Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 31, 2023

Subdued picture from flash PMIs masks widening growth divergences

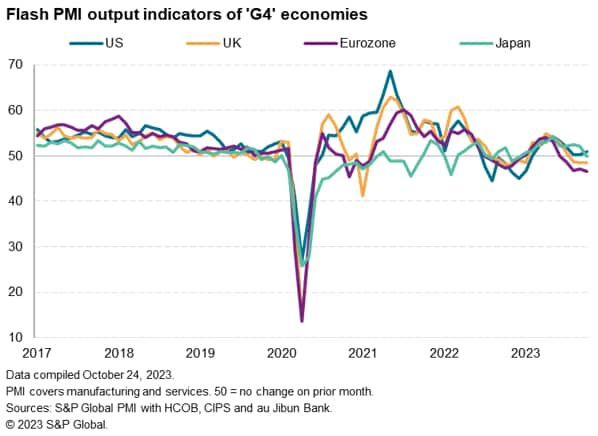

Early PMI survey data for October from S&P Global showed the major developed economies collectively contracting for a third month. While only very modest, the decline represents a major faltering of growth momentum since the resurgence of demand seen earlier in the year.

Disappointingly, new inflows of work continued to fall. Until inflows of work return to growth, output is likely to remain under pressure, especially as companies are depleting their reserves of backlogged customer orders.

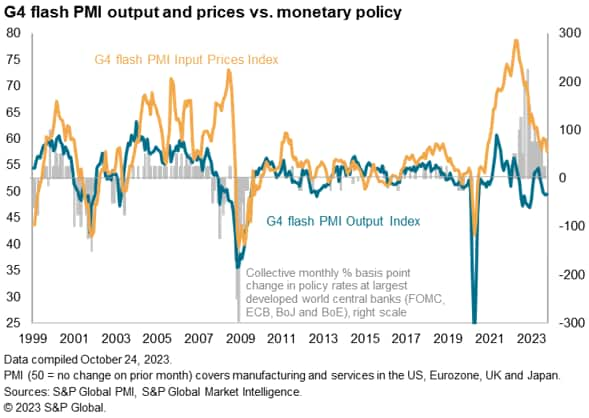

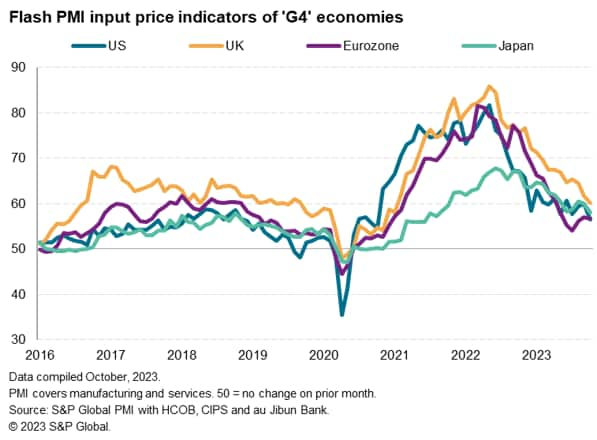

More encouragingly, the inflation outlook improved, with input cost inflation across the four major developed economies falling below its pre-pandemic five-year average in October, boding well for consumer price inflation to cool further in the months ahead.

Such a loss of growth momentum combined with the cooling of price pressures hints at interest rates having peaked in the US and Europe, which in turn has helped lift business confidence. Expectations of output turned higher in October across the G4 despite the rising geopolitical tensions amid hopes that demand will strength again as households and businesses see the cost-of-living pressures lifting and peak interest rates in sight. These future output expectations have diverged, however, signaling a further outperformance of the US relative to Europe.

Major developed economies contract at start of fourth quarter

Business activity across the four largest developed world economies (the "G4") fell for a third successive month in October, according to the provisional 'flash' PMI data compiled by S&P Global Market Intelligence, suggesting a soft start to the fourth quarter for the developed world economy.

The decline was only very modest, only slightly more marked than witnessed in September, but represented a significant contrast to the robust growth signaled during the second quarter to hint at a considerable downshifting in global economic growth momentum.

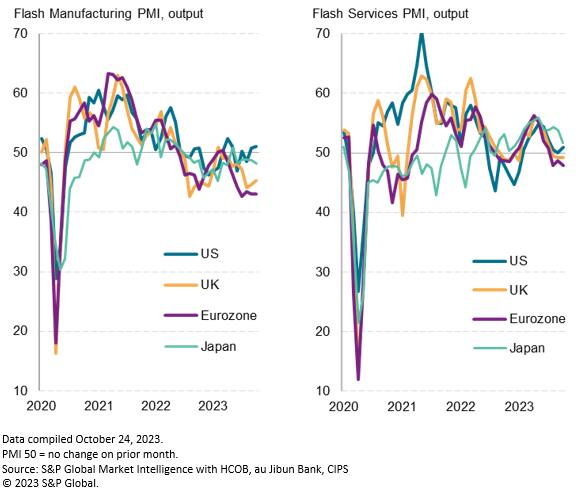

Near-term prospects remain uncertain, as backlogs of work continued to decline in October. Falling backlogs were recorded in both manufacturing and services, matched by deteriorating output conditions, with manufacturers suffering marked declines while services activity stagnated.

