Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jun 30, 2015

Calls of overheating in US high yield overdone

Investors have been pulling money out of US high yield bonds amid calls that the market is overheating, but a closer look at the data reveals that risks are actually lower than a few months ago.

- US high yield ETF outflows have accelerated over the last two months, but AUM growth has been slowing for years

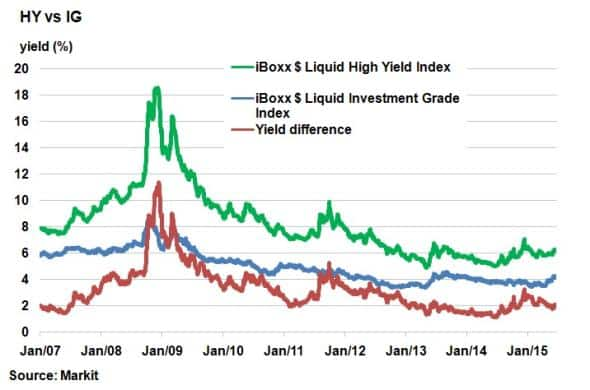

- The yield difference between US HY and IG is 2.12%; still 97bps above the post crisis low of 1.15%

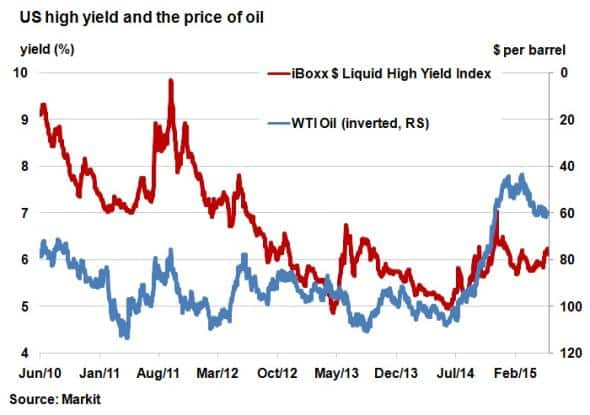

- Yield on the iBoxx $ Liquid Investment Grade Index has come down as the price of oil has stabilised

Last week influential investor Carl Icahn tweeted that he felt the high yield bond market was "overheated"; essentially claiming that the market now presents considerable risks for investors. But data

ETF outflows

If ETF flows are anything to go by, investor sentiment is waning. US high yields bond ETFs have experienced over $3bn of outflows in the last two months, with the current month experiencing the largest outflow since July 2014. This comes after a strong start in 2015, with the first two months seeing nearly $6bn piled into to US high yield ETFs; a sign that investors have started to rotate out of the asset class.

But looking at the bigger picture, US high yield bond ETF net inflows have dramatically tapered off over the last three years. Peaking in 2012 with $11.52bn of net inflows, 2013 and 2014 saw a third less than this, with 2015 set to be even lower if the current trend continues.

Investigating issuance

Proponents of the view that the US high yield market is presenting potential higher risks often point towards the massive amount of issuance that has taken place post the financial crisis.

The five years from 2010-2014 saw an average of $293bn of issuance per year; a stark contrast to the five years preceding the financial crisis (2003-2007) which saw an average of $130bn of issuance per year. Low borrowing costs and relaxed covenants have helped riskier corporations finance operations.

The problem lies when this debt needs to be refinanced in the future. Interest rates and therefore borrowing costs are predicted to rise at some point, potentially straining corporate operations. But it can be argued that while issuance has grown, so has the average maturity for newly issued high yields bonds, which creates a larger gap between debt rollovers and adds extra time for these corporations to adapt to an environment of higher future borrowing costs.

Relative value

Another way of looking at the overheating argument is to compare USD high yield bonds to their higher quality investment grade peers.

Using the Markit iBoxx $ Liquid High Yield Index and the Markit iBoxx $ Liquid Investment Grade Index, the current yield difference between the two bond classes is 2.12%. This number has been widely quoted as too low, given that risks associated for just 2% of extra yield.

While the current yield difference is down from 2.58% at the start of the year, this is still 97bps above the post financial crisis low of 1.15% seen 12 months ago. The current basis is also roughly in line with the five years average of 2.48%, only 36bps above the current level.

Hardly a sign of the current market overheating given the fact that bond yields have started to widen in anticipation of a possible rate hike.

Another point worth noting is the changing composition of the US high yield market, especially since the emergence of shale market in 2011. The largest contributor to the Markit iBoxx $ Liquid Investment Grade Index is the Oil and Gas sector and as a consequence the sector has become more correlated with the price of oil. When oil prices plunged last year, so did US high yield bond, which sent yields spiking. WTI has since recovered some of its lost ground; sending yields back down from their highs.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30062015-Credit-Calls-of-overheating-in-US-high-yield-over-done.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30062015-Credit-Calls-of-overheating-in-US-high-yield-over-done.html&text=Calls+of+overheating+in+US+high+yield+overdone","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30062015-Credit-Calls-of-overheating-in-US-high-yield-over-done.html","enabled":true},{"name":"email","url":"?subject=Calls of overheating in US high yield overdone&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30062015-Credit-Calls-of-overheating-in-US-high-yield-over-done.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Calls+of+overheating+in+US+high+yield+overdone http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30062015-Credit-Calls-of-overheating-in-US-high-yield-over-done.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}