Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 30, 2014

Russian ETFs see strong inflows despite sanctions

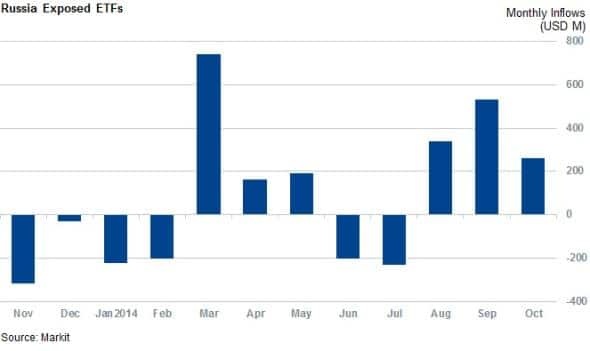

In spite of sinking oil prices, international sanctions and a falling currency, investors have been eager to add to their Russian exposure in the last few months.

- Russian ETF inflows across 23 traded products over the past three months have pushed inflows for the year past the $1bn mark

- This comes despite a heavy reliance on energy shares which have been hit by sanctions and falling oil prices

- ETF inflows contrast with a downbeat mood from the country's companies, with Markit forecasting flat aggregate dividend payments in the coming year

Despite what one would expect to be a "perfect storm" scenario for Russian stocks, ETF inflows have remained strong. Net inflows into the 23 Russian tracking ETFs have proved buoyant in the last three months. These bullish investments take the 2014 net inflows into Russian ETFs past the $1bn mark, and set to make this year the second best for Russian ETFs in term of net inflows. Investors are no doubt drawn to the volatile situation which has seen shares in the country swing wildly in the wake of political and economic developments.

Another angle for ETF investors to consider is currency swings, as the ruble has also proven as volatile as Russian shares, though the recent prospect of a central bank intervention looks to have played in the hand of ETF investors.

Underlying exposure grows

As ever in the ETF world, funds are concentrated at the top end of the market with one ETF, the Market Vectors Russia (RSX), holding 54% of $3.7bn of total Russian exposed ETF funds. Its constituents are equally crowed with nine shares make up over half of the Market Vector Basket's weight. The ETF has also gathered the majority of new assets into the country with $214m of inflows. These are dominated by energy shares which have led the index down in the wake of falling oil prices and international sanctions.

The fund's largest constituent is state owned gas monopoly Gazprom. The fund has an 8% weight in the Russian energy giant's London listing. Gazprom has recently benefited on a positive outcome from talks between Russia, Ukraine and the European Commission on natural gas deliveries as well as the recent spike in the ruble's value which has lifted its shares off the recent lows.

The next largest position is 7.9% in discount retailer Magnit who reported growingthird quarter sales with increasing ebitda margins despite the government's ban on food imports. The company has been able to manage high price inflation and looks set to continue to deliver growth. These strong results have seen Magnit shares significantly outperform the rest of its RSX peers in the last three months, after seeing its shares increase by 23% over the last three months.

The third largest position is 7.6% in Siberian based Lukoil who explores, produces, refines and transports oil and gas as well as operates refineries in Russia and the US. Recently Hedge fund Lakewood Capital Management has gone long, according to a letter distributed to clients obtained by Bloomberg News, and is the "cheapest stock" in the firm's portfolio according to founder Anthony Bozza.

Sberbank, currently one of three of Russia's largest lenders under sanctions by the EU, is the fourth largest position at 6.7% of the ETF. The share price is currently down 42% year to date in the wake of EU imposed sanctions.

Dividends flat

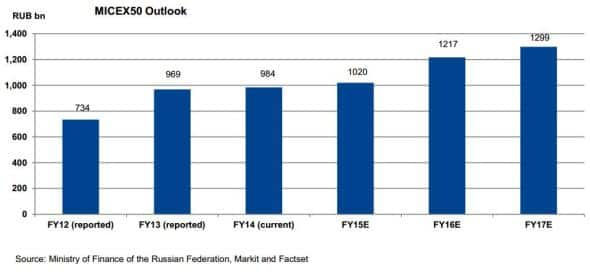

Contrasting to the buoyant ETF picture, Recent dividend research by Markit forecasts aggregate Russian dividends for the MICEX50 in 2014 and 2015 to remain relatively flat. The 2014 figure is partly propped up by one off special distributions form Severstal, Norilsk Nickel and M.Video, suggesting that not all of Russia is suffering.

We expect the oil and gas sectors to cut dividends overall by 6% with the banking sector decreasing payments by 14% in line with official Russian government announcements that it expects seven large blue chip companies in sanctions affected industries to lower payments in 2015.

The majority of the Russian companies boosted dividends against the market's expectations this year. Offering the enlarged dividends, these companies tried to defy the sanctions while some companies in worse financial situation simply increased their payout ratio. As an example, Novatek increased its interim dividend payment right after the second round of sanctions in July, with oil and gas companies being a major target.

Lukoil and Novatek are the only sanctioned companies that we are forecasting to boost payments next year, in line with the outlined dividend policy.

In August Lukoil confirmed its intention to target annual dividend growth of 15%, and a 30% payout ratio. Lukoil has been "disciplined" by Europe and USA with technical sanctions only, which allows it to borrow money externally to cover the dividend payments, as it has done in the past.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30102014-Equities-Russian-ETFs-see-strong-inflows-despite-sanctions.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30102014-Equities-Russian-ETFs-see-strong-inflows-despite-sanctions.html&text=Russian+ETFs+see+strong+inflows+despite+sanctions","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30102014-Equities-Russian-ETFs-see-strong-inflows-despite-sanctions.html","enabled":true},{"name":"email","url":"?subject=Russian ETFs see strong inflows despite sanctions&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30102014-Equities-Russian-ETFs-see-strong-inflows-despite-sanctions.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Russian+ETFs+see+strong+inflows+despite+sanctions http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30102014-Equities-Russian-ETFs-see-strong-inflows-despite-sanctions.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}