This depletion of outstanding business reflected the fact that new order inflows across the G4 once again fell at a faster rate than output in October, meaning companies had to rely on the previously-placed orders to sustain current levels of capacity utilization. Clearly, unless new order inflows start to lift higher, risks to output in the months ahead remain tilted to the downside as these backlogs of work will eventually be depleted.

Europe leads slowdown as US outperforms

The economic malaise was again led by Europe, with the US notably outperforming as its expansion regained some poise, albeit remaining somewhat lackluster.

Eurozone output contracted for a fifth month in a row in October, the rate of decline gathering pace to the steepest since November 2020 as the flash PMI fell from 47.2 to 46.5. Excluding pandemic months, the fall in activity was the sharpest since March 2013. The current level of the eurozone PMI is broadly consistent with eurozone GDP falling at a quarterly rate of 0.4% at the start of the fourth quarter, having signalled a 0.3% contraction in the third quarter.

A seventh successive month of falling output in the euro area's manufacturing sector was accompanied by a third month of contracting service sector activity. Factories notably remain in the deepest downturn since 2009 barring the early pandemic lockdowns.

UK output fell for the third straight month, albeit to lesser extent than the Eurozone as PMI edged up from 48.5 to 48.6. The pace of decline has also remained largely unchanged over the past three months to signal only very modest recession risk. The UK PMI is broadly indicative of GDP falling at a quarterly rate of just over 0.1%, having pointed to a 0.1% quarter-on-quarter GDP contraction in Q3. Service sector output fell in the UK for a third successive month. Although again only modest, the sustained downturn represents a major change to the buoyancy seen in this part of the economy earlier in the year. The decline was the steepest since January. UK manufacturing output meanwhile continued to fall sharply in October, dropping for an eighth successive month with the rate of contraction easing only slightly.

US growth ticked higher, with the flash PMI up from 50.2 in prior two months to 51.0. However, growth is very modest still, and suggests weak growth momentum going into the fourth quarter. The US flash PMI is consistent with annual GDP growth of approximately 1.5%, hinting at a lower underlying growth profile than official GDP data are expected to show for Q3.

In contrast to Europe, the US saw growth of both manufacturing output and services activity in October, albeit with rates of growth remaining lacklustre (despite improving on September). Notably, like Europe, the US has seen a marked cooling of its service sector expansion since earlier in the year.

Japan meanwhile lost its recent shine, the flash PMI slipping to 49.9 from 52.1 to signal first (marginal) contraction since December. The Japan flash PMI points to GDP growing at an annual rate just under 1.0% at the start of Q4, which is in line with the pre-pandemic 10-year average.

Factory output fell in Japan at the quickest rate since February as destocking exacerbated weaker demand growth. Services activity remained in expansion amid still-robust consumer services demand. Anecdotal evidence highlighted that tourism demand continued to support service sector growth, but the expansion slowed sharply.

Demand downturn brings lower price pressures

One upside to the downturn in demand was a further cooling of price pressures in October. Input costs across manufacturing and services rose in the G4 at the slowest rate since November 2020.

Lower wage growth (employment growth in the G4 over the past three months has been the lowest since early-2021) and falling goods prices have helped offset higher oil prices.

The impact of the latter, and how central banks deal with this, will be a key aspect to monitor in the coming months, but at the moment the combination of falling output, weak demand and slower cost growth means there is good reason to believe developed world interest rates have peaked.

The need for rates to remain high for long will be tested by the PMI data in the coming months. Further falls in service sector inflation in particular will be eagerly sought in support of any conviction that rates have peaked.

Diverging outlooks for the US and Europe

The improving inflation outlook, and signs of interest rates peaking, played a role in lifting business confidence higher in October. Expectations of output in the year ahead across the G4 rose to the highest since June, albeit with the gain limited to the US. The forward-looking data therefore add further to the likelihood of the US outperforming Europe in the months ahead, with a soft-landing for the former contrasting with rising recession risks in the latter.

Access the press releases for the Eurozone, Japan, UK and the US.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsubdued-picture-from-flash-pmis-masks-widening-growth-divergencesOctober2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsubdued-picture-from-flash-pmis-masks-widening-growth-divergencesOctober2023.html&text=Subdued+picture+from+flash+PMIs+masks+widening+growth+divergences+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsubdued-picture-from-flash-pmis-masks-widening-growth-divergencesOctober2023.html","enabled":true},{"name":"email","url":"?subject=Subdued picture from flash PMIs masks widening growth divergences | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsubdued-picture-from-flash-pmis-masks-widening-growth-divergencesOctober2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Subdued+picture+from+flash+PMIs+masks+widening+growth+divergences+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsubdued-picture-from-flash-pmis-masks-widening-growth-divergencesOctober2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}