Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 29, 2015

Most shorted ahead of earnings

A review of how short sellers are positioning themselves in stocks ahead of earnings announcements in the coming week.

- Mediterranean inspired fast casual restaurant Zoe's kitchen most shorted in North America

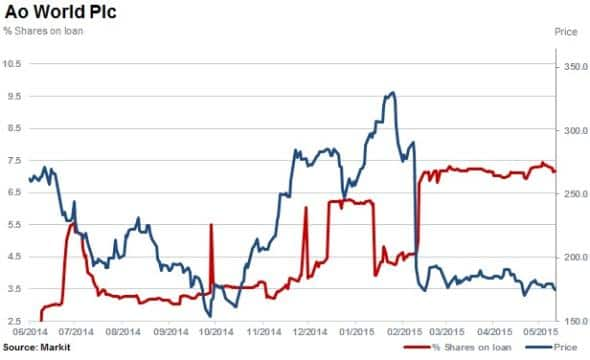

- Short sellers continue to hold positions in online retailer AO World ahead of earnings

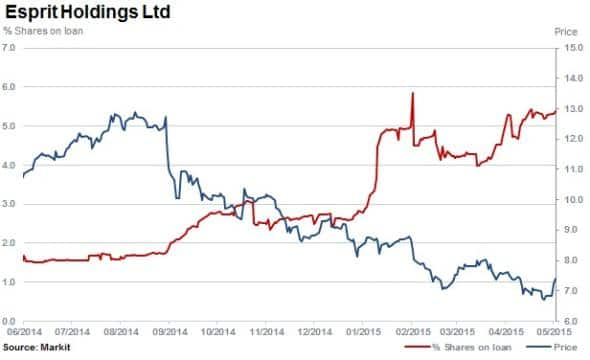

- Rising Japanese tea seller Ito the most short sold in Apac, followed by fashion retailer Esprit

North America

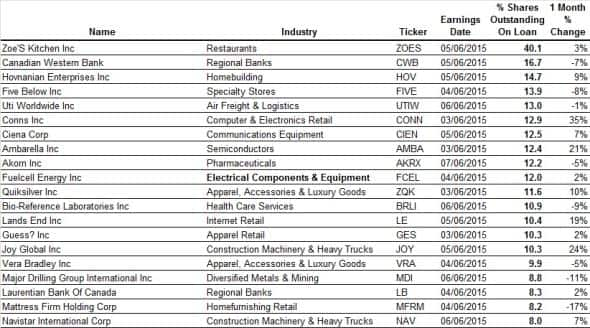

Zoe's Kitchen returns and retains the position of the most shorted stock ahead of earnings in North America this week.

Short sellers continue to target the stock with 40% of shares outstanding on loan. Shares have declined by 9% in the last three months. The restaurant's IPO in 2014 saw the stock surge over 65%. The company is expected to grow sales substantially according to consensus forecasts - however material earnings are not yet expected.

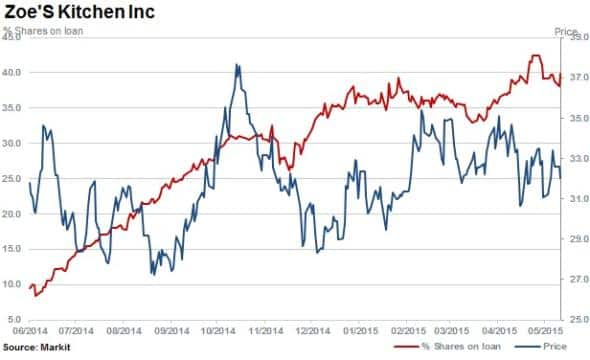

With 14.7% of shares outstanding on loan is US homebuilder and seller, Hovnanian Enterprises. Consensus forecasts expect the company to grow sales significantly for the fiscal year ending October 2015 however earnings forecasts point to a collapse, declining from $300m to $6m.

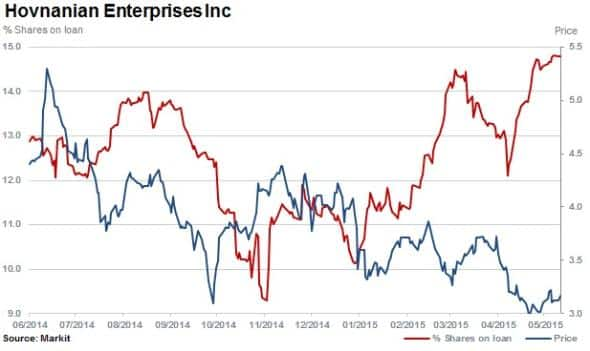

Short sellers in Ambarella have been covering during the recent share price rise but shares outstanding on have loan spiked in the last month, rising 45% to 12.3%.

Ambarella, a producer of compression semiconductor chips, is up by an astonishing 237% in the last 12 months. Driven in part by large increases in company sales, net income has doubled for the company over the last year. However earnings growth is expected to slow for the year ending January 2016.

Western Europe

It has been a relatively quiet week ahead for short sold companies in Europe about to report earnings. Only two single names register material levels of short interest as measured by the percentage of shares outstanding on loan.

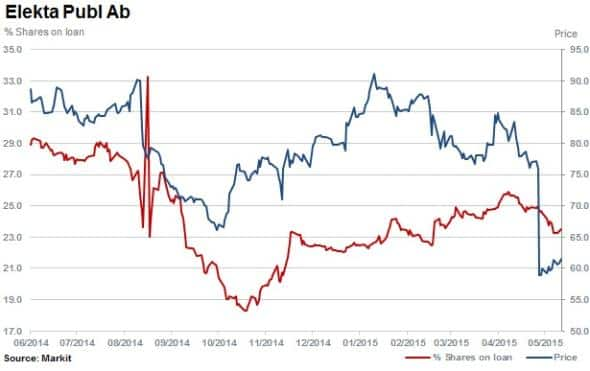

Most short sold is Elekta with 23.5% of shares outstanding on loan. The company provides healthcare services, specialising in cancer and brain disorder treatments. Shares have declined by 22% in May post the company guiding for weaker full year results earlier in the month.

Online retailer AO World is the second most shorted stock in Europe with 7.2% of shares outstanding on loan. The company saw shares plunge by a third in February when it guided profit expectations down by a third.

Asia Pacific

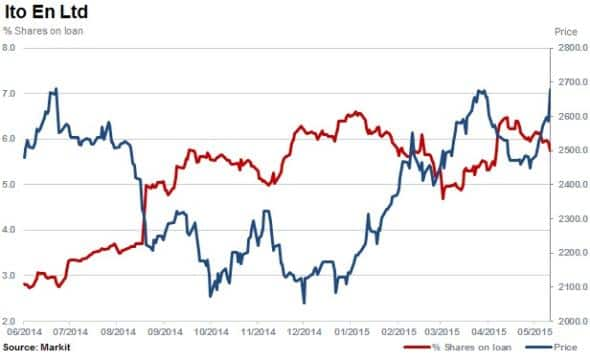

Most shorted in Apac this week is Tokyo based producer and seller of tea leaves Ito En, which currently has 5.7% of shares outstanding on loan. Shares in the company have rallied by 24% in the past six months, attracting increased interest from short sellers.

Second most shorted ahead of earnings in Apac is Hong Kong based global fashion wholesaler and retailer Esprit. The company issued a profit warning in early May, citing weak performances emanating out of Chinese operations. Shares outstanding on loan have increased throughout the year to reach 5.4% currently while the stock has declined by 34% in the last 12 months.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29052015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29052015-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29052015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29052015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29052015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}