Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Sep 29, 2016

OPEC deal sparks rally in HY bonds

High yield bonds rallied in the wake of yesterday's OPEC proposed cut in output

- The iBoxx $ Liquid High Yield Index returned 20bps in the wake of the deal

- Year to date HY oil bonds returns now over 30%

- The iShares iBoxx $ High Yield Corporate Bond ETF topped yesterday's inflow table

High yield bonds rallied yesterday after OPEC announced its first cut in output in eight years, which sent the global oil prices surging. Oil firms had been some of the most eager issuers of high yield bonds, which has exposed the asset class to the whims of global oil prices in the last two years. This link continued yesterday as the Markit iBoxx $ Liquid High Yield Index advanced by 20 bps after the deal was announced, the largest one-day advance in over a month.

Oil leads the way

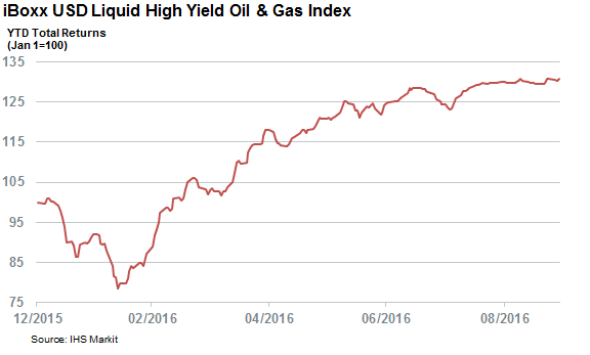

Not surprisingly, oil bonds were at the vanguard of yesterday's rally as the iBoxx USD Liquid High Yield Oil & Gas Index, a subset of the wider high yield index, delivered advances by 26bps on a total returns basis. Yesterday's advance brings the index's ytd total returns to an astonishing 30.7%.

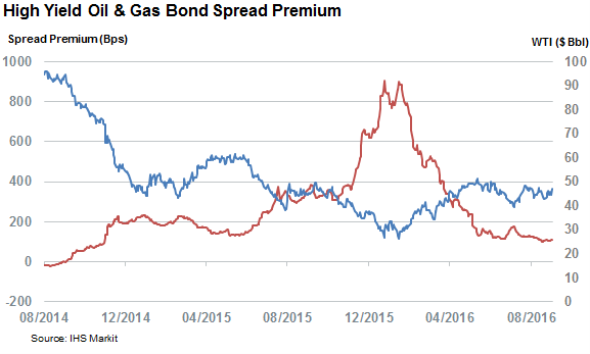

While much noise has been made over the last two years about the link between high yield bonds and oil prices, bond investors had been coming to terms with the new normal in oil price. The current extra spread required by investors to hold high yield bonds issued by oil & gas producers over the rest of the asset class, has ranged between 100 and 110 bps in over the last few weeks. This required extra yield has more than doubled since last summer; the last time West Texas Intermediate oil traded in the current $40-50 range.

This increasing willingness to hold high yield oil & gas bonds reflects the cost cutting and deleveraging undertaken by the industry in the wake of the recent slump seen in the last 24 months. The level of pragmatism around these high yield bonds also reflects the growing consensus that while oil will continue to trade in its current range in the near term, the prospect of a return to the lows set back in February is dwindling. This consensus will only get stronger after yesterday's move by OPEC.

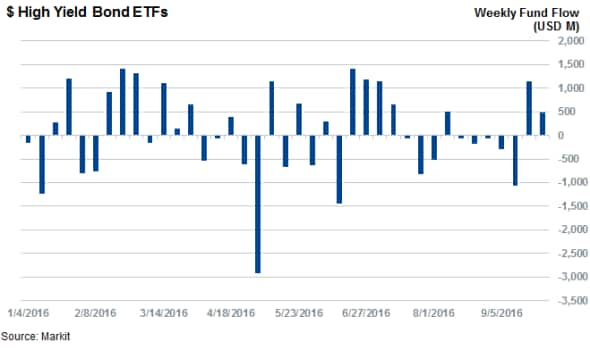

Investors pile into high yield bonds

Investors are also getting behind the oil-fueled high yield bond rally as investors ploughed over $237m into high yield bonds yesterday according to the Markit ETF analytics database. In fact the iShares iBoxx $ High Yield Corporate Bond ETF, which tracks the previously mentioned liquid high yield index, topped the global ETF inflow table yesterday with a $233m one-day haul.

These inflows into high yield bonds follow on from the wake of last week's $1.1bn haul, which snapped a five week outflow streak. Despite the vacillating investor sentiment towards high yield bonds in the last few weeks, the high yield bond ETFs are still on track to overtake last year's inflow total as the asset class has gathered $2.68bn so far this year vs last year's total of $2.7bn.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29092016-Credit-OPEC-deal-sparks-rally-in-HY-bonds.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29092016-Credit-OPEC-deal-sparks-rally-in-HY-bonds.html&text=OPEC+deal+sparks+rally+in+HY+bonds","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29092016-Credit-OPEC-deal-sparks-rally-in-HY-bonds.html","enabled":true},{"name":"email","url":"?subject=OPEC deal sparks rally in HY bonds&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29092016-Credit-OPEC-deal-sparks-rally-in-HY-bonds.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=OPEC+deal+sparks+rally+in+HY+bonds http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29092016-Credit-OPEC-deal-sparks-rally-in-HY-bonds.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}