Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 30, 2015

Chinese investors hold their breath

Stocks in China have shed more than 20% of their value over the last couple of weeks, but domestic and foreign investors' opinions continue to diverge.

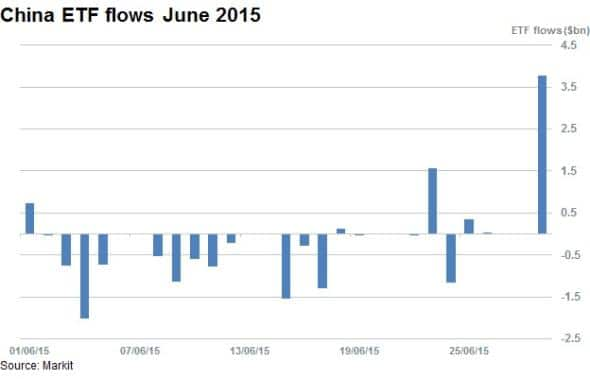

- Chinese domiciled domestic ETFs recorded $3.8bn of inflows on the 29th

- Waning foreign demand for stocks dwarfed by locals placing 30% plus premiums on stocks

- Short sellers continue to target A shares through FTSE A50; which has 8% of shares short

A sharp equities selloff in China has sent the Shanghai market into bear territory in the second quarter of the year.

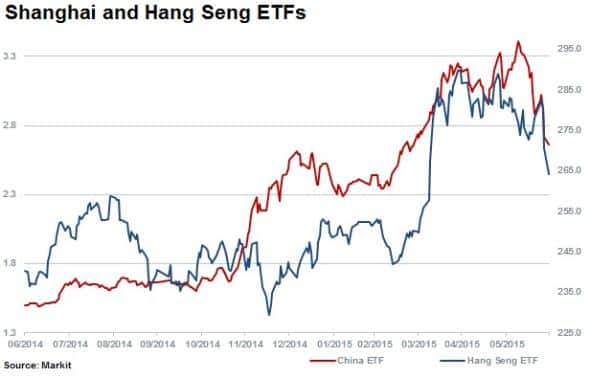

Shares of companies that trade in Shanghai (A shares) have continued to drift from the same companies that trade in Hong Kong (H shares). Trading at over a 40% premium before markets plummeted; the Hang Seng China AH premium index is currently at 133.6, representing a premium of 33.6%.

Mainland premium drivers

Local asset managers have urged Chinese investors to take advantage of the recent drop in prices and the Chinese government has stepped up efforts to reassure investors of their support for stocks.

The central bank surprised with a 25bps reduction in benchmark rates this weekend and reduced the reserve requirement ratio at selected banks to improve liquidity amid falling prices, particularly hurting leveraged investors.

Adding further support to markets are state investment agencies supposedly purchasing large cap ETFs, providing increased liquidity and price stability. Recently published draft regulations, allowing pension funds to invest up to 30% of assets in equities, will also potentially unlock $100bn destined for equity markets.

Panda bear market still up

Despite its price declining by 22% in the last week, the China 50 ETF which tracks the largest 50 blue chip stocks in Shanghai is still up by 77% over the last 12 months. The recent market selloff has spread to Hong Kong but to a far less severe extent, demonstrated by the Hang Seng Index ETF falling 'just' 6% in the last week.

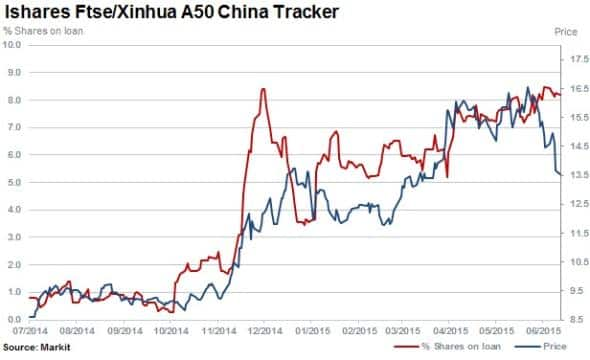

While short selling in single names in Hong Kong is more prevalent than mainland shares, short sellers have targeted mainland shares through the iShares FTSE A50 China Index which currently has 8.2% of shares outstanding on loan. The Hong Kong listed ETF has $6.5bn in AUM.

Strong ETF flows

While markets have fallen, local ETF investors, public or state sponsored, have been very active in recent days with $3.8bn of inflows recorded into local domiciled ETFs. Three quarters of these flowed into equity ETFs, with the balance going to fixed income ETFs.

The three equity ETFs which received the bulk of inflows are: China 50 ETF ($708m); Hutai-PineBridge CSI 300 ETF ($685bn) and the Shanghai SSE108 Index ETF ($590bn). These strong inflows occurred while foreign domiciled ETFs saw a total of $78m withdrawn from funds.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30062015-Equities-Chinese-investors-hold-their.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30062015-Equities-Chinese-investors-hold-their.html&text=Chinese+investors+hold+their+breath","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30062015-Equities-Chinese-investors-hold-their.html","enabled":true},{"name":"email","url":"?subject=Chinese investors hold their breath&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30062015-Equities-Chinese-investors-hold-their.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Chinese+investors+hold+their+breath http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30062015-Equities-Chinese-investors-hold-their.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}