021.

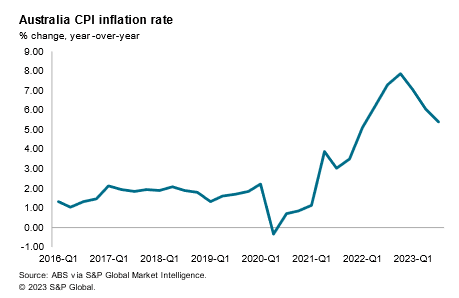

While the Australian consumer price index (CPI) has moderated from a recent peak of 7.8% y/y in the December 2022 quarter, the CPI inflation rate remained high in the September 2023 quarter, at 5.4% y/y. The CPI inflation rate rose by 1.2% in the September 2023 quarter with auto fuel prices up 7.2% q/q and rents rising by 2.2% q/q.

Reflecting the upturn in inflation pressures since early 2022, the Reserve Bank of Australia (RBA) has tightened monetary policy by a cumulative increase in the policy cash rate of 400 basis points (bps) since May 2022. The most recent rate hike was by 25bps at the RBA's June 2023 meeting, which brought the cash rate target to 4.1%.

The RBA central forecast is for CPI inflation to moderate to 3.25% by the end of 2024, to be back in the 2% to 3% range by late 2025. The RBA central forecast for economic growth is for the economy to expand at a below-trend pace in 2024. GDP growth is forecast to moderate from 3% in 2022 to 1.5% in 2023 and 1.25% in 2024.

Rising interest rates due to monetary policy tightening by the RBA has put increasing pressure on the residential property sector. Dwelling investment is estimated by the Australian Treasury to have declined by 2.5% y/y in 2022-23, with a further decline of 3.5% y/y forecast for 2023-24. (Australian Treasury Budget Paper No. 1, May 2023).

The higher interest rates, on top of higher materials and labour shortages are also constraining growth in new housing construction. Housing rental costs are running at 13-year highs, boosted by net inward migration by returning international students, new migration and expatriate workers following the end of pandemic-era border controls.

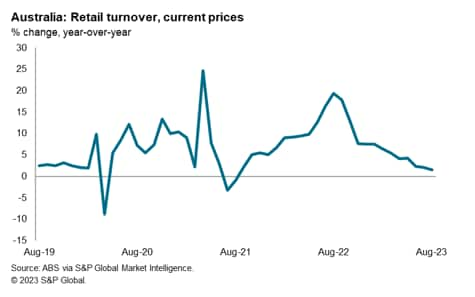

Housing costs due to higher mortgage repayments as well as rising rents have weighed on private consumption as housing costs are consuming a larger proportion of disposable incomes. Mortgage interest payments by households almost doubled in 2022-23 compared to interest payments in the previous year. Discretionary household spending fell 0.5% q/q in the June quarter, which was the third quarterly fall in a row. Spending on furnishings and household equipment fell for the fifth quarter in succession, down 3.4% in annual terms. Retail sales fell 0.5% q/q during the June quarter.

However, the tight property market has also resulted in a renewed upturn in residential property prices in Australian cities, with rents rising rapidly due to extremely low rental vacancy rates in many cities.

Economic outlook

Economic indicators during recent months have signalled moderating economic growth momentum in the Australian economy, reflecting the cumulative impact of 400bps of monetary policy tightening. Rising interest rates, high inflation and rapidly increasing housing costs have resulted in a significant slowdown in consumption spending, with retail sales declining in the June 2023 quarter.

However, an important positive factor for domestic demand has been the continued strength of the Australian labour market. The unemployment rate was at 3.6% in September 2023, close to a 50-year low. The total number of persons in employment in Australia has risen from 13 million in September 2019 to 14.1 million in September 2023, a total increase of 1.1 million net new jobs. The high level of employment has helped to support the resilience of the economy.

However, continuing headwinds from high inflation and the cumulative increase in interest rates since May 2022 are expected to constrain GDP growth in 2024 to a pace of around 1.5%.

Economic growth momentum is expected to improve in 2025, as moderating inflation pressures allow some easing of monetary policy settings. This is expected to result in some upturn in domestic demand, with stronger private consumption and higher residential construction activity.

Access the Judo Bank Flash Australia Composite PMI press release.

Rajiv Biswas, Asia Pacific Chief Economist, S&P Global Market Intelligence

Rajiv.biswas@spglobal.com

© 2023, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2faustralian-economic-growth-moderates-due-to-tighter-monetary-policy-oct23.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2faustralian-economic-growth-moderates-due-to-tighter-monetary-policy-oct23.html&text=Australian+economic+growth+moderates+due+to+tighter+monetary+policy+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2faustralian-economic-growth-moderates-due-to-tighter-monetary-policy-oct23.html","enabled":true},{"name":"email","url":"?subject=Australian economic growth moderates due to tighter monetary policy | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2faustralian-economic-growth-moderates-due-to-tighter-monetary-policy-oct23.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Australian+economic+growth+moderates+due+to+tighter+monetary+policy+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2faustralian-economic-growth-moderates-due-to-tighter-monetary-policy-oct23.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}