Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

May 29, 2015

Greek end game looms; Muni credit edges higher

Bond yields remain high but calm in Greece as June repayment tests approach; while despite municipal credit creeping higher investor demand remains strong.

- Credit markets imply a 71% chance of Greek default, faces repayment test June 5th

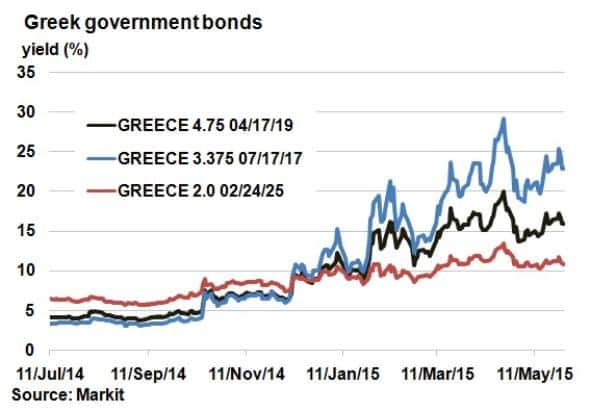

- Greek two year bond yield has fluctuated above and below 23% since March

- MCDX has widened 13bps this year, but ETF inflows remains strong

Time is running out for Greece

Attention in the markets has once again turned to Greece and a potential exit from the eurozone as major debt repayments loom in June. As talks to unlock bailout funds in exchange for structural reforms continue between Greek officials and 'the institutions', progress remains languid and details sparse.

The IMF is due a repayment of €300m from Greece on June 5th, followed quickly by another €300m and €600m on June 12th and 16th respectively. While the market expects Greece to find a way through June (the IMF has confirmed Greece has the option to bundle its June repayments), if no resolution is found, July might present an end game scenario when a €3.5bn bond repayment is due to the ECB.

Credit markets currently imply a 71% chance of Greece defaulting over the next five years; a figure that hasn't improved over the last two months.

CDS trading volumes on Greece however remain very thin and have done since the ban on naked short selling in 2012. In contrast, the bond market has proven to be more responsive to market sentiment.

The Greek ten year bond (2% 2025) yield continues to hover above 10%, whereas more sensitive shorter maturity bonds have been yielding double, at over 20%. The 3.375% coupon bond due to expire in 2017 has pared losses over the last three days and currently yields 22.91%, down from 25.29% on Tuesday This was only the second time this year that yields tipped above 25%, the other time between 21st-24th April. The 23% appears significant, as yields have surpassed and subsequently retreated from here on four separate occasions since March

Muni risk

On May 12th Moody's downgraded Chicago's municipal bonds to junk status, citing pension deficit problems. The downgrade came as a surprise, especially the timing, as it threw off debt refinancing obligations. This hasn't been a special case in the US muni market; Puerto Rico was also downgraded in April and faces problems of its own.

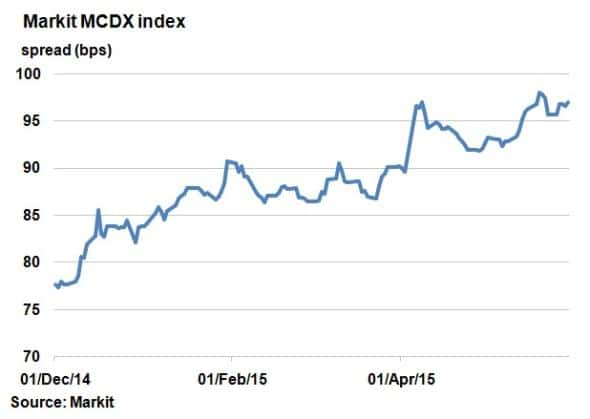

The MCDX, a credit index referencing 50 municipal single name CDS, continues to creep higher. The latest spread, 97bps, is 13bps higher than at the start of the year. The widening credit spread signals that cost to protect against municipal bonds defaulting is becoming more expensive.

Despite the concerns in credit markets, Chicago still managed to pull off a successful bond sale this week to rapturous investor demand, albeit having to offer higher yields than normal. The demand was not just in primary markets however; investors have been piling into fixed income ETFs tracking municipal bond indices. A small hiccup following the Chicago downgrade, where ETFs saw a small outflow, quickly rebounded with the week starting May 18th recording the second highest weekly inflow this year.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29052015-Credit-Greek-end-game-looms-Muni-credit-edges-higher.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29052015-Credit-Greek-end-game-looms-Muni-credit-edges-higher.html&text=Greek+end+game+looms%3b+Muni+credit+edges+higher","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29052015-Credit-Greek-end-game-looms-Muni-credit-edges-higher.html","enabled":true},{"name":"email","url":"?subject=Greek end game looms; Muni credit edges higher&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29052015-Credit-Greek-end-game-looms-Muni-credit-edges-higher.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Greek+end+game+looms%3b+Muni+credit+edges+higher http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29052015-Credit-Greek-end-game-looms-Muni-credit-edges-higher.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}