Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Feb 02, 2015

Oil slump sees yields spike

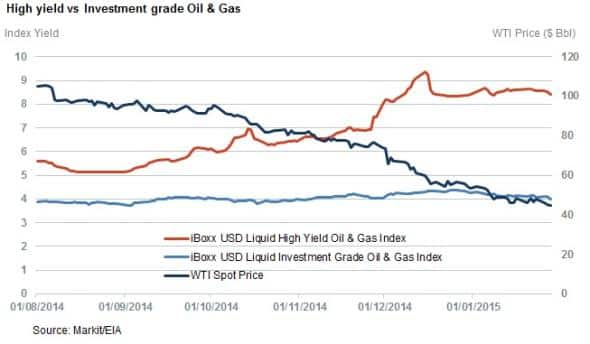

The tumbling price of oil has driven yields higher among the most speculative oil and gas names; a trend that has yet to manifest itself with investment grade issuers.

- The yield on the iBoxx high yield oil & gas index has jumped by more than 3% to 8.5%

- The investment grade oil & gas index has seen relatively flat yields

- High yield issuances are also exhibiting bearish behaviour in the securities lending market with short sellers willing to pay more to gain negative exposure

Last week the price of WTI Oil dipped below $44 for the first time since March 2009. While the previous lows were largely driven by speculation that demand for energy would collapse in the wake of the financial crisis, the current tumble in oil prices is arguably more worrying for energy producers as it is tied to oversupply, which has seen established producers fight against upstarts for a share in the global energy market.

While the jury is still out as to what the long term impact of the recent developments will be on the global economy, the short term has seen energy investors reeling as markets start to price in the prospects of sustained low oil prices.

Flight to quality

The direct impact can be seen by the rise in borrowing costs in the industry, although the current spike in yields has so far been constrained to speculative high yield names. Since last summer, the iBoxx high yield oil & gas index has moved from yielding 5.5% to around 8.5%, with the spike in yield mirroring oil's dip.

While the market seems to have stabilised in recent weeks after the index topped 9% in the opening fortnight of the year, the 3% jump in the high yield index indicates that investors see the recent dip as more than a passing trend as evident by their desire to be compensated to continue to fund the industry.

On the other side of the investment grade divide, the iBoxx investment grade oil & gas index has remained relatively flat over the last few months, demonstrating that fixed income investors have not fundamentally changed their views on the ability of these more established companies to repay their debts.

But the industry's more established players have not entirely been immune from the recent falling oil price as evident by a string of layoffs and cuts in capital expenditure, with the likes of Royal Dutch Shell and Conoco Philips slashing spending on new projects. BP and Total have also come out with recent cost cuts.

Shale explorers hit hard

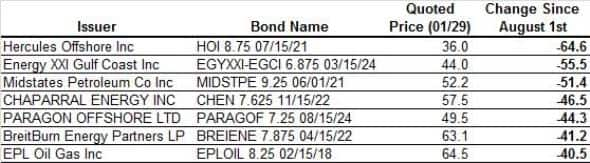

A deeper dive in the high yield space has seen negative sentiment targeted towards high cost producers, with shale drillers and offshore firms targeted.

Many of the large movers in the index were small, highly leveraged oil drillers and explorers. The US shale boom, which started in 2011, bought in a spout of new players in an era of expanding economic growth and low interest rates. In many cases, looser covenants were in place and bondholders now fear they may be subordinated in time of refinancing.

Oklahoma based Chaparral and Texas headquartered Midstates Petroleum highlight this trend, with both firms seeing some of their bonds trade more than 45% lower than six months ago.

Offshore producers, many of which suffer from the same high cost issues as shale producers, have also seen their bonds trade with increased bearish sentiment. Hercules Offshore has seen its July 2021 bond offering now trading over 60% lower than its August levels.

Bearish Securities lending

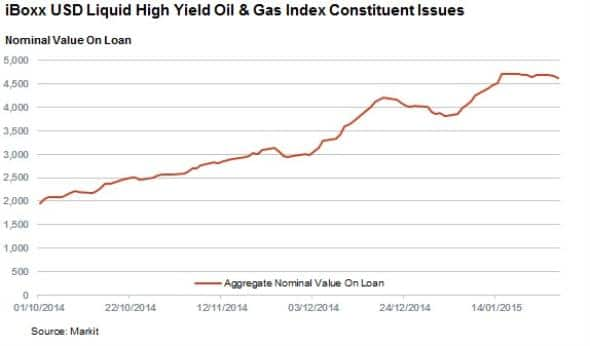

Another sign of increased bearish sentiment in high yield manes is the fact that the constituent bonds of the iBoxx high yield oil & gas index now command a higher fee in the securities lending market. This phenomenon points to a higher demand to borrow from short sellers, which is also reflected in the fact that the outstanding notional value of loan across these issuance has more than doubled since the start of October last year.

Neil Mehta

Analyst

Markit

Tel: +44 207 260 2298

Email: neil.mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02022015-Credit-Oil-slump-sees-yields-spike.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02022015-Credit-Oil-slump-sees-yields-spike.html&text=Oil+slump+sees+yields+spike","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02022015-Credit-Oil-slump-sees-yields-spike.html","enabled":true},{"name":"email","url":"?subject=Oil slump sees yields spike&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02022015-Credit-Oil-slump-sees-yields-spike.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Oil+slump+sees+yields+spike http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02022015-Credit-Oil-slump-sees-yields-spike.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}