Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jan 30, 2015

Most shorted ahead of earnings

A review of how short sellers are positioning themselves in companies due to announce results in the coming week.

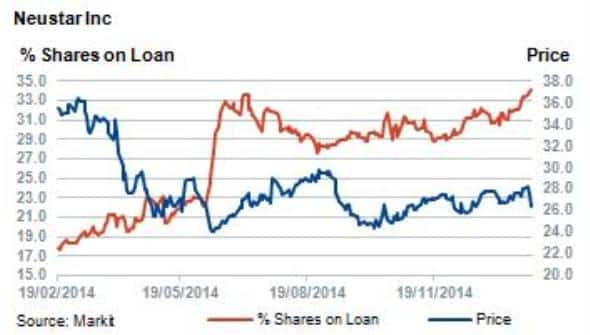

- 126% increase in short interest in Neustar as the company loses its role as the American phonebook administrator

- Finnish tyre maker Nokian's short interest climbs to 17% as Russian sales plummet

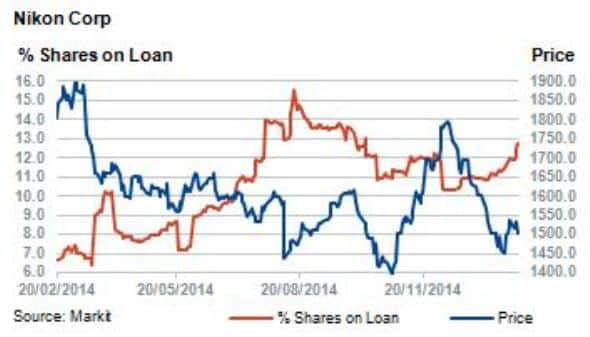

- Nikon and Sharp see 20% rise in short interest as Japanese electronics makers struggle with weaker yen and markets

North America

Oil & gas, energy and healthcare dominate the firms seeing highest short interest ahead of earnings in the US this week. Whereas record low oil prices explain why many oil and energy firms are struggling, healthcare may be being punished for performing too well as the sector was one of the top performers in 2014 and is currently up almost 30% over the last 12 months.

Online security, data and marketing firm Neustar is the most shorted ahead of earnings with 34% of shares outstanding out on loan. The company helps corporates prevent hacks and threats on websites such as twitter. The stock has seen a significant increase in short interest growing by 127% over the last year. The stock enjoyed a strong 15% run in 2013, but fell by 26% over the last 12 months.

Concerns over the company's future gained attention in 2013 as 48% of its revenue was derived from a single, highly profitable business contract that came under scrutiny. The contract involved the management and running of the entire US phone registry database - a function known as the Local Number Portability Administrator. On January 29th 2014 the company announced that it was notified that its proposal for the next contract term would not be considered.

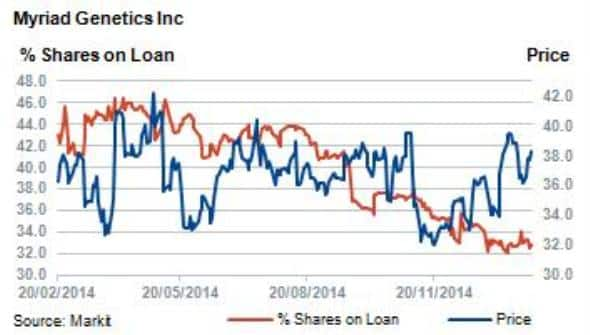

Myriad Genetics develops and markets molecular diagnostic products. The company lost a court ruling in the US Appeals court, which decided that the company cannot block competitors from conducting similar DNA tests. The ruling also mentioned that those patents granted for the Myriad tests should have never been issued in the first place.

Myriad currently has 33% of shares outstanding on loan and the share price is up 11% over the past volatile year.

Third most shorted in the US is ARC group, a specialised manufacturing and 3D printing company. The company's share price is down by 65% to $8.22 since peaking at $23 in September 2014. Short sellers have increased positions however, with shares outstanding on loan increasing by 30% since September 2014 to stand at 32% currently.

Western Europe

The top two most heavily shorted companies in Europe ahead of earnings this week are oil and gas service providers TGS and SBM Offshore, with 20% and 18% of shares outstanding on loan respectively. TGS is a Norwegian based geophysical services provider to the oil and gas industry while SBM provides offshore services to the global oil and gas industry.

Companies which service the oil and gas industries continue to struggle against low crude oil prices as major and minor energy firms alike continue to cut capital expenditure expansion and look to contract certain operations and decrease supply.

Nokian Tyres is the third most shorted company this week in Europe. Currently 33% of shares outstanding are sold short. The Finish based tyre maker's biggest market is Russia followed by Europe at 20%. The shares have suffered over the last 12 months as the Russian economy struggled with sanctions and record low oil prices and signs of deflation and slower economic growth emerge in the eurozone.

Asia Pacific

Continuing on last week's theme Asian consumer and electronics manufacturers are again seeing high levels short interest ahead of earnings.

Sharp Corp has seen a 19% increase in short sellers this past month as shares outstanding on loan reach 14%. The company guided profit down in January 2015 and cited competition from Asian rivals driving prices down and the weaker Japanese yen for the disappointing results.

Nikon has also seen a spike in short interest as short sellers increase positions by 17%, with 13% of the company's shares outstanding currently on loan.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30012015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30012015-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30012015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30012015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30012015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}