Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 31, 2014

Most shorted ahead of earnings

We review how short sellers are reacting to companies due to announce earnings in the third week of the third quarter results season.

- Continuing from a trend we observed last week, small scale producers firms make up the majority of the top 20 shorted companies announcing earnings

- FLSmidth is the most shorted company ahead of earnings in Europe

- Tech firms continue dominate the sectors seeing high short interest ahead of earnings

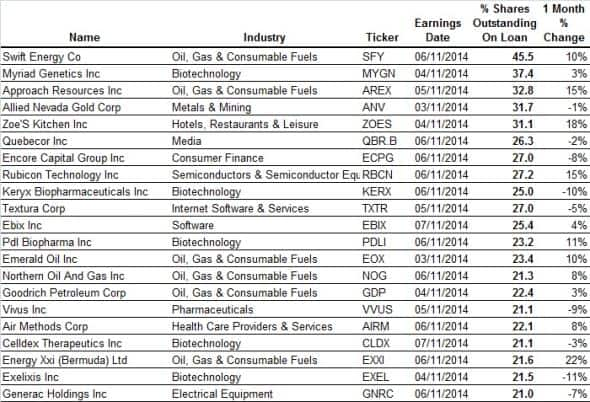

North America

The third quarter earnings season continues next week, and we see 21 firms with more than 21% of shares out on loan prior to announcing earnings next week.

Most shorted ahead of earnings this week in is oil and gas producer Swift Energy. The company has 45% of shares outstanding on loan. Swift is joined in the podium of the most shorted firms by Approach Resources, another oil and gas producer whose share price is down 48% this year to date and currently has 32% of shares are out on loan.

Both firms reported solid production growth in thesecond quarter with increased volumes, however the circa 25% decline in oil price and cost pressures for smaller producers has come under increasing investor scrutiny.

Joining the firms from the oil and gas sector with more than 20% of shares out on loan short is Emerald Oil, Northern, Oil, Goodrich Petroleum and Energy Xxi (Bermuda).

Biotech firm Myriad Genetics, whose shares are up 75% so far this year, is the second most shorted stock ahead of earnings with 37% of shares out on loan. This represents a decrease from 46% at the beginning of the year, as the company has proven to be an expensive short in the last few months.

Allied Nevada Gold, a gold mining site explorer and developer, has seen its share price fall 62% this year, half of which was seen last week. According to the SEC, the firm has fallen victim to a fraudulent takeover bid with the perpetrator thought to have fled to China. Shorts look to have familiar with the recent ruling as the current short interest represents nearly the entirety of what can be borrowed from lending programs.

Finally casual Mediterranean restaurant chain Zoe's Kitchen has attracted increasing short interest since its April IPO. Currently there are 31% of shares out on loan while the share price is up 35% since listing.

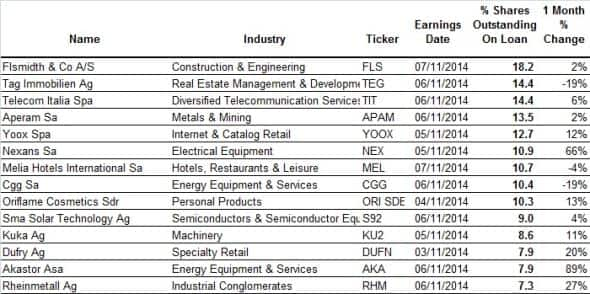

Europe

This week ahead of earnings in Europe, 14 firms have over 7% of shares out on loan with an overall average of 11%.

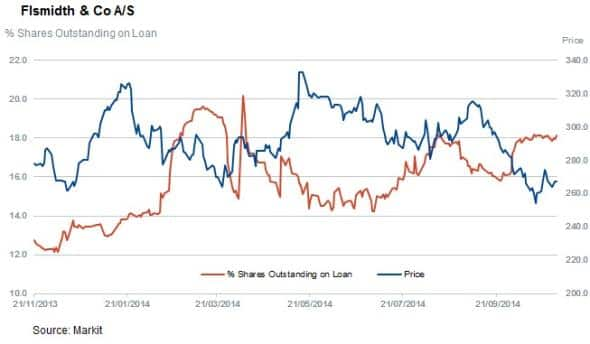

FLSmidth holds the top spot with 18% of shares out loan. The company supplies minerals and cement industries with "everything" and its share price is moderately down by 6% this year to date. This no doubts reflect the uncertainty around economic outlook in the Eurozone.

