Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Oct 31, 2014

A Monte of trouble

Italian bank Monte dei Paschi emerges as the loser after ECB stress tests

- Monte dei Paschi's spreads extremely volatile while capital plans are uncertain

- Tests won't be a panacea for eurozone's malaise

- ISDA 2014 basis has changed significantly over the past month

After the announcement of the results, Monte's sub spreads gave up a further 50bps to trade at 677bps. But only two days later they had recovered to 610bps, an improvement from the pre-result levels. On the face of it, this seems surprising given that subordinated bondholders are in the firing line if government intervention forces a bail-in (an eventuality that the new definitions explicitly cover through an additional credit event). But the Italian authorities were quick to deny that public money would be used to prop up the country's ailing banking sector (three other institutions require capital injections).

Monte dei Paschi has already received €4bn in public aid, some of which has been paid back, and other alternatives are likely to be considered before that route is taken again. It can sell assets or raise funds through a rights issue, both of which should be positive for credit investors. Or it could sell itself to another, larger institution, which would also benefit bondholders.

However, Intesa Sanpaolo described a merger of the two institutions as "unimaginable". The reaction of the credit markets showed that investors had expected a larger Italian bank to rescue the ailing bank - Monte dei Paschi's subordinated spreads widened 154bps to 800bps. MPS has a little over a week to come up with a capital raising plan, and we can expect further volatility in the interim.

The dust is still settling from the results, but it seems clear that the catharsis EU officials hoped for hasn't materialised. The AQR, in particular, was worthwhile and bank balance sheets are more transparent. But it doesn't follow that Europe's banks will now embark on a lending spree - lack of demand remains the underlying problem. And deflation looms, a scenario, incidentally, that the stress tests didn't consider.

Nonetheless, the credit markets ended the week on a high, thanks to an unexpected intervention from the Bank of Japan. The Japanese central bank announced that it was expanding its asset purchase programme, a decision that shocked the markets. It was a timely move given that the Fed stopped its own bond buying programme earlier this week (though the size of its balance sheet is still accommodative). If the ECB (and Germany) can manage to overcome its conservatism and follow suit, then there might be some hope for the eurozone.

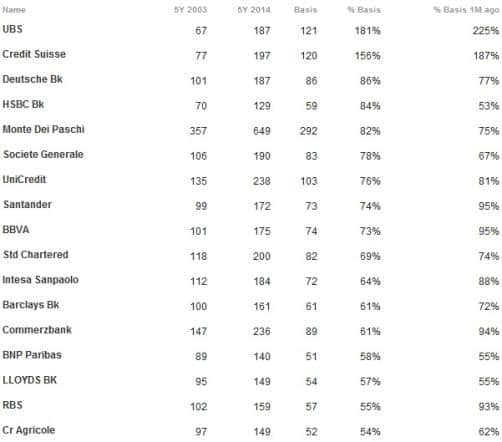

We analysed the basis caused by the introduction of the ISDA 2014 definitions last month. One month on from the roll, we can see that there have been some changes in the subordinated basis as the market acclimatised to the new rules. The Swiss banks still have the widest basis due to the inclusion of the coco supplement as standard.

Elsewhere, we have seen the basis in some banks, such as HSBC and Deutsche Bank, increase significantly. Others, particularly RBS and Commerzbank, have seen their basis shrink by a considerable amount. The size of the basis changes and the lack of a discernible pattern perhaps shows the challenges faced by the CDS market in adjusting to the 2014 definitions.

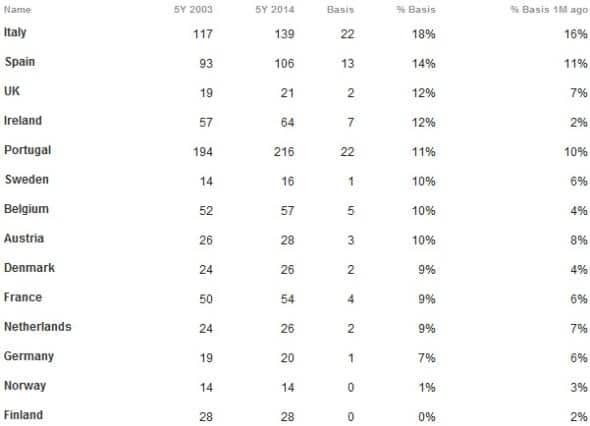

In sovereigns, however, there is a clear shift in the basis. The vast majority of western European names saw their basis increase over the past month, with Italy's 2014 spreads trading as much as 18% wider than 2003 equivalents.

Gavan Nolan | Director, Fixed Income Pricing, IHS Markit

Tel: +44 20 7260 2232

gavan.nolan@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31102014-credit-a-monte-of-trouble.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31102014-credit-a-monte-of-trouble.html&text=A+Monte+of+trouble","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31102014-credit-a-monte-of-trouble.html","enabled":true},{"name":"email","url":"?subject=A Monte of trouble&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31102014-credit-a-monte-of-trouble.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=A+Monte+of+trouble http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31102014-credit-a-monte-of-trouble.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}