Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Nov 30, 2015

Retail bonds pressured heading into December

Dollar-denominated retail bonds have seen a rise in credit risk in the weeks leading up to the crucial December holiday shopping season.

- Macy's and Nordstrom's CDS spreads surge after poor results

- Markit iBoxx $ Retail index has seen its spread over swaps jump to new yearly highs

- Retail bonds are still in positive total return territory for the year

December's holiday shopping is a key period for US retailers, accounting for around a tenth of all non gas retail volumes. But early indications for this year's December sales volume indicate a worrying trend for several of the sector's key players. Third quarter earnings season was replete with retailers cutting their profit and revenue forecasts for the upcoming quarter, due to the hypercompetitive state of the market and a build-up in inventory over the months leading up to the final quarter.

These developments have seen short sellers target the equity portion of retailers' balance sheets as short interest among US retailers has surged in the last few weeks. On the other side of the sector's balance sheet, the recent weak earnings updates have seen credit risk in retail firms jump in earnest.

CDS spreads jump

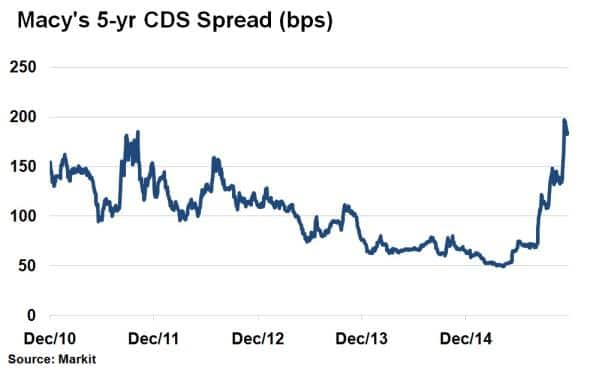

On a single name basis, firms with a heavy physical bricks and mortars presence have borne the brunt of the recent bad results due to competition from cheaper price online offerings. Firms in the former category have seen their CDS spreads jump to new multi year highs.

Leading the trend is Macy's. The mall stalwart has seen its CDS spread jump more than four-fold from its April all-time lows to a high of 200bps two weeks ago. While that level has since settled somewhat to 180bps, the recent spreads mark a five year high water mark for the company's risk perception as gauged by its CDS spreads

Other names coming under pressure in the CDS market are Gap, Nordstrom's and Dillard's which have all experienced a similar jump in their CDS spreads in recent weeks.

Bonds spreads rising

This negative sentiment is also being felt more broadly across the sector given that the extra spread required by bond investors in the sector has jumped to recent yearly highs. This trend, as gauged by the asset swap spread of the Markit iBoxx $ Retail index, indicates that investors are now requiring 182bps of extra yield to holds bonds issued by retailers is now 178bps, just 2bps off the yearly highs seen last week. This number has jumped by a full 50bps from where it stood one year ago.

Although retail bonds are still in positive total return territory for 2015 as the year to date total return of the index now stands at 32bps, the recent volatility and surge in extra yield demanded by investors shows the market's anxiety towards the sector heading into this critical period.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30112015-Credit-Retail-bonds-pressured-heading-into-December.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30112015-Credit-Retail-bonds-pressured-heading-into-December.html&text=Retail+bonds+pressured+heading+into+December","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30112015-Credit-Retail-bonds-pressured-heading-into-December.html","enabled":true},{"name":"email","url":"?subject=Retail bonds pressured heading into December&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30112015-Credit-Retail-bonds-pressured-heading-into-December.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Retail+bonds+pressured+heading+into+December http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30112015-Credit-Retail-bonds-pressured-heading-into-December.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}