Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Nov 30, 2015

Shorts dim the lights on solar

As leaders meet this week at COP21talks in Paris to negotiate new emission reduction measures, struggling solar companies are becoming victims of their own success as the cost of panels and energy prices continues to fall, attracting short sellers.

- Average short interest in the Guggenheim solar ETF TAN spikes to 7.4%

- Short interest in Solarcity hits an all-time high, with Tesla close behind

- Sunedison sees short interest spike to record high with stock now down by 82% ytd

Fossils lose their edge

The oil price collapse and subsequent sell off in commodities over the past 18 months has seen the input costs of energy production diminish. End prices have fallen and remain weak as emerging markets continue to cool off, easing demand amid a glut in global supply.

With fortuitous timing, renewable energy costs are achieving parity with fossil fuels and environmental benefits plus improved economic incentives have seen the sector flourish. Solar installations are now growing at the fastest pace in history and the US now produces almost 2% of total energy from solar power.

But companies operating in the renewables sector are under pressure as energy price declines have been steep and swift, putting projects into precarious positions. Additionally, manufacturers of solar panels are facing a worldwide glut in supply as prices continue to fall; further adding to price deflation of producers and lowering prices.

Too much of a good thing

The Guggenheim Solar ETF (ticker: TAN), reached its 2015 high of $50 in April after a stellar six month performance, in part driven by Hanergy Thin Film Power Group. Hanergy eventually plummeted in Hong Kong, ultimately being suspended and then deleted from the ETF.

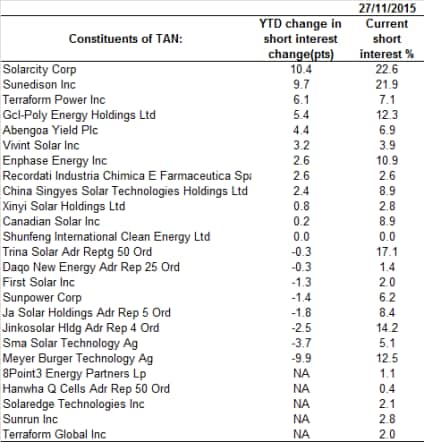

Currently constituents average 7.3% of shares outstanding on loan for TAN. This is around three times the average for companies in the S&P 500 and twice the short interest for constituents of the Russell 2000.

The expiration of the solar tax credits in December 2016 has created uncertainty in the US solar market, as currently residential and commercial solar projects enjoy a 30% tax credit for new solar investments. The UK government also recently announced drastic cuts to renewable tax credits ahead of the COP21 as it expects the sector to be self-sufficient by 2020.

City focus for short sellers

Solarcity has seen the largest increase in short interest over the past year of any solar company within TAN. Short interest as a percentage of shares outstanding rose by 46% year to date with 22.6% of total shares outstanding on loan.

Some analysts have indicated that that Solarcity is primed for a short squeeze, however Markit Research Signals' short squeeze model does not agree. The short squeeze composite ranks highly shorted securities in on a scale of 1-100 with 1 being the highest potential for a squeeze and 100 being the lowest.

Solarcity currently has a rank of 80 which indicates a relatively low risk compared to others. It is also ranked 90 for capital constraints, which means most open short loan positions are profitable and short sellers will be less likely to be squeezed out of their position.

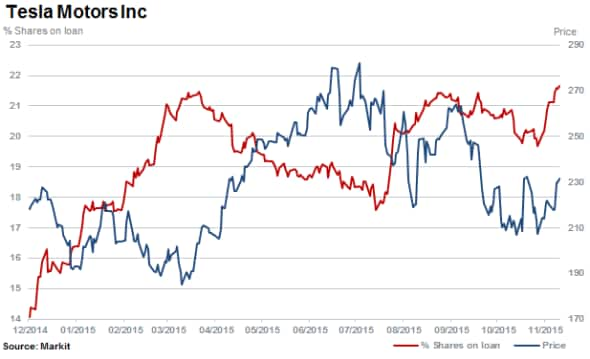

Solarcity's Chairman Elon Musk is no stranger to short sellers and short interest in Musk's other venture, Tesla, has once again breached a fifth of shares outstanding on loan at 21.7%. Since September short sellers have rebuilt positions in the electric automaker after being forced to cover in 2012 as the stock price continued to soar.

Other shining shorts

Short interest in Abengoa Yield spiked recently as the Spanish renewable firm Abengoa (Parent) announced the start of bankruptcy proceedings as the firm struggles to raise funds required for continuing operations.

Shares outstanding on loan have increased to 6.9% while the stock has fallen 60% in the last six months.

Faced with lower prices, subsidies and funding issues, shares in Sunedison have fallen 90% in the past six months with short interest jumping to an all-time high recently. Shares outstanding on loan have increased to 21.9%.

Andrew Laird | Securities Finance Analyst, Markit

Tel: +1 646-312-8990

andrew.laird@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30112015-Equities-Shorts-dim-the-lights-on-solar.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30112015-Equities-Shorts-dim-the-lights-on-solar.html&text=Shorts+dim+the+lights+on+solar","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30112015-Equities-Shorts-dim-the-lights-on-solar.html","enabled":true},{"name":"email","url":"?subject=Shorts dim the lights on solar&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30112015-Equities-Shorts-dim-the-lights-on-solar.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Shorts+dim+the+lights+on+solar http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30112015-Equities-Shorts-dim-the-lights-on-solar.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}