CGG Sa, a manufacturer and provider of geophysical equipment for onshore and offshore oil and gas clients has 10% of its shares our on loan. This has proven to be another successful short as its shares are down sharply year to date.

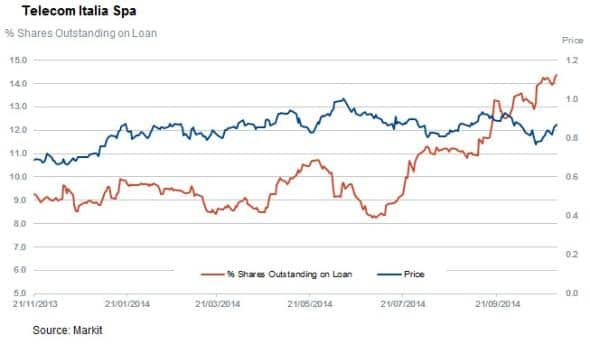

Another notable short ahead of earnings in Europe is Telecom Italia with 14% of shares outstanding on loan. The share price is flat so far this year, but is up 25% over 12 months. The heavy demand to borrow comes as Telecom Italia comes up against its effort to consolidate its Brazilian business, which represents about a third of TIT's, revenue and recently suffered a setback when it lost out to Spanish rival Telefonica on a bid for Brazilian broadband telecoms and TV firm GVT.

Asia

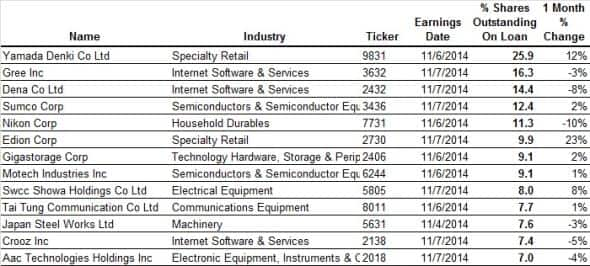

In Asia, last week's heavy presence of tech companies among the most shorted firms continues with ten of the 13 firms with heavy short interest coming from the sector. The non tech names reporting earnings this week also have a heavy exposure to the sector, as two of the three remaining firms are electronics retailers.

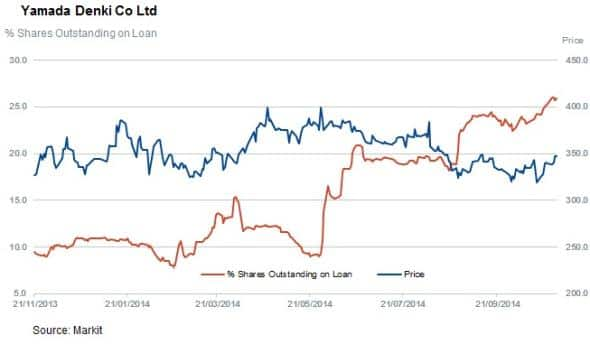

The title of the most shorted Asian company announcing earnings this week goes to white goods retailer Yamada Denki which has just under 26% of shares out on loan. Yamada's short interest has climbed to new recent highs in the last few months as Japanese consumers cut back on spending in a wake of a sales tax hike. This trend is reflected in Yamada's results as the company saw its last quarterly revenues fall by over a fifth in the wake of the tax hike. The story is also reflected in Edion, which has just under 10% of shares out on loan ahead of its earnings announcement.

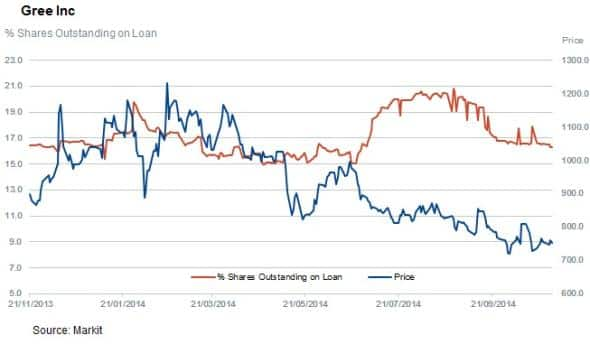

In the tech space, social media firms Gree and Dena continue to make popular shorts as analysts brace themselves for another year of falling revenue.

Semiconductor wafer manufacturer Sumco rounds out the top five, with 12.4% of the firms shares out on loan. Short interest in the Nikkei 225 constituent has jumped six folds since the start of the year as the firm's shares have doubled.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31102014-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31102014-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31102014-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31102014-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f31102014-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}