Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Dec 01, 2015

Bearish steel sentiment steady as price tumbles

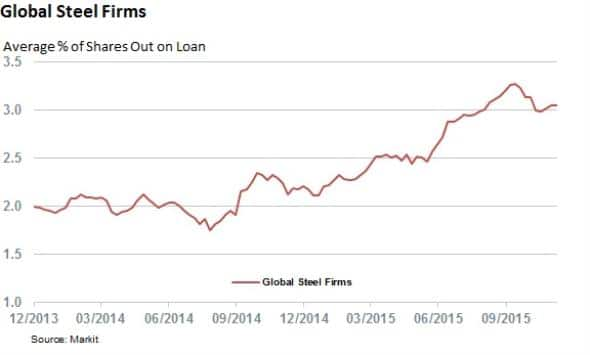

Falling metal prices have seen steel firms caught in the crosshairs of short sellers throughout 2015, although bearish sentiment has begun to slide from the highs seen in early October.

- Global average steel short interest is up by 50% year to date to hit 3.05%

- US firms most targeted; US Steel sees all-time high 28% of shares out on loan

- European firms Kloeckner and Ssab also seeing heavy demand to borrow

China's economic slowdown continued into November as the Caixin China Manufacturing PMI, complied by Markit, indicated that the Chinese economy remained below the breakeven 50 point for the ninth month running. While the number indicated that the pace of China's slowdown was not as sharp as the September lows, this will come as little comfort to industrial metals producers as the Bloomberg Commodities index continues to hover around the recent lows seen last week.

Iron ore, and its derivative steel, which are not part of the basket tracked by the index, have also felt China's slowdown with bothcommodities hitting recent all-time lows as the market struggles to cope with a glut stemming from oversupply in China. This excess supply is in turn finding its way into the international market with the US now importing 40% of its steel; twice the level seen a few years prior. This has led to accusations of price dumping both in the US and Europe as domestic suppliers struggle to compete.

Steel shorts surge

The tough operating conditions have seen short sellers circle around steelmakers, with global steelmaking firms tracked by Markit's short interest data seeing a 50% increase in the demand to borrow their shares since the start of the year. The increase takes the demand to borrow to past the 3% of shares outstanding mark, something which the sector hasn't seen since the start of 2013.

US firms most shorted

North American firms, which have had to contend with the recent rising dollar, are top on the short seller's shopping list as American firms make up the four global steel firms with more than 20% of their shares out on loan.

US Steel leads the way with the S&P500 constituent now seeing an all-time high 28% of shares out on loan. This is over twice the levels seen in June and comes in the wake of a 70% fall in the company's stock.

The other three firms leading the shorting activity are Cliffs Natural Resources, Labrador Iron Ore Royalty and AK Steel. The first of the three has a large exposure to coal, which is increasingly falling out of fashion across the world.

European steel still targeted

While North American firms have been the favourite target of short sellers, overseas listed firms have seen their fair share of bearish sentiment in recent months with five non-North American listed firms now seeing more than 10% of their shares shorted.

German trading house Kloeckner is the most shorted of the lot, now seeing 17.5% of its shares out on loan; a ten-fold jump since the start of the year. This large surge in short interest has yet to pay off for short sellers however as Kloeckner shares are only 10% off the level seen at the start of 2015, a fifth less than the average fall among the 11 shares seeing more than 10% of their shares shorted.

The other European firms in the list of the heavily shorted shares are Scandinavian firms Ssab and Outokumpu.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122015-Equities-Bearish-steel-sentiment-steady-as-price-tumbles.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122015-Equities-Bearish-steel-sentiment-steady-as-price-tumbles.html&text=Bearish+steel+sentiment+steady+as+price+tumbles","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122015-Equities-Bearish-steel-sentiment-steady-as-price-tumbles.html","enabled":true},{"name":"email","url":"?subject=Bearish steel sentiment steady as price tumbles&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122015-Equities-Bearish-steel-sentiment-steady-as-price-tumbles.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Bearish+steel+sentiment+steady+as+price+tumbles http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122015-Equities-Bearish-steel-sentiment-steady-as-price-tumbles.